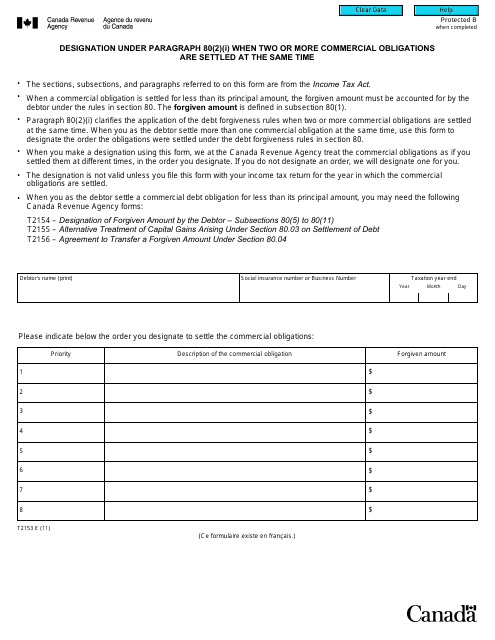

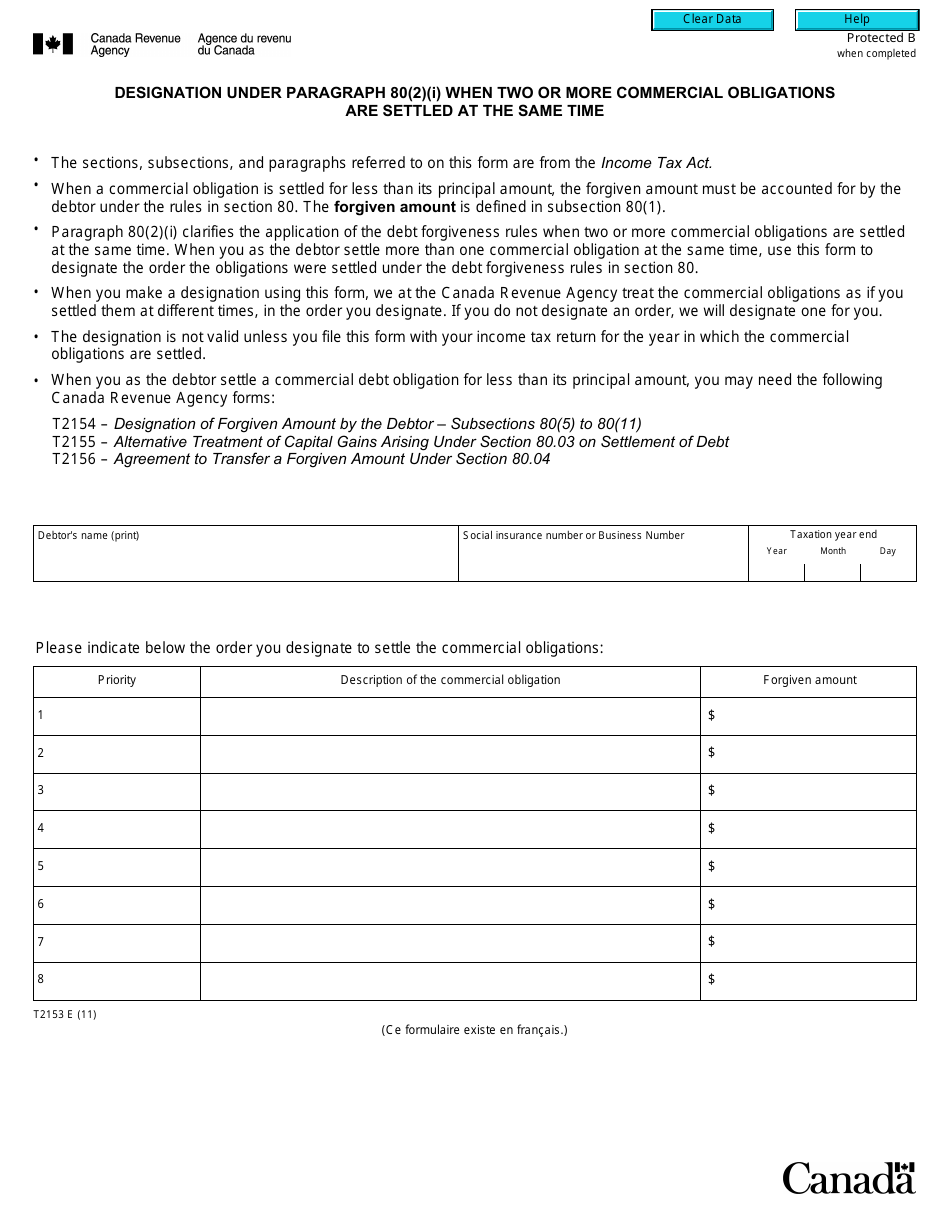

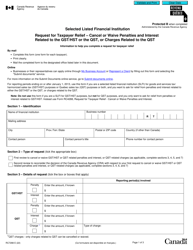

Form T2153 Designations Under Paragraph 80(2)(I) When Two or More Commercial Obligations Are Settled at the Same Time - Canada

Form T2153, "Designations Under Paragraph 80(2)(i) When Two or More Commercial Obligations Are Settled at the Same Time," is a tax form used in Canada. It is used to designate which commercial obligations are being settled when two or more are settled at the same time, for the purposes of determining taxable income.

The person or entity who settles the commercial obligations is responsible for filing the Form T2153 Designations under Paragraph 80(2)(i) in Canada.

FAQ

Q: What is Form T2153?

A: Form T2153 is a designation form used in Canada for tax purposes.

Q: What does Form T2153 cover?

A: Form T2153 covers designations under paragraph 80(2)(I) of the Income Tax Act.

Q: What is paragraph 80(2)(I) of the Income Tax Act?

A: Paragraph 80(2)(I) of the Income Tax Act pertains to the settlement of two or more commercial obligations at the same time.

Q: When should Form T2153 be used?

A: Form T2153 should be used when you need to designate the settlement of multiple commercial obligations simultaneously.

Q: Why is Form T2153 important?

A: Form T2153 is important for accurately reporting and claiming tax deductions or credits related to the settlement of multiple commercial obligations.

Q: Are there any specific requirements for completing Form T2153?

A: Yes, there are specific requirements and instructions provided on the form itself. It is important to follow them carefully.

Q: Can I submit Form T2153 electronically?

A: No, Form T2153 cannot be submitted electronically. It must be printed, signed, and mailed to the CRA.

Q: Is Form T2153 only for individuals?

A: No, Form T2153 can be used by individuals, corporations, and partnerships.

Q: Are there any fees associated with filing Form T2153?

A: There are no fees associated with filing Form T2153. It is a free form provided by the CRA.