This version of the form is not currently in use and is provided for reference only. Download this version of

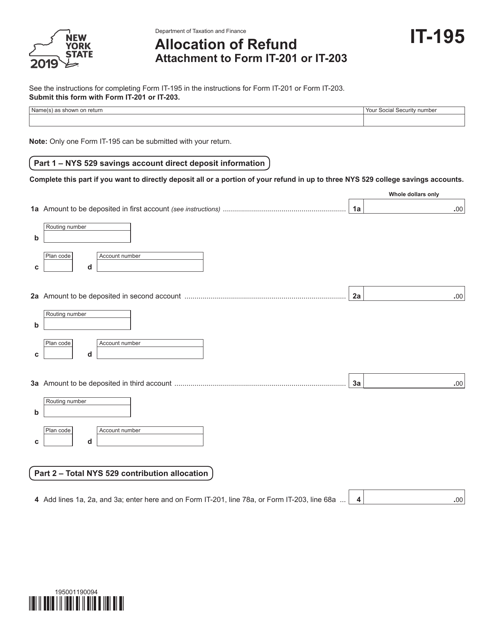

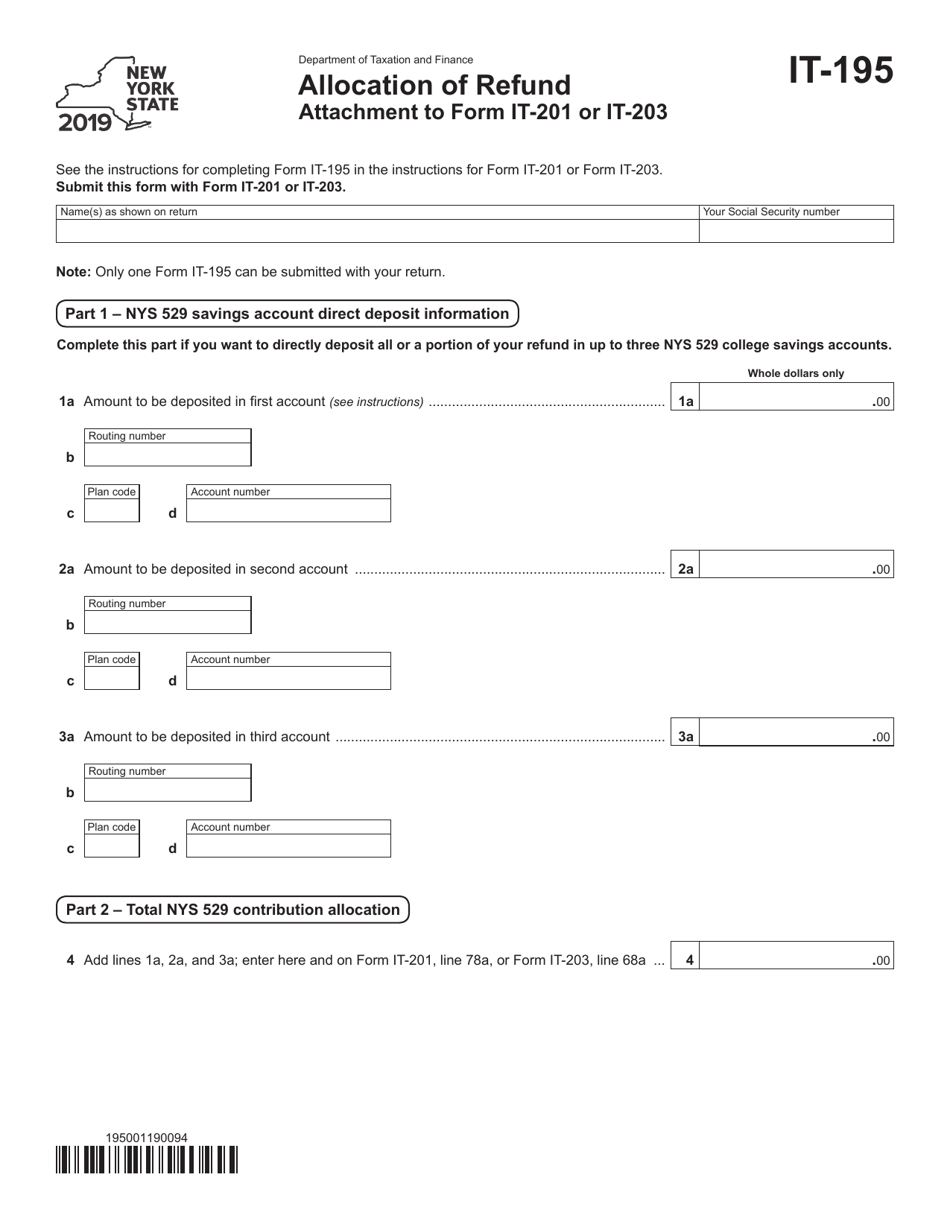

Form IT-195

for the current year.

Form IT-195 Allocation of Refund - New York

What Is Form IT-195?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is form IT-195?

A: Form IT-195 is the Allocation of Refund form for New York state taxes.

Q: Who should use form IT-195?

A: Form IT-195 should be used by individuals who want to allocate their New York state tax refund to multiple accounts or payment options.

Q: What is the purpose of form IT-195?

A: The purpose of form IT-195 is to provide instructions on how to allocate your New York state tax refund to different accounts or payment options.

Q: How do I fill out form IT-195?

A: To fill out form IT-195, you will need to provide your personal information, indicate the amount you want to allocate to each account or payment option, and sign the form.

Q: When is form IT-195 due?

A: Form IT-195 is typically due at the same time as your New York state tax return, which is usually April 15th.

Q: Are there any other requirements or attachments needed with form IT-195?

A: No, in most cases, you do not need to attach any additional documents to form IT-195.

Q: Can I make changes to my allocation after submitting form IT-195?

A: No, once you submit form IT-195, you will not be able to make changes to your allocation.

Q: What if I don't want to allocate my refund and want it all in one payment?

A: If you do not want to allocate your refund and prefer to receive it in one payment, you do not need to fill out form IT-195.

Q: Is form IT-195 applicable for federal taxes?

A: No, form IT-195 is specific to allocating New York state tax refunds and does not apply to federal taxes.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-195 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.