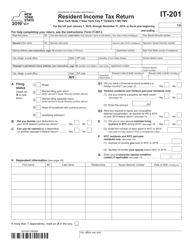

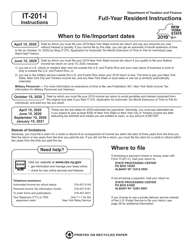

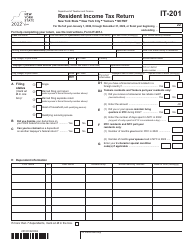

Instructions for Form IT-201, IT-195, IT-201-ATT - New York

This form contains official instructions for Form IT-201, along with Forms IT-195 and IT-201-ATT. These instructions were released in 2019 by the New York State Department of Taxation and Finance and a PDF version of the file can be downloaded below.

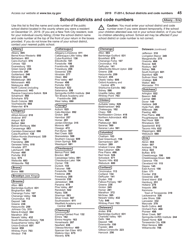

The instructions consist of 11 steps developed to help taxpayers file their documents. Each of them contains information based on a section of the application they are describing. These steps include:

- Completing the taxpayer information section;

- Selecting your filing status and complete items;

- Entering your federal income and adjustments;

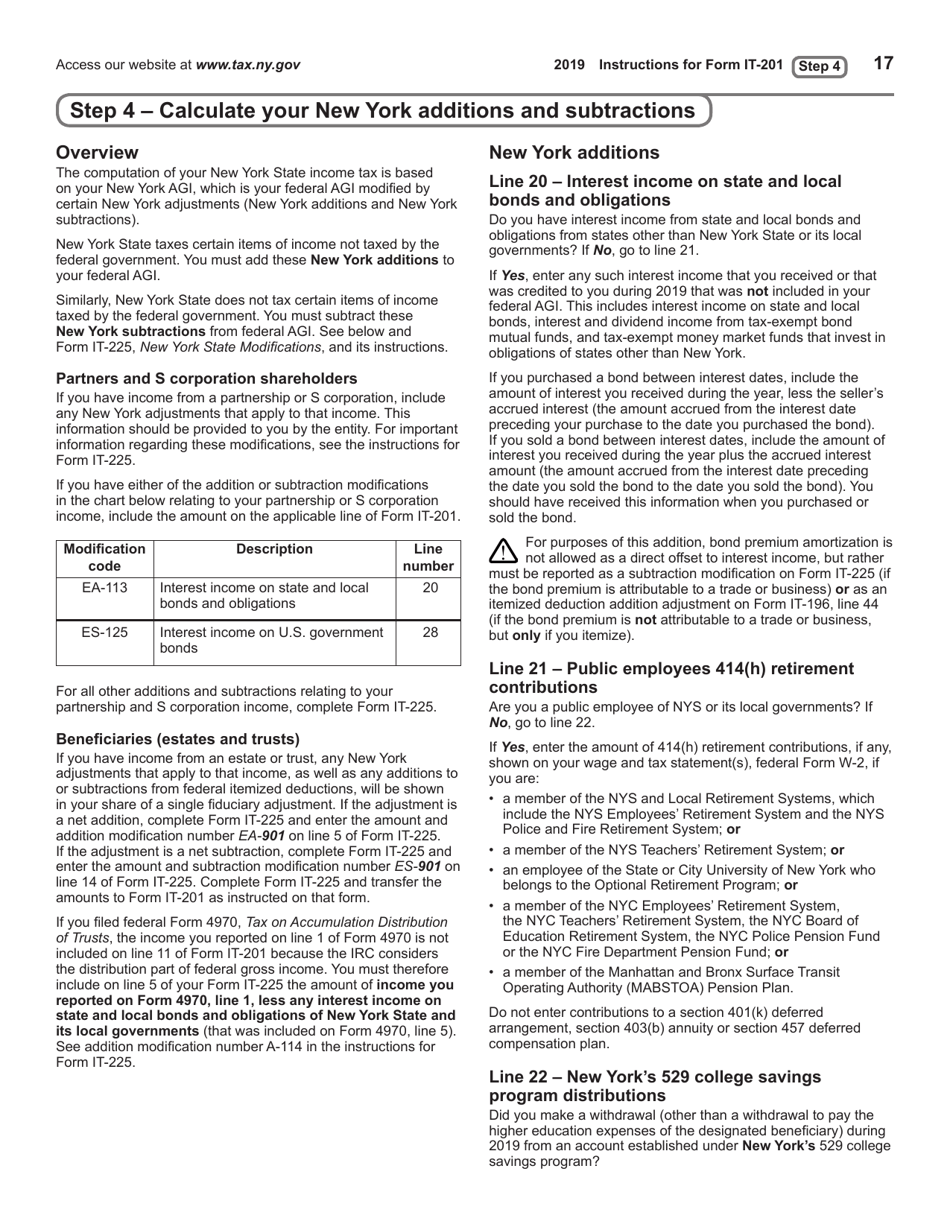

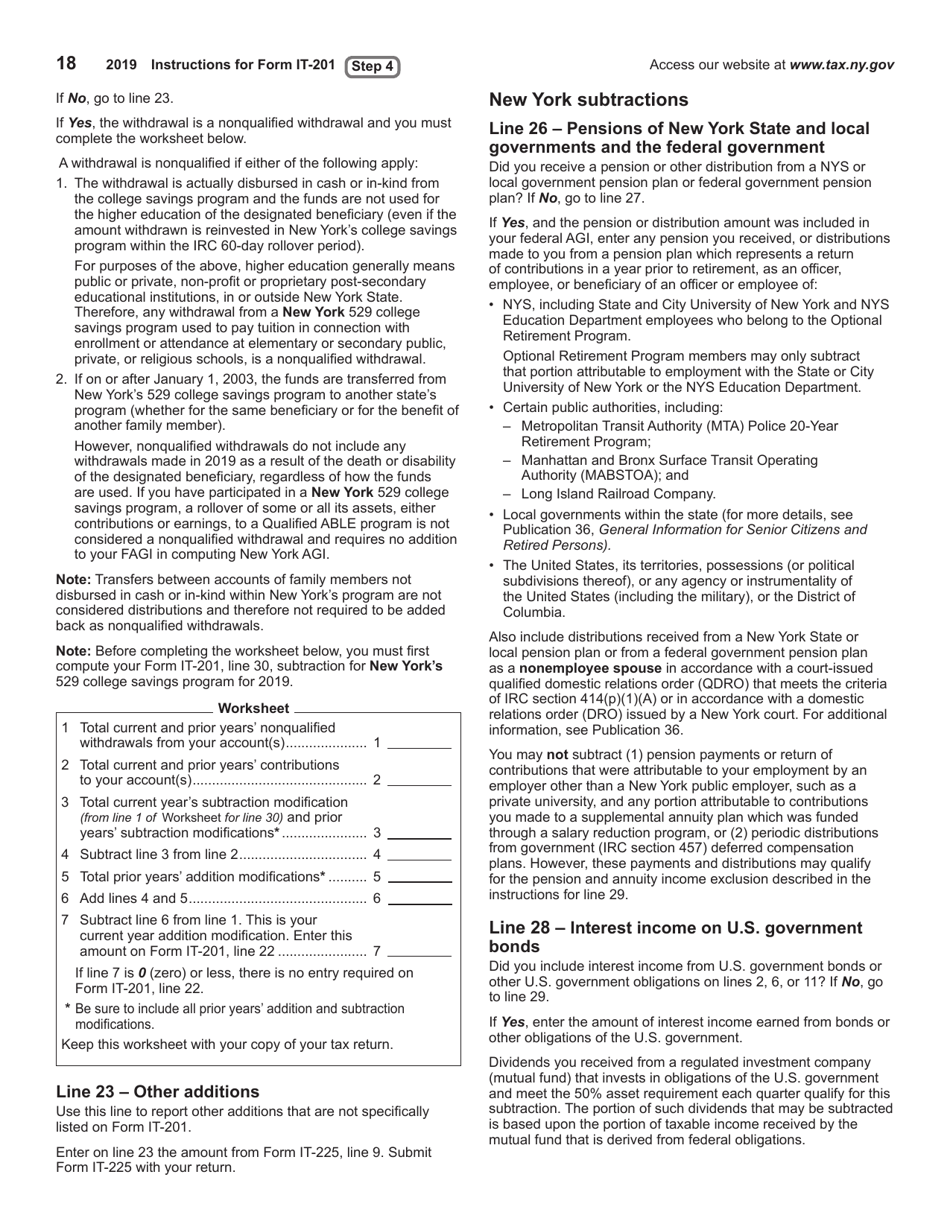

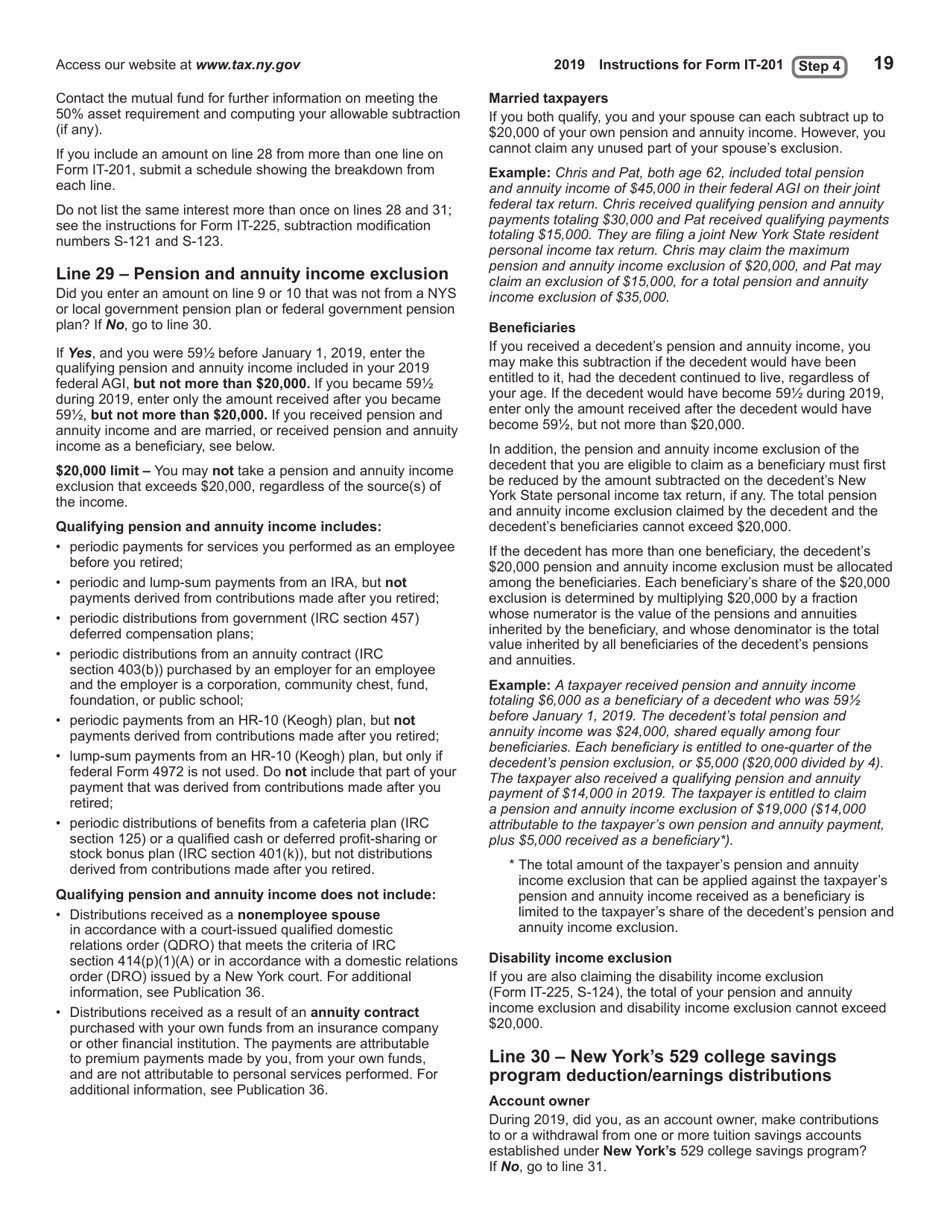

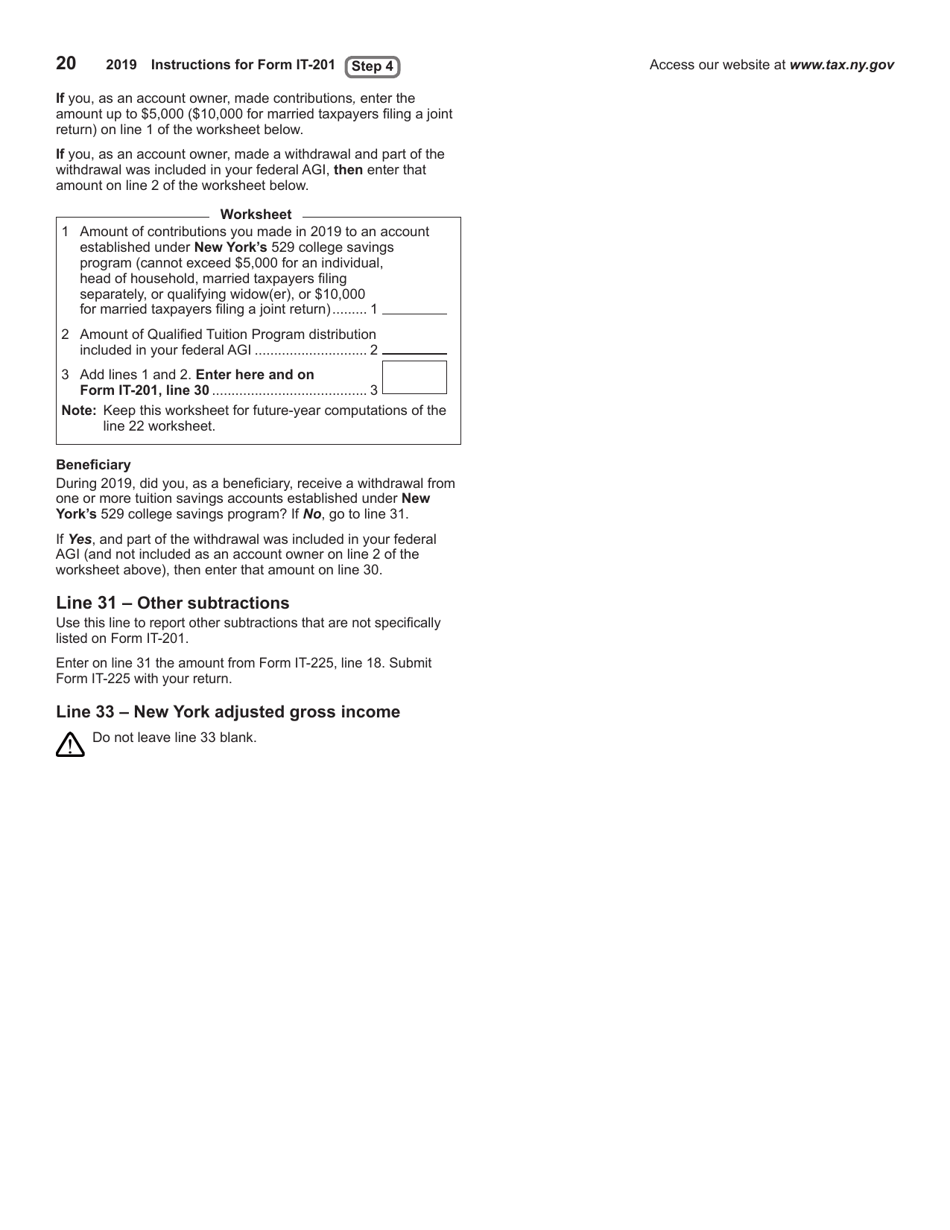

- Calculating your New York additions and subtractions;

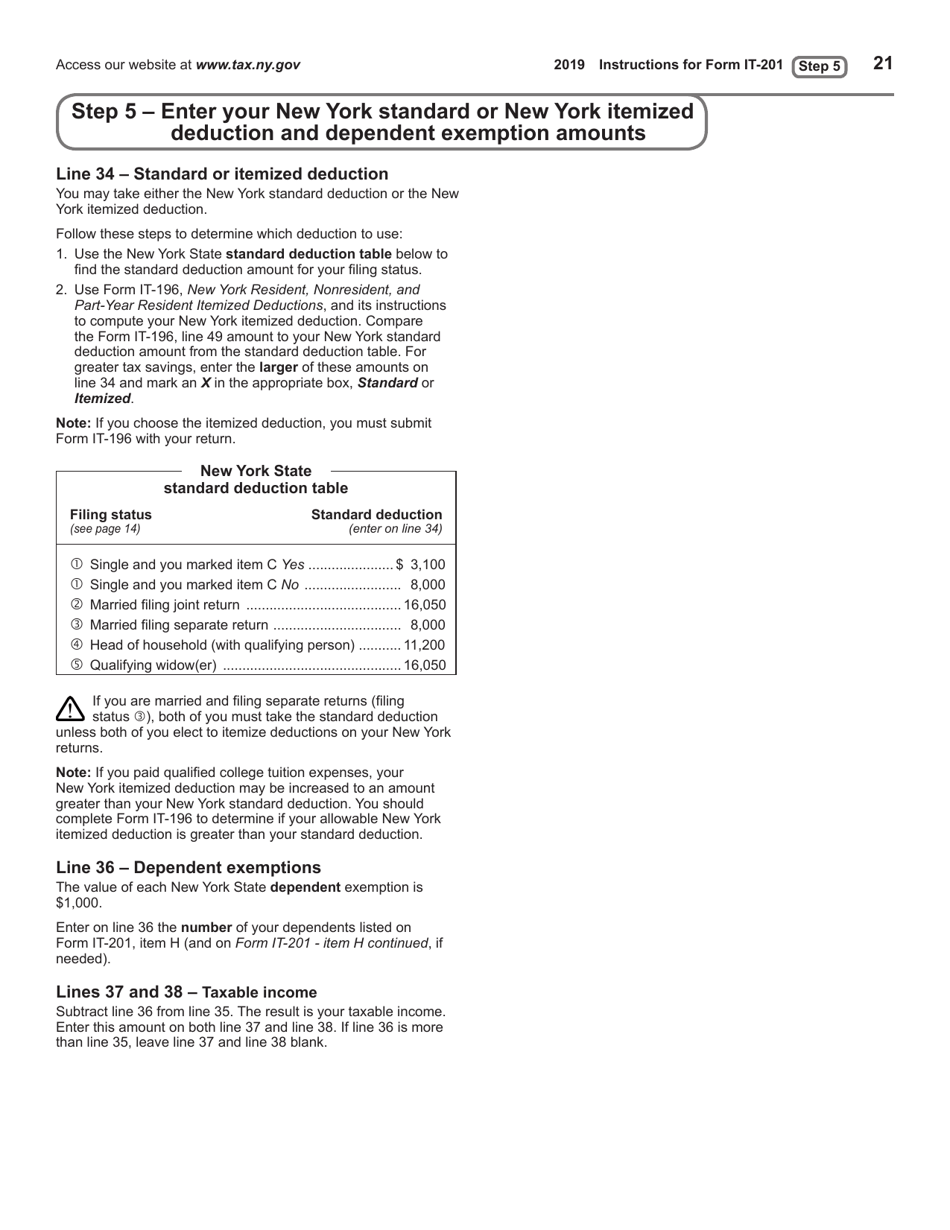

- Entering your New York standard or New York itemized deduction and dependent exemption amounts;

