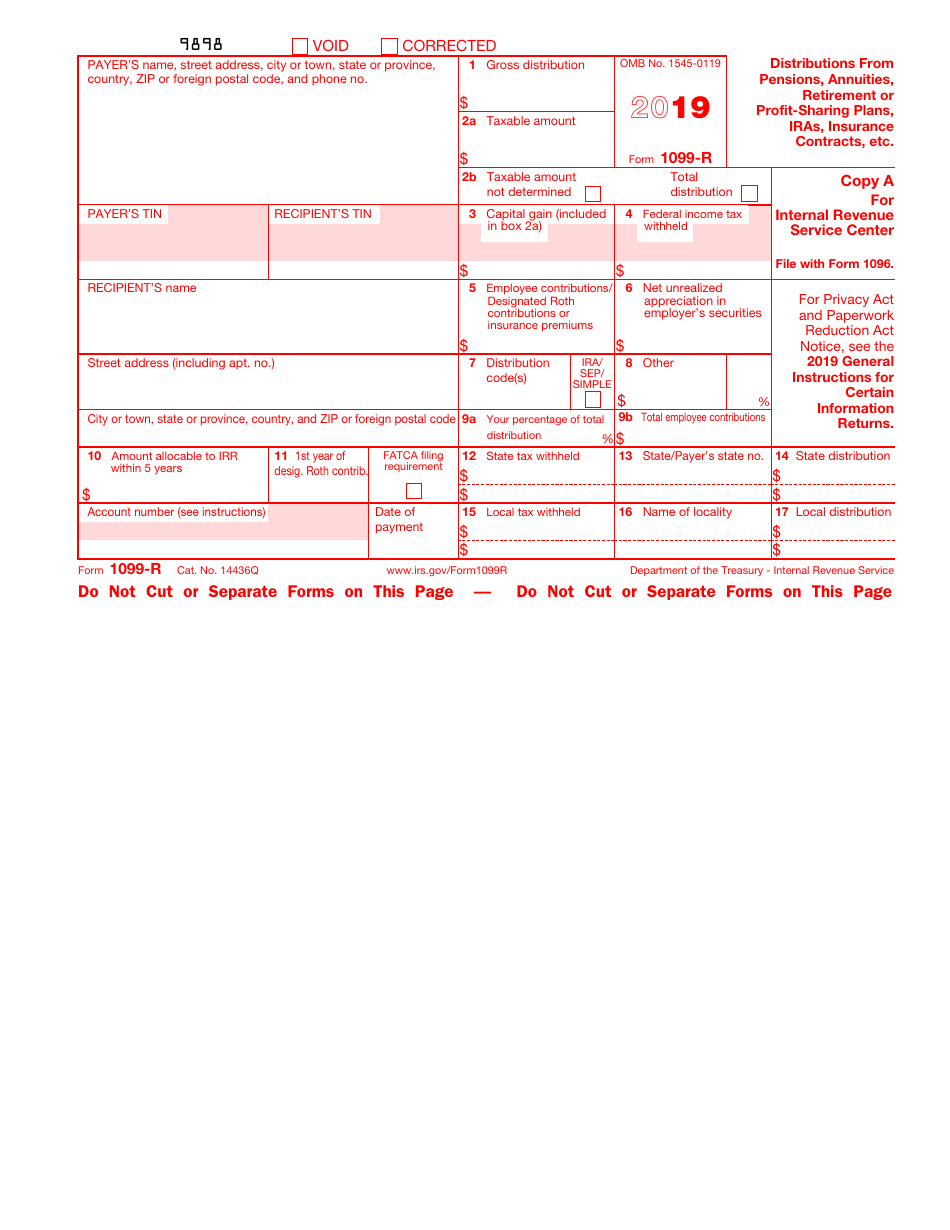

This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form 1099-R

for the current year.

