This version of the form is not currently in use and is provided for reference only. Download this version of

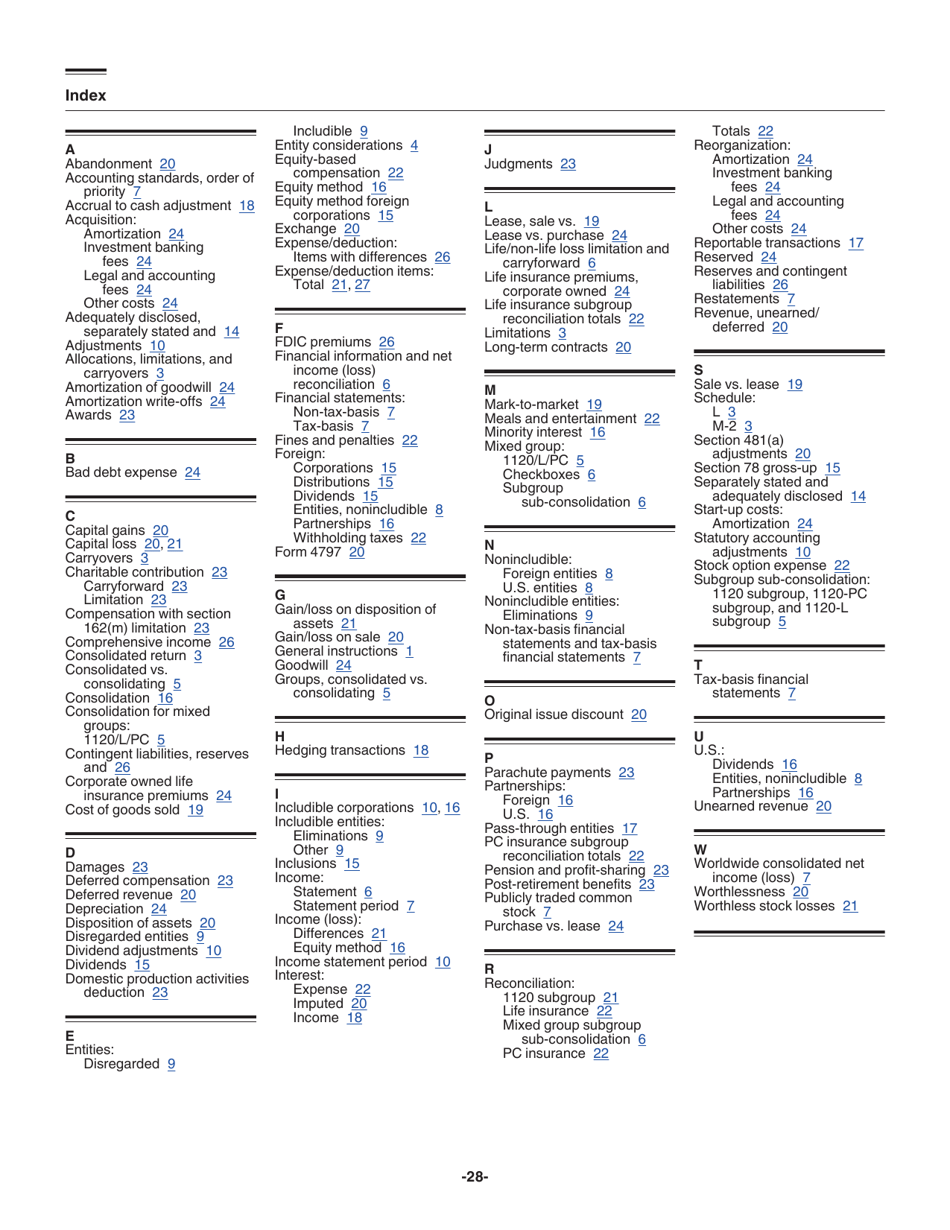

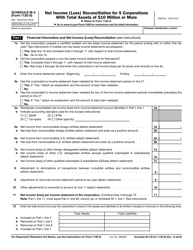

Instructions for IRS Form 1120 Schedule M-3

for the current year.

Instructions for IRS Form 1120 Schedule M-3 Net Income (Loss) Reconciliation for Corporations With Total Assets of $10 Million or More

This document contains official instructions for IRS Form 1120 Schedule M-3, Total Assets of $10 Million or More - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury.

FAQ

Q: What is IRS Form 1120 Schedule M-3?

A: IRS Form 1120 Schedule M-3 is a reconciliation form used by corporations with total assets of $10 million or more to report their net income (loss).

Q: Who needs to file IRS Form 1120 Schedule M-3?

A: Corporations with total assets of $10 million or more are required to file IRS Form 1120 Schedule M-3.

Q: What is the purpose of IRS Form 1120 Schedule M-3?

A: The purpose of IRS Form 1120 Schedule M-3 is to reconcile the net income (loss) reported on a corporation's tax return with the financial statements of the corporation.

Q: What information is required on IRS Form 1120 Schedule M-3?

A: IRS Form 1120 Schedule M-3 requires information such as net income (loss) per books, adjustments to reconcile net income (loss) per books to taxable income (loss), and other reconciling and nonreconciling items.

Q: Is there a deadline for filing IRS Form 1120 Schedule M-3?

A: Yes, the deadline for filing IRS Form 1120 Schedule M-3 is the same as the deadline for filing the corporation's annual tax return, usually March 15th or April 15th.

Q: Are there any penalties for not filing IRS Form 1120 Schedule M-3?

A: Yes, there may be penalties for not filing IRS Form 1120 Schedule M-3 or for filing it incorrectly. It is important to consult with a tax professional or refer to the IRS guidelines for specific penalty information.

Q: Can I use IRS Form 1120 Schedule M-3 if my corporation's total assets are less than $10 million?

A: No, IRS Form 1120 Schedule M-3 is specifically required for corporations with total assets of $10 million or more. Corporations with total assets less than $10 million should use other applicable forms.

Q: Is IRS Form 1120 Schedule M-3 the same as Schedule L?

A: No, IRS Form 1120 Schedule M-3 is not the same as Schedule L. Schedule M-3 focuses on reconciling net income (loss) while Schedule L provides information on balance sheet accounts and related reconciliations.

Q: Is professional assistance recommended for completing IRS Form 1120 Schedule M-3?

A: Yes, due to the complexity of IRS Form 1120 Schedule M-3, it is recommended to seek professional assistance from a tax advisor or accountant to ensure accurate completion and compliance.

Instruction Details:

- This 28-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.