This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form 1120

for the current year.

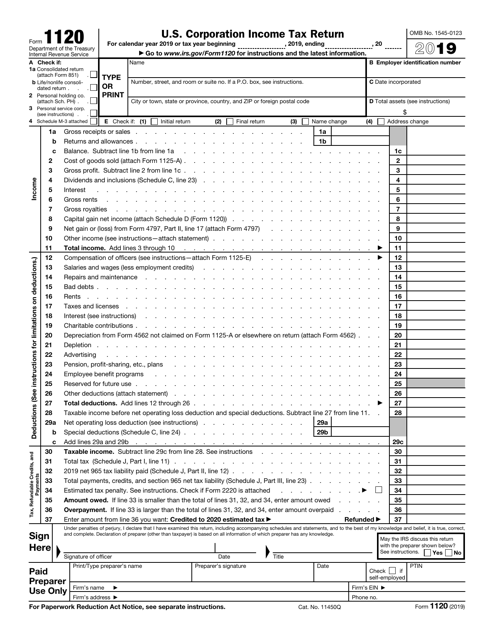

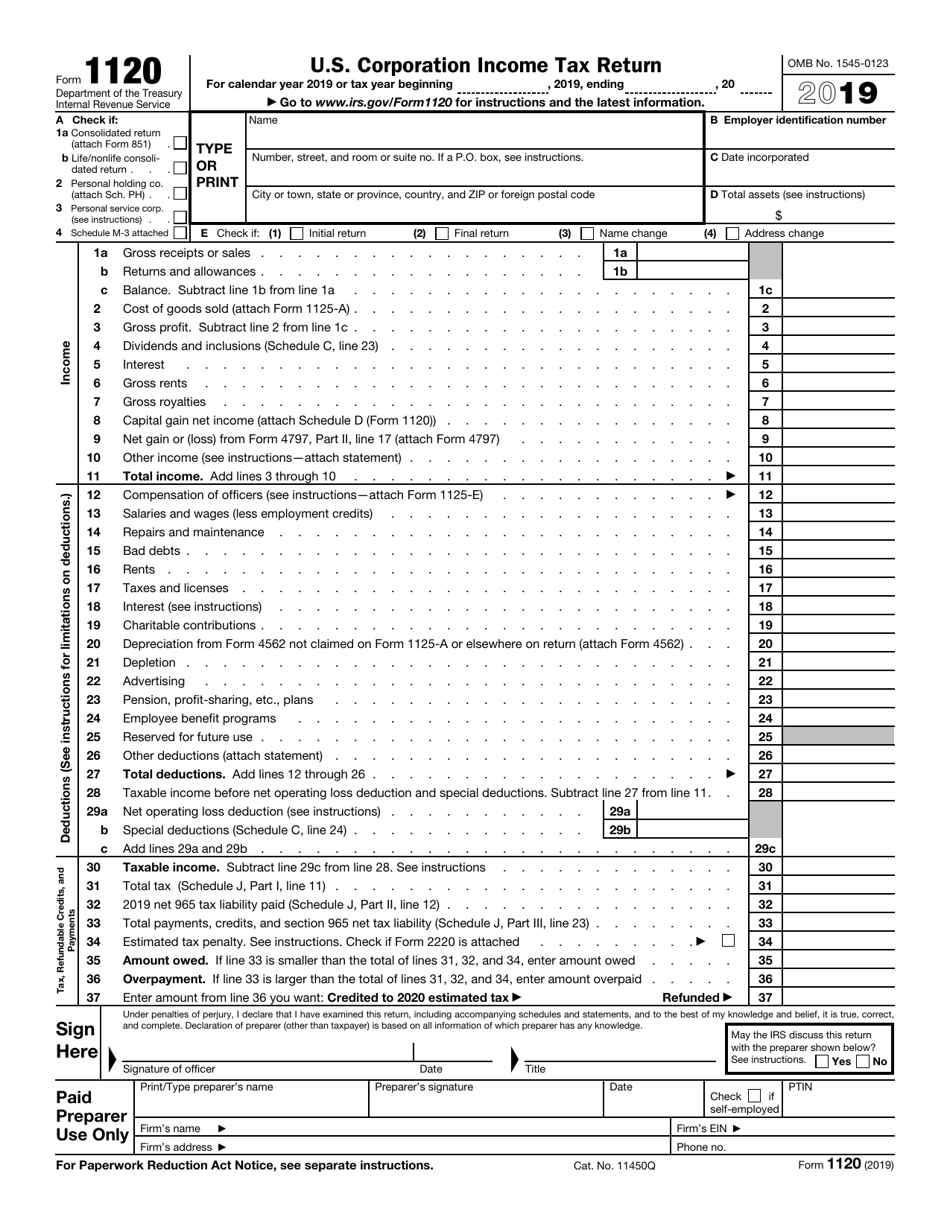

IRS Form 1120 U.S. Corporation Income Tax Return

What Is Form 1120?

IRS Form 1120, U.S. Corporation Income Tax Return , is a form filed with the Internal Revenue Service (IRS) by domestic corporations to report their income, gains, losses, deductions, and credits, and to figure their income tax liability.

Alternate Name:

- Corporation Tax Return.

The form was issued by the IRS and last revised in 2019 . Corporations may use a fillable Form 1120 available below for download.

Who Files Form 1120?

Form 1120 must be filed by every domestic corporation (including those in bankruptcy), regardless of if the corporation has taxable income, except if the corporation is required, or elects to file a special return instead.

IRS Form 1120 Instructions

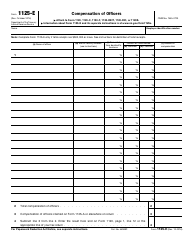

The form must be signed and dated by the corporation's president, vice president, chief accounting officer, treasurer, assistant treasurer, or any corporate officer authorized to sign.

Corporations can electronically file Form 1120, as well as related forms, schedules, and attachments.