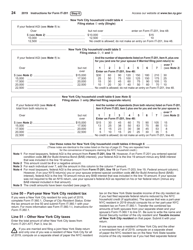

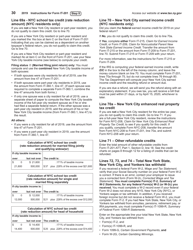

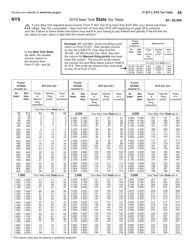

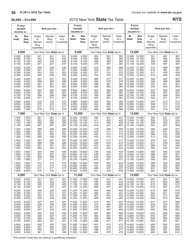

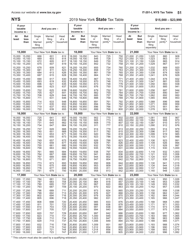

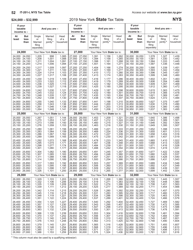

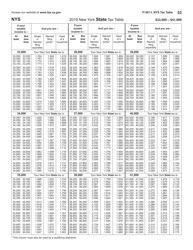

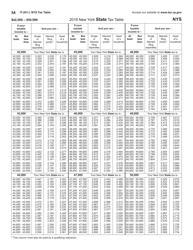

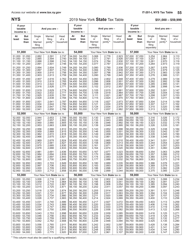

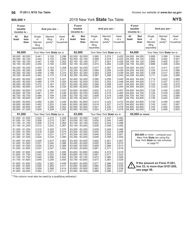

