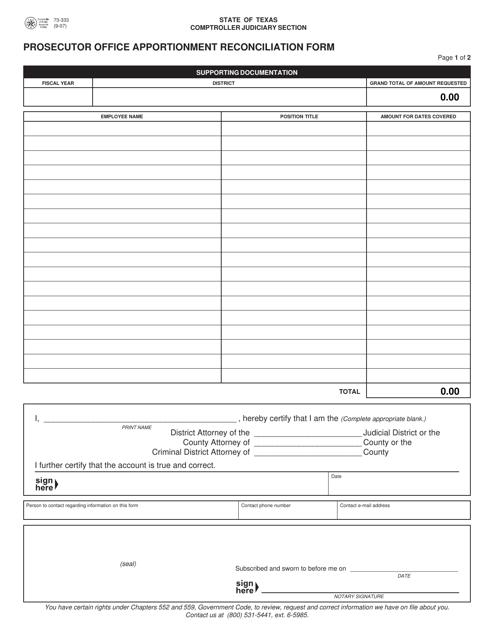

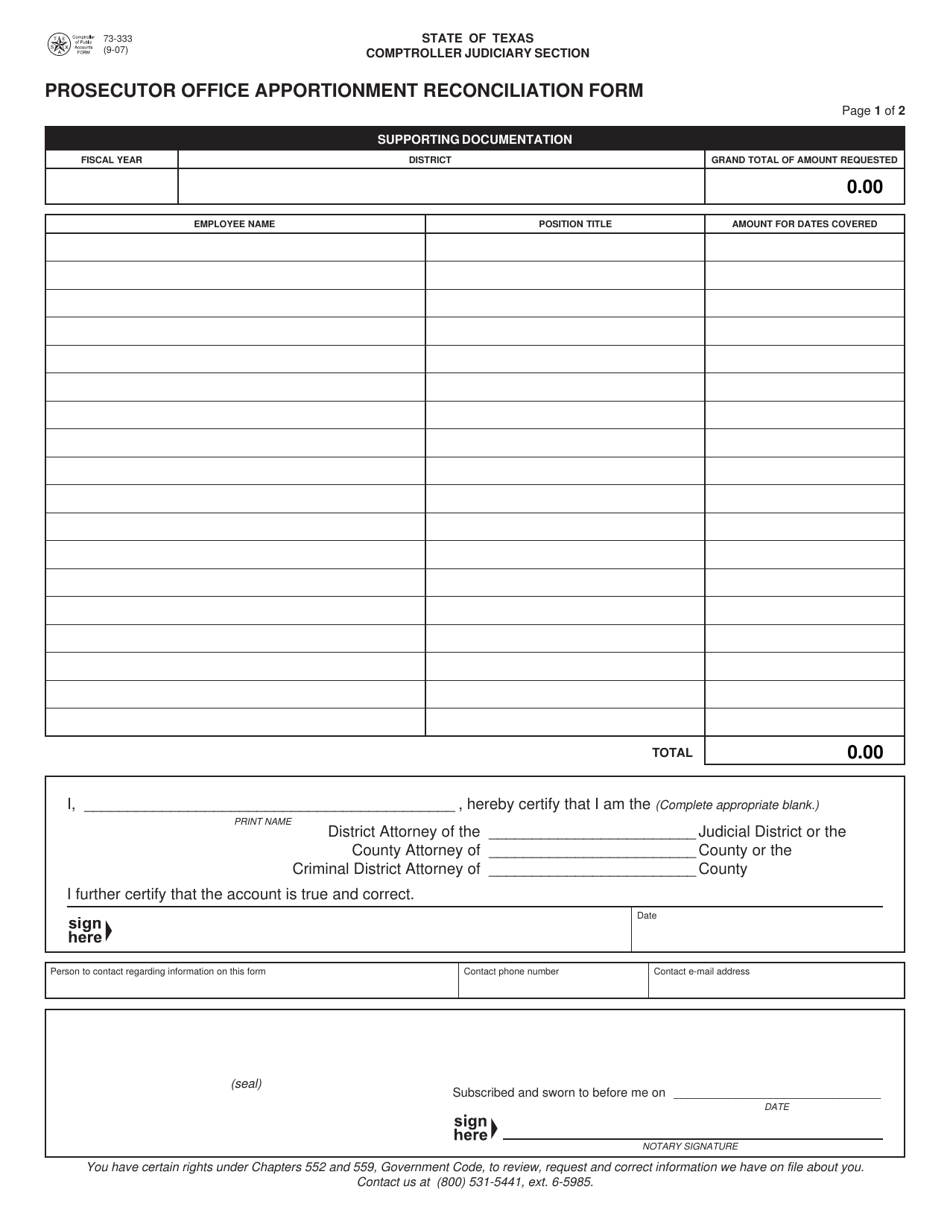

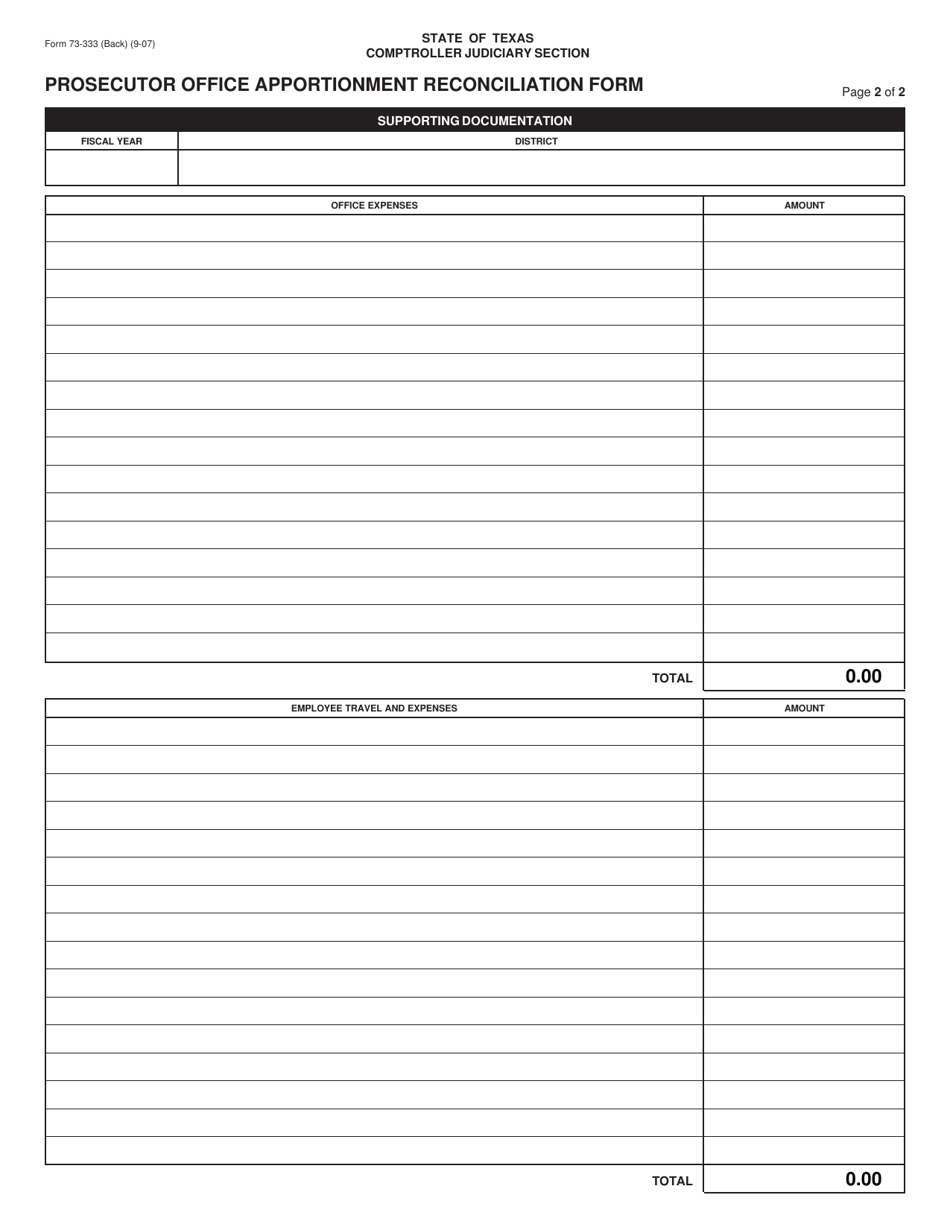

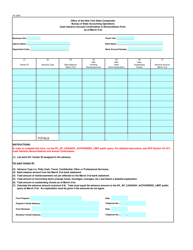

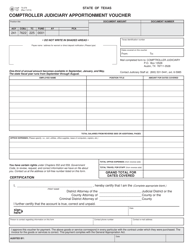

Form 73-333 Prosecutor Office Apportionment Reconciliation Form - Texas

What Is Form 73-333?

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 73-333?

A: Form 73-333 is the Prosecutor Office Apportionment Reconciliation Form used in Texas.

Q: What is the purpose of Form 73-333?

A: The purpose of Form 73-333 is to reconcile the apportionment of prosecutor office funds in Texas.

Q: Who uses Form 73-333?

A: Form 73-333 is used by prosecutor offices in Texas.

Q: When should Form 73-333 be filled out?

A: Form 73-333 should be filled out during the reconciliation process for prosecutor office funds in Texas.

Q: Is Form 73-333 specific to Texas?

A: Yes, Form 73-333 is specific to Texas and is used for prosecutor office apportionment reconciliation in the state.

Q: Is Form 73-333 mandatory?

A: Yes, Form 73-333 is mandatory for prosecutor offices in Texas to complete during the reconciliation process.

Form Details:

- Released on September 1, 2007;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 73-333 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.