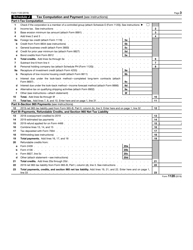

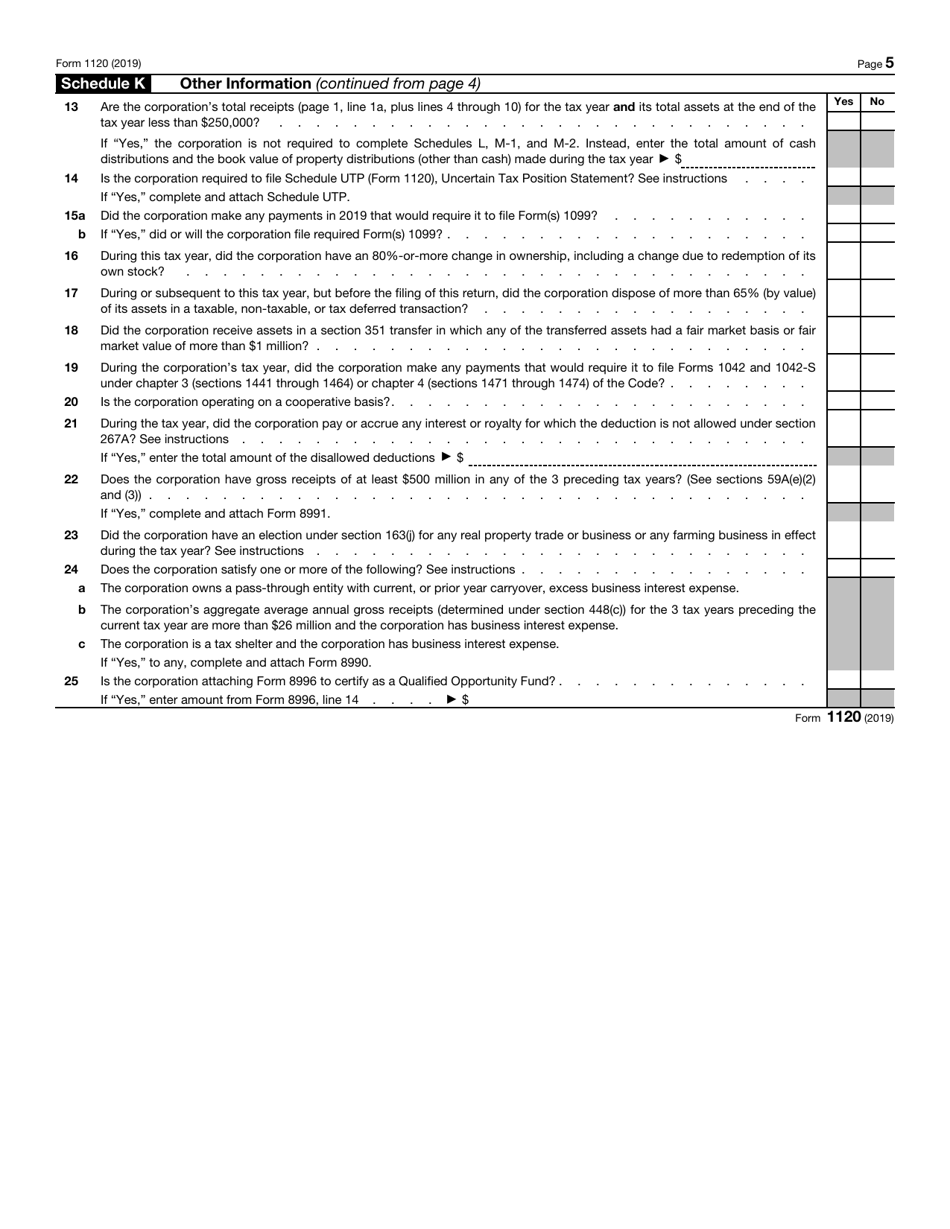

Generally, Form 1120 must be filed by the 15th day of the 4th month after the end of the corporation's tax year. The IRS provides separate Instructions for Form 1120. Please refer to them in order to learn about the specific due dates depending on your tax year. If the due date falls on a weekend or a legal holiday, the form may be filed on the next business day.

In cases of late filing, a penalty of 5% of the unpaid tax for the days the return is late will be applied, and the penalty may go up to a maximum of 25%. If the corporation can show that there is a reasonable cause behind the failure to file on time, the penalty will not be imposed.

How to Fill Out Form 1120?

Please follow these steps to fill out the form:

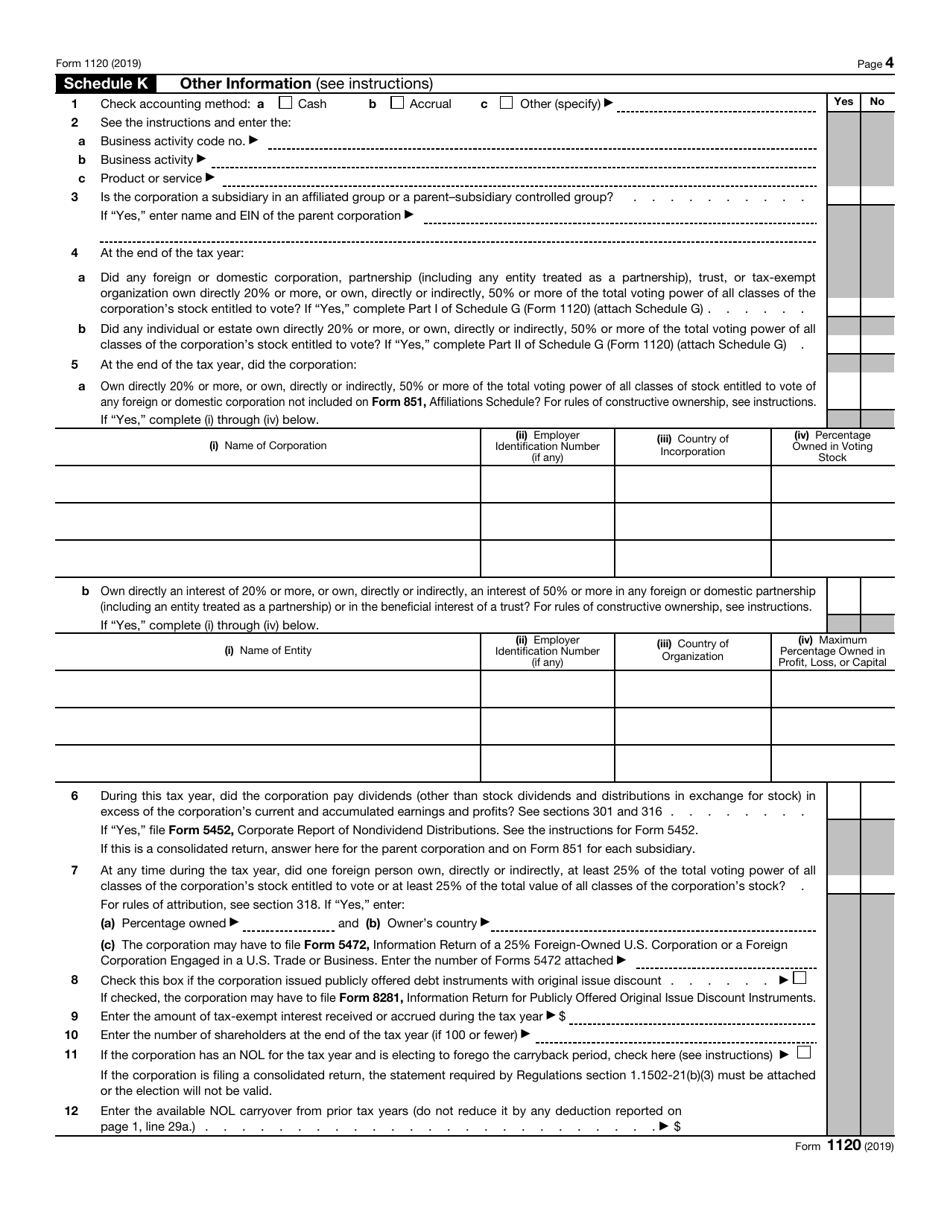

- Item A. Identifying Information. Check the appropriate box and attach the applicable schedules and supporting statements.

- Item B. Employer Identification Number (EIN). Enter the corporation's EIN.

- Item C. Date incorporated. Enter the date of incorporation.

- Item D. Total Assets. Enter the corporation's total assets at the end of the tax year.

- Item E. Initial Return, Final Return, Name Change, Address Change. Check all that apply.

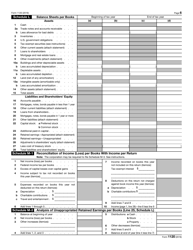

- Section 1. Income. Enter the income amounts on each line, as per the form instructions.

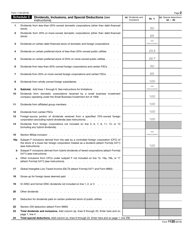

- Section 2. Deductions. Enter the appropriate corporation's costs, expenses, contributions, and other deductible amounts on each line.