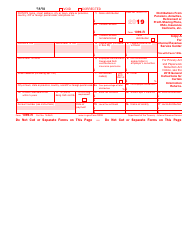

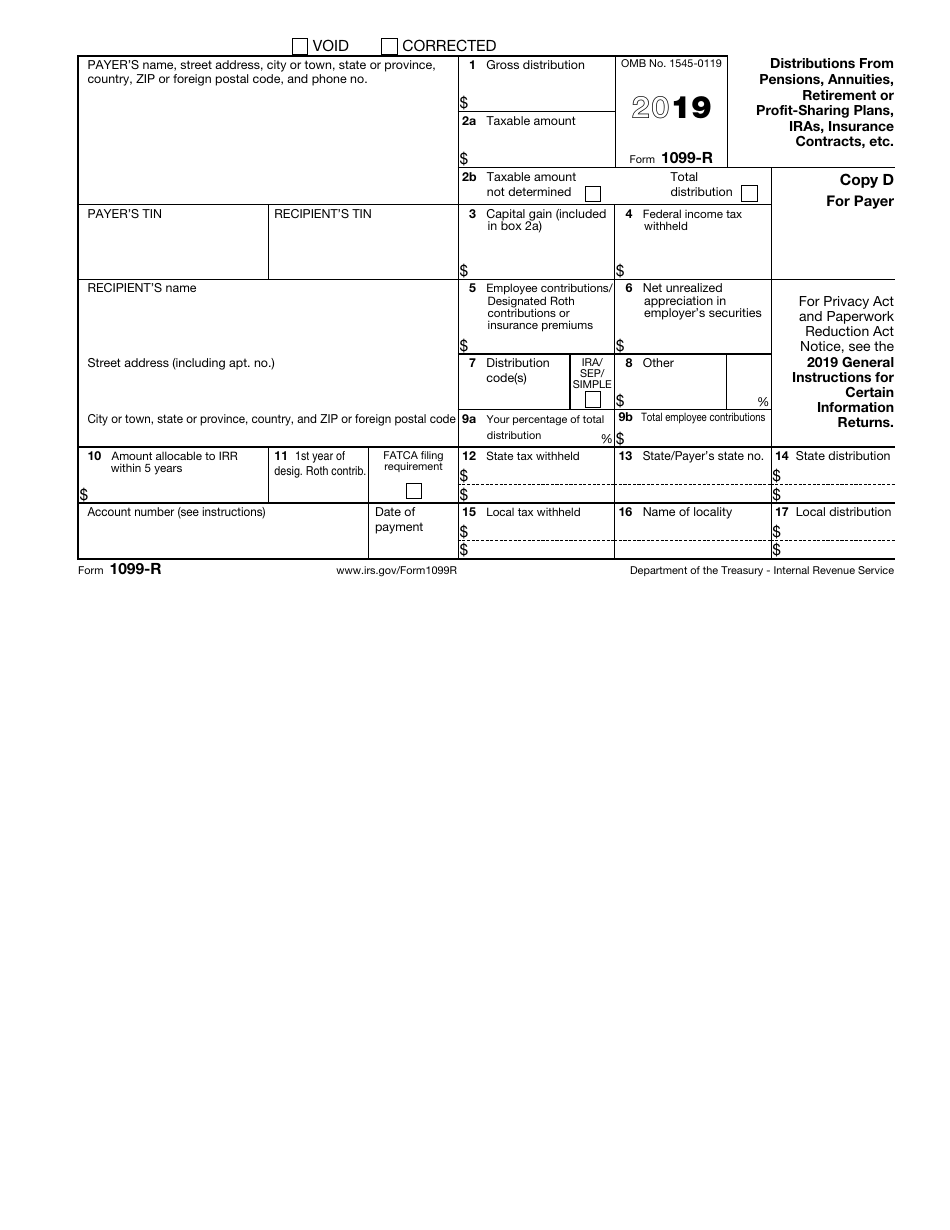

IRS Form 1099-R Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, Etc.

What Is IRS Form 1099-R?

IRS Form 1099-R, Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc. , is a legal document sent by the plan issuers (payers) to the Internal Revenue Service (IRS) and individuals (recipients) to whom these payers have made designated distributions from qualified and non-qualified profit-sharing or retirement plans, annuities, pensions, insurance contracts, disability payments, etc. This document reports the gross distribution, the taxable amount applicable to this gross distribution, a portion of federal income tax that was withheld, and capital gains associated with the distribution.

This form was released by the IRS . The latest version of the form was issued in 2019 with all previous editions obsolete. You can download a fillable 1099-R Form through the link below.

Here you can find other related 1099 forms, also known as information returns, used to report various types of income other than salaries to the IRS.

What Is Form 1099-R Used For?

By January 31, plan issuers send Form IRS 1099-R to any payee - retiree or beneficiary - who received any of the following distributions of $10 or more:

- Individual retirement accounts (IRAs);

- Profit-sharing and retirement plans;

- Charitable gift annuities;

- Total and permanent disability payments under life insurance contracts;

- Pensions, annuities, survivor income benefit plans, and insurance contracts.