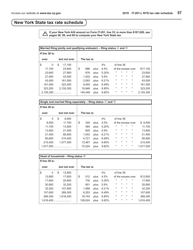

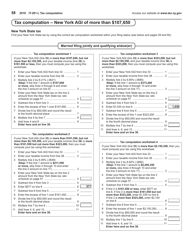

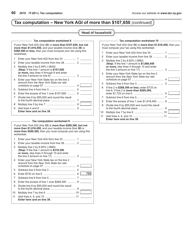

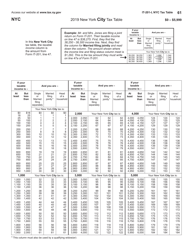

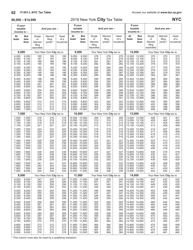

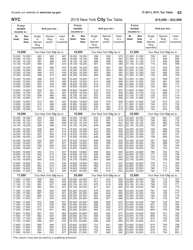

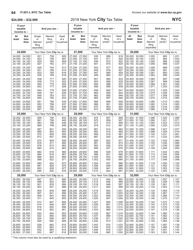

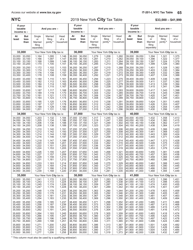

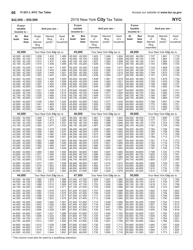

