This version of the form is not currently in use and is provided for reference only. Download this version of

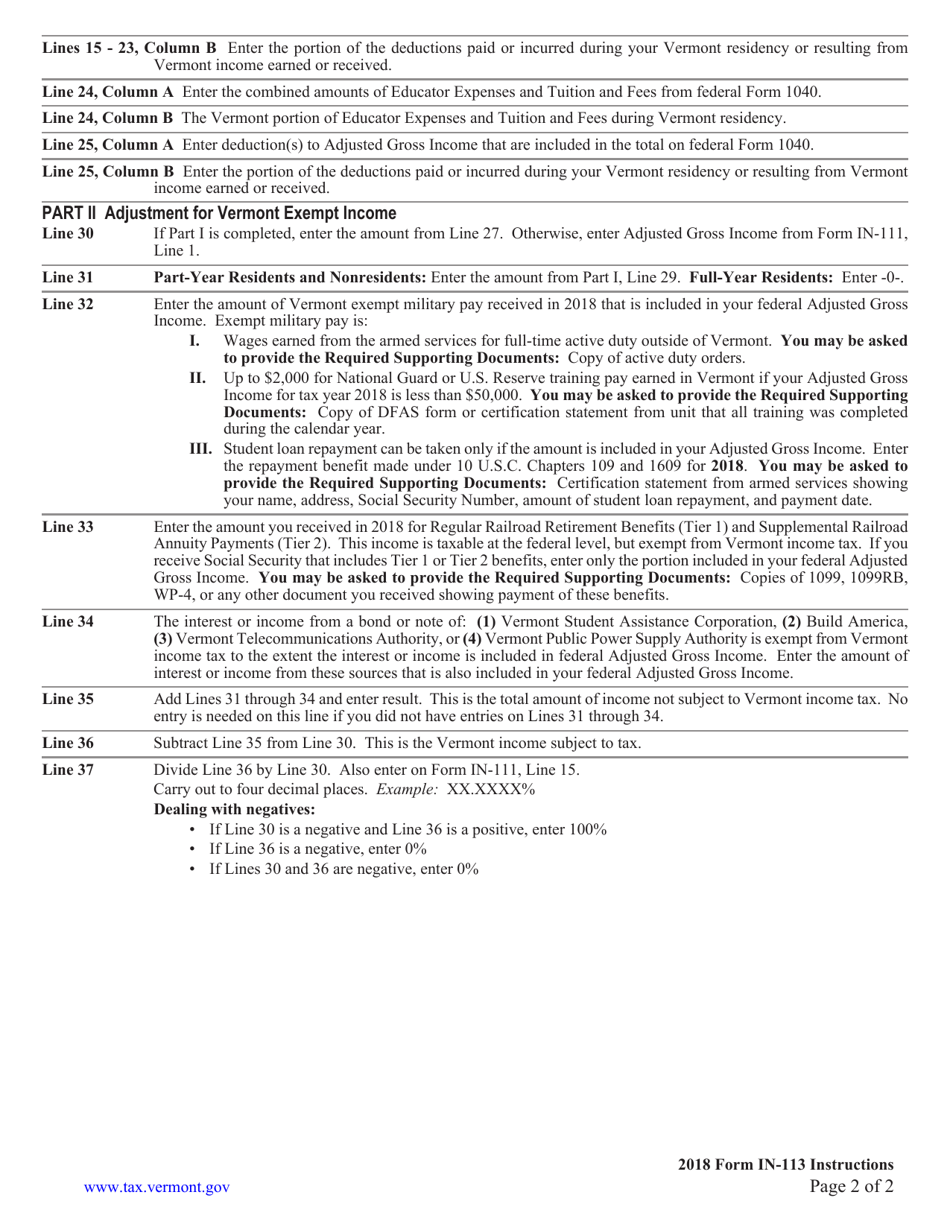

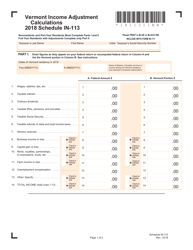

Instructions for Schedule IN-113

for the current year.