Additionally, a copy of the form is sent to the IRS. Different types of retirement payments must be reported on separate forms.

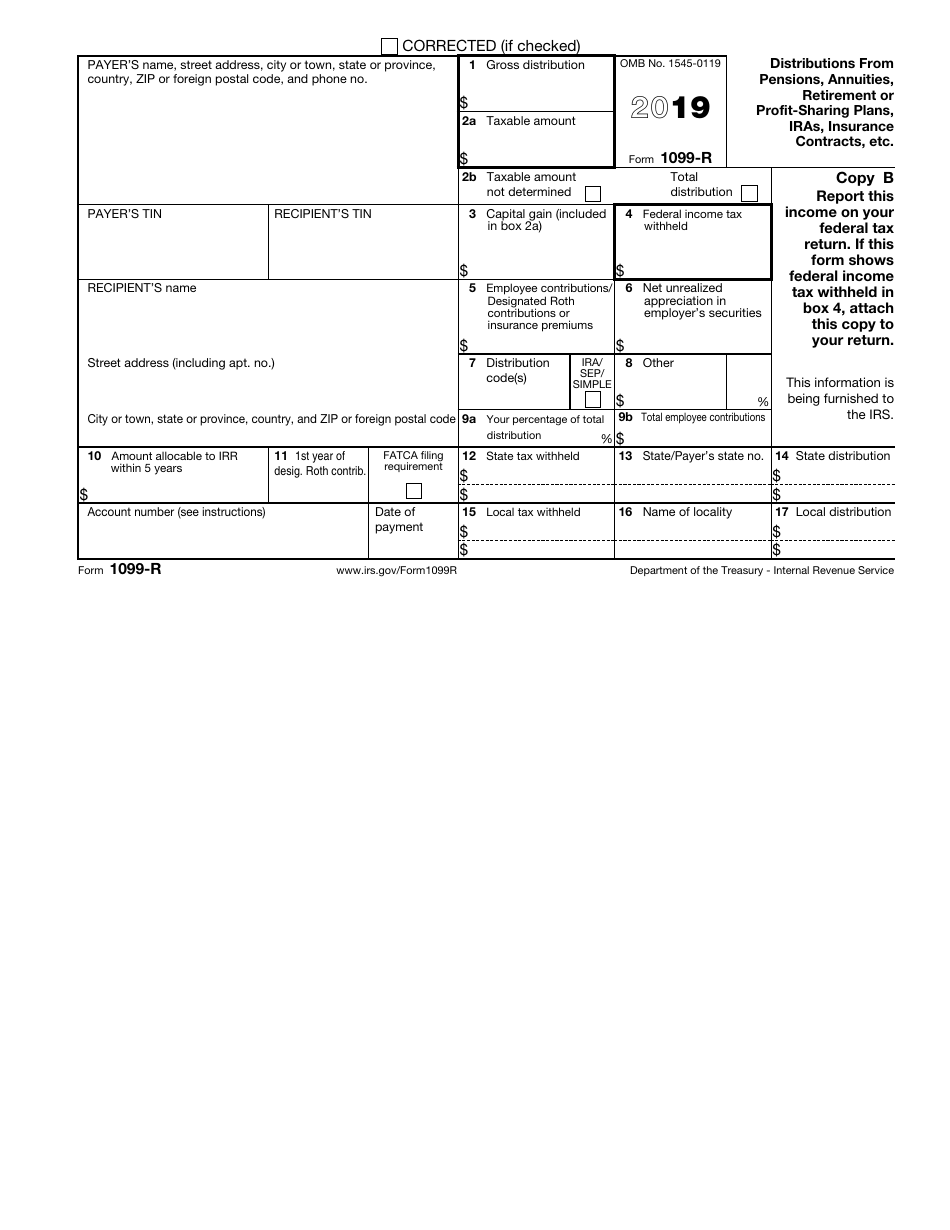

When you receive Form 1099-R, you must include the amount of distributions shown on it in Form 1040, U.S. Individual Income Tax Return, and send it to the IRS no later than April 15. Report the amount from Box 1 (gross distributions) on the line for "IRAs, pensions, and annuities", or the line for "Taxable Amount". If you have not reached the minimum age of retirement, report the disability payments on the line for "Wages, salaries, tips, etc." on Form 1040. If federal income tax was withheld and you show it on the 1099-R Form, attach a copy of this document to your tax return.