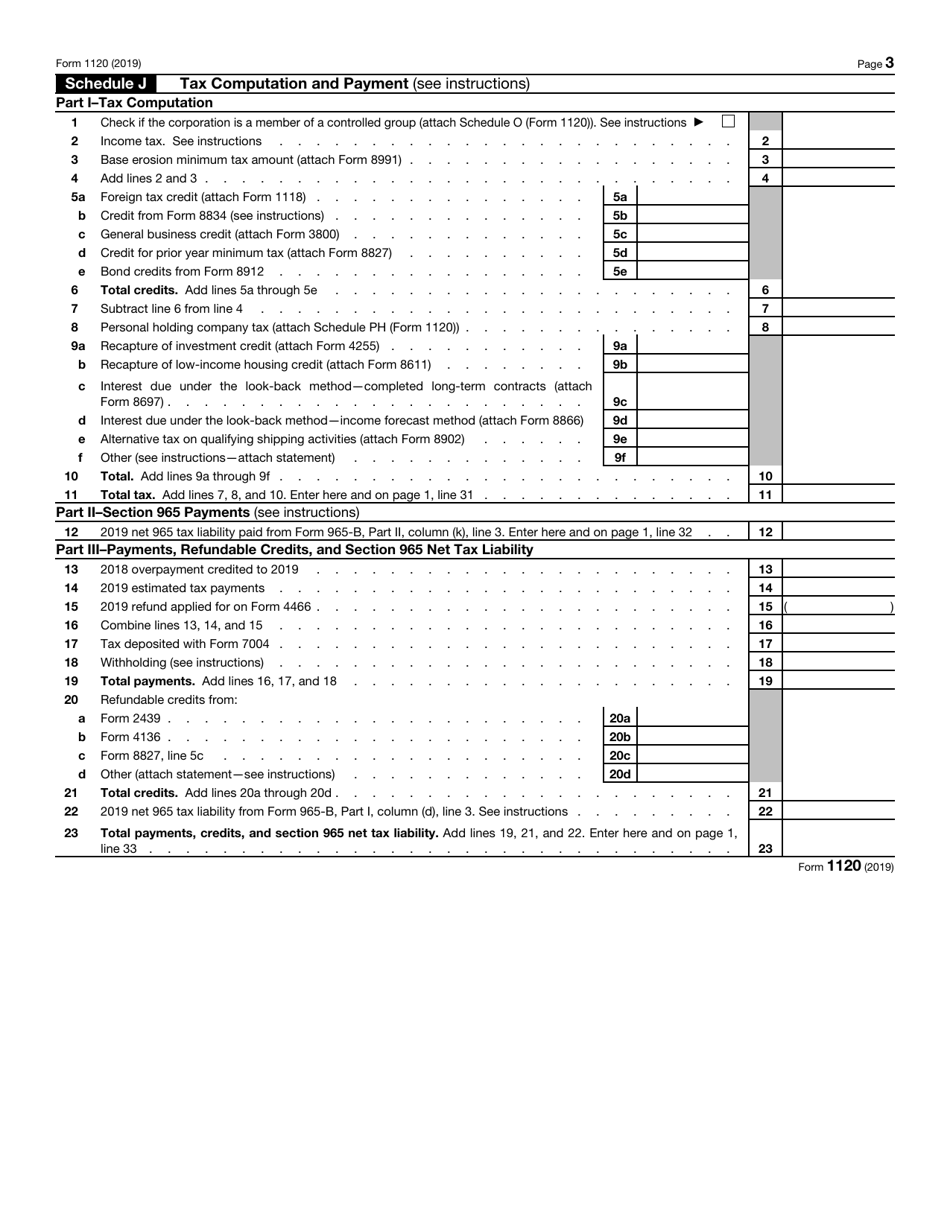

- Section 3. Payments, Refundable Credits, and Section 965 Net Tax Liability. Enter the applicable tax, credits, and payment amounts on each line.

Where to Mail Form 1120?

Form 1120 must be filed to the applicable IRS address. Check on the IRS website if you need to file at the IRS Center in Cincinnati, OH; Ogden, UT; or Kansas City, MO.

