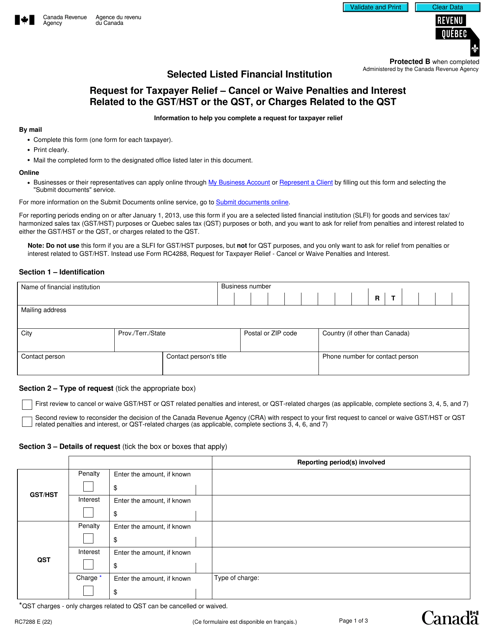

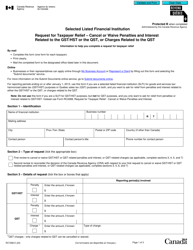

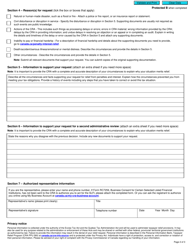

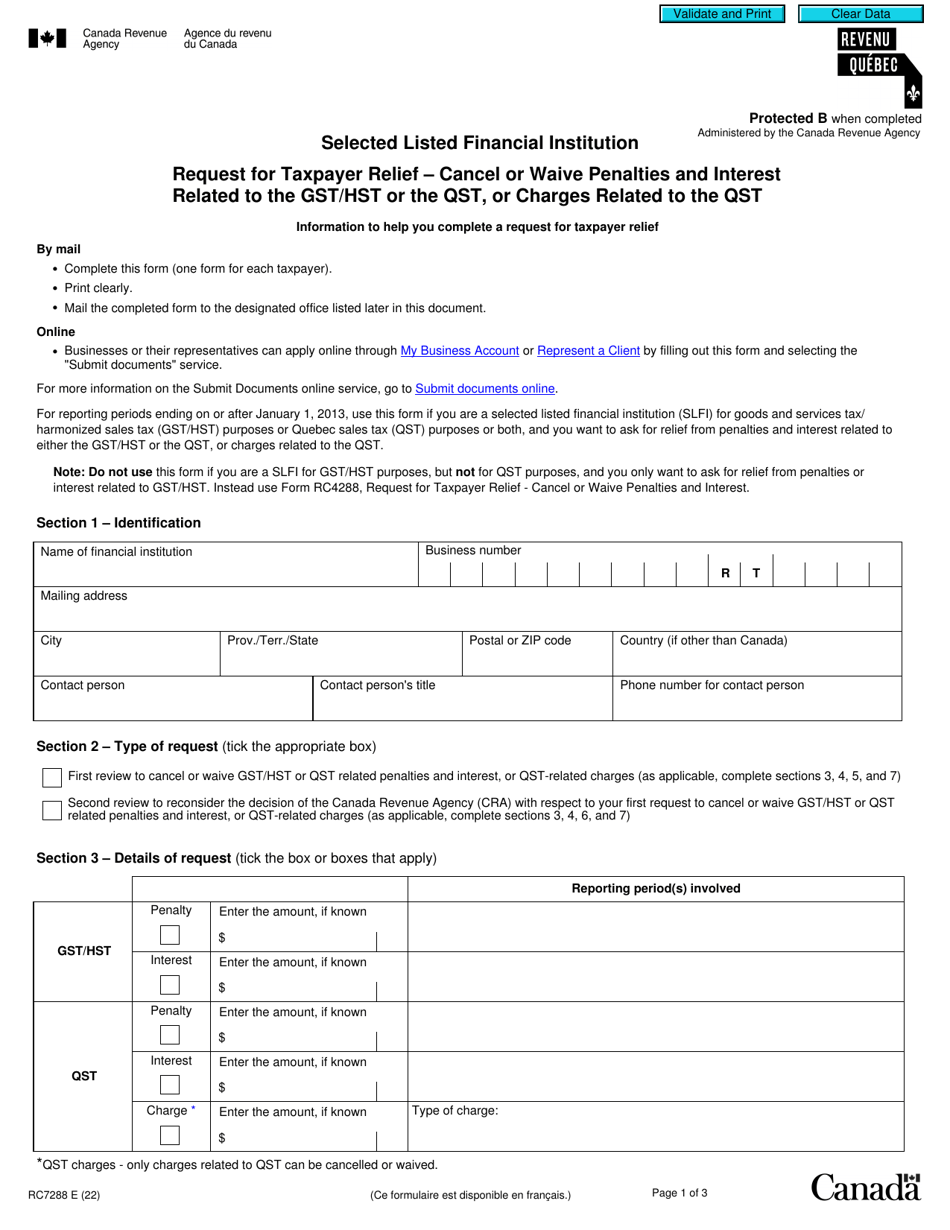

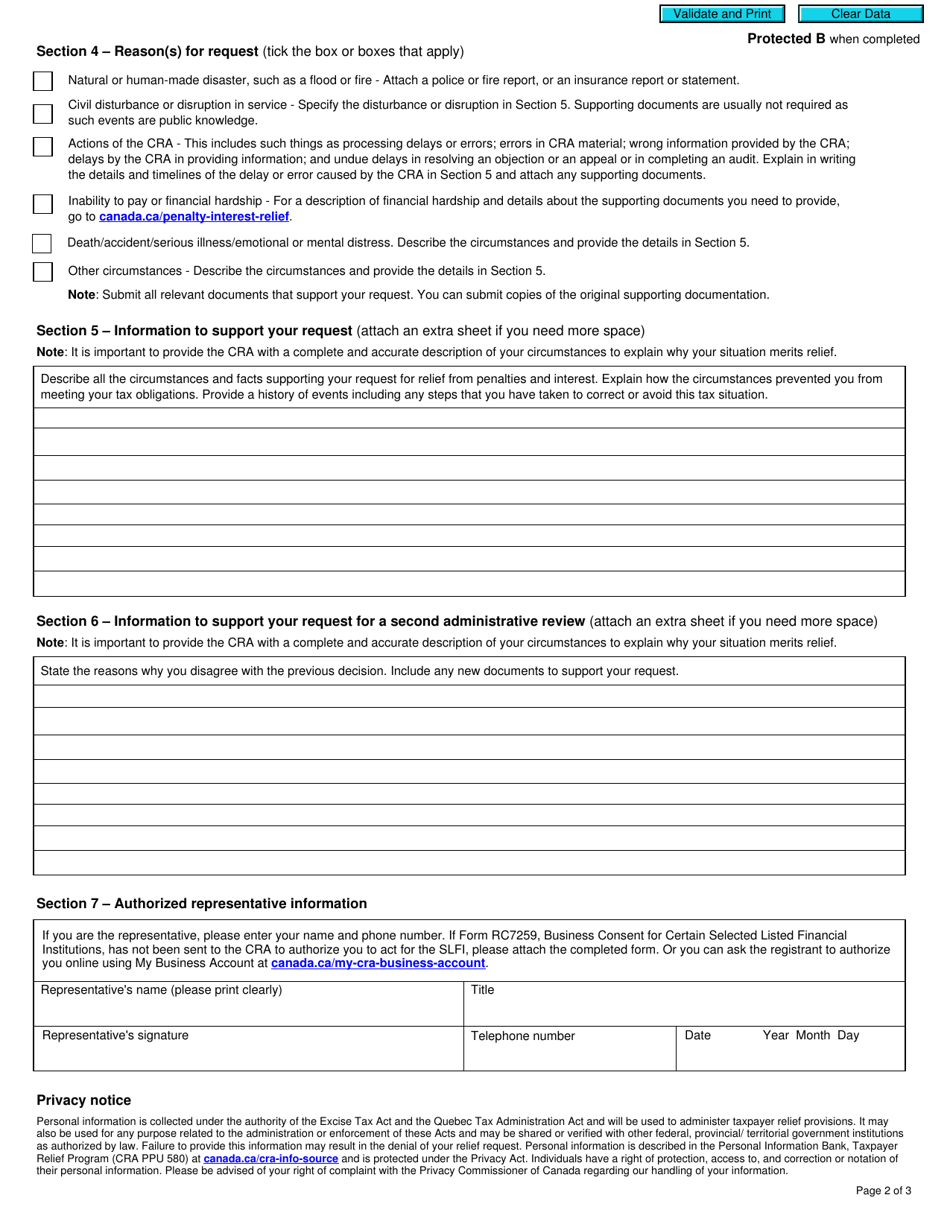

Form RC7288 Selected Listed Financial Institution - Request for Taxpayer Relief - Cancel or Waive Penalties and Interest Related to the Gst / Hst or the Qst, or Charges Related to the Qst - Canada