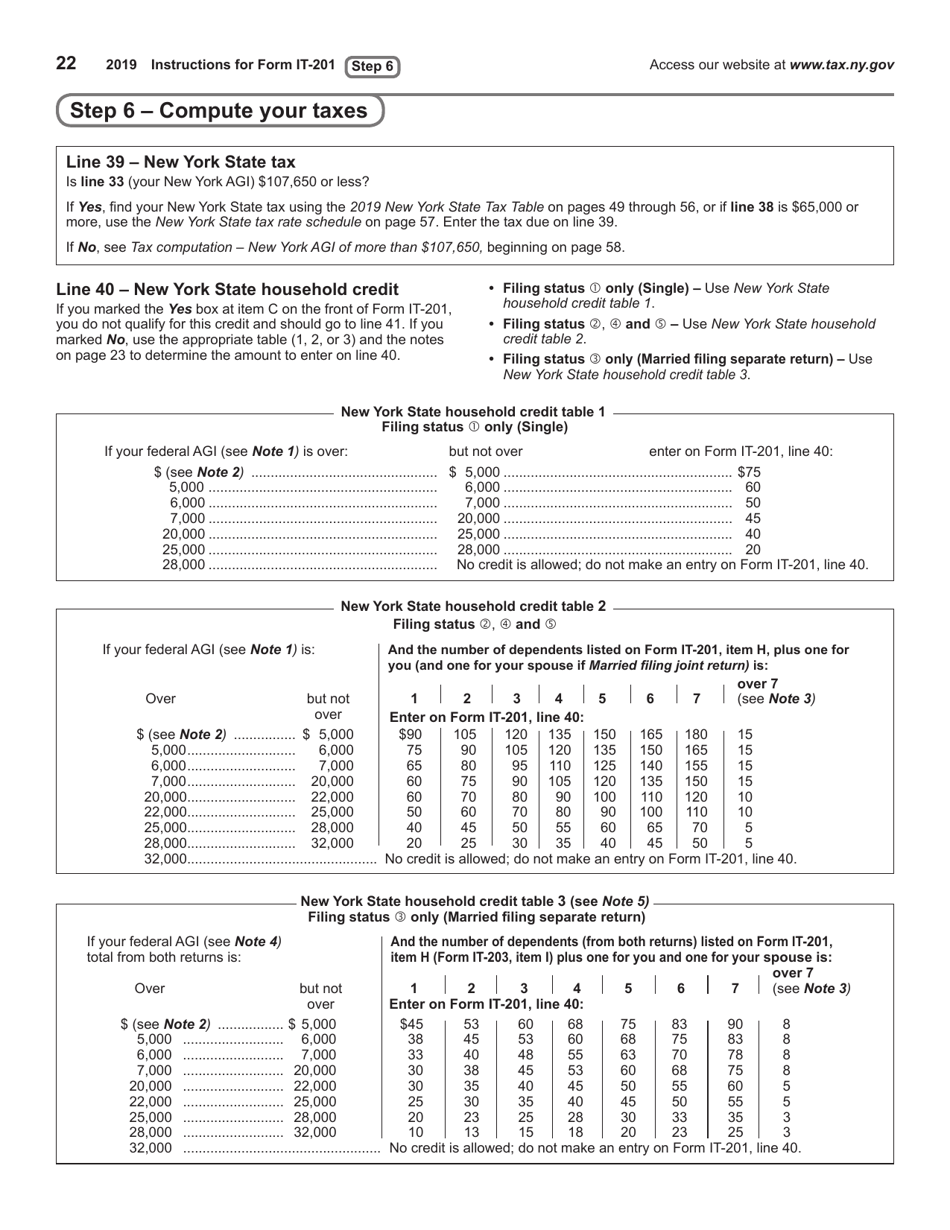

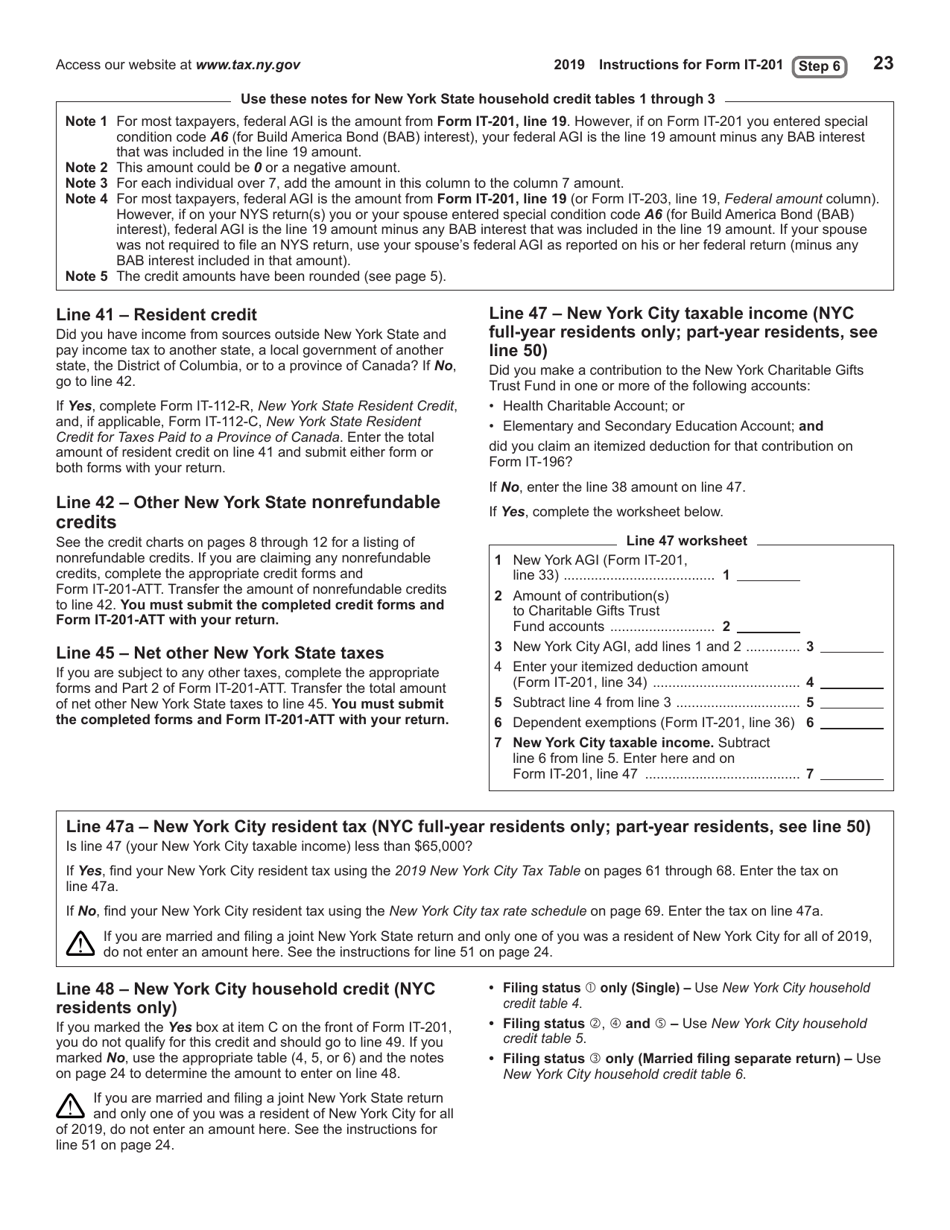

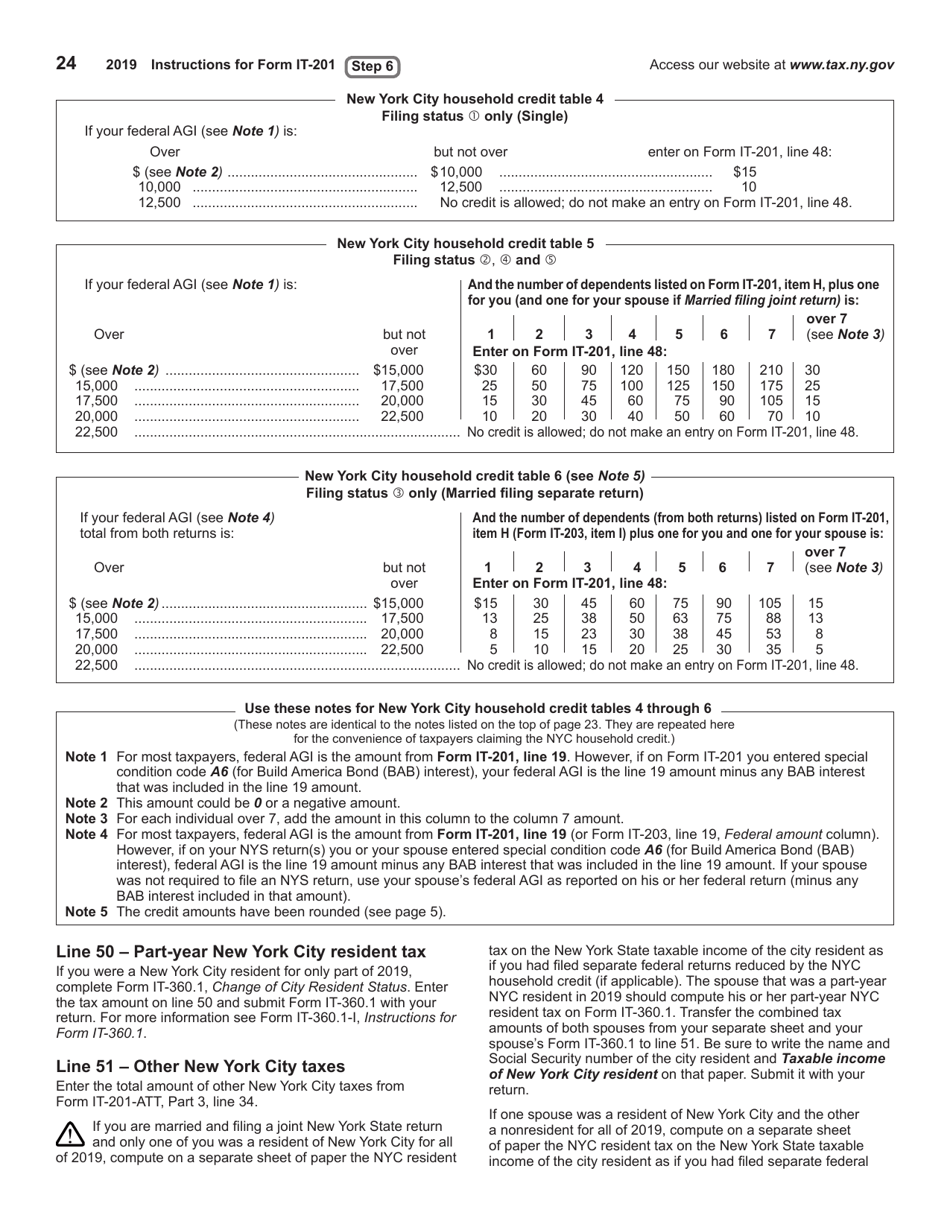

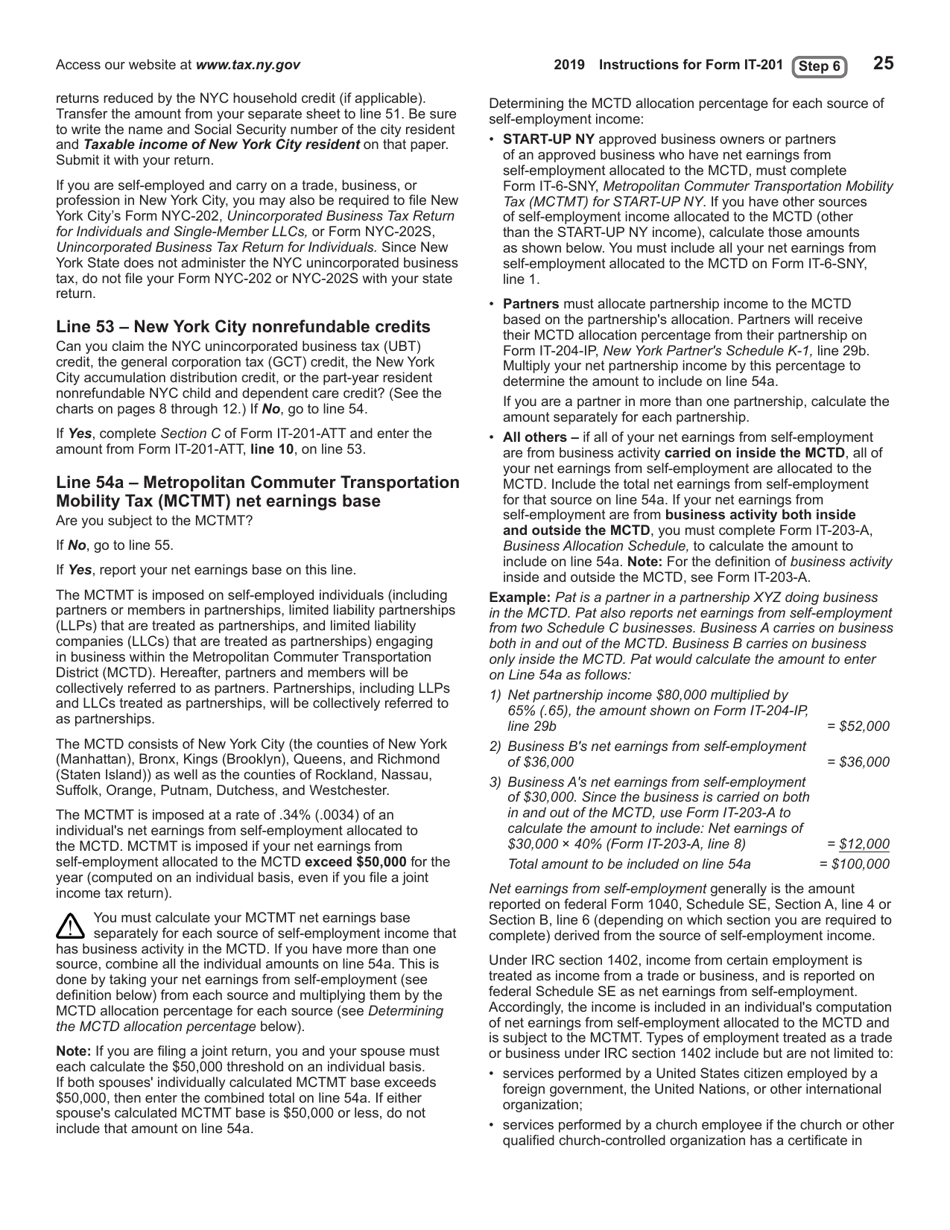

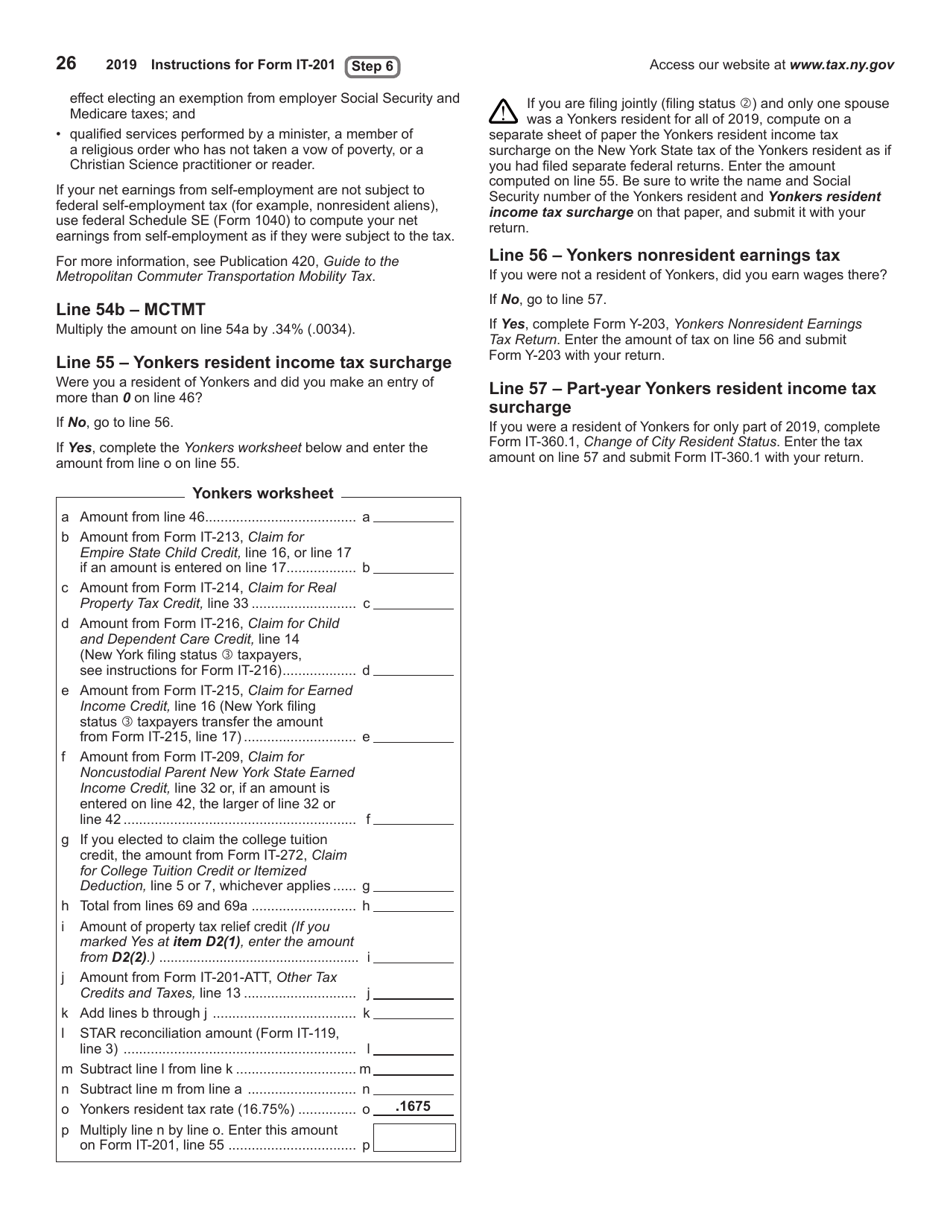

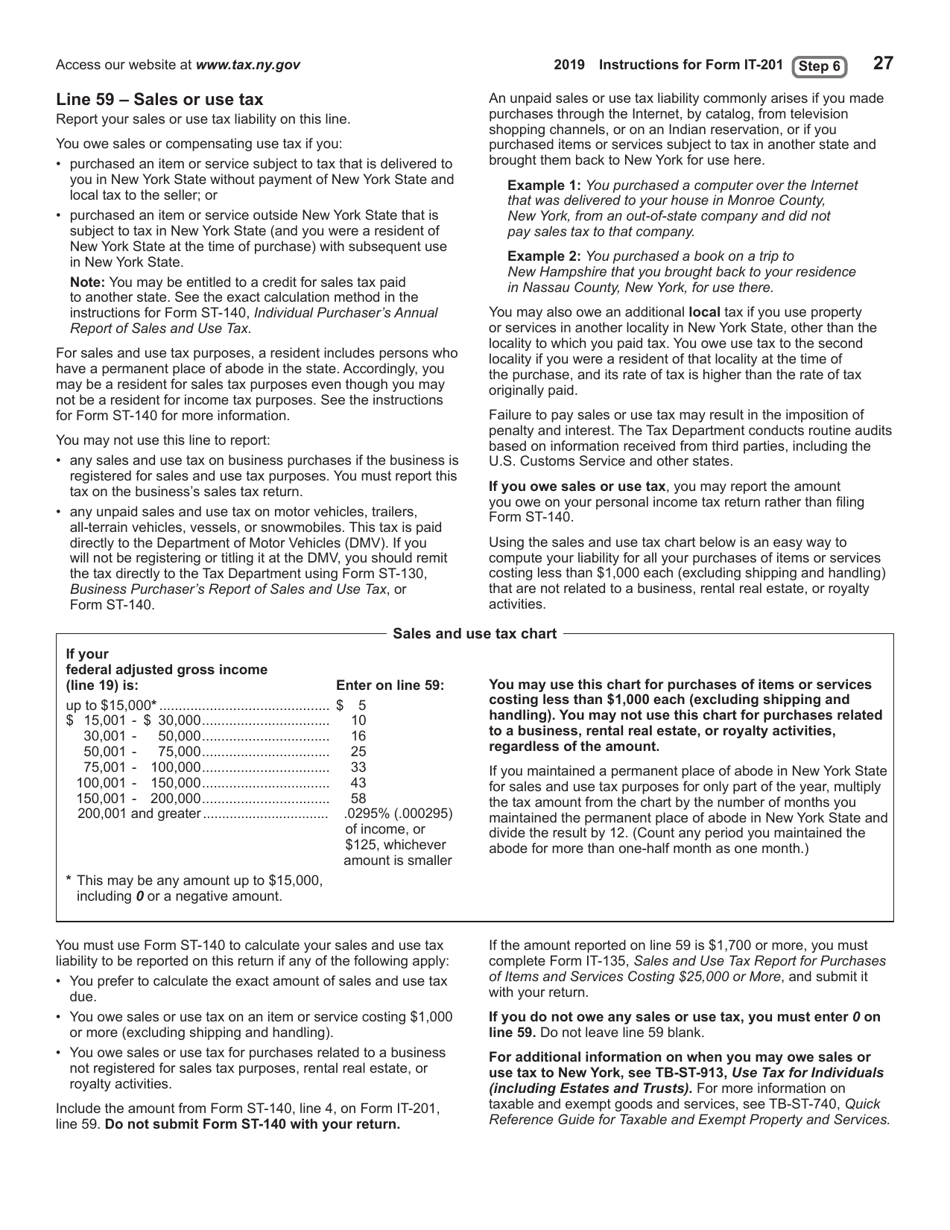

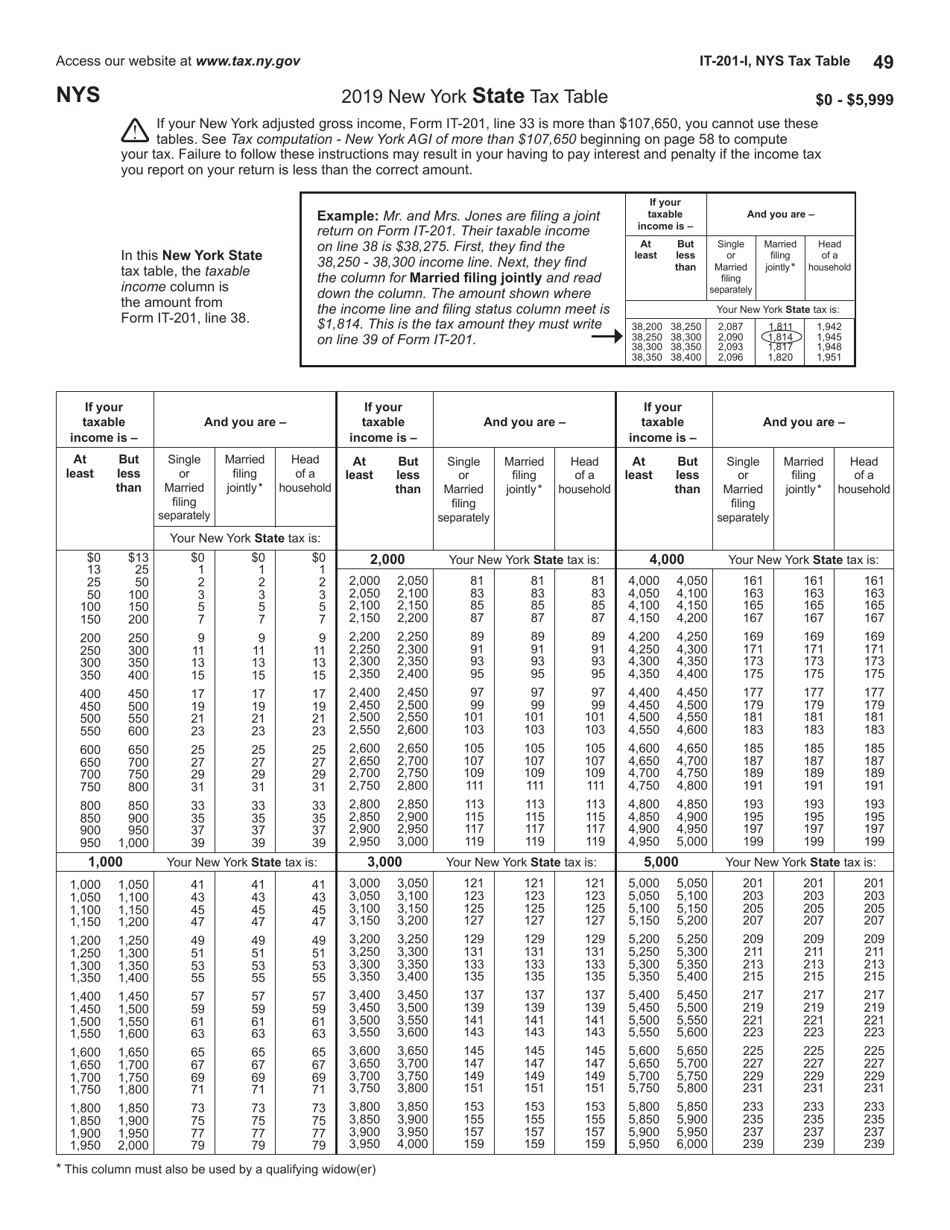

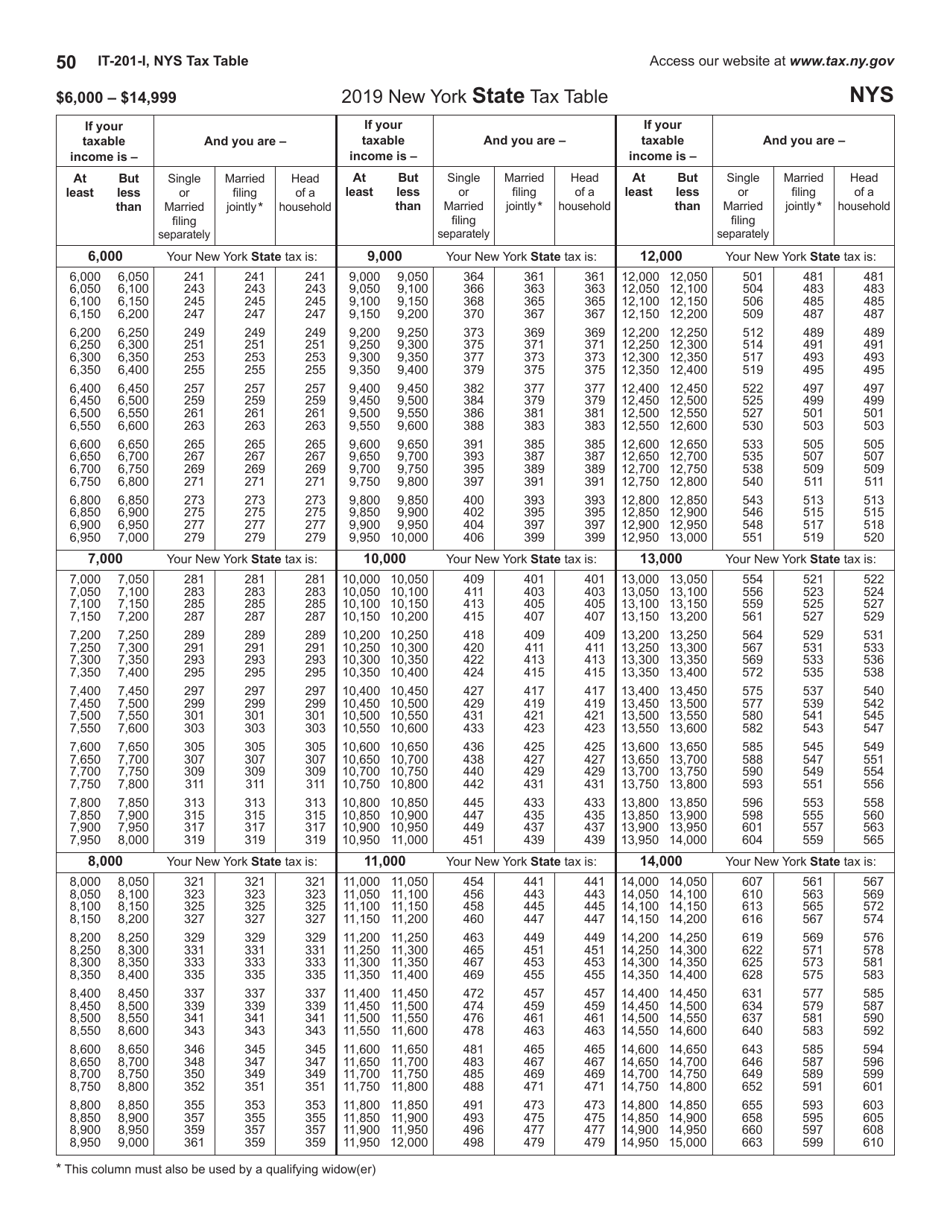

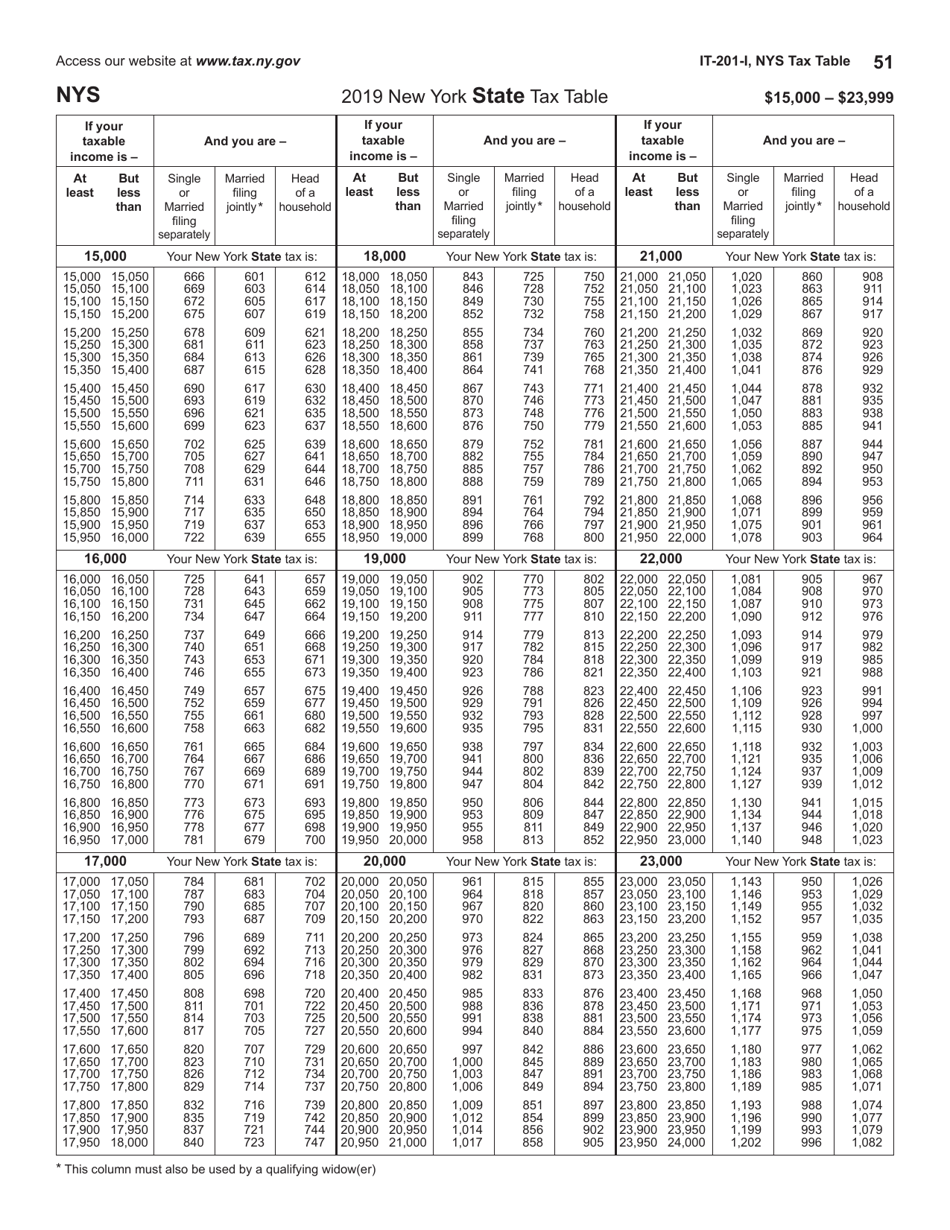

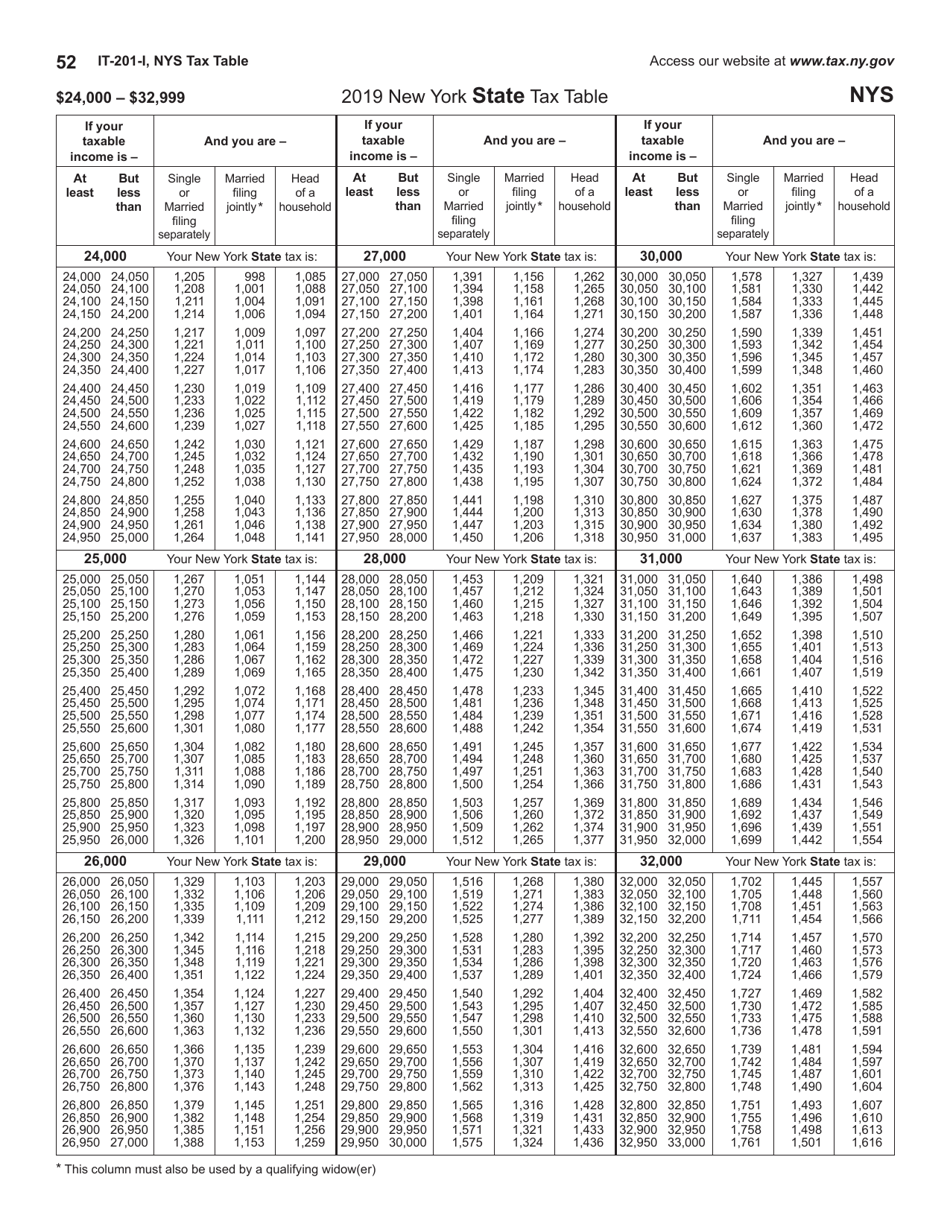

