This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 1099-R, 5498

for the current year.

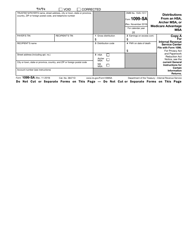

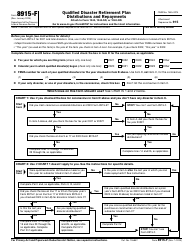

Instructions for IRS Form 1099-R, 5498 Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, Etc.

This document contains official instructions for IRS Form 1099-R , and IRS Form 5498 . Both forms are released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 1099-R is available for download through this link. The latest available IRS Form 5498 can be downloaded through this link.

FAQ

Q: What is IRS Form 1099-R?

A: IRS Form 1099-R is a tax form used to report distributions from pensions, annuities, retirement or profit-sharing plans, IRAs, insurance contracts, and more.

Q: Who needs to file IRS Form 1099-R?

A: Financial institutions and other entities that made distributions to individuals during the tax year need to file IRS Form 1099-R.

Q: What information is required on IRS Form 1099-R?

A: IRS Form 1099-R requires you to provide the recipient's identification information, distribution amounts, and any federal income tax withheld.

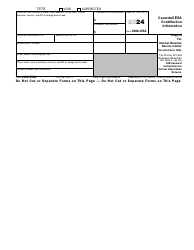

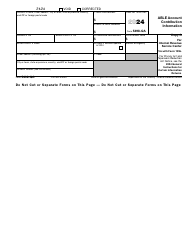

Q: What is IRS Form 5498?

A: IRS Form 5498 is a tax form used to report contributions to Individual Retirement Accounts (IRAs), including Traditional, Roth, and SIMPLE IRAs.

Q: Who needs to file IRS Form 5498?

A: Financial institutions and other entities that received contributions to IRAs during the tax year need to file IRS Form 5498.

Q: What information is required on IRS Form 5498?

A: IRS Form 5498 requires you to provide the account owner's identification information, contribution amounts, and the type of IRA.

Q: When is the deadline to file IRS Form 1099-R and IRS Form 5498?

A: The deadline to file IRS Form 1099-R and IRS Form 5498 is generally January 31st of the following year, but it may vary depending on certain circumstances.

Q: What should I do if I received IRS Form 1099-R or IRS Form 5498?

A: If you received IRS Form 1099-R or IRS Form 5498, you should review the information provided for accuracy and use it to prepare your tax return.

Instruction Details:

- This 25-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.