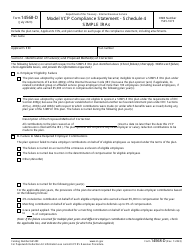

This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form 5498

for the current year.

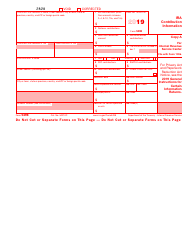

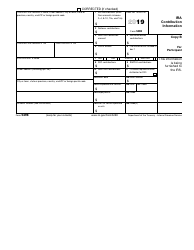

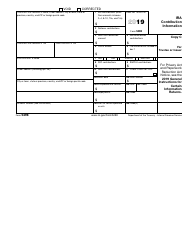

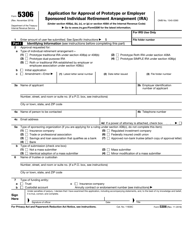

IRS Form 5498 Ira Contribution Information

What Is Form 5498?

