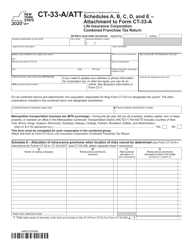

This version of the form is not currently in use and is provided for reference only. Download this version of

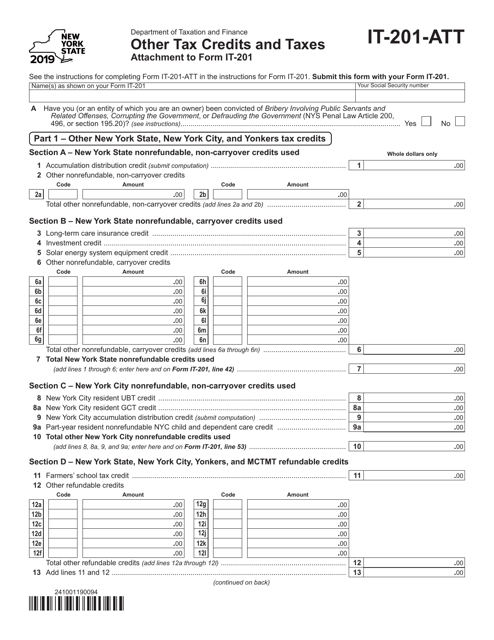

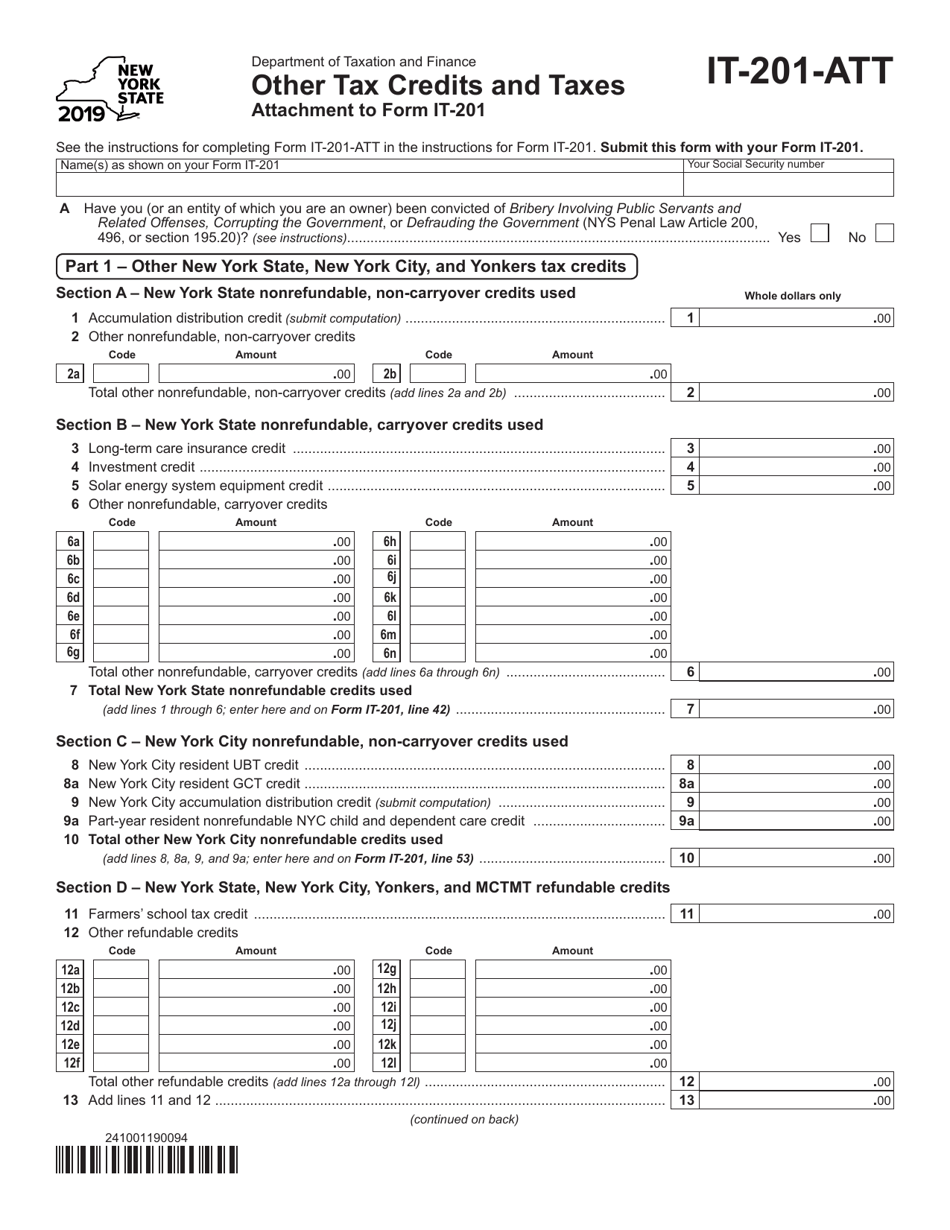

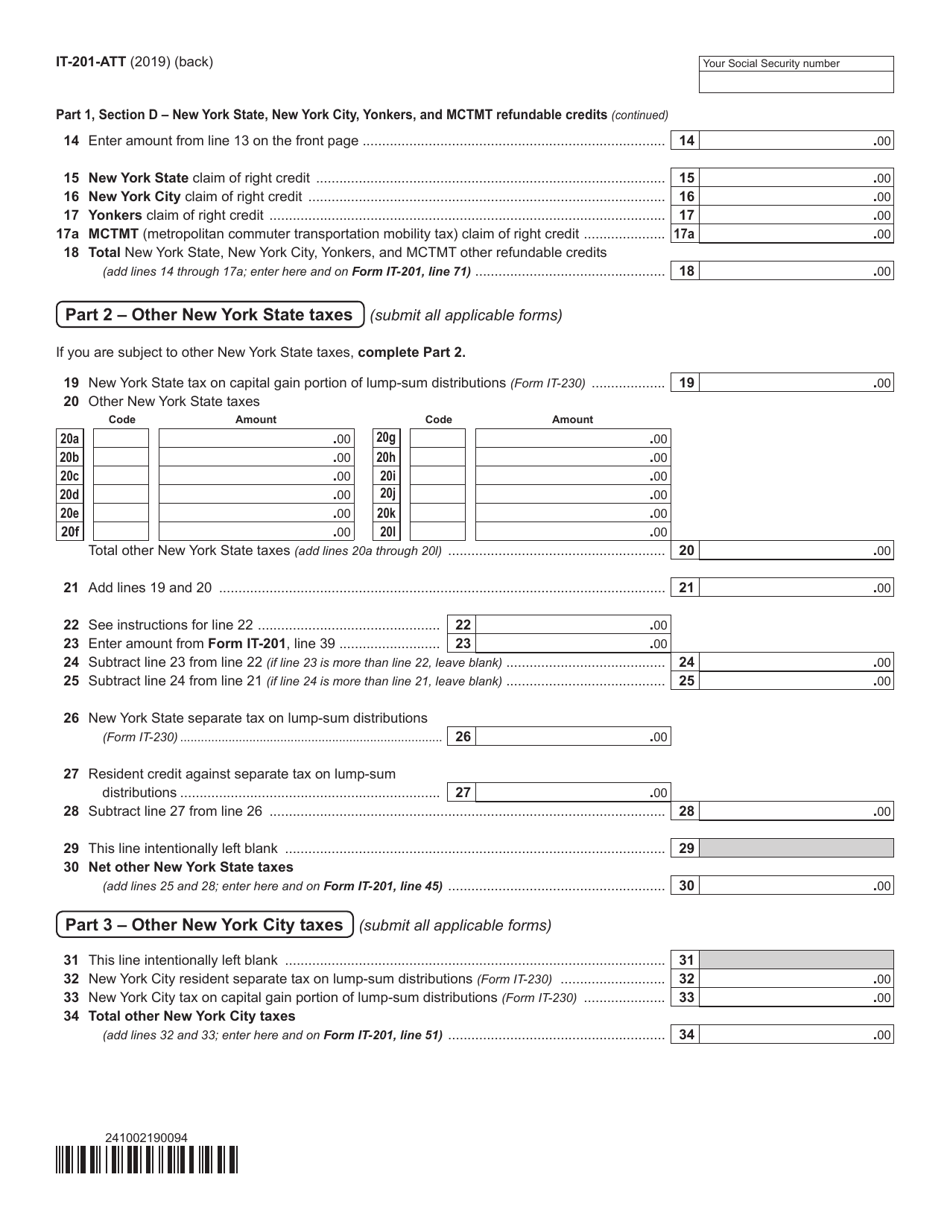

Form IT-201-ATT

for the current year.

Form IT-201-ATT Other Tax Credits and Taxes - New York

What Is Form IT-201-ATT?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IT-201-ATT?

A: Form IT-201-ATT is a New York state tax form that is used to claim various tax credits and report additional taxes.

Q: What is the purpose of Form IT-201-ATT?

A: The purpose of Form IT-201-ATT is to provide taxpayers with a way to claim tax credits and report additional taxes in New York.

Q: What tax credits can be claimed on Form IT-201-ATT?

A: Form IT-201-ATT allows you to claim tax credits such as the Empire State Child Credit, the Real Property Tax Credit, the Household Credit, and many others.

Q: What additional taxes can be reported on Form IT-201-ATT?

A: Form IT-201-ATT is used to report taxes like the MCTMT (Metropolitan Commuter Transportation Mobility Tax), the NYC Earned Income Credit, the NYC Unincorporated Business Tax, and more.

Q: Is Form IT-201-ATT required for every taxpayer in New York?

A: Form IT-201-ATT is not required for every taxpayer. It is only necessary if you are claiming certain tax credits or reporting additional taxes.

Q: What supporting documents are required to file Form IT-201-ATT?

A: The specific supporting documents required depend on the tax credits or additional taxes you are claiming. Refer to the instructions accompanying the form for details.

Q: When is the deadline for filing Form IT-201-ATT?

A: The deadline for filing Form IT-201-ATT is the same as the deadline for filing your New York state income tax return, which is usually April 15th.

Q: Can I file Form IT-201-ATT if I am using tax software?

A: Yes, most tax software programs include support for Form IT-201-ATT, allowing you to electronically file it along with your state income tax return.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-201-ATT by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.