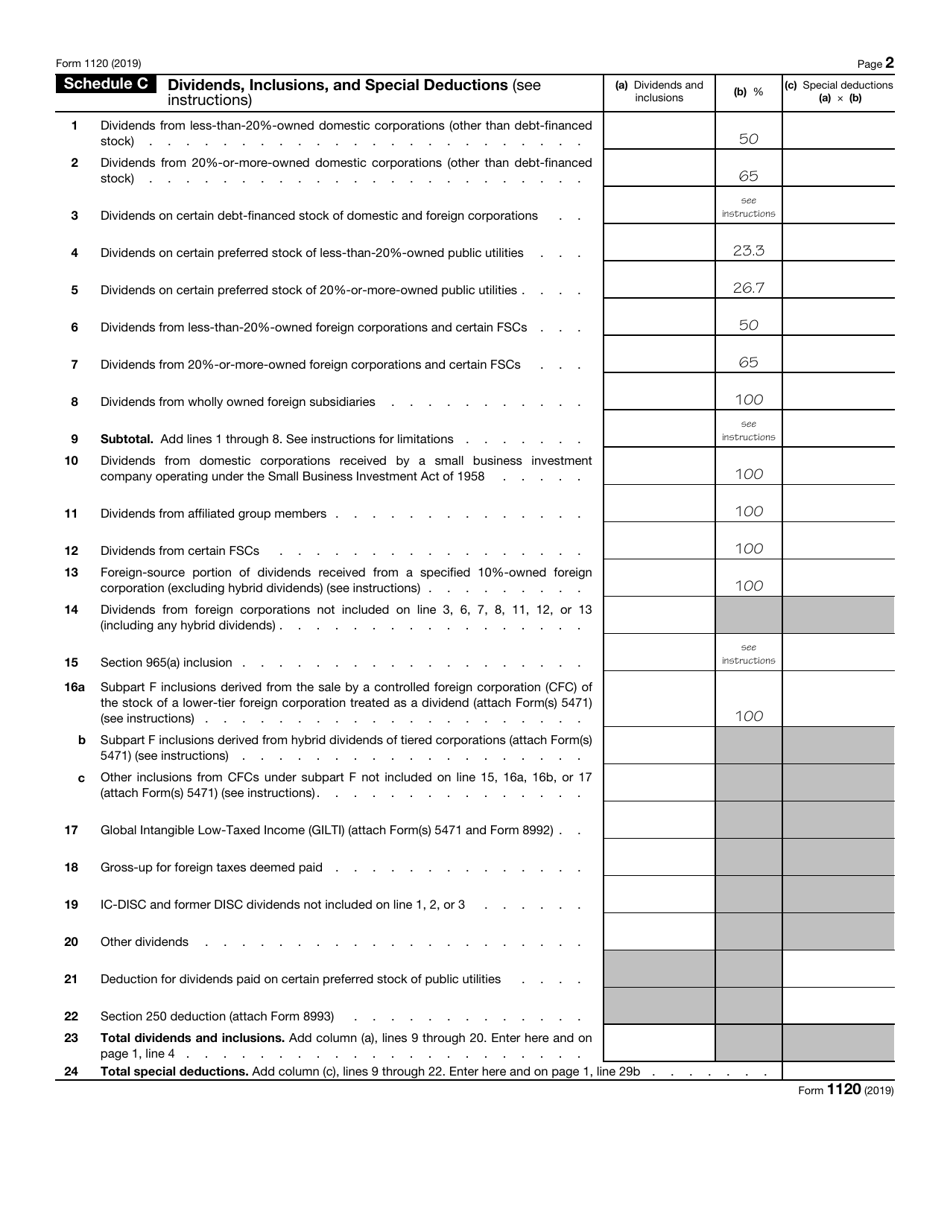

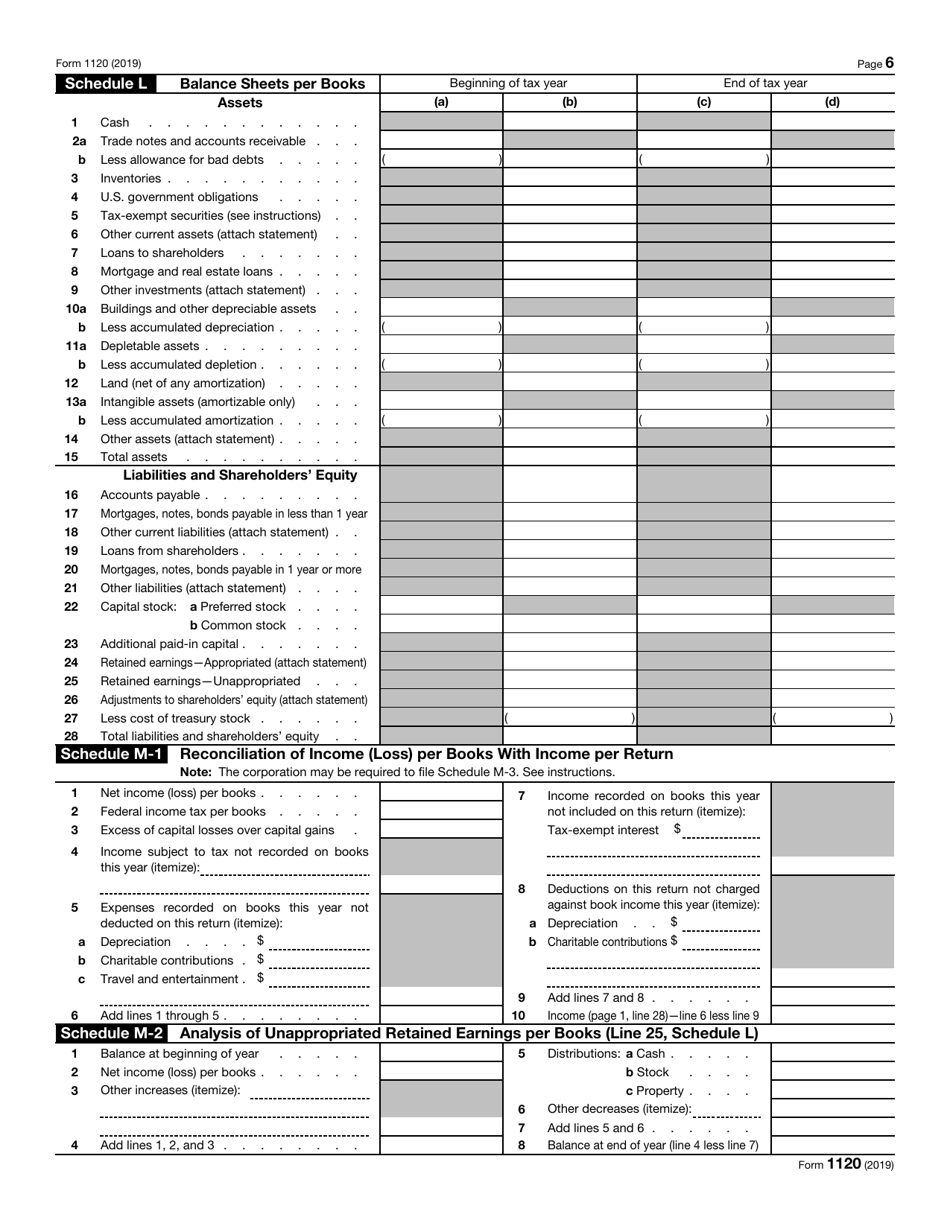

IRS Form 1120 Schedules

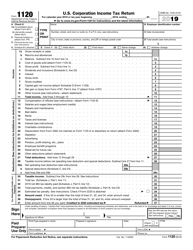

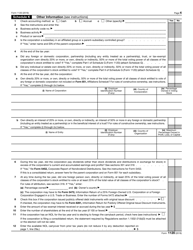

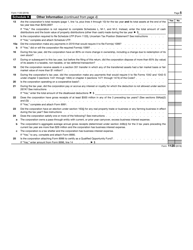

- Schedule B (Form 1120), Additional Information for Schedule M-3 Filers. Filers of Schedule M-3 (Form 1120) use this schedule to provide answers to additional questions.

- Schedule D (Form 1120), Capital Gains and Losses, is used to estimate the overall gain or loss from transactions reported on Form 8949, as well as to report certain transactions not reported on Form 8949, and to report capital gain distributions not reported on Form 1120.

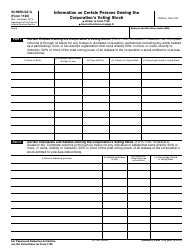

