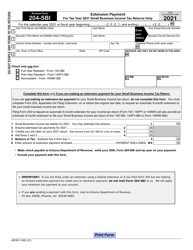

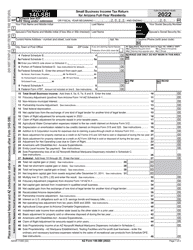

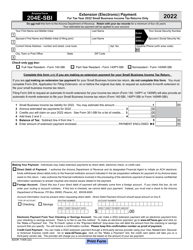

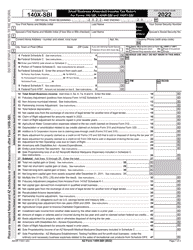

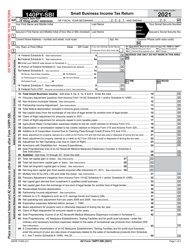

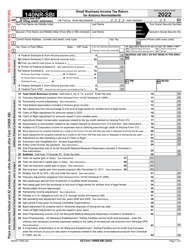

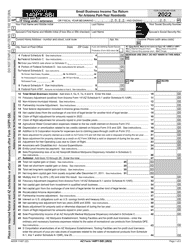

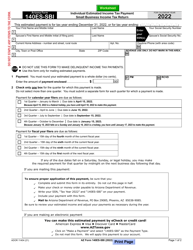

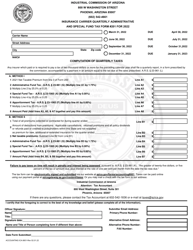

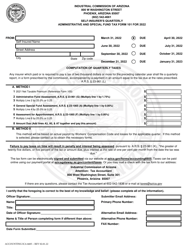

Instructions for Arizona Form 204-SBI, ADOR11402 Extension Payment - Small Business Income Tax Returns Only - Arizona

This document contains official instructions for Arizona Form 204-SBI , and Form ADOR11402 . Both forms are released and collected by the Arizona Department of Revenue.

FAQ

Q: What is Arizona Form 204-SBI?

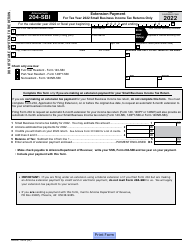

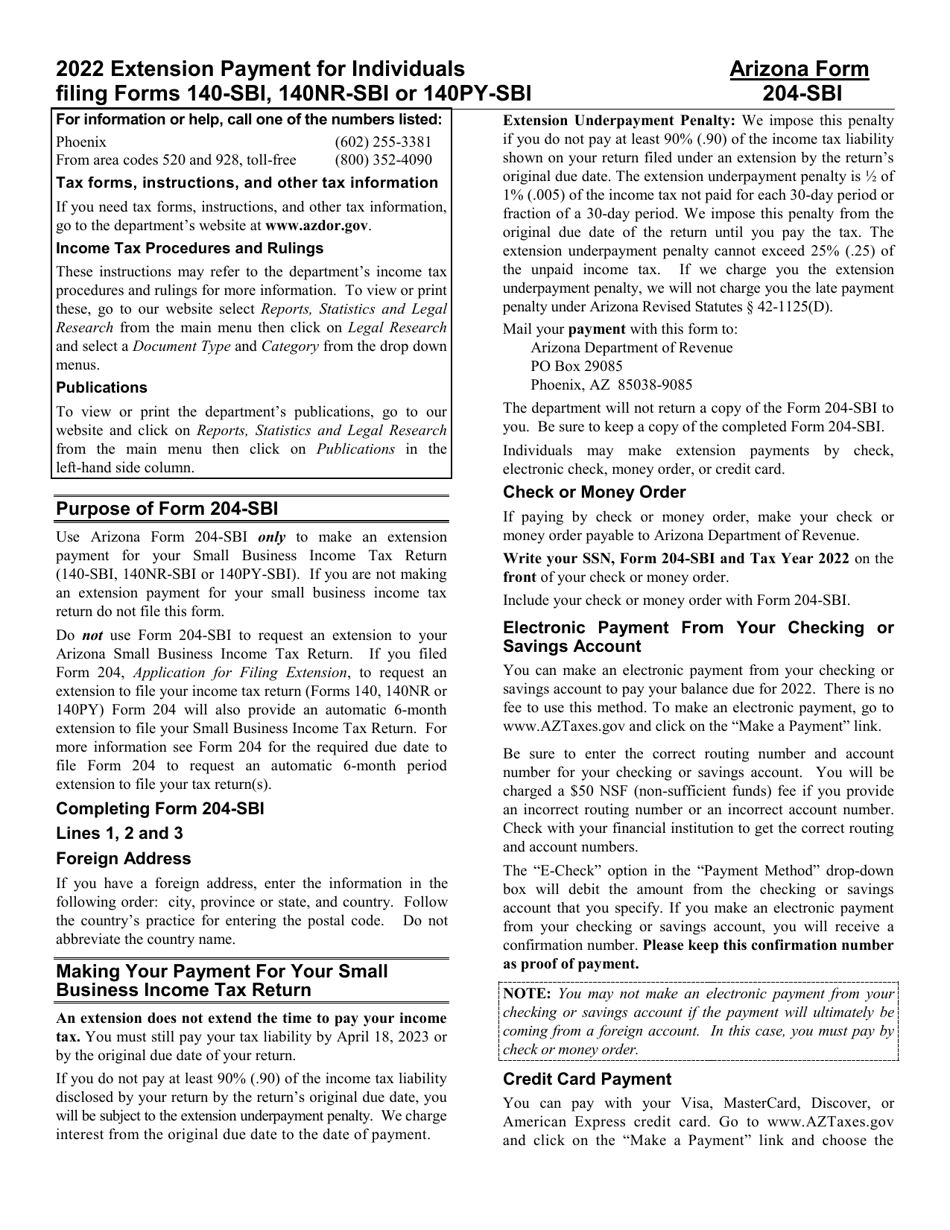

A: Arizona Form 204-SBI is a form used for filing extension payments for small business income tax returns in Arizona.

Q: Who is required to file Arizona Form 204-SBI?

A: Small businesses in Arizona who need an extension to file their income tax returns must file Arizona Form 204-SBI.

Q: What is the purpose of Arizona Form 204-SBI?

A: The purpose of Arizona Form 204-SBI is to make an extension payment for small business income tax returns in Arizona.

Q: What other forms may be required to file besides Arizona Form 204-SBI?

A: Besides Arizona Form 204-SBI, small business owners may also need to file other tax forms for their income tax returns in Arizona, depending on their specific circumstances.

Q: What is the deadline for filing Arizona Form 204-SBI?

A: The deadline for filing Arizona Form 204-SBI is the same as the deadline for filing small business income tax returns in Arizona.

Q: Are there any penalties for not filing Arizona Form 204-SBI?

A: Yes, there may be penalties for not filing Arizona Form 204-SBI or for not paying the extension payment on time.

Q: How can I get help with filling out Arizona Form 204-SBI?

A: You can contact the Arizona Department of Revenue for assistance with filling out Arizona Form 204-SBI or consult a tax professional.

Q: Is Arizona Form 204-SBI only for small businesses?

A: Yes, Arizona Form 204-SBI is specifically for small business income tax returns in Arizona.

Instruction Details:

- This 2-page document is available for download in PDF;

- Actual and applicable for this year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Arizona Department of Revenue.