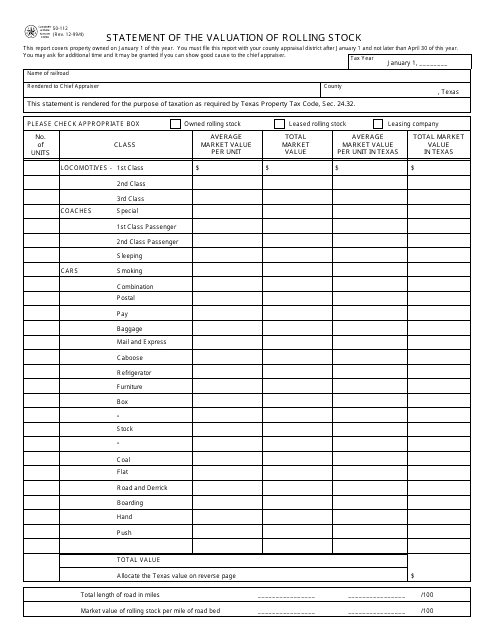

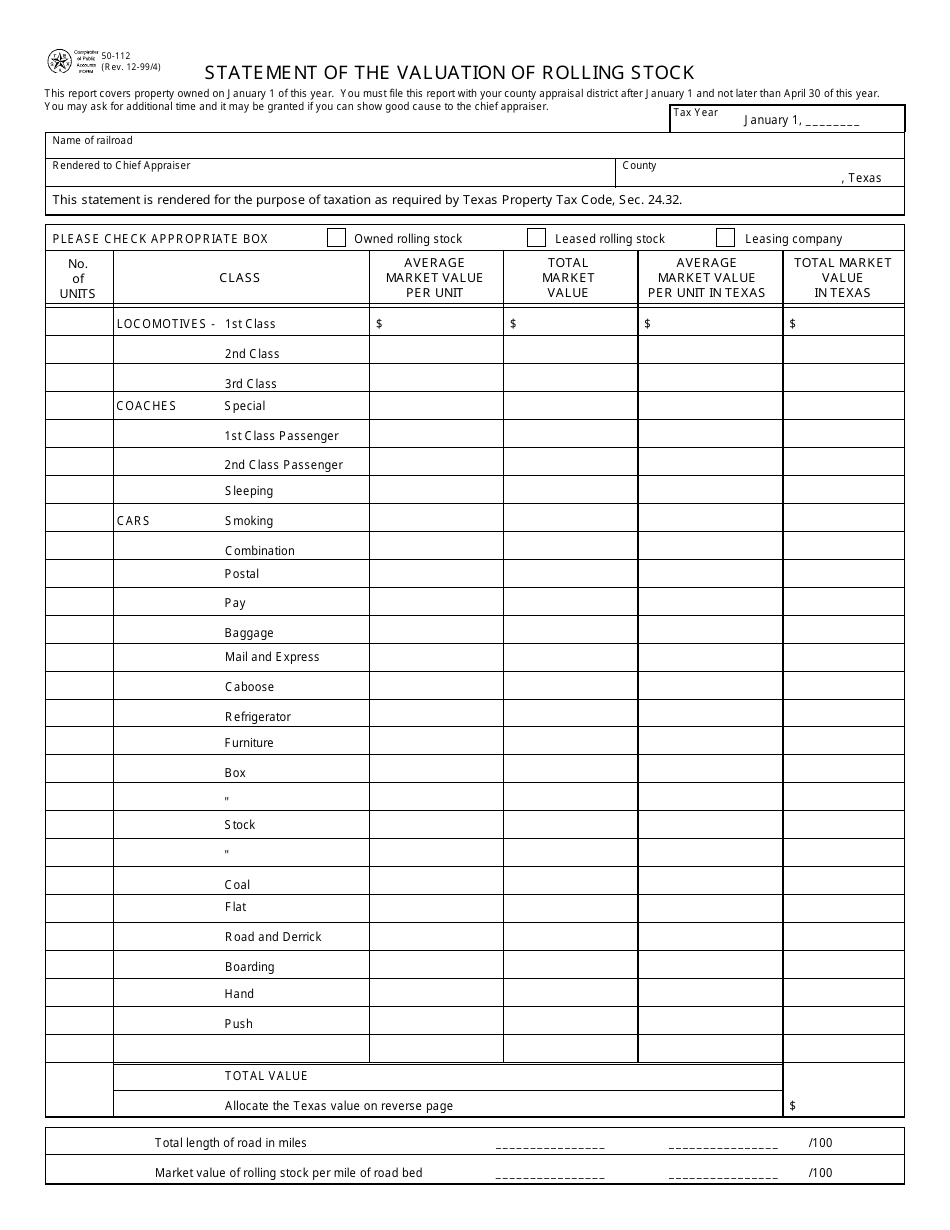

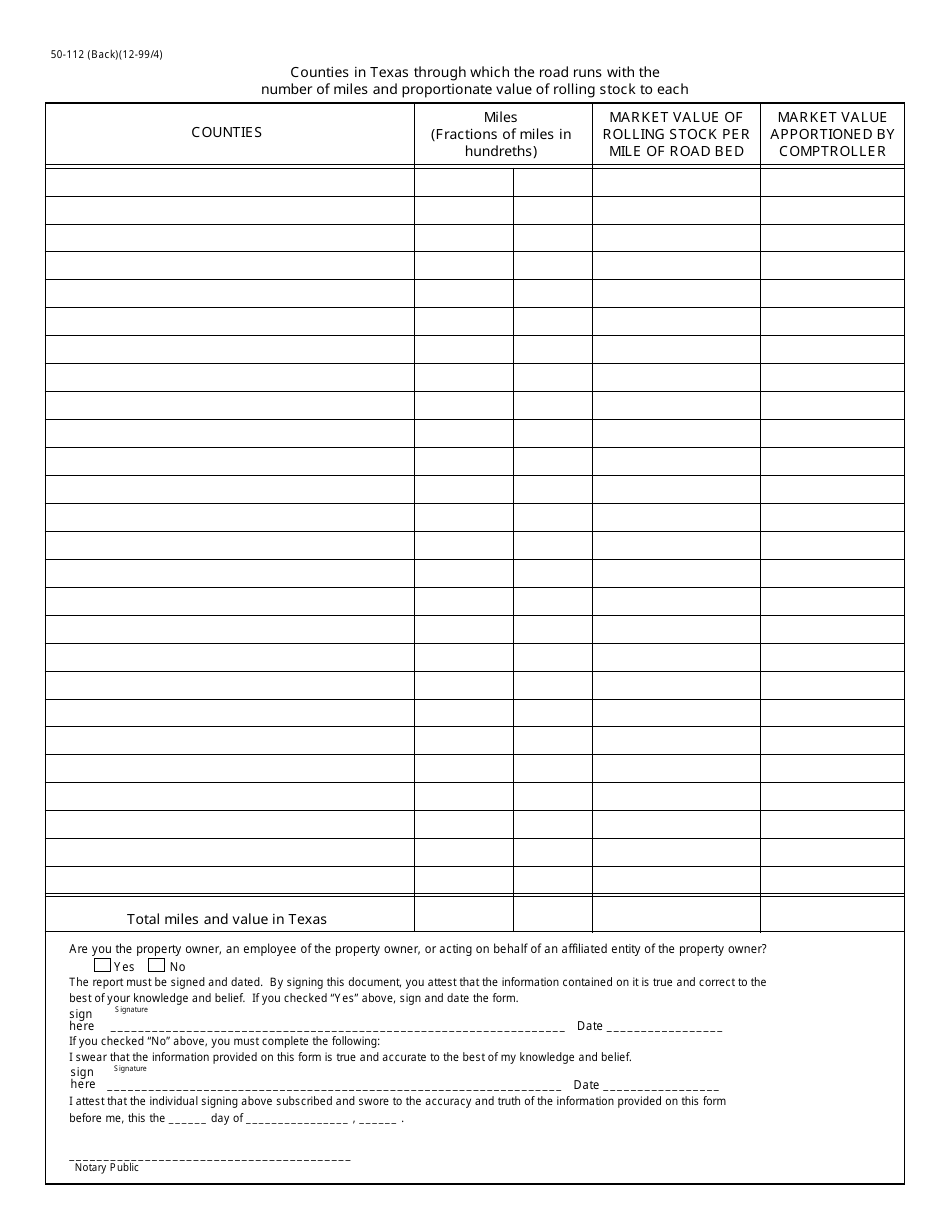

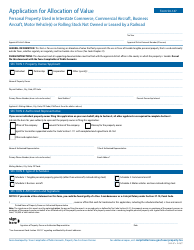

Form 50-112 Statement of the Valuation of Rolling Stock - Texas

What Is Form 50-112?

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 50-112?

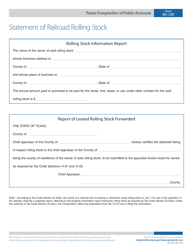

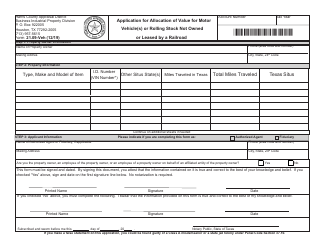

A: Form 50-112 is the Statement of the Valuation of Rolling Stock for the state of Texas.

Q: Who needs to file Form 50-112?

A: Railroad companies operating in Texas need to file Form 50-112.

Q: What is the purpose of Form 50-112?

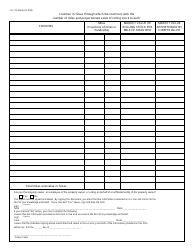

A: The purpose of Form 50-112 is to determine the taxable value of rolling stock owned or leased by railroad companies in Texas.

Q: When is Form 50-112 due?

A: Form 50-112 is due on April 30th of each year.

Q: Are there any penalties for not filing Form 50-112?

A: Yes, there are penalties for not filing Form 50-112, including potential fines and the loss of certain tax exemptions.

Q: What information do I need to complete Form 50-112?

A: You will need to provide information about the rolling stock, including its value, description, and location, as well as other relevant details.

Q: Can I amend Form 50-112 after filing?

A: Yes, you can amend Form 50-112 after filing if you need to make any corrections or updates to the information provided.

Form Details:

- Released on December 4, 1999;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 50-112 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.