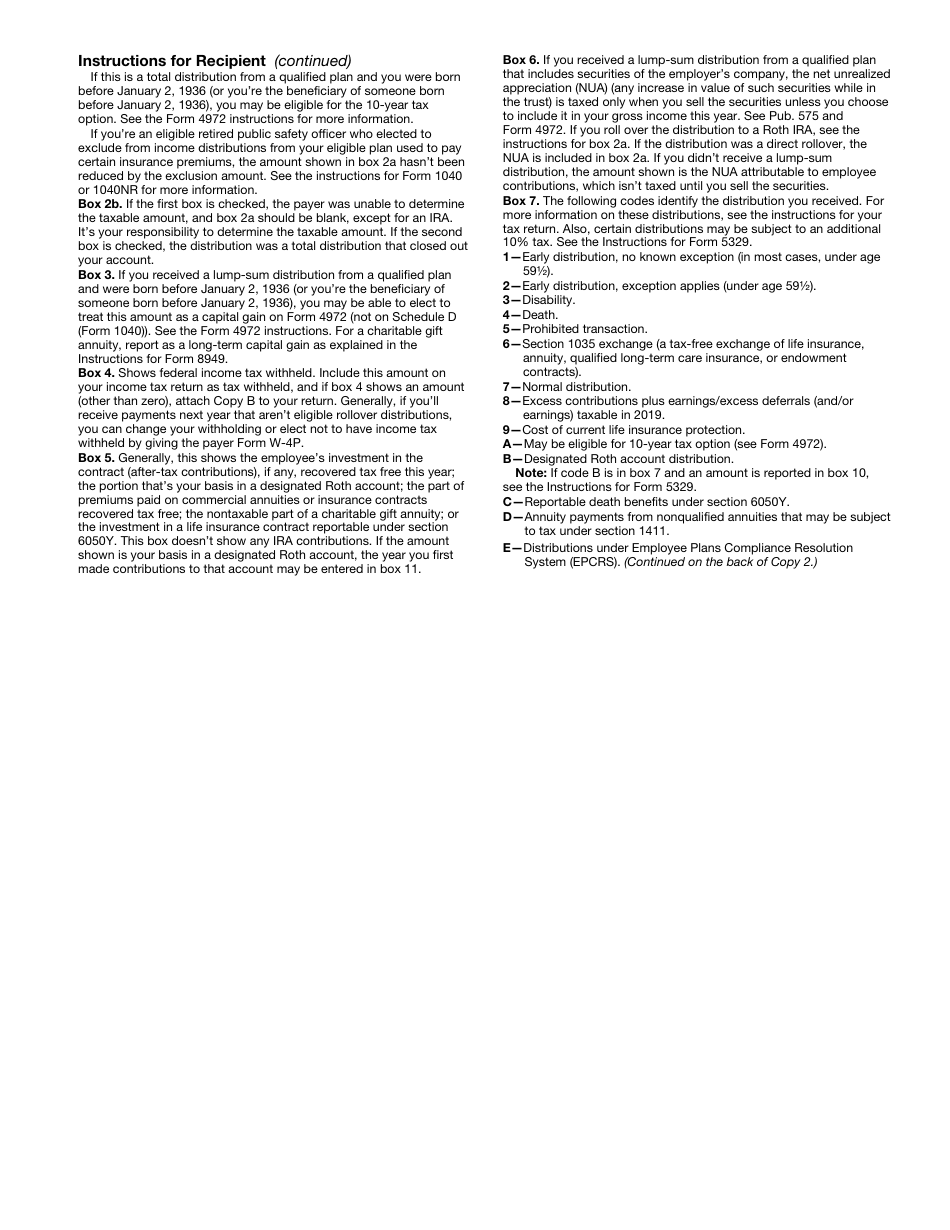

Form 1099-R Instructions

Form 1099-R instructions are as follows:

- Write down the payer's name, address, telephone number, and Taxpayer Identification Number;

- Add the recipient's name, address, and Taxpayer Identification Number;

- State the total amount of the distribution before deductions, including income tax, were withheld;

- Enter the 1099-R taxable amount. If you are unable to determine it, enter "X" in the appropriate box;

- If the payment is a total distribution - the entire balance of the account was distributed - enter "X" in the appropriate box;

- Report the amount taxable as a capital gain;

- Indicate the federal income tax withheld;

- If you can compute the Net Unrealized Appreciation (NUA) in the employer's securities, enter its amount;

- Record the appropriate distribution code - consult the Official Instructions for Forms 1099-R and 5498 to find out the 1099-R distribution codes;

- Indicate the current value of the annuity contract that is part of a lump-sum distribution;

- State your percentage of total distribution and total employee contributions;

- Write down the amount of the distribution allocable to the In-Plan Roth Rollover made within 5 years since the rollover was made and enter the first year of this tax period;

- If you are a Foreign Financial Institution and need to file in accordance with the Foreign Account Tax Compliance Act (FATCA), check the appropriate box;

- Enter the date payment was made for reportable death benefits;

- Name the state where tax was withheld or the payer's state number, and the amounts of tax withheld and the state distribution. If local income tax was withheld, enter its amount, name the locality, and the amount of the local distribution;

- If you have multiple accounts for one recipient, enter their account number.

