This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 1120-IC-DISC

for the current year.

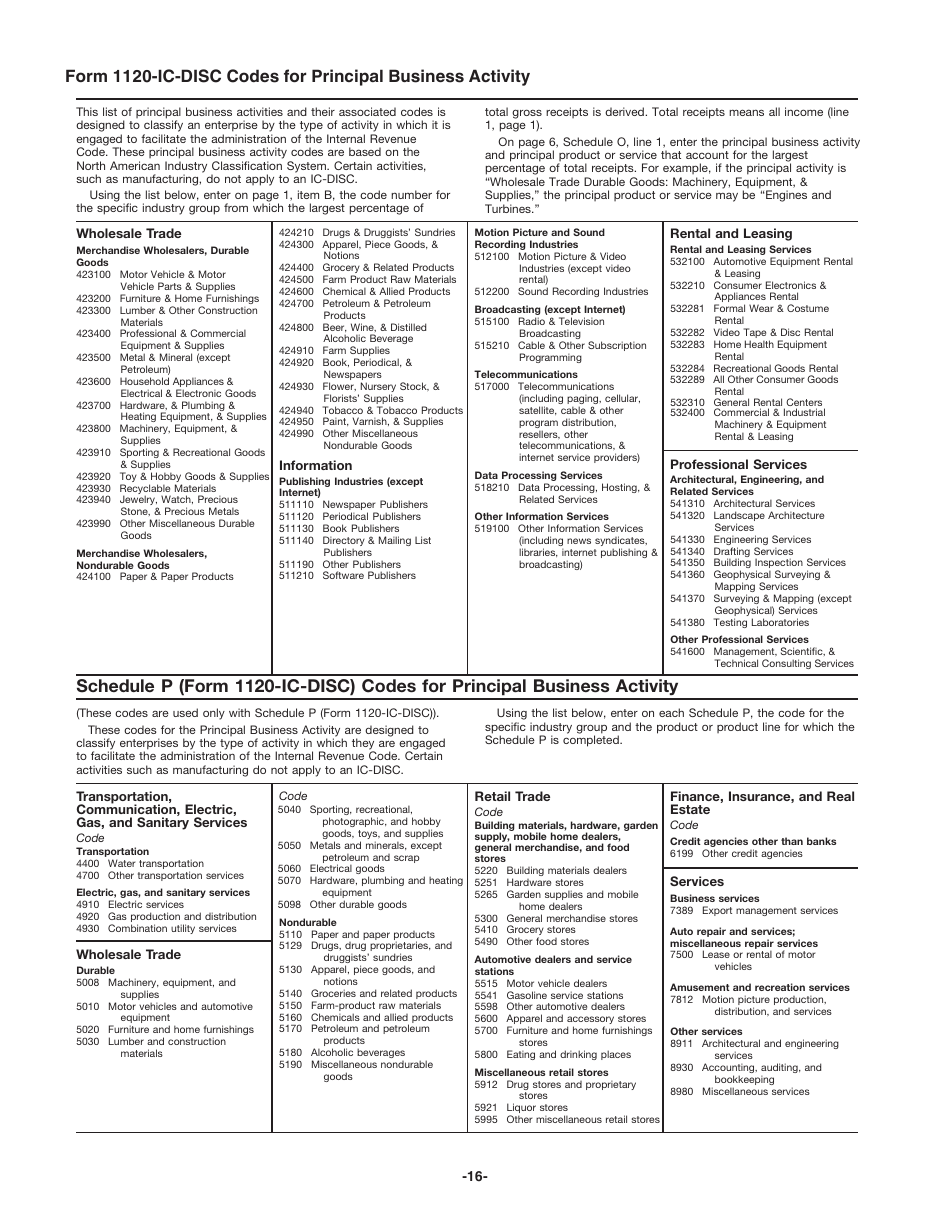

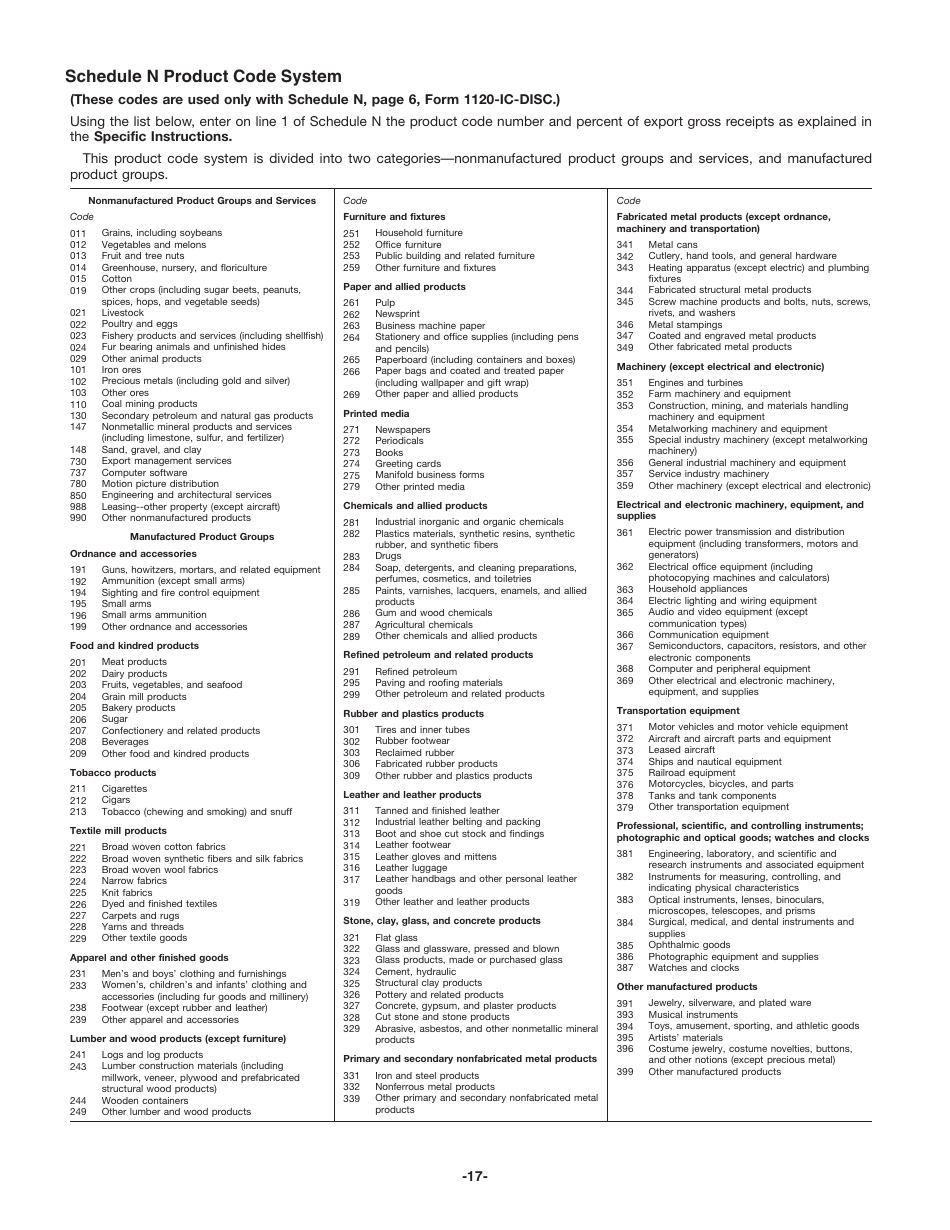

Instructions for IRS Form 1120-IC-DISC Interest Charge Domestic International Sales Corporation Return

This document contains official instructions for IRS Form 1120-IC-DISC , Interest Charge Domestic International Sales Corporation Return - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 1120-IC-DISC Schedule P is available for download through this link.

FAQ

Q: What is IRS Form 1120-IC-DISC?

A: IRS Form 1120-IC-DISC is the form used to file the Interest Charge Domestic International Sales Corporation (IC-DISC) return.

Q: Who needs to file IRS Form 1120-IC-DISC?

A: Only corporations that qualify as an IC-DISC need to file IRS Form 1120-IC-DISC.

Q: What is an IC-DISC?

A: An IC-DISC is a domestic corporation that meets certain criteria and is formed for the purpose of reducing the tax liability of U.S. exporters.

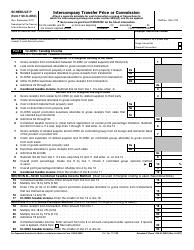

Q: What information is required on IRS Form 1120-IC-DISC?

A: IRS Form 1120-IC-DISC requires information on the IC-DISC's financial transactions, shareholders, and related party transactions.

Q: When is IRS Form 1120-IC-DISC due?

A: IRS Form 1120-IC-DISC is due on the 15th day of the 9th month after the end of the corporation's tax year.

Q: Are there any penalties for not filing IRS Form 1120-IC-DISC?

A: Yes, failure to file IRS Form 1120-IC-DISC or filing it late can result in penalties and interest charges.

Q: Can I file IRS Form 1120-IC-DISC electronically?

A: Yes, IRS Form 1120-IC-DISC can be filed electronically using the IRS e-file system.

Q: Can I get an extension to file IRS Form 1120-IC-DISC?

A: Yes, you can request an extension to file IRS Form 1120-IC-DISC by filing Form 7004.

Q: Do I need to attach any documents with IRS Form 1120-IC-DISC?

A: Yes, certain supporting documents and schedules may need to be attached with IRS Form 1120-IC-DISC.

Instruction Details:

- This 17-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.