- Schedule G (Form 1120), Information on Certain Persons Owning the Corporation's Voting Stock, is used to provide information applicable to certain individuals, entities, and estates that own, directly, at least 20%, or own, directly or indirectly, at least 50% of the total voting power of a corporation's voting stock.

- Schedule H (Form 1120), Section 280H Limitations for a Personal Service Corporation (PSC), is used by PSCs to determine if they meet the minimum distribution requirement for the tax year, or to estimate the limits on deductions if the requirement were not met.

- Schedule M-3 (Form 1120), Net Income (Loss) Reconciliation for Corporations with Total Assets of $10 Million or More, is filed to answer the corporation's financial statements questions and to reconcile financial statement net income (loss) for the corporation to the net and taxable income reported on Form 1120.

- Schedule N (Form 1120), Foreign Operations of U.S. Corporations, may be filed if the corporation had assets in or operated a business in a foreign country.

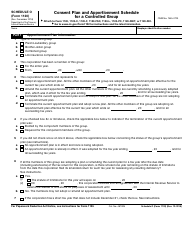

- Schedule O (Form 1120), Consent Plan and Apportionment Schedule for a Controlled Group, is used to consent to an apportionment plan and allocated income, taxes, or other items.

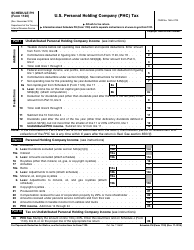

- Schedule PH (Form 1120), U.S. Personal Holding Company (PHC) Tax, is used by a personal holding company (PHC) to compute tax and is then filed with every PHC return.