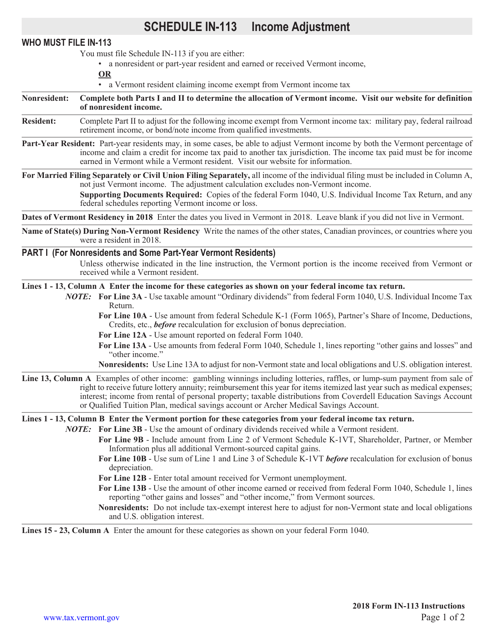

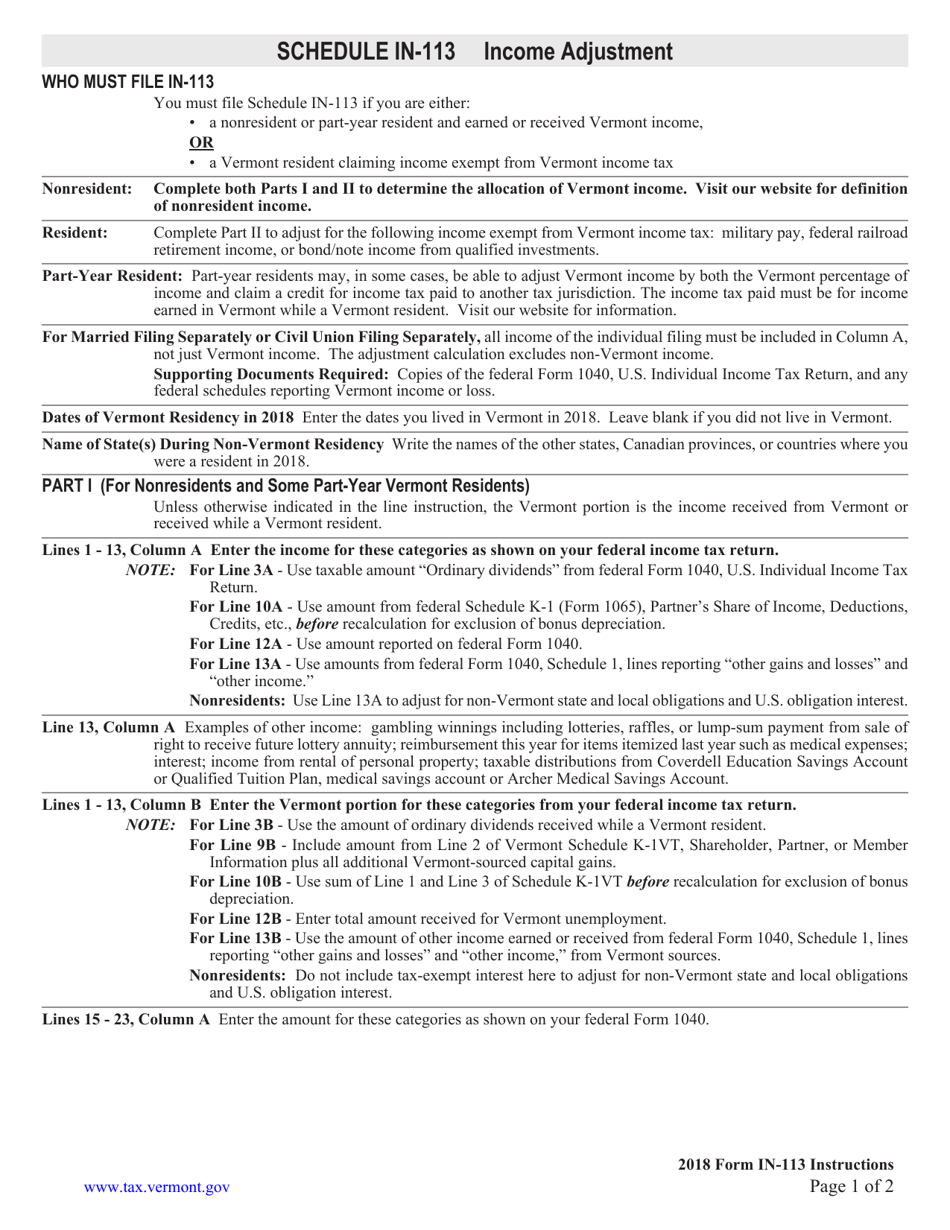

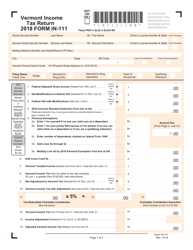

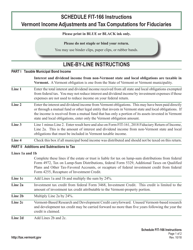

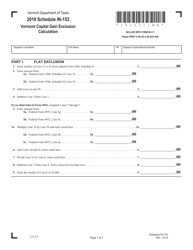

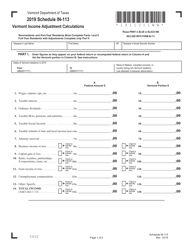

Instructions for Schedule IN-113 Income Adjustment Calculations - Vermont

This document contains official instructions for Schedule IN-113 , Income Adjustment Calculations - a form released and collected by the Vermont Department of Taxes.

FAQ

Q: What is Schedule IN-113?

A: Schedule IN-113 is a form used for calculating income adjustments in Vermont.

Q: Who needs to file Schedule IN-113?

A: Residents of Vermont who need to make income adjustments as specified by the instructions.

Q: What type of income adjustments can be made using Schedule IN-113?

A: Schedule IN-113 allows for the adjustment of certain types of income, such as federal taxable income, additions to federal taxable income, and subtractions from federal taxable income.

Q: How do I fill out Schedule IN-113?

A: Follow the instructions provided on the form. You will need to provide specific information and calculations for each income adjustment.

Q: When is the deadline to file Schedule IN-113?

A: The deadline to file Schedule IN-113 is the same as the deadline for filing your Vermont state tax return.

Q: What happens if I don't file Schedule IN-113?

A: If you are required to file Schedule IN-113 and fail to do so, your Vermont state tax return may be considered incomplete or inaccurate, resulting in penalties or additional taxes owed.

Q: Are there any specific requirements or considerations for Schedule IN-113?

A: Yes, be sure to carefully review the instructions and guidelines provided with Schedule IN-113 to ensure accurate completion and compliance with Vermont tax laws.

Instruction Details:

- This 2-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Vermont Department of Taxes.