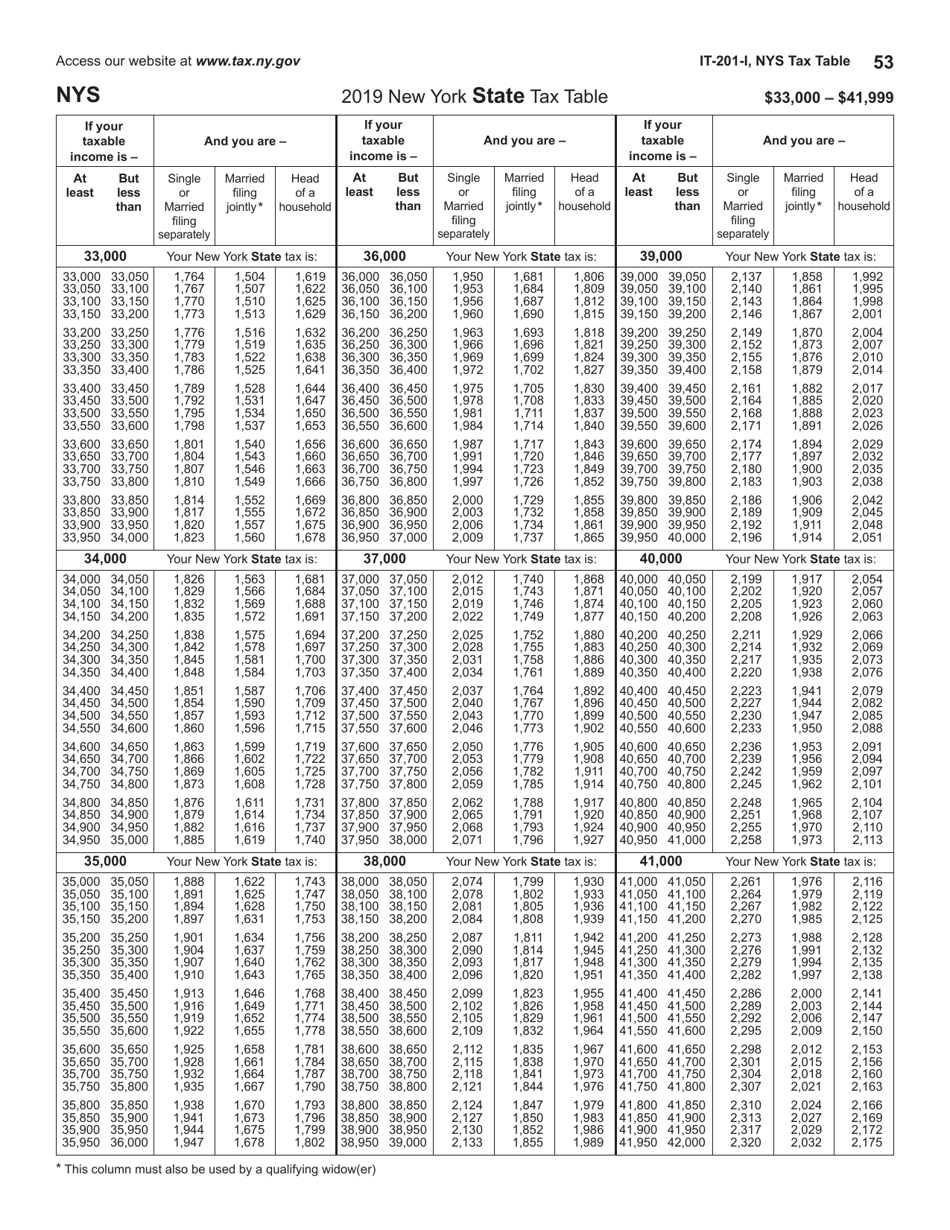

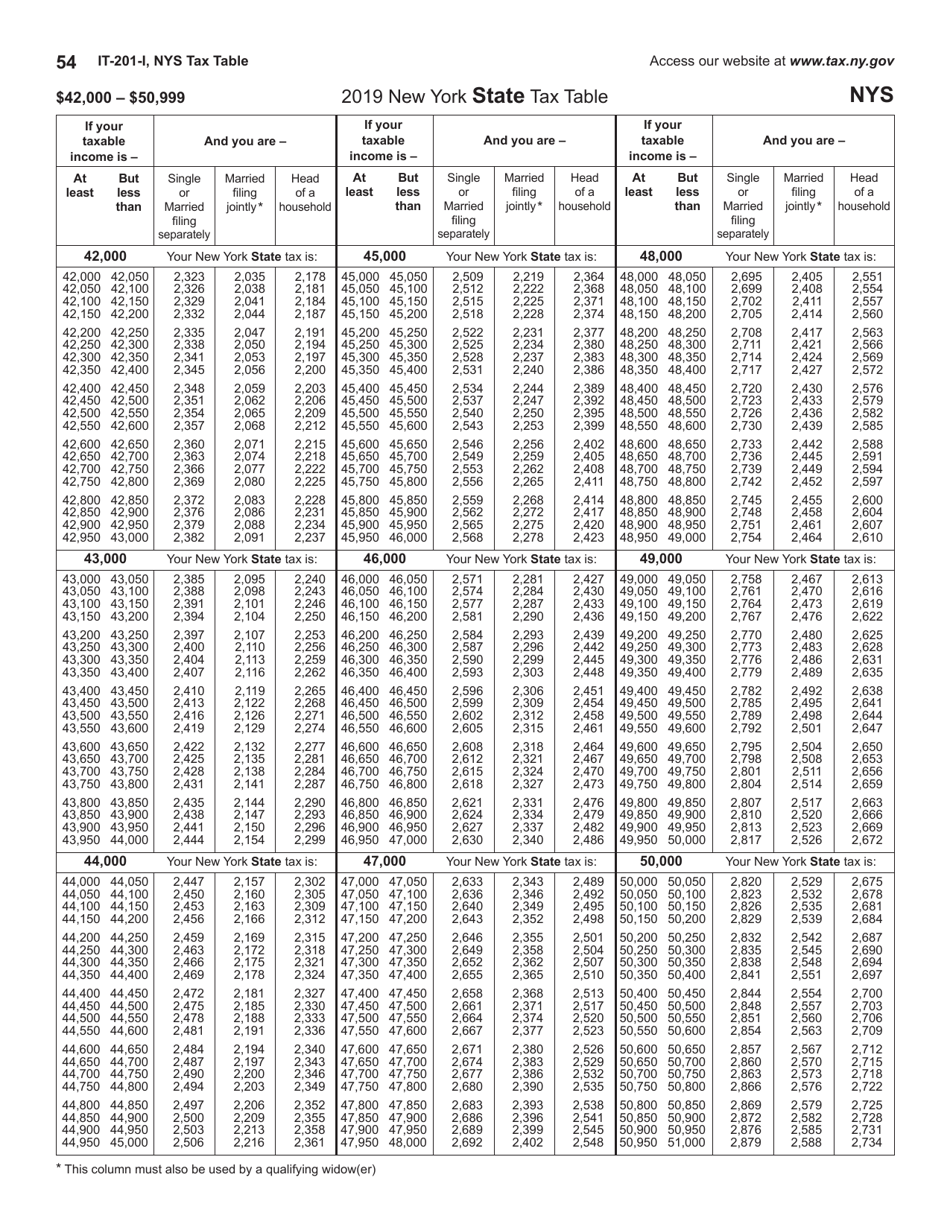

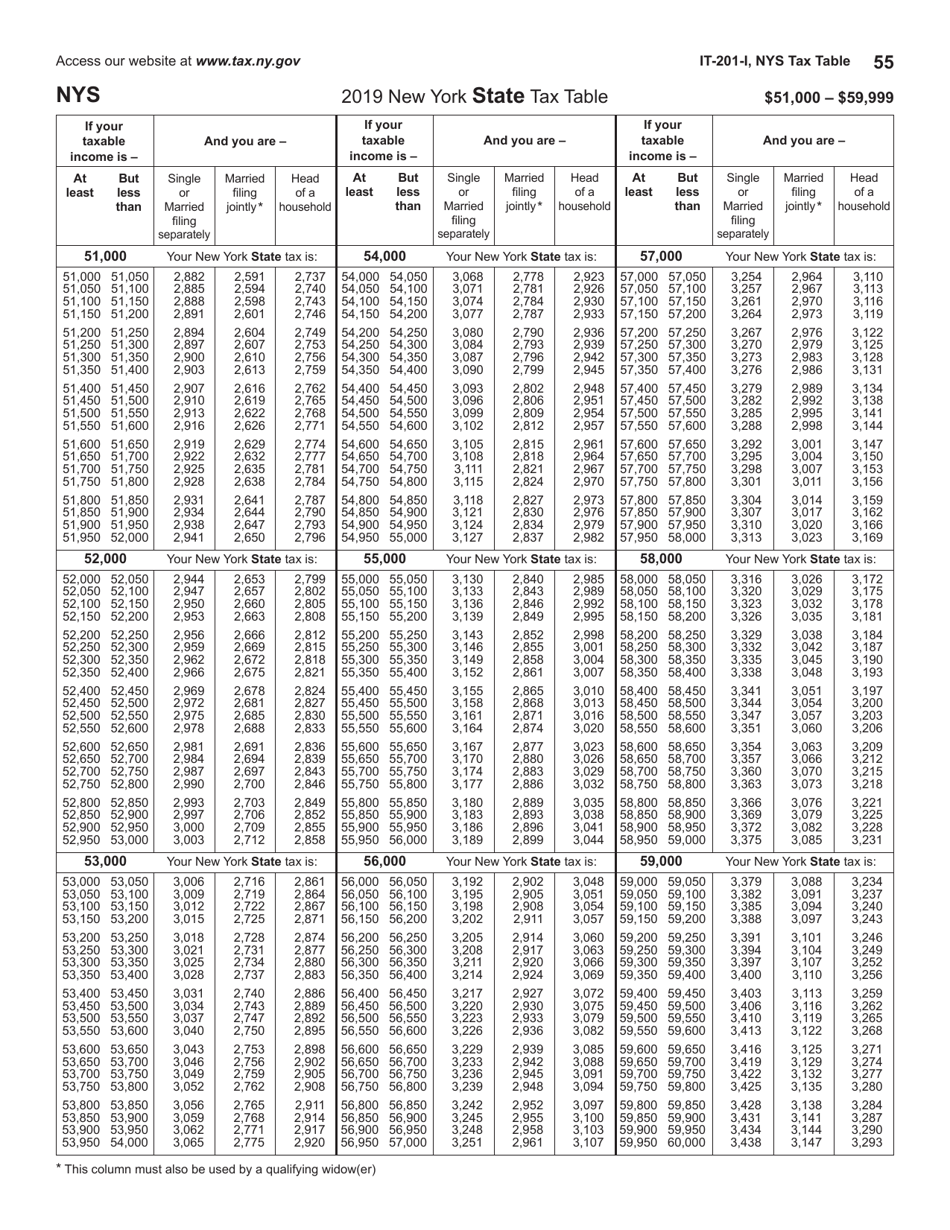

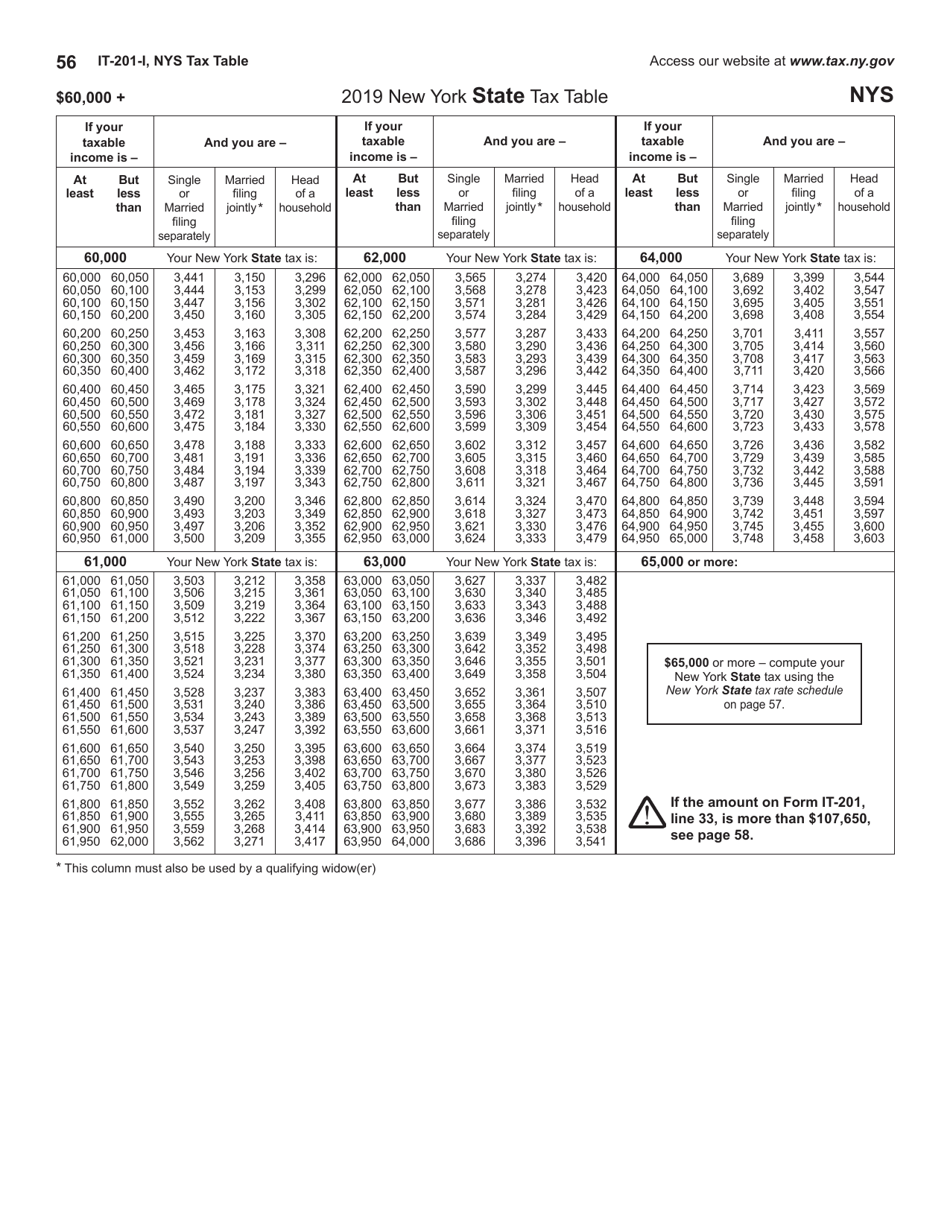

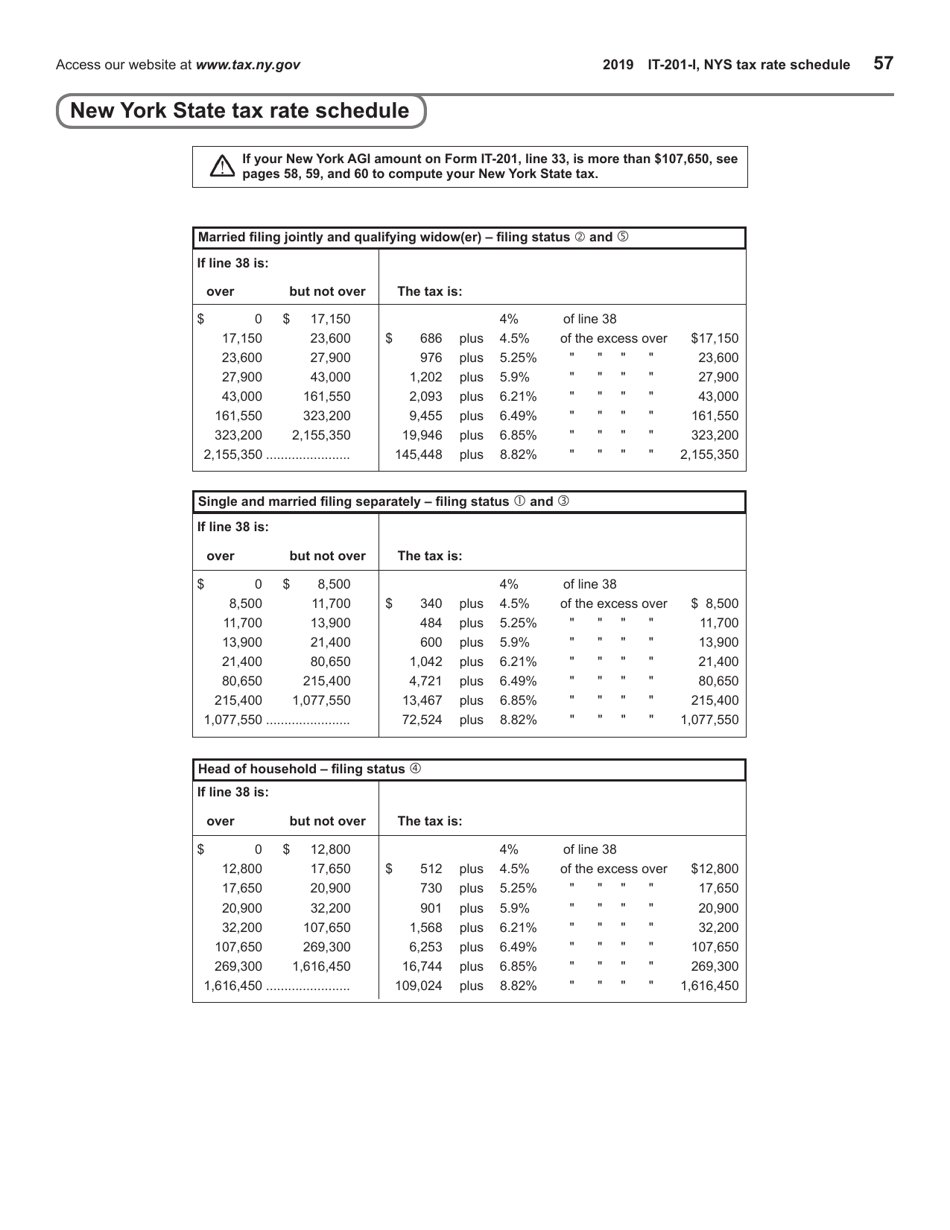

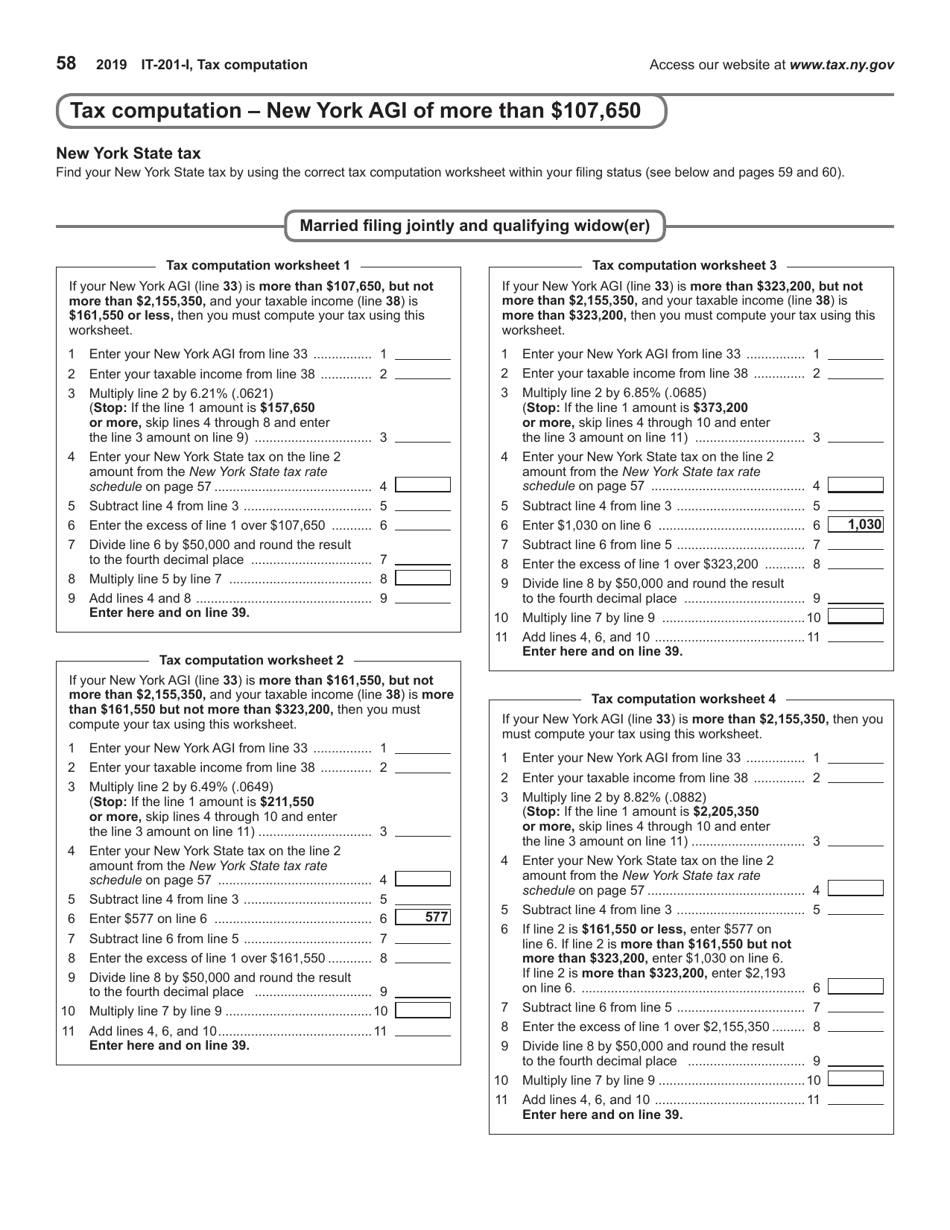

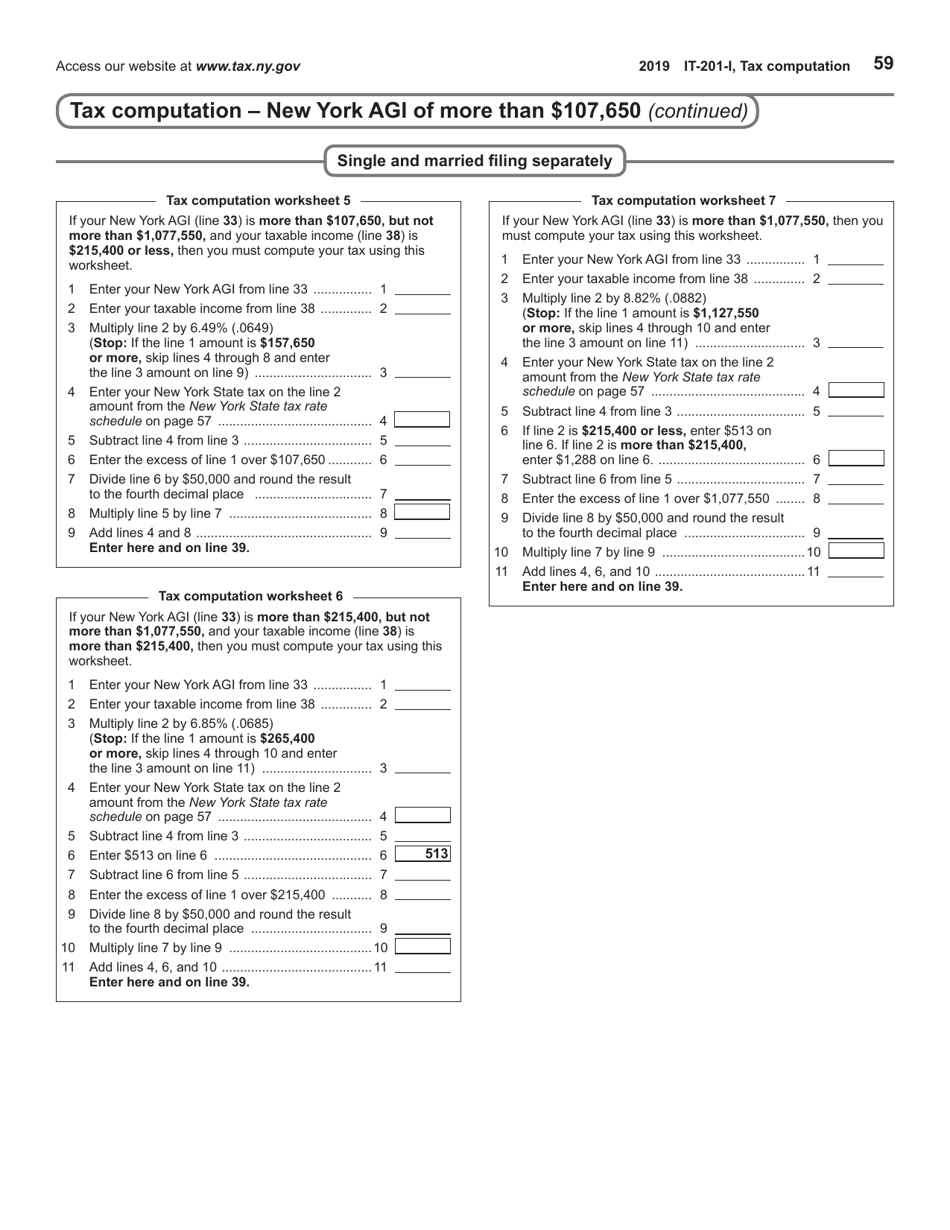

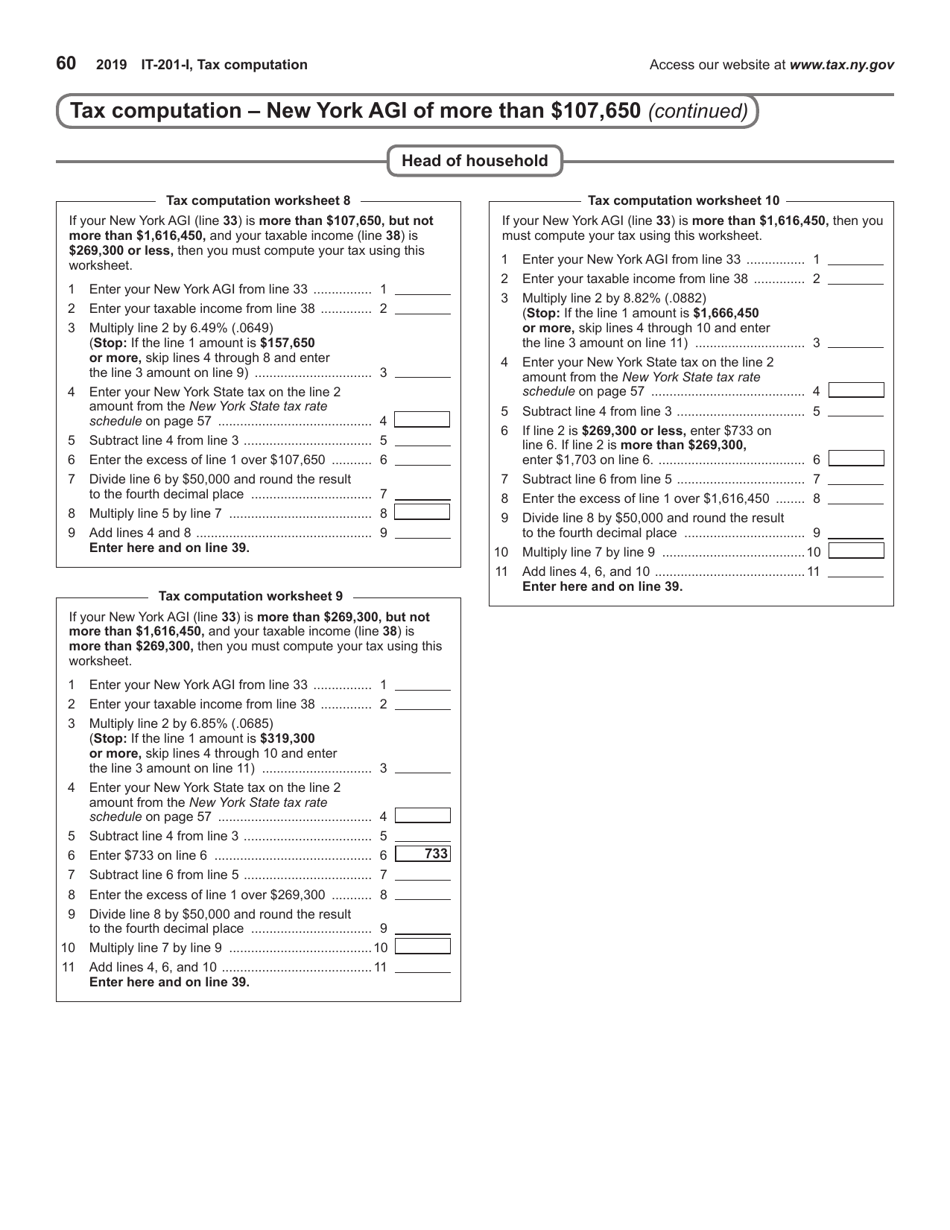

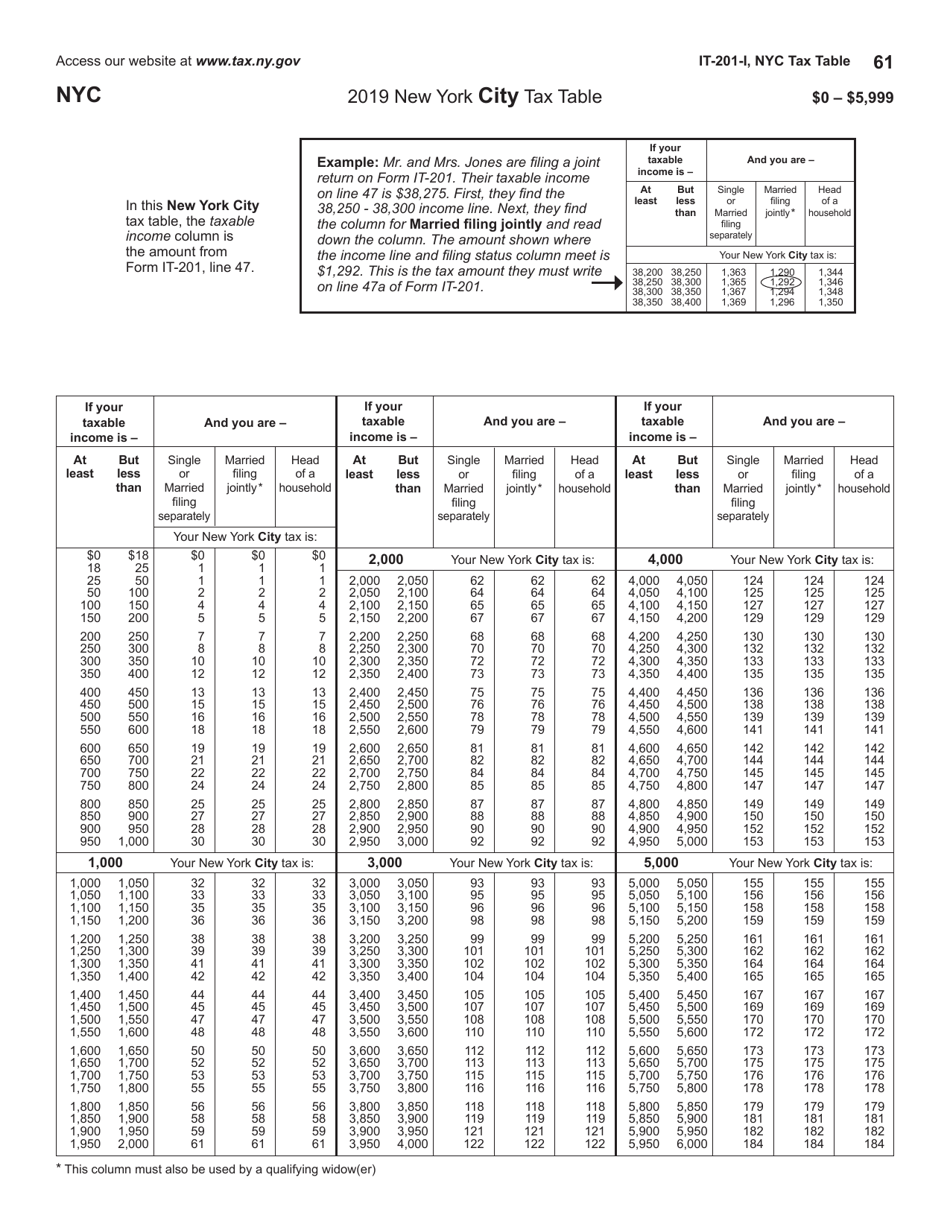

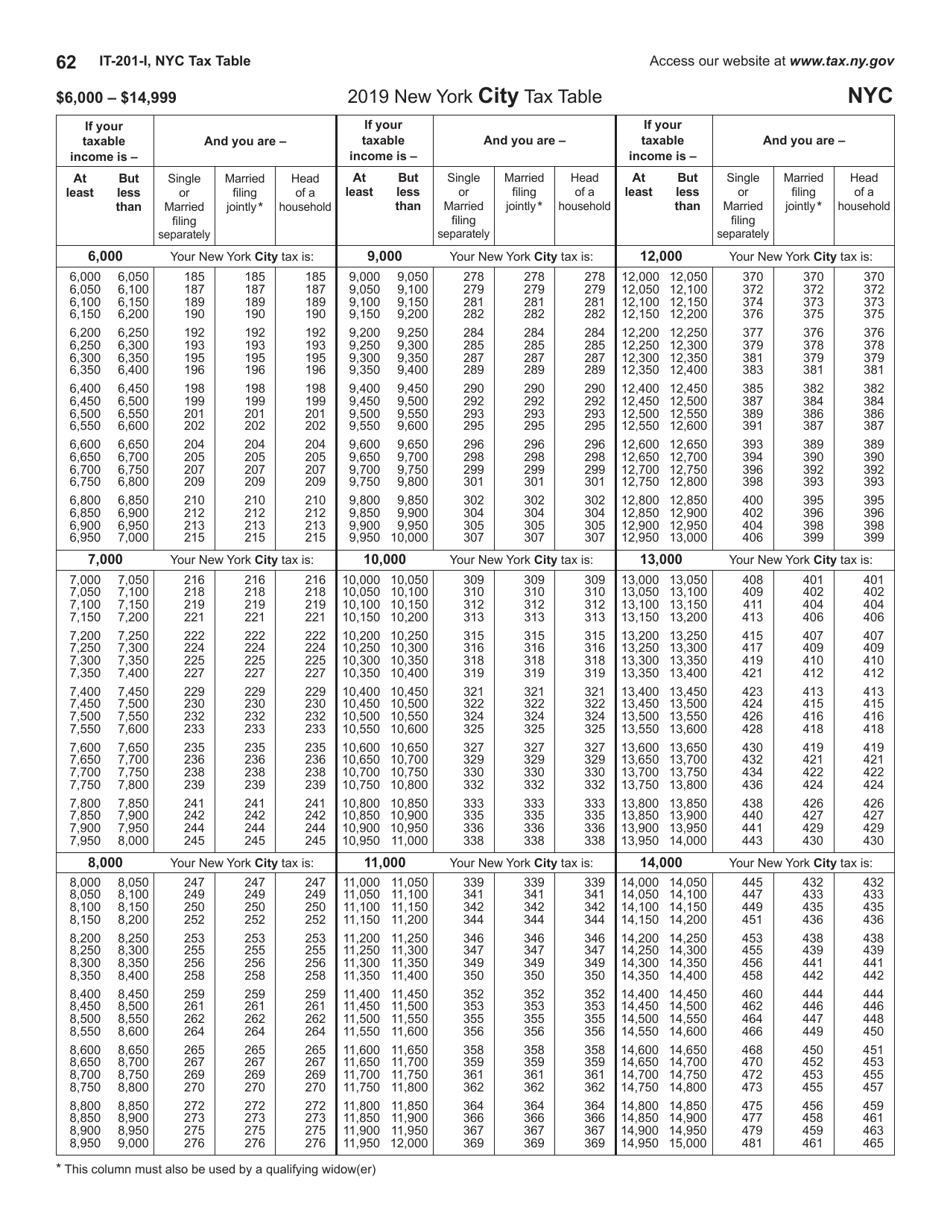