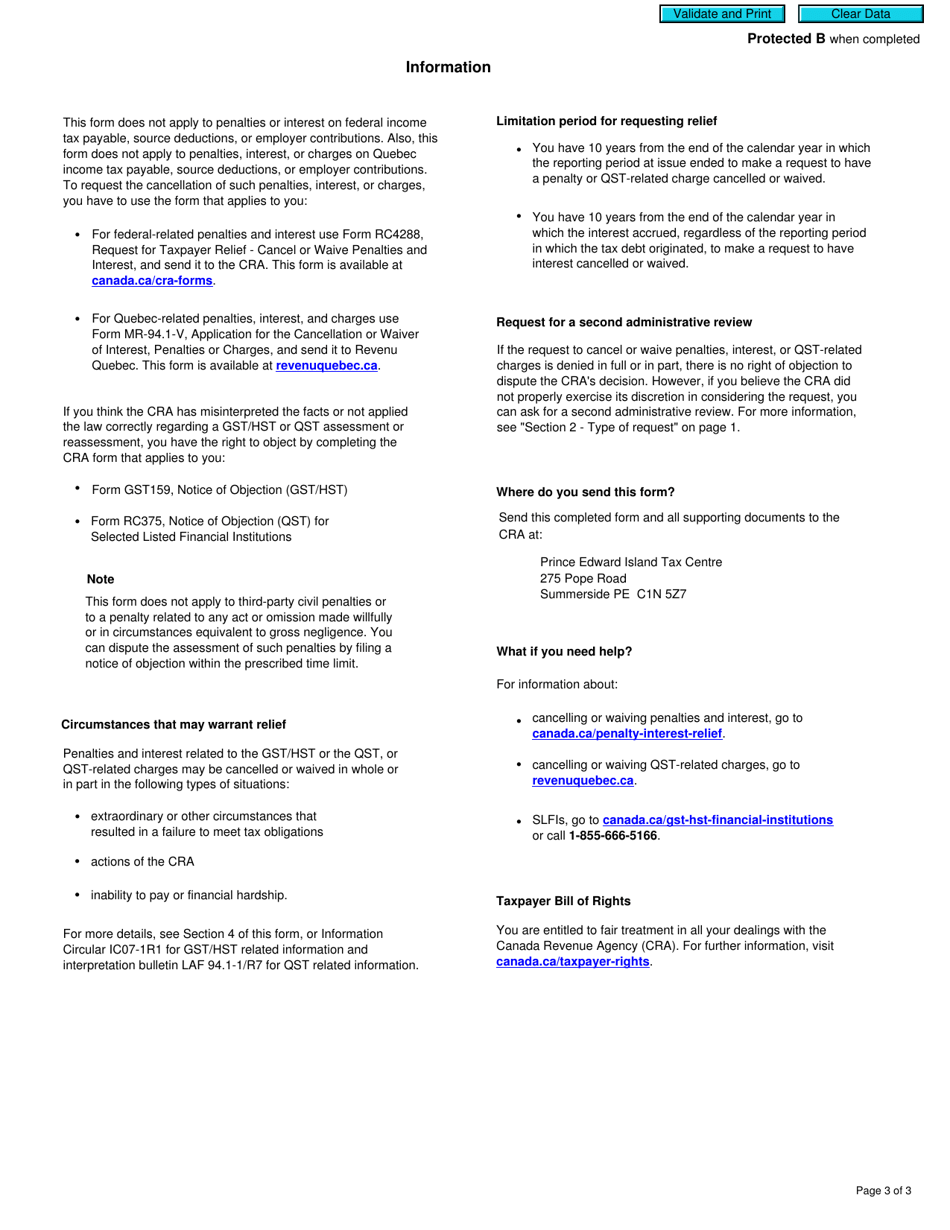

Form RC7288 is used in Canada to request taxpayer relief for the cancellation or waiver of penalties and interest related to the Goods and Services Tax/Harmonized Sales Tax (GST/HST) or the Quebec Sales Tax (QST), as well as charges related to the QST.

The form RC7288 (Selected Listed Financial Institution - Request for Taxpayer Relief) in Canada is typically filed by the taxpayer seeking to cancel or waive penalties, interest, or charges related to the GST/HST or the QST.

Form RC7288 Selected Listed Financial Institution - Request for Taxpayer Relief - Cancel or Waive Penalties and Interest Related to the Gst/Hst or the Qst, or Charges Related to the Qst - Canada - Frequently Asked Questions (FAQ)

Q: What is the Form RC7288?

A: Form RC7288 is a document used in Canada to request taxpayer relief for penalties and interest related to the GST/HST or the QST, or charges related to the QST.

Q: What is taxpayer relief?

A: Taxpayer relief refers to the cancellation or waiver of penalties and interest charges imposed by the Canada Revenue Agency.

Q: Who can use Form RC7288?

A: Any individual or business who needs to request taxpayer relief for GST/HST or QST penalties, interest, or charges can use Form RC7288.

Q: How can I request taxpayer relief?

A: To request taxpayer relief, you need to complete and submit Form RC7288 to the Canada Revenue Agency, along with any supporting documents required.

Q: What penalties and interest can be cancelled or waived?

A: Penalties and interest related to the GST/HST or the QST, as well as charges related to the QST, may be eligible for cancellation or waiver under taxpayer relief.