- Schedule UTP (Form 1120), Uncertain Tax Position Statement, is used by corporations that issue or are included in audited financial statements and have assets equal or greater than $10 million to provide information on tax positions that affect their federal income tax liabilities.

IRS 1120 Related Forms:

- 1120-C, U.S. Income Tax Return for Cooperative Associations. Corporations that operate on a cooperative basis use this form to report their income, gains, losses, deductions, and credits, and to figure their income tax liability.

- 1120-F, U.S. Income Tax Return of a Foreign Corporation. This form is filed by foreign corporations to report their income, gains, losses, deductions, and credits, and to figure their U.S. income tax liability.

- 1120-S, U.S. Income Tax Return for an S Corporation. This is a form used to report the income, gains, losses, deductions, and credits of a domestic corporation or any other entity for any tax year covered by an election to be an S corporation.

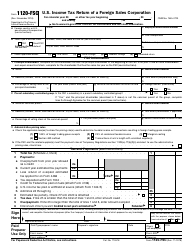

- 1120-FSC, U.S. Income Tax Return of a Foreign Sales Corporation. Foreign Sales Corporation (FSC) or small FSC use this form to report their income, deductions, losses, gains, credits, and income tax liability.

- 1120-H, U.S. Income Tax Return for Homeowners Associations. A homeowners' association files this form to be able to exclude exempt function income from its gross income.

- 1120-IC-DISC, Interest Charge Domestic International Sales Corporation Return. This form is filed by interest charge domestic international sales corporations (IC-DISCs), former DISCs, and former IC-DISCs.

- 1120-POL, U.S. Income Tax Return for Certain Political Organizations. This form is filed by political organizations and certain exempt organizations to report their political organization taxable income and income tax liability section 527.

- 1120-L, U.S. Life Insurance Company Income Tax Return. Life insurance companies use this form to report income, gains, losses, deductions, and credits, and to figure their income tax liability.

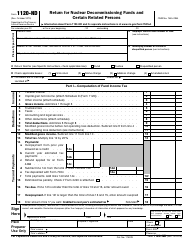

- 1120-ND, Return for Nuclear Decommissioning Funds and Certain Related Persons. Nuclear decommissioning funds file this form to report income earned, contributions received, the administrative expenses of fund operation, the tax on modified gross income, and the section 4951 initial taxes.

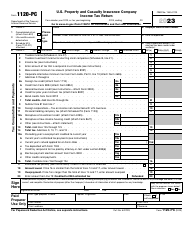

- 1120-PC, U.S. Property and Casualty Insurance Company Income Tax Return. This form is filed to report the income, gains, losses, deductions, and credits, and to figure the income tax liability of insurance companies, apart from life insurance companies.

- 1120-REIT, U.S. Income Tax Return for Real Estate Investment Trusts. Corporations, trusts, and associations electing to be treated as Real Estate Investment Trusts file this form to report their income, deductions, credits, gains, losses, certain penalties, and income tax liability.

- 1120-RIC, U.S. Income Tax Return for Regulated Investment Companies. Regulated investment companies (RIC) file this form to report their income, deductions, gains, losses, credits, and to calculate their income tax liability.

- 1120-SF, U.S. Income Tax Return for Settlement Funds (Under Section 468B). Qualified settlement funds file this form to report transfers received, income earned, deductions claimed, distributions made, and a designated or qualified settlement fund income tax liability.

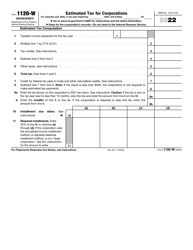

- Form 1120-W, Estimated Tax for Corporations. Corporations use this form to estimate their tax liability and to figure the amount of their estimated tax payments.

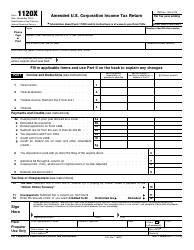

- Form 1120-X, Amended U.S. Corporation Income Tax Return. This form is used by corporations to correct a Form 1120 (or Form 1120-A), a claim for refund, or an examination, and also, to make certain elections after the prescribed deadline.