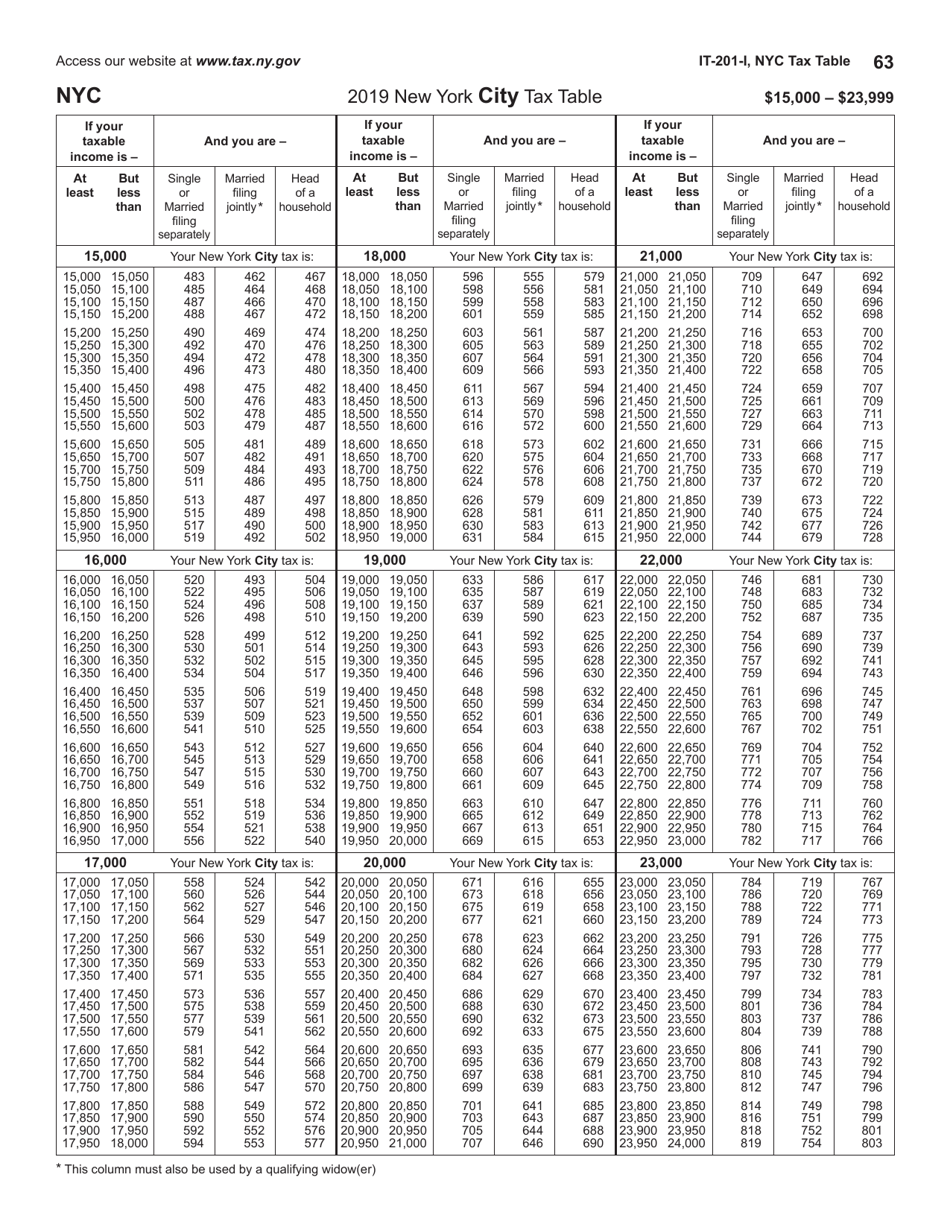

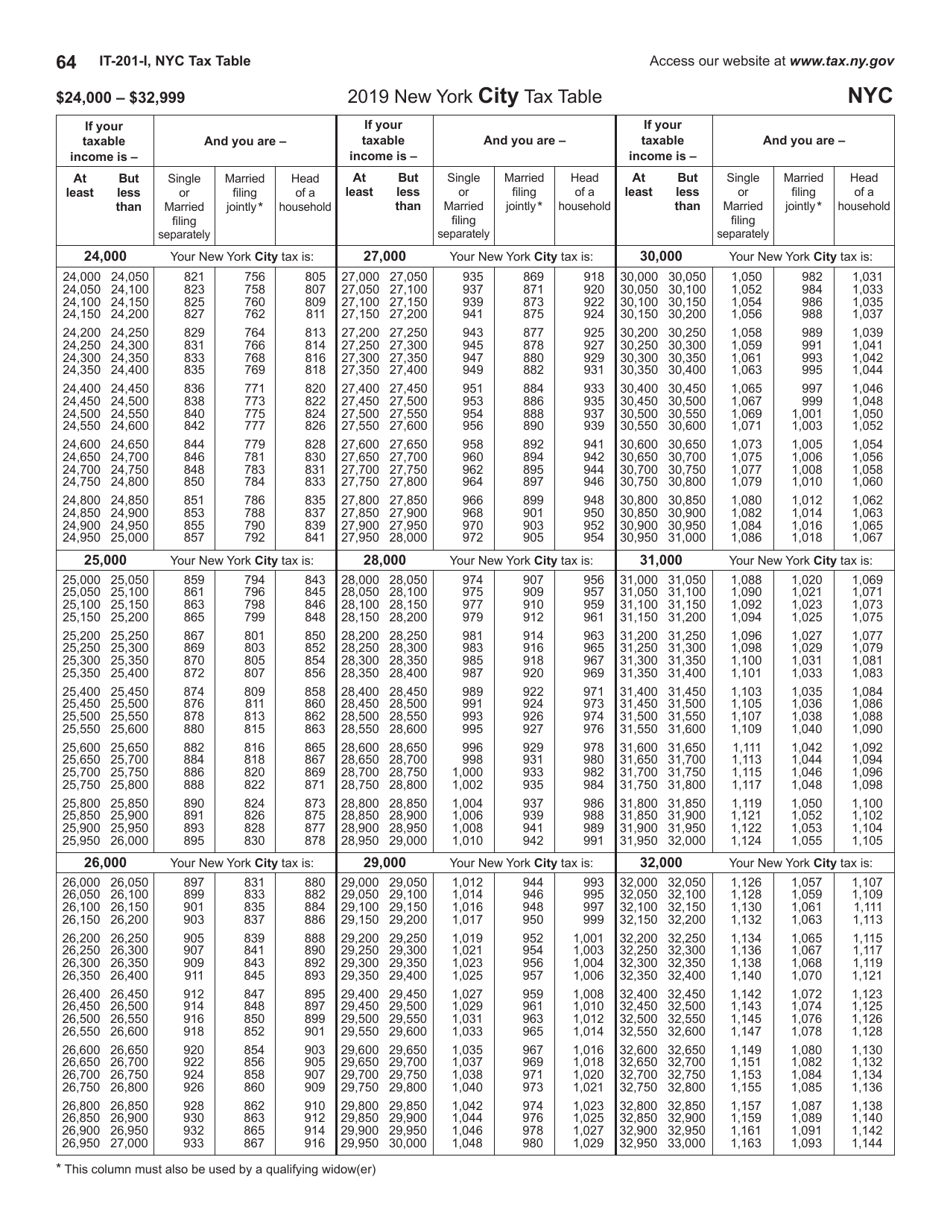

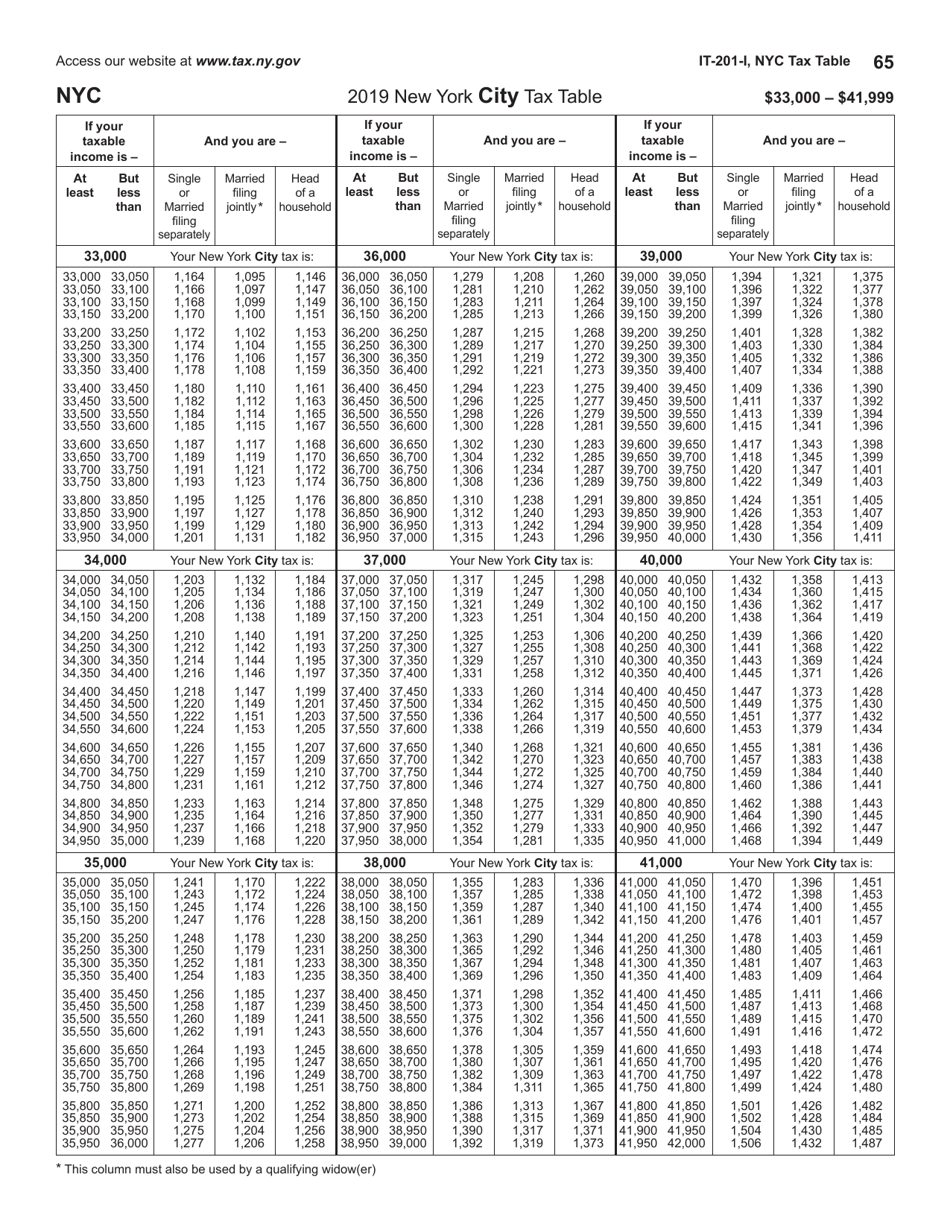

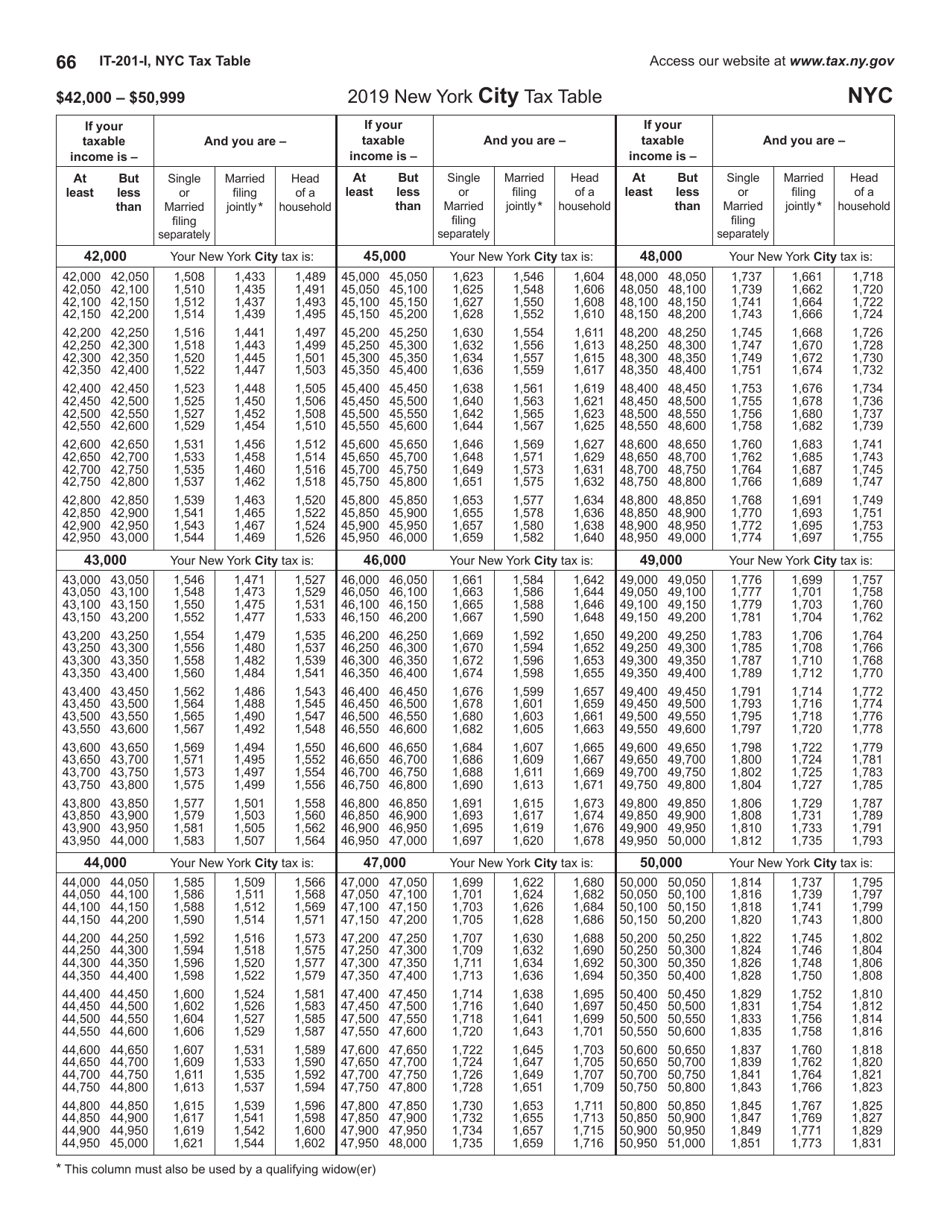

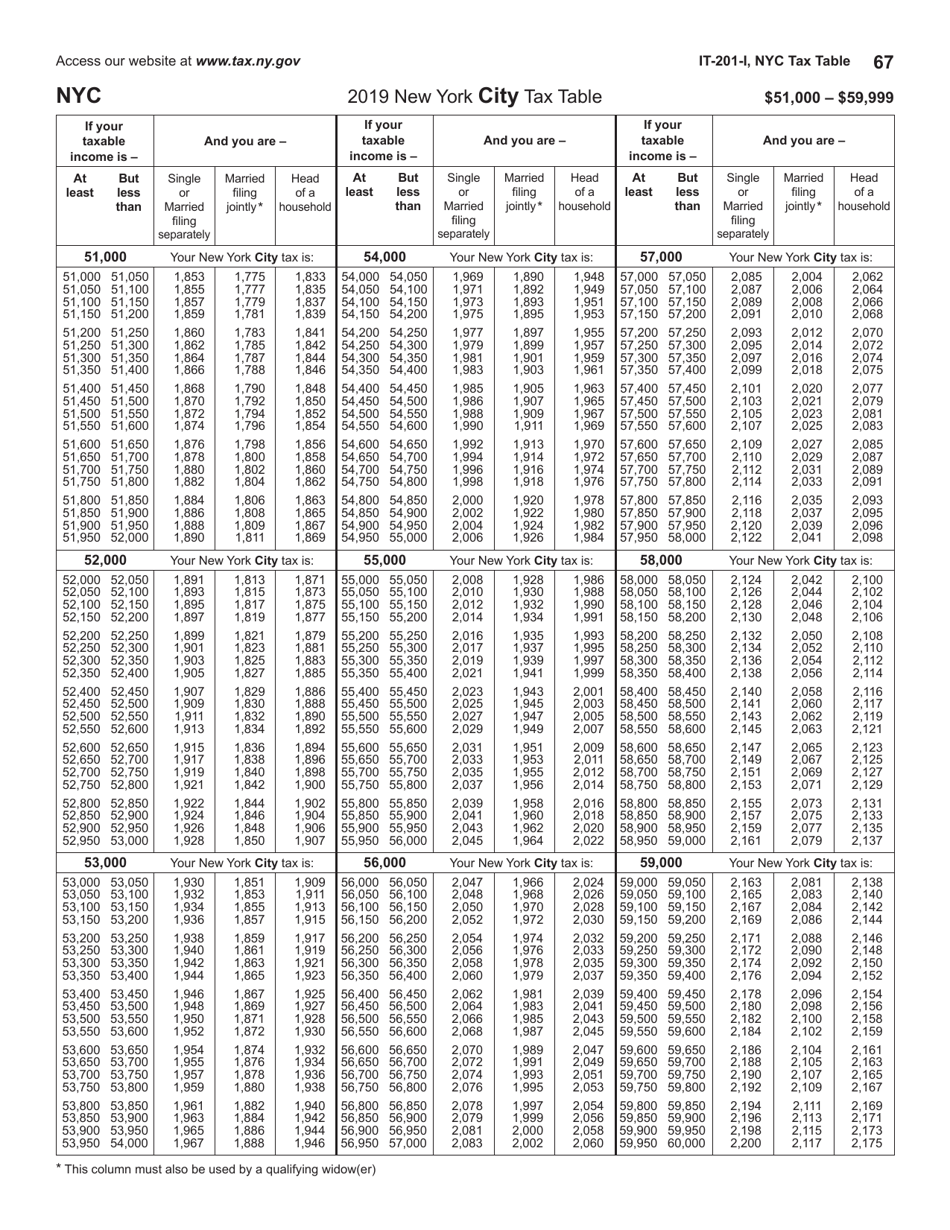

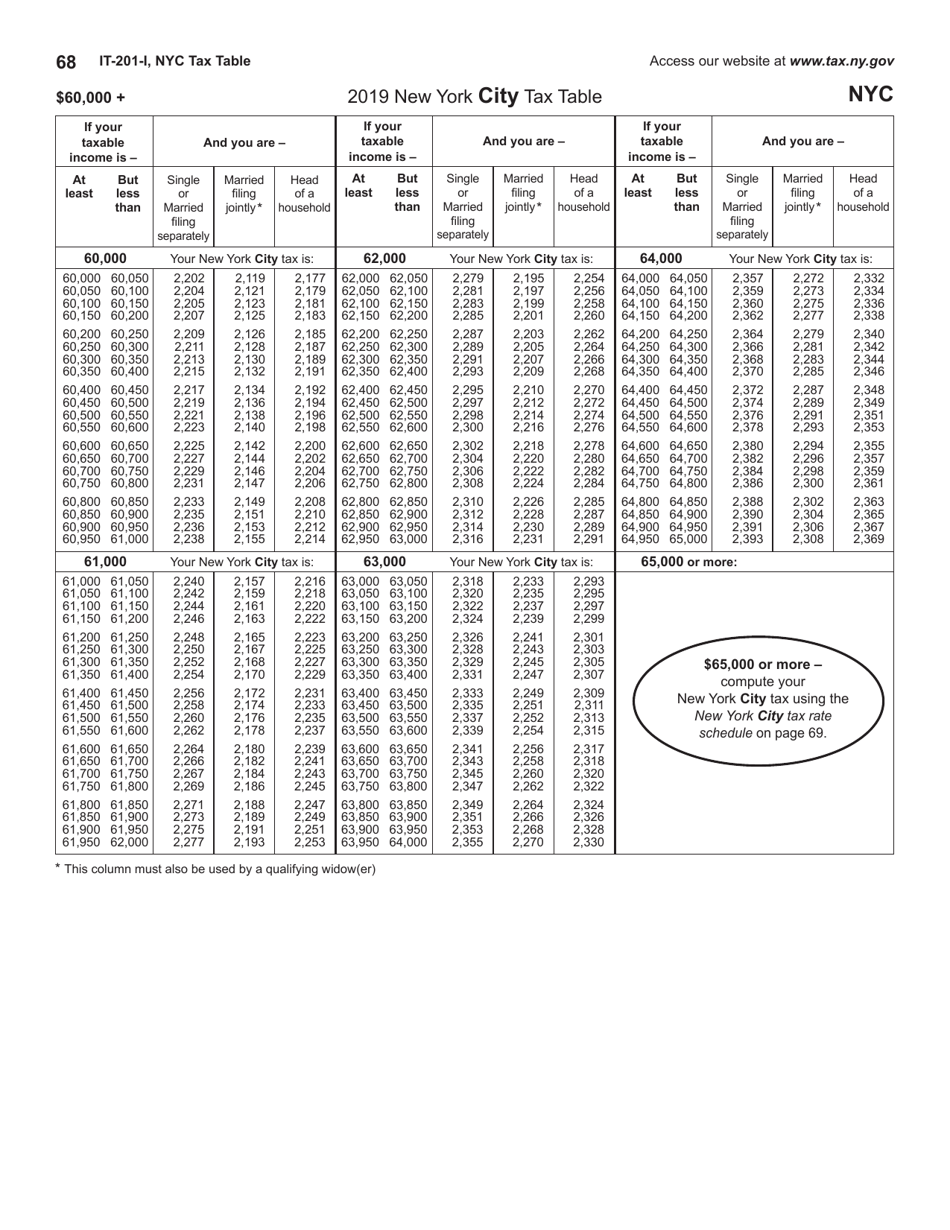

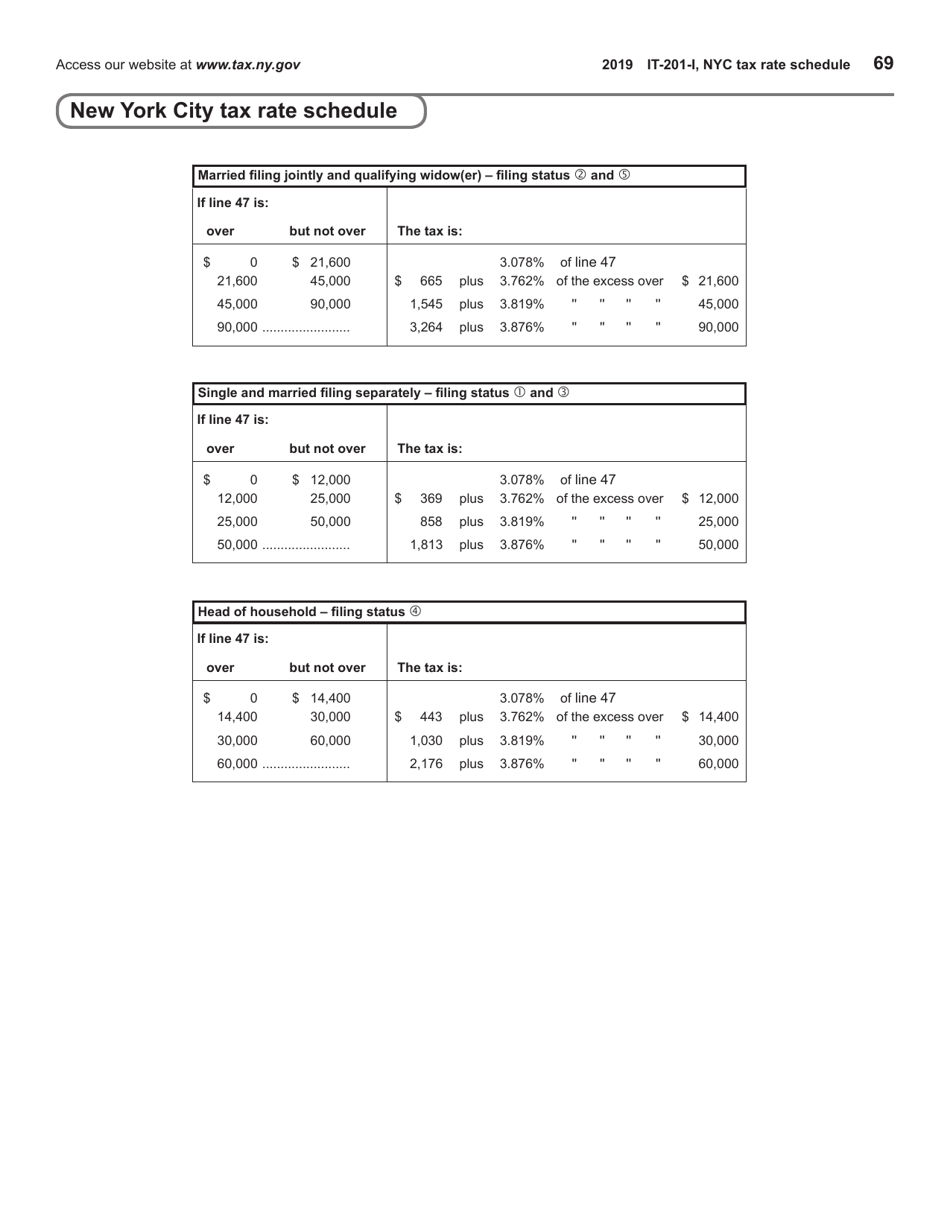

- Computing your taxes;

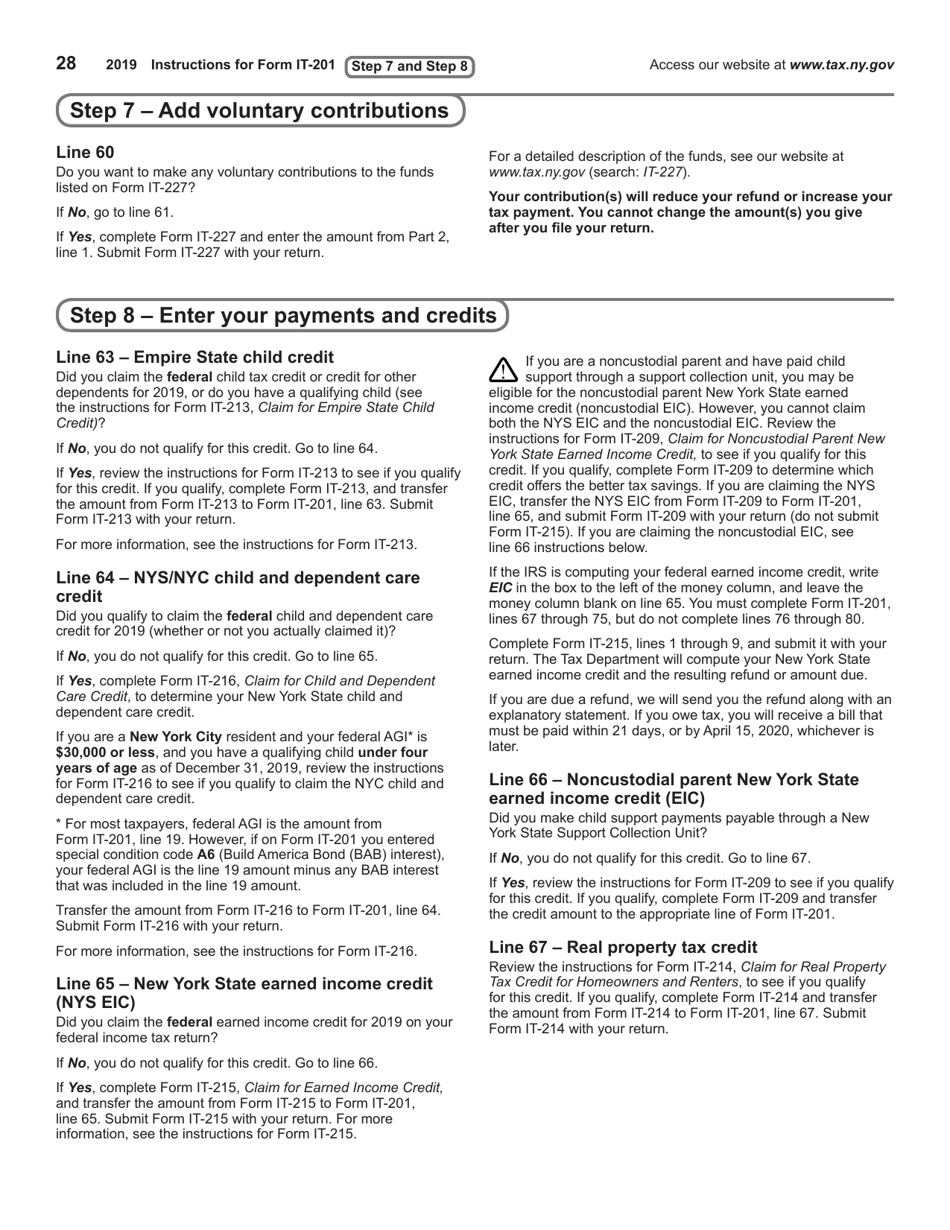

- Adding voluntary contributions;

