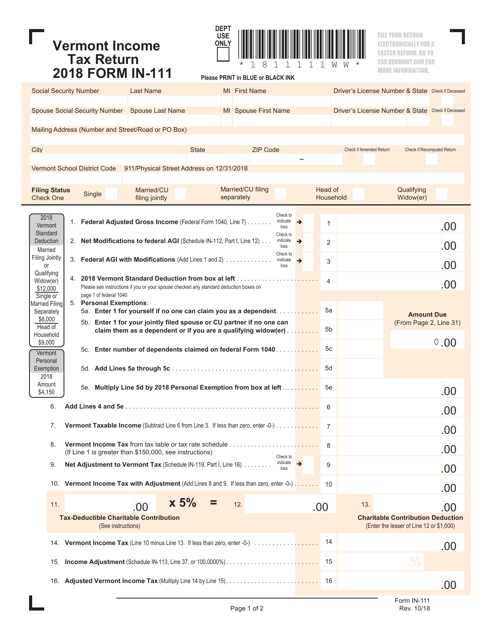

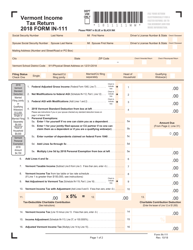

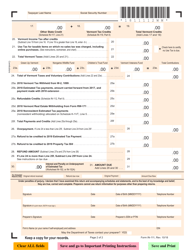

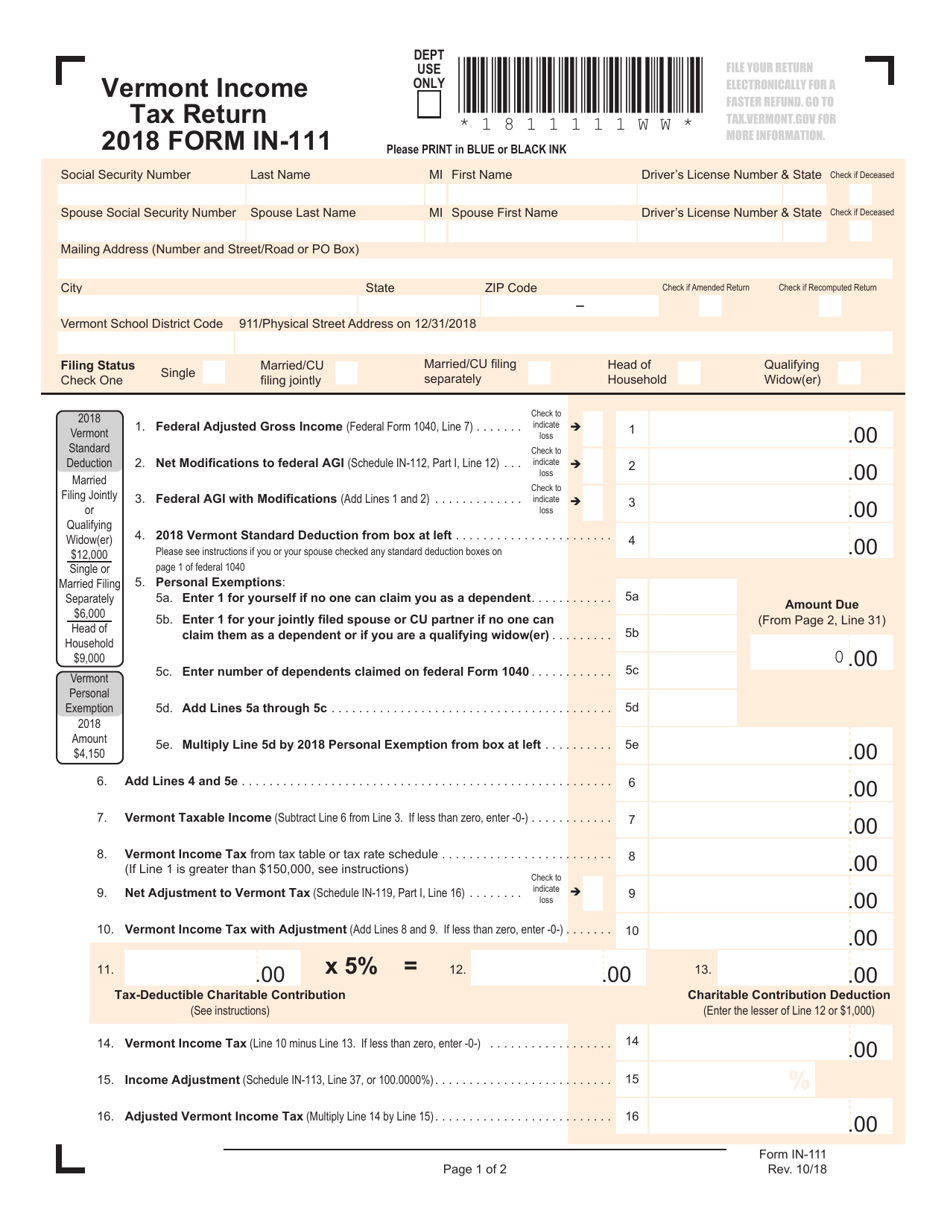

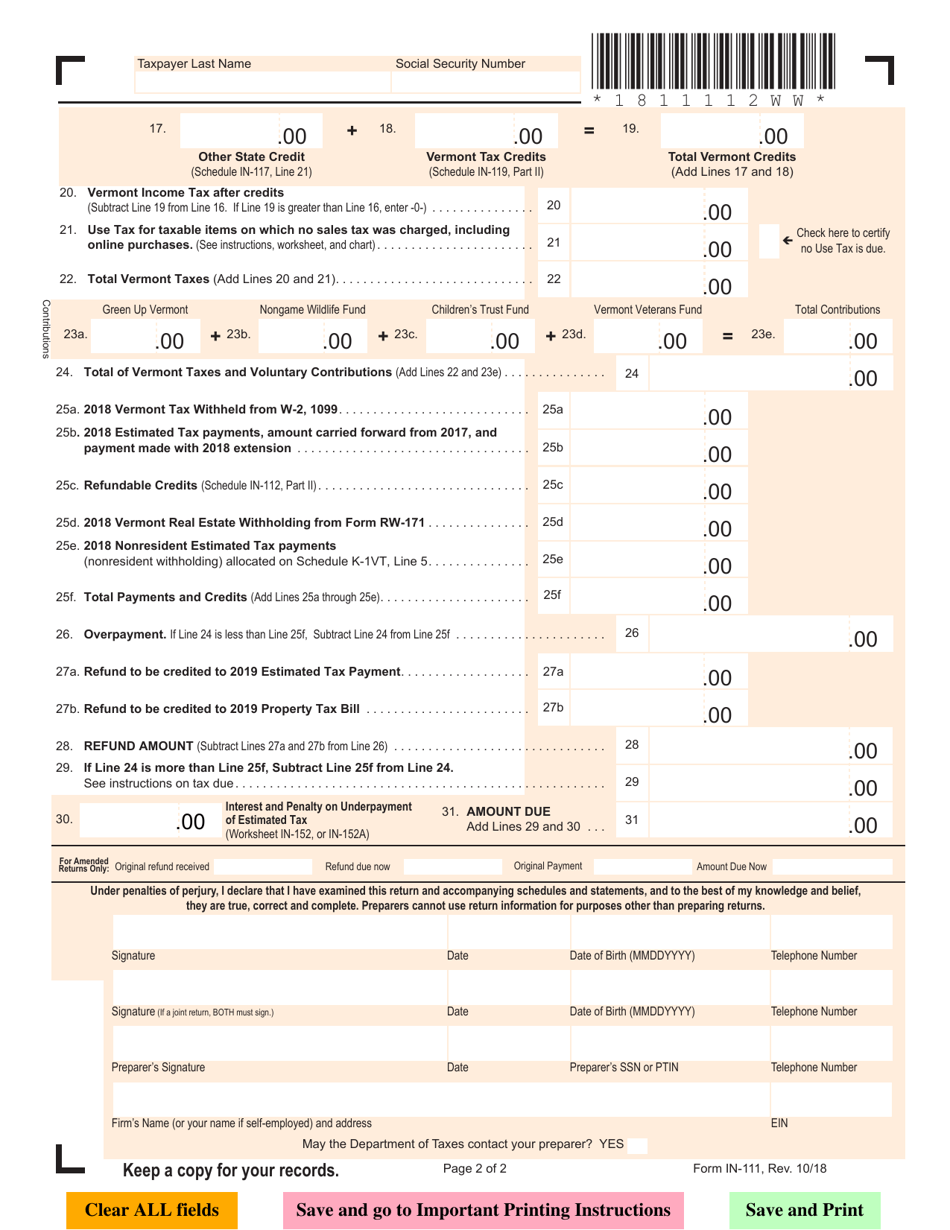

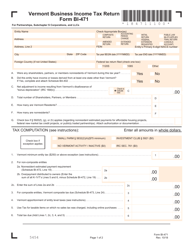

VT Form IN-111 Income Tax Return - Vermont

What Is VT Form IN-111?

This is a legal form that was released by the Vermont Department of Taxes - a government authority operating within Vermont. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the VT Form IN-111?

A: VT Form IN-111 is the income tax return form used in Vermont.

Q: Who needs to file the VT Form IN-111?

A: Vermont residents, part-year residents, and nonresidents with Vermont source income must file the VT Form IN-111.

Q: What is the due date for filing the VT Form IN-111?

A: The due date for filing the VT Form IN-111 is usually April 15th, or the next business day if April 15th falls on a weekend or holiday.

Q: Are there any specific requirements for completing the VT Form IN-111?

A: Yes, you will need to provide information about your income, deductions, credits, and any other applicable information.

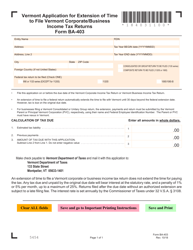

Q: What should I do if I can't file the VT Form IN-111 by the due date?

A: If you are unable to file the VT Form IN-111 by the due date, you can request an extension. However, you still need to pay any taxes owed by the original due date to avoid penalties and interest.

Q: Do I need to include any additional documentation with the VT Form IN-111?

A: You may need to attach supporting documentation such as W-2 forms, 1099s, and other income-related documents.

Q: What happens if I make a mistake on the VT Form IN-111?

A: If you discover a mistake on your VT Form IN-111 after filing, you should file an amended return using the appropriate form and follow the instructions for correcting the error.

Form Details:

- Released on October 1, 2018;

- The latest edition provided by the Vermont Department of Taxes;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of VT Form IN-111 by clicking the link below or browse more documents and templates provided by the Vermont Department of Taxes.