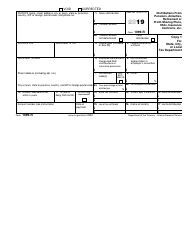

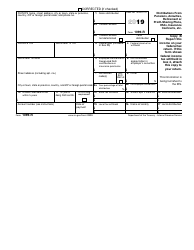

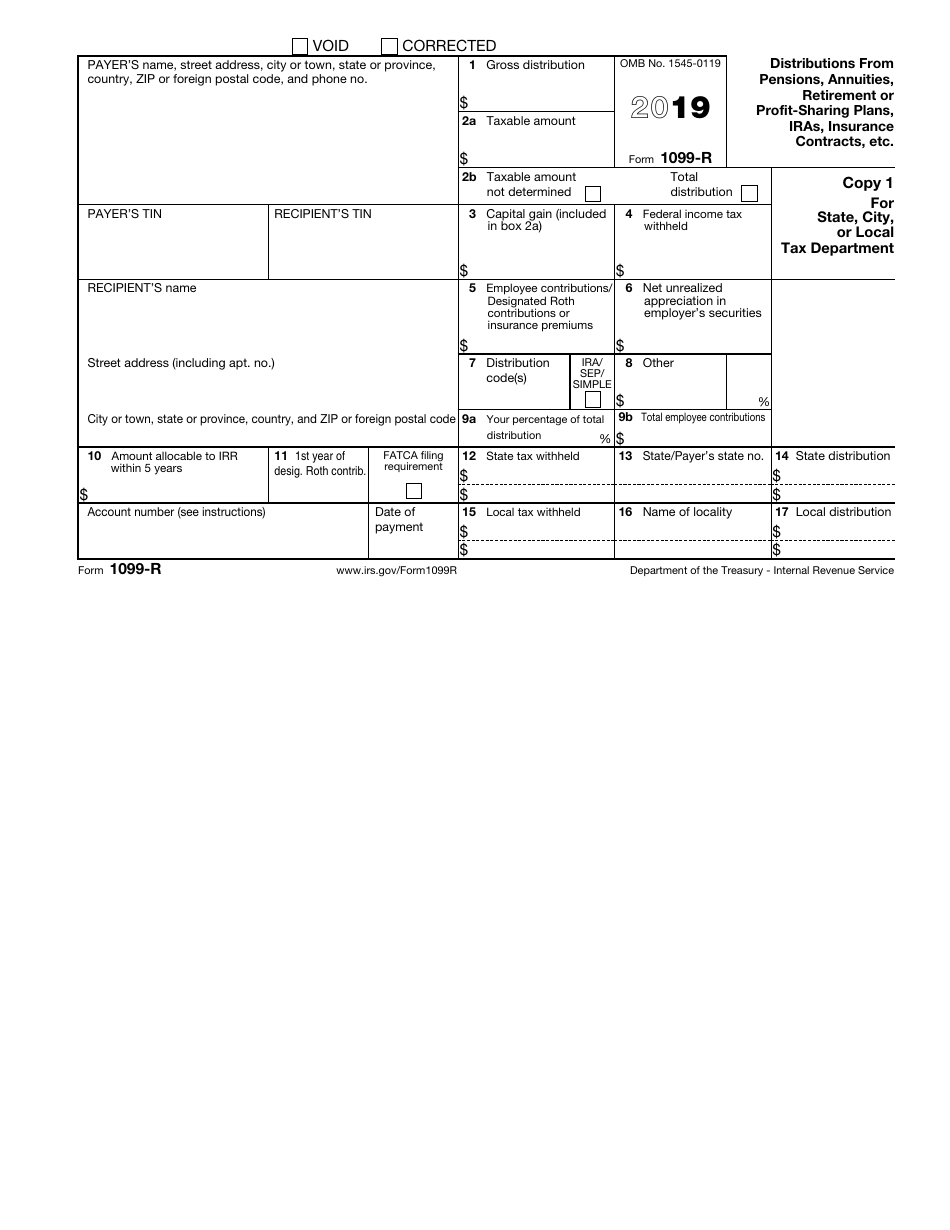

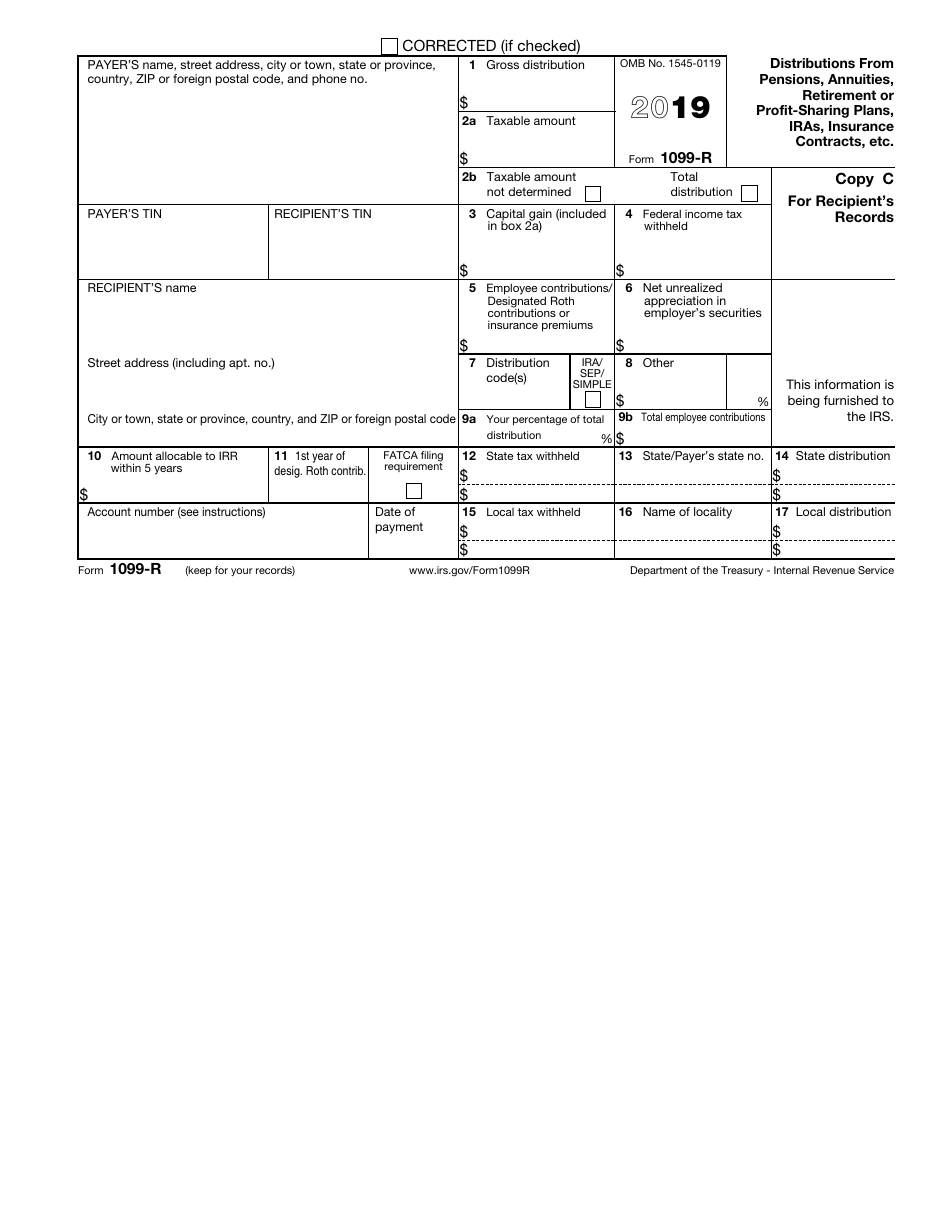

There are three copies of Form 1099-R sent to recipients. Copy B must be filed with your tax return, Copy C is for your own records, and Copy 2 is filled out if you are required to file taxes with your state.

Where Is the Federal ID Number on 1099-R?

Federal ID Number on 1099-R Form is also known as Taxpayer Identification Number (TIN). It is a unique nine-digit number that identifies an individual or business in tax returns and other documentation submitted to the IRS. You need to enter the payer's TIN in the box located under the payer's name and contact information.