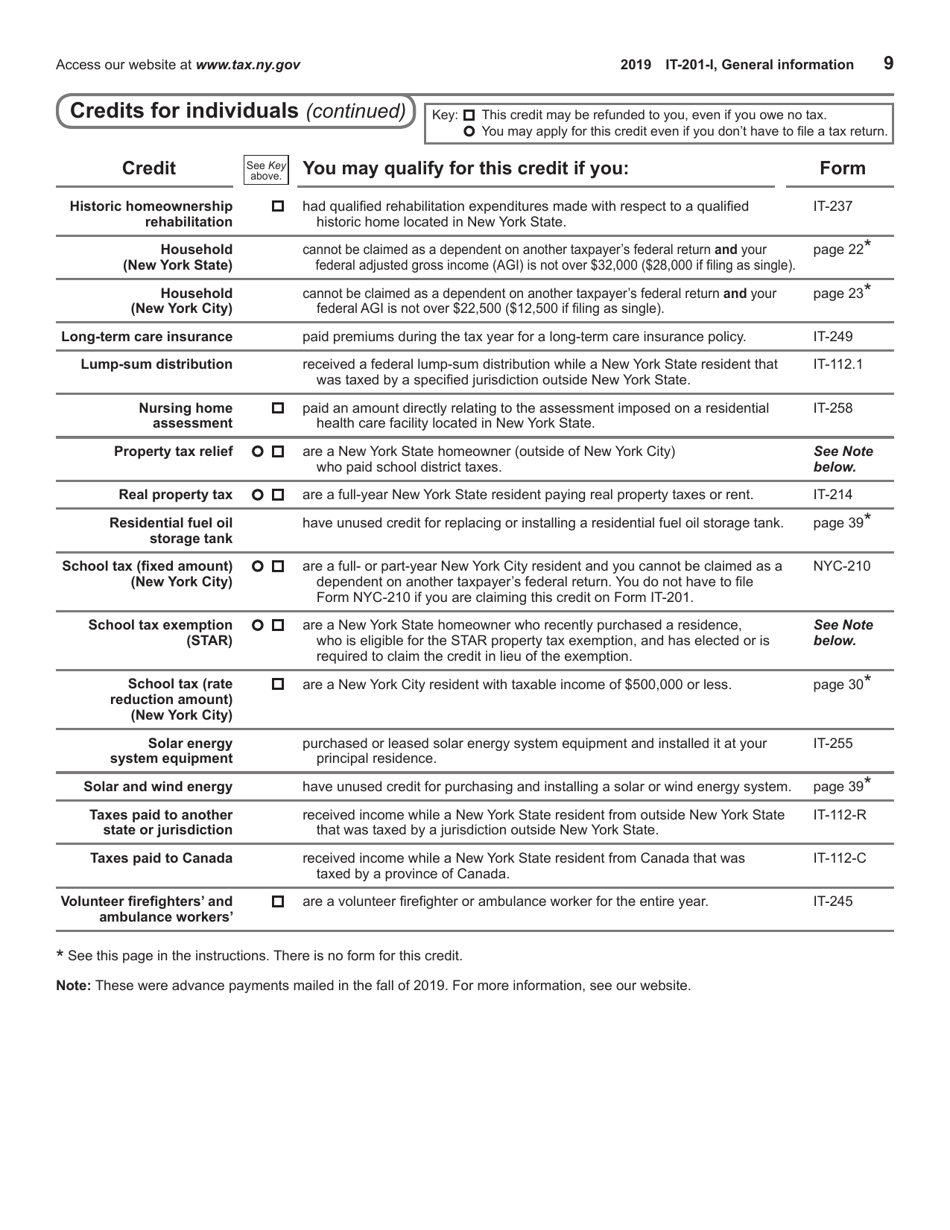

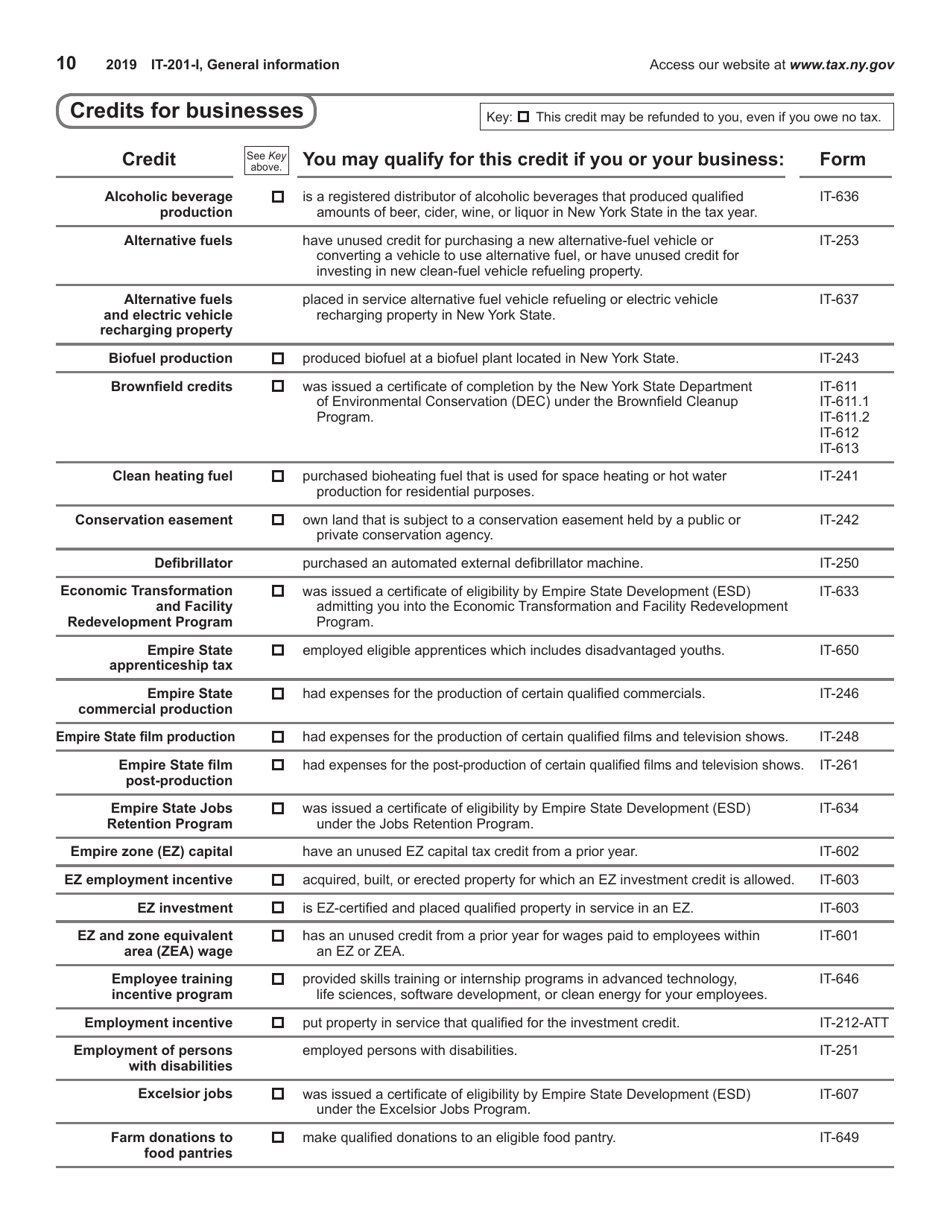

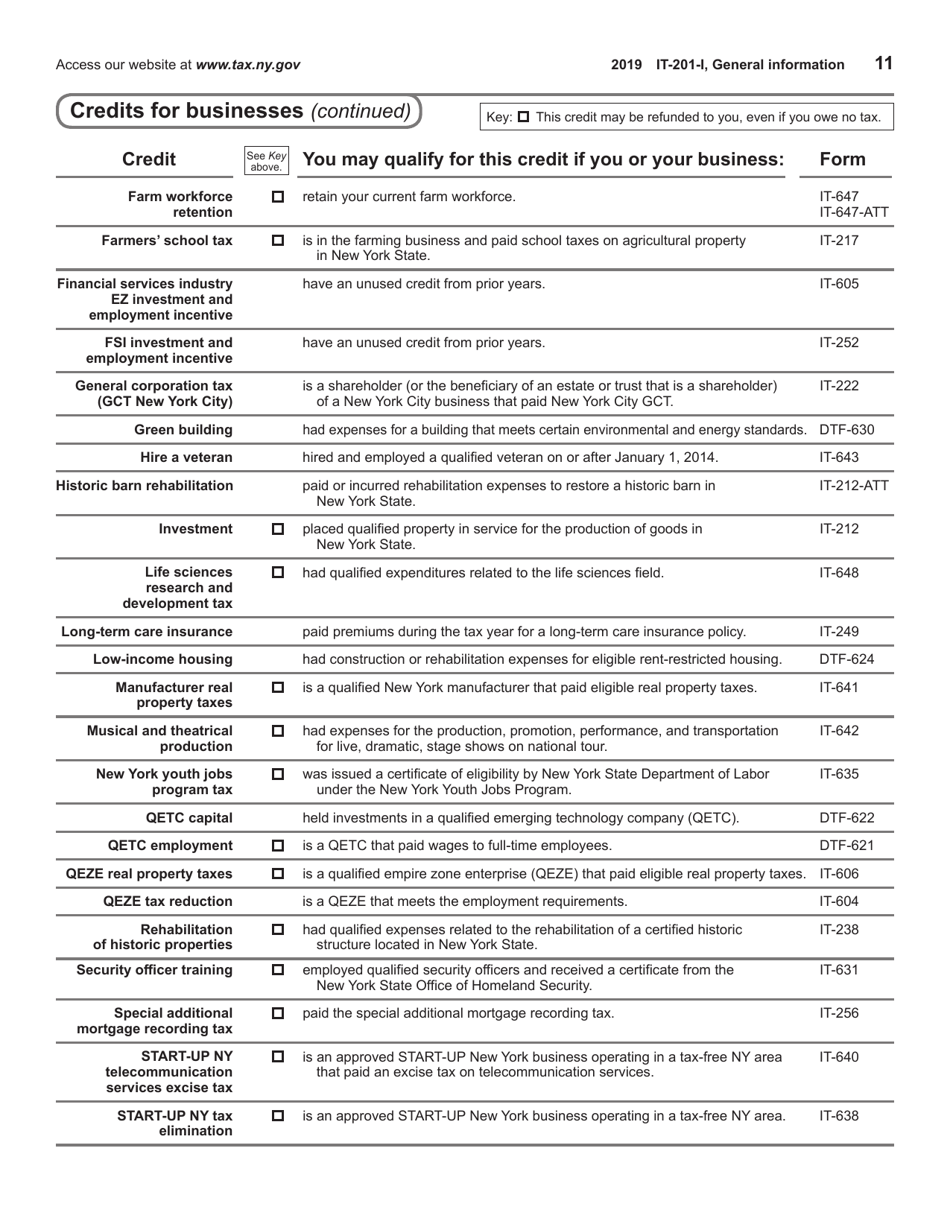

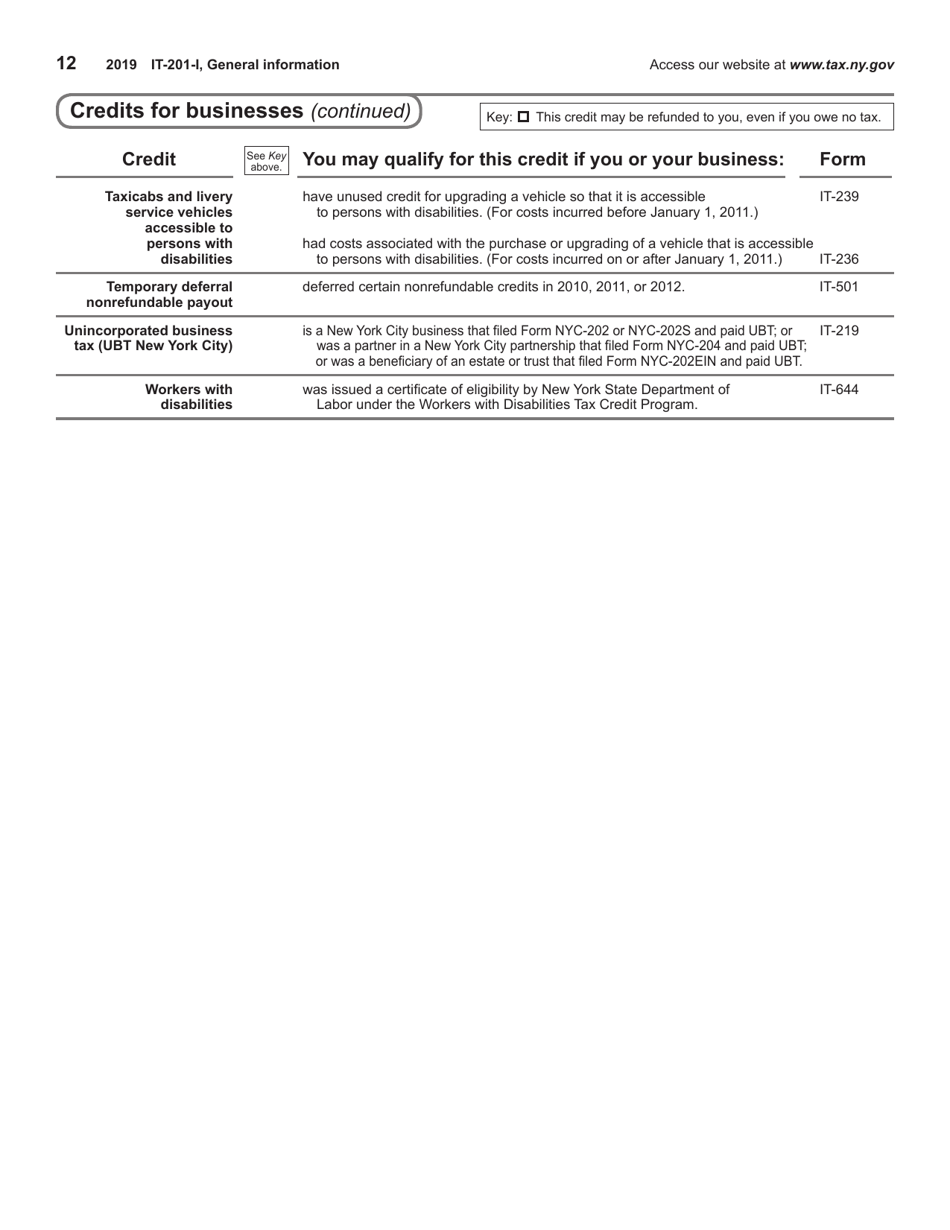

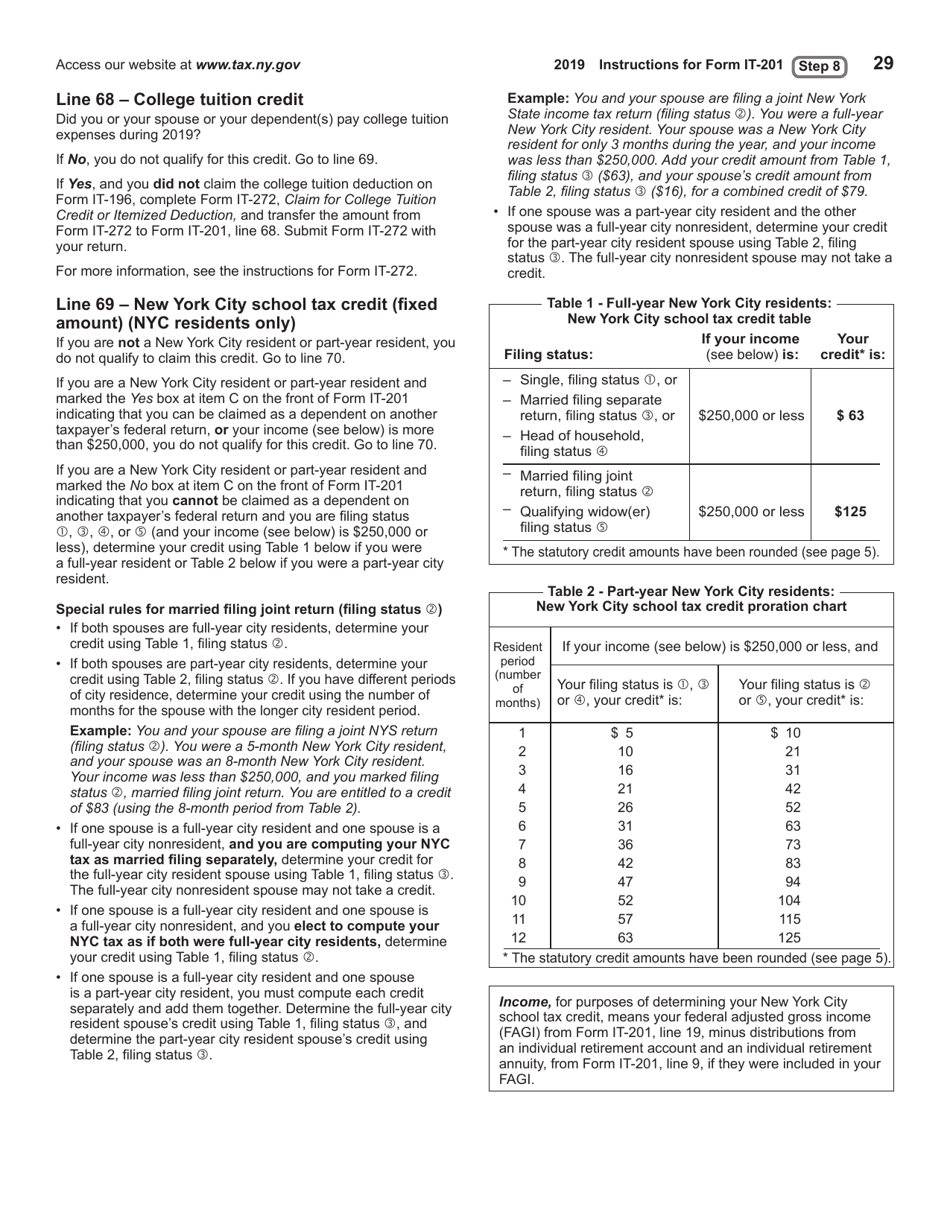

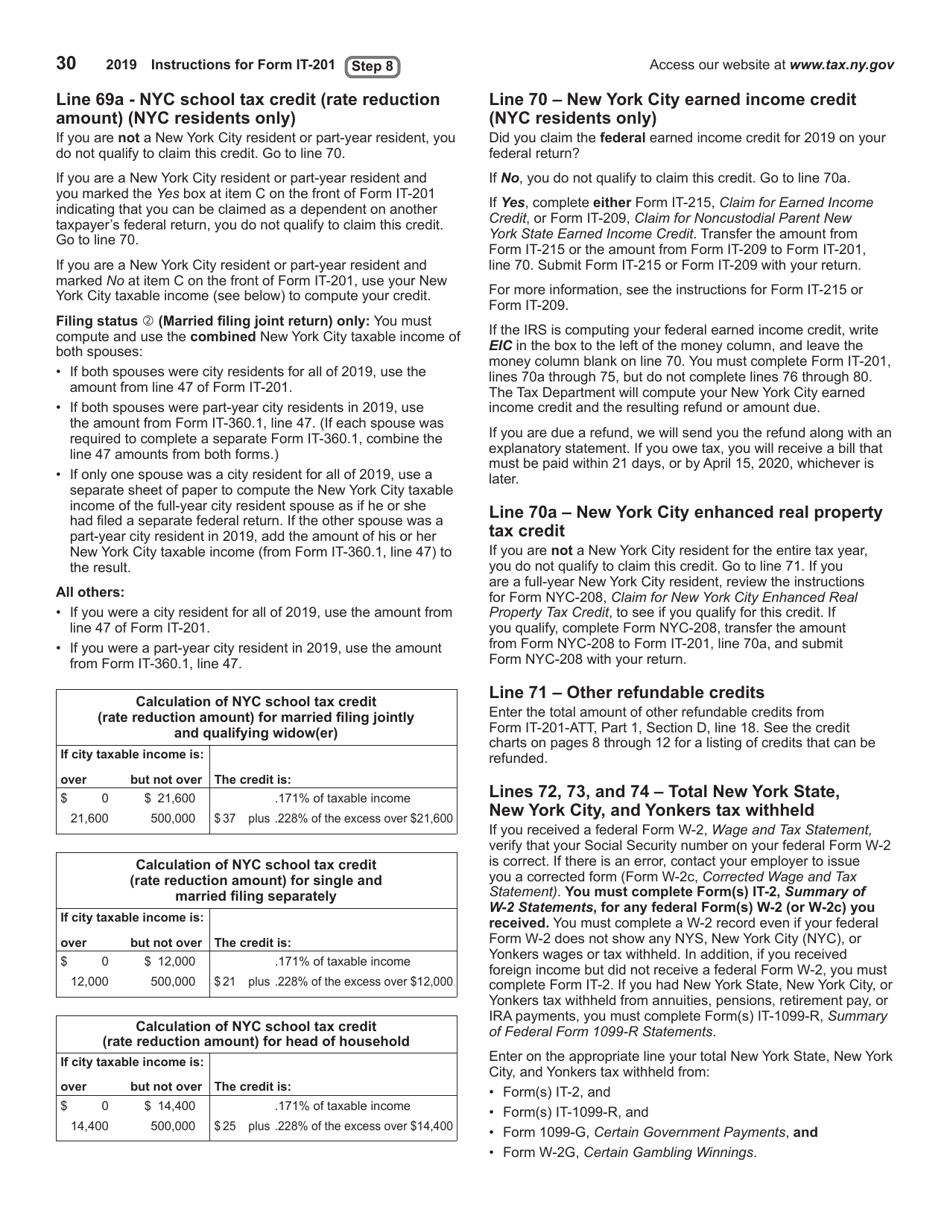

- Entering your payments and credits;

- Calculating your refund on the amount you owe;

- Signing and date your return;

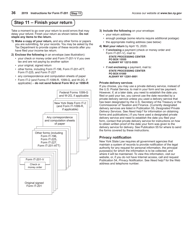

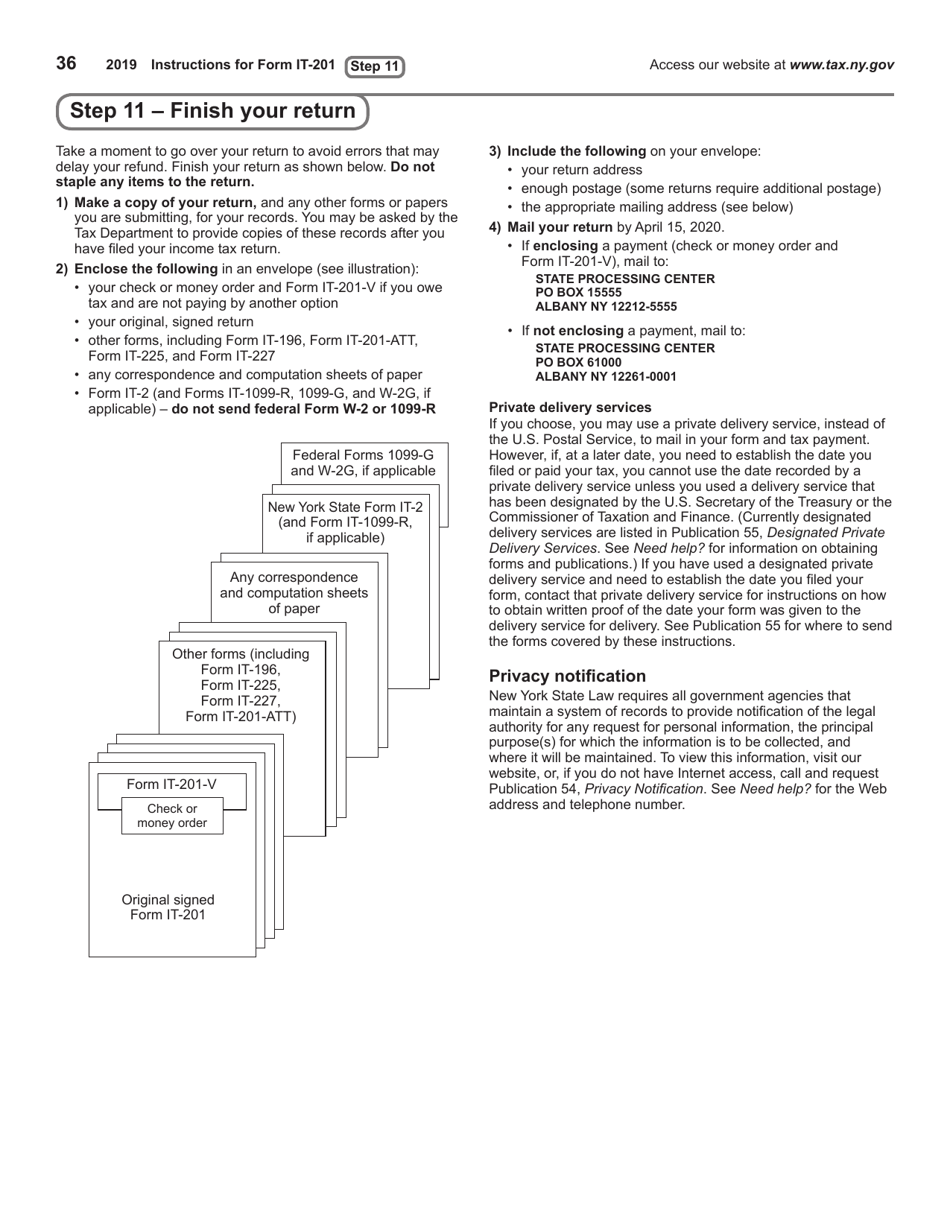

- Finishing your return.

