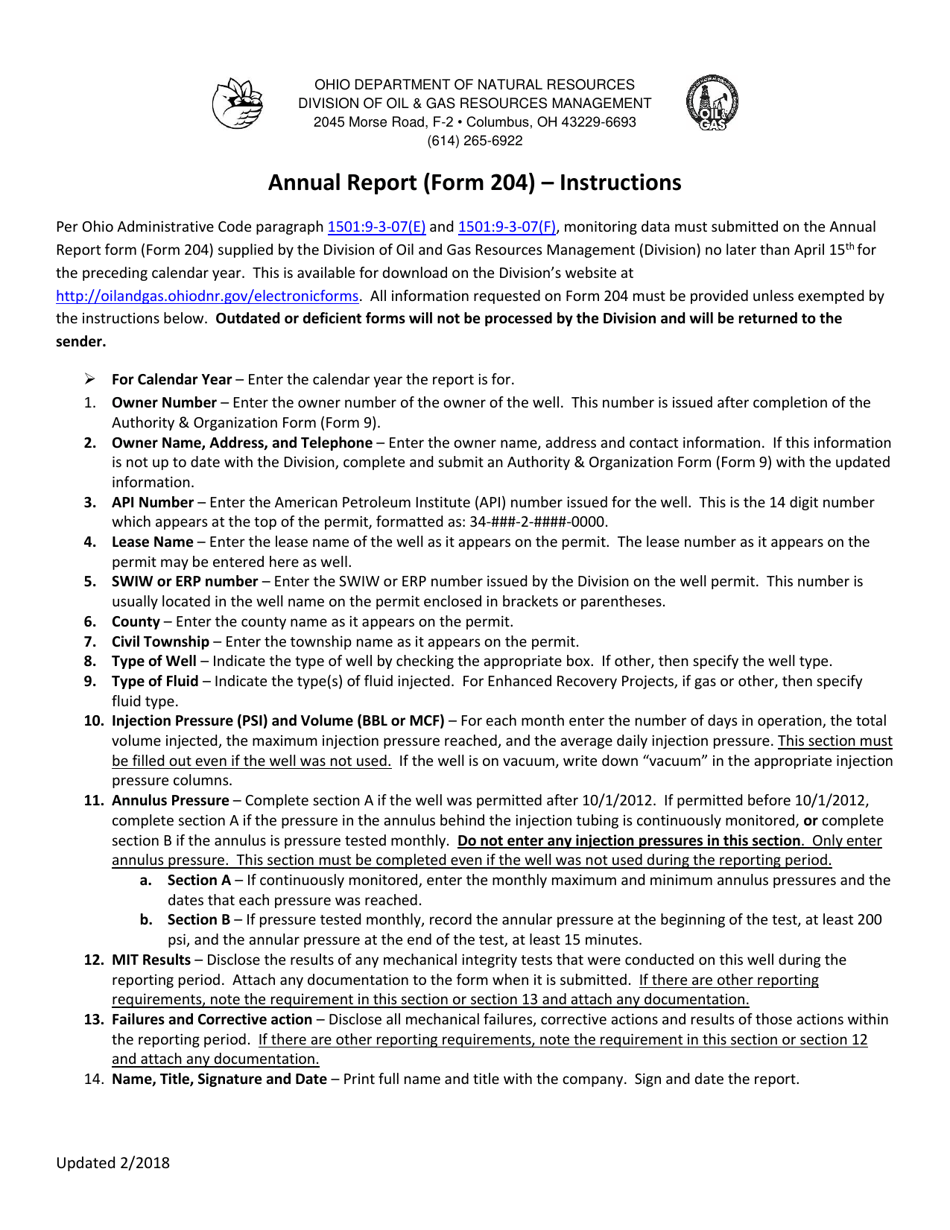

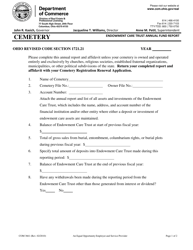

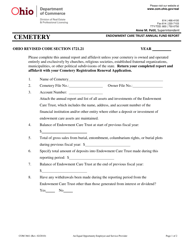

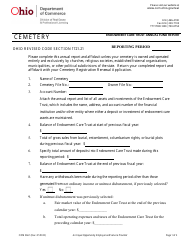

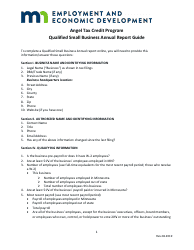

Instructions for Form 204 Annual Report - Ohio

This document contains official instructions for Form 204 , Annual Report - a form released and collected by the Ohio Department of Natural Resources.

FAQ

Q: What is Form 204?

A: Form 204 is the Annual Report for Ohio.

Q: Who needs to file Form 204?

A: All Ohio corporations and limited liability companies (LLCs) are required to file Form 204.

Q: When is Form 204 due?

A: Form 204 is due by the 15th day of the third month following the close of your fiscal year.

Q: What information is required to complete Form 204?

A: You will need to provide basic information about your company, such as its name, address, and registered agent.

Q: Is there a fee to file Form 204?

A: Yes, there is a filing fee for Form 204. The fee amount varies depending on the type of entity.

Q: What happens if I don't file Form 204?

A: Failure to file Form 204 can result in penalties and possibly the dissolution of your company.

Q: Can I request an extension to file Form 204?

A: No, there is no extension available for filing Form 204. It must be filed by the due date.

Instruction Details:

- This 1-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Ohio Department of Natural Resources.