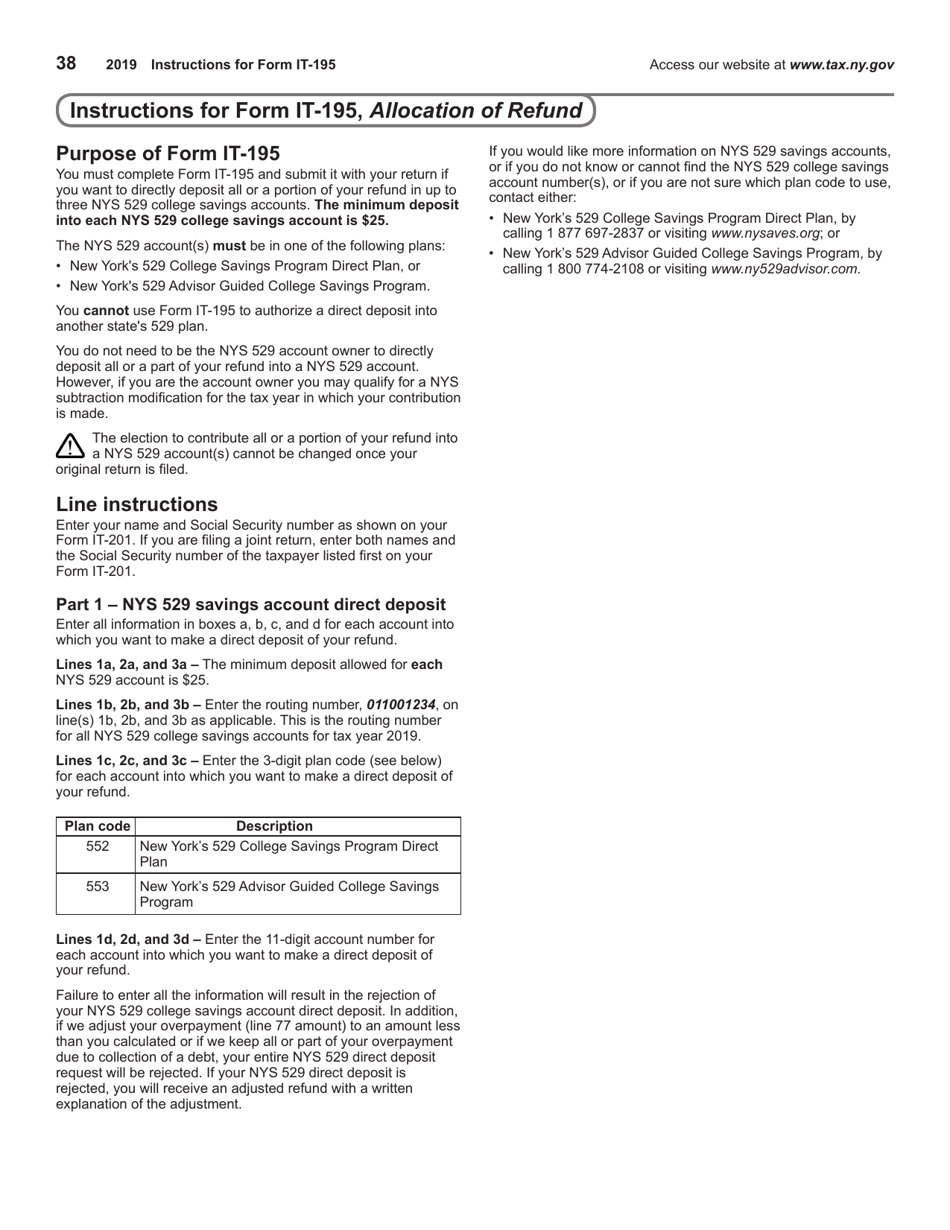

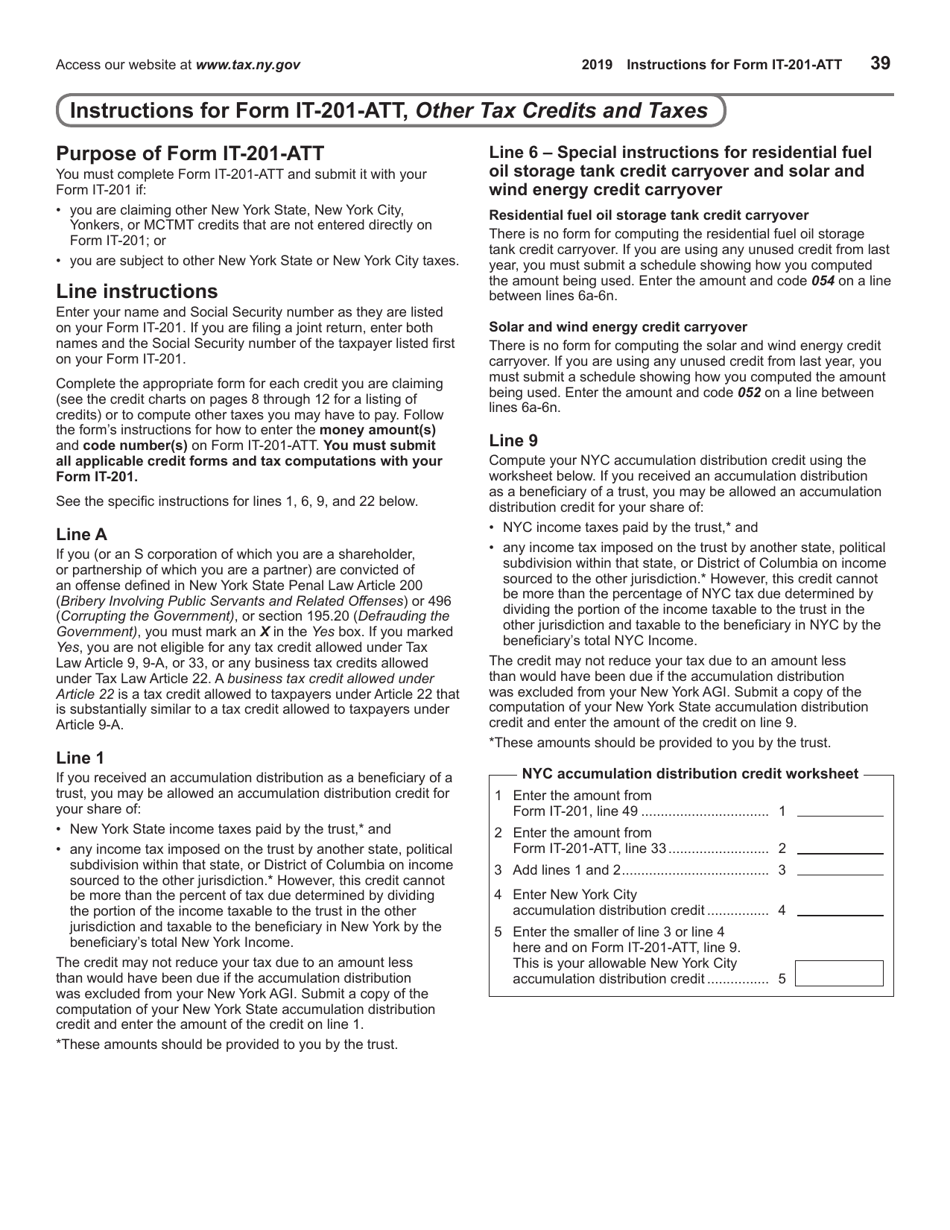

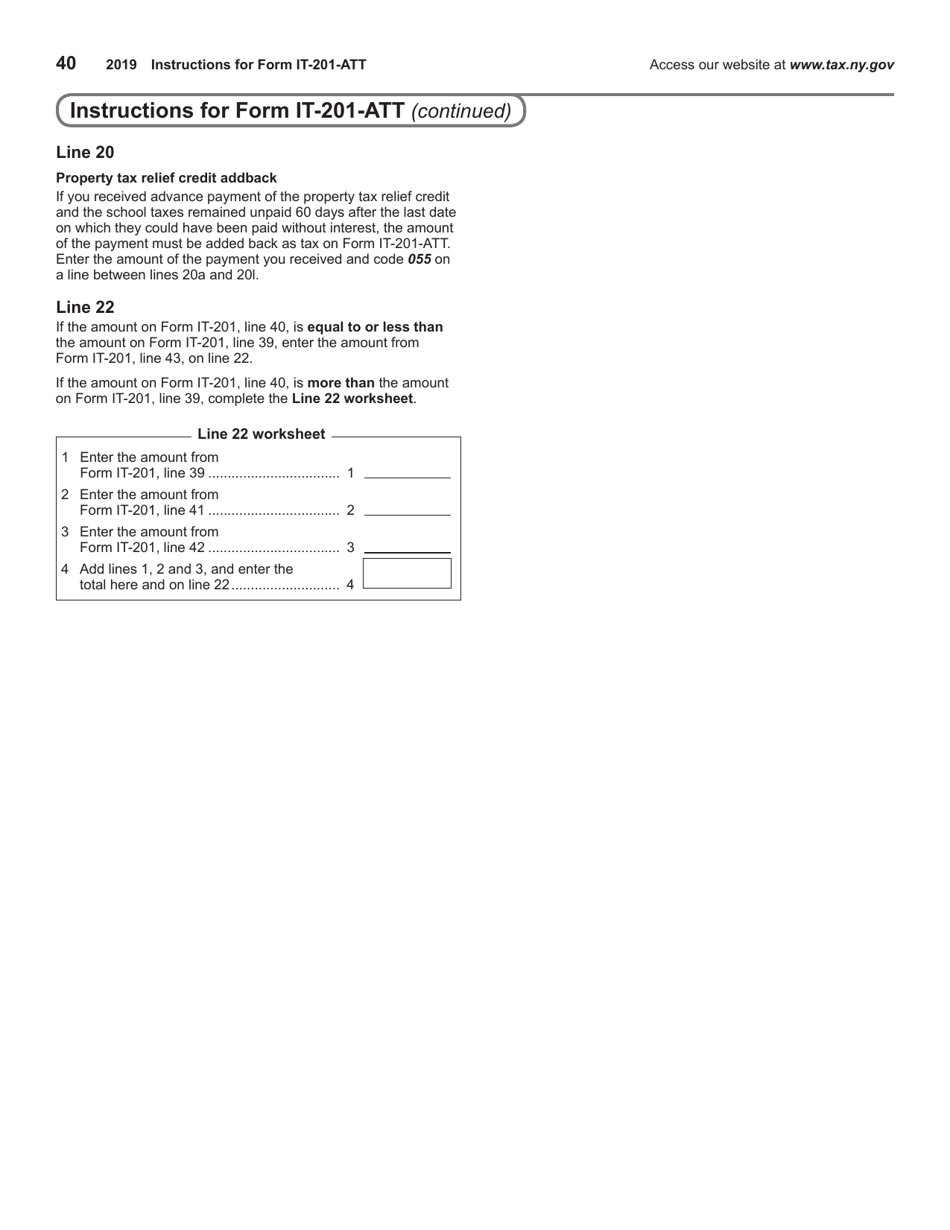

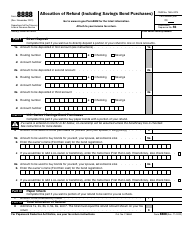

If an applicant is required to file Forms IT-195 and/or IT-201-ATT, then they can use the NYS IT-201 instructions as well. It has a filling guide for both of the forms, where taxpayers can find explanations on how tofill out the lines.

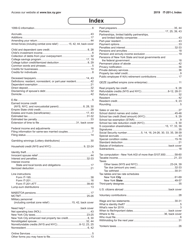

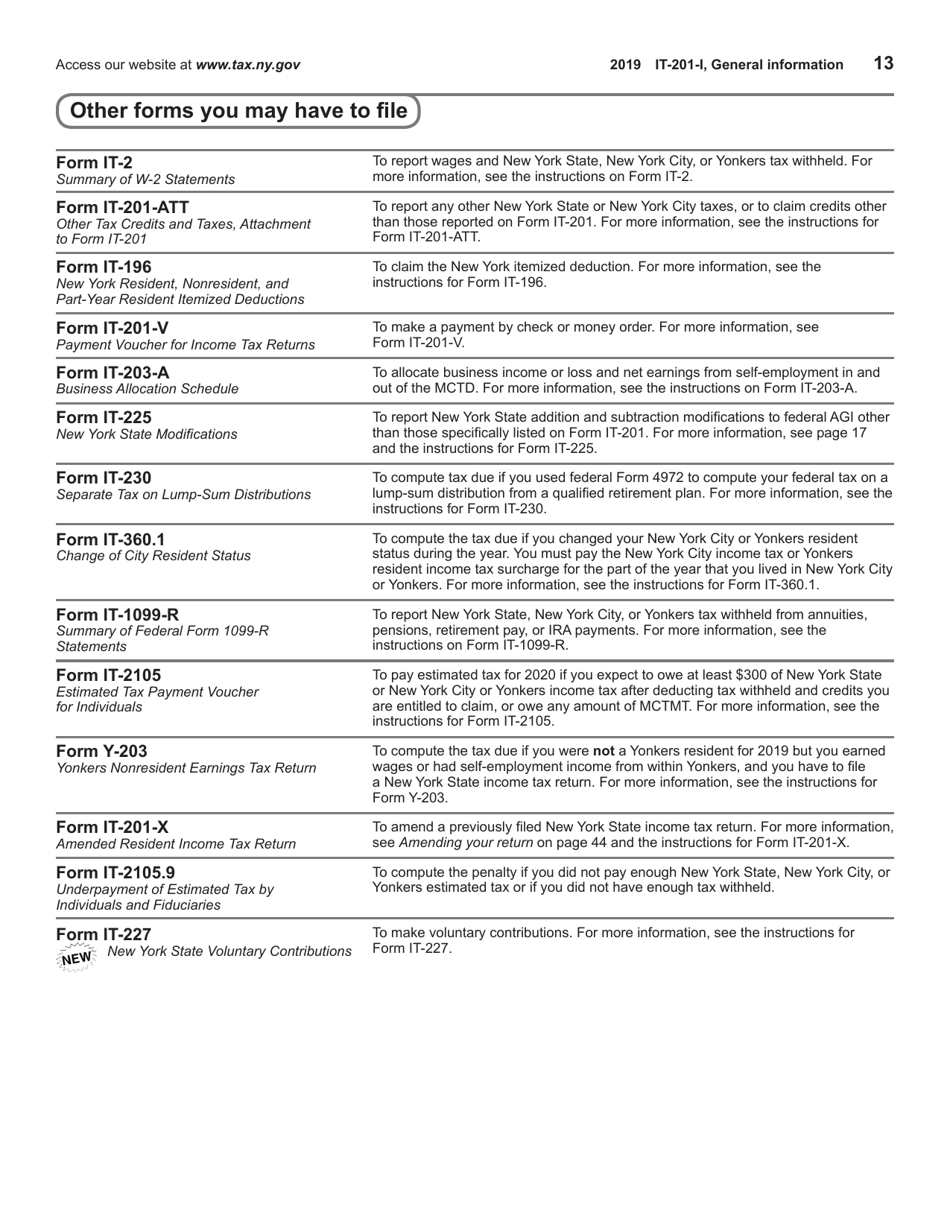

IT-201 Instructions Related Forms:

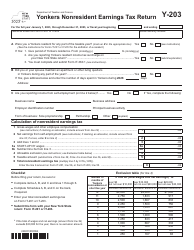

- Form IT-2, Summary of W-2 Statements. This document is used by taxpayers to report wages and NYS, NYC, or Yonkers tax withheld;

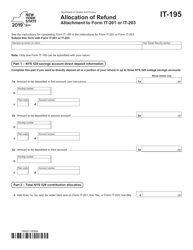

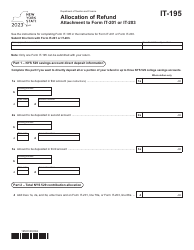

- Form IT-195, Allocation of Refund. Individuals use this application to allocate all or a portion of their income tax refund to a New York State 529 account;

- Form IT-196, New York Resident, Nonresident, and Part-Year Resident Itemized Deductions. To claim the New York itemized deduction a filer should use this document;

- Form IT-201-V, Payment Voucher for Income Tax Returns. If a taxpayer wants to make a payment by check or money order with their return, they should use this application;

- Form IT-1099-R, Summary of Federal Form 1099-R Statements. This application is used to report New York State, New York City, or Yonkers tax withheld from annuities, pensions, retirement pay, or IRA payments;

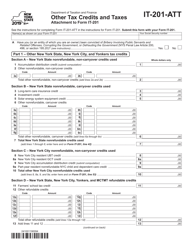

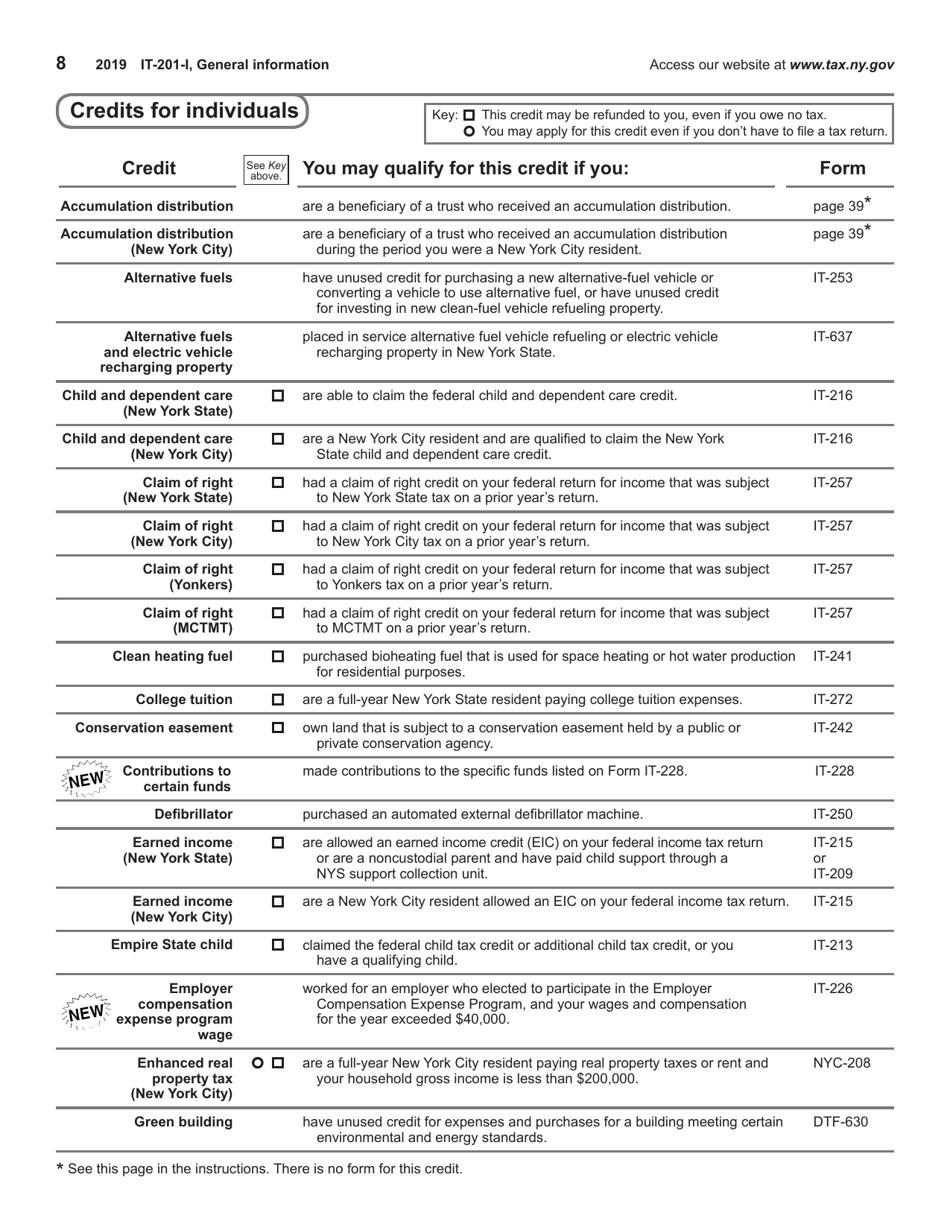

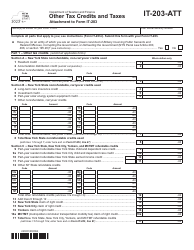

- Form IT-201-ATT, Other Tax Credits, and Taxes. The purpose of this document is to report other New York State or New York City taxes, or to claim credits other than those reported on Form IT-201;

- Form IT-225, New York State Modifications. An individual can use this application to report NY addition and subtraction modifications not reported directly on Form IT-201;

- Form IT-227, New York State Voluntary Contributions. In order to make voluntary contributions, a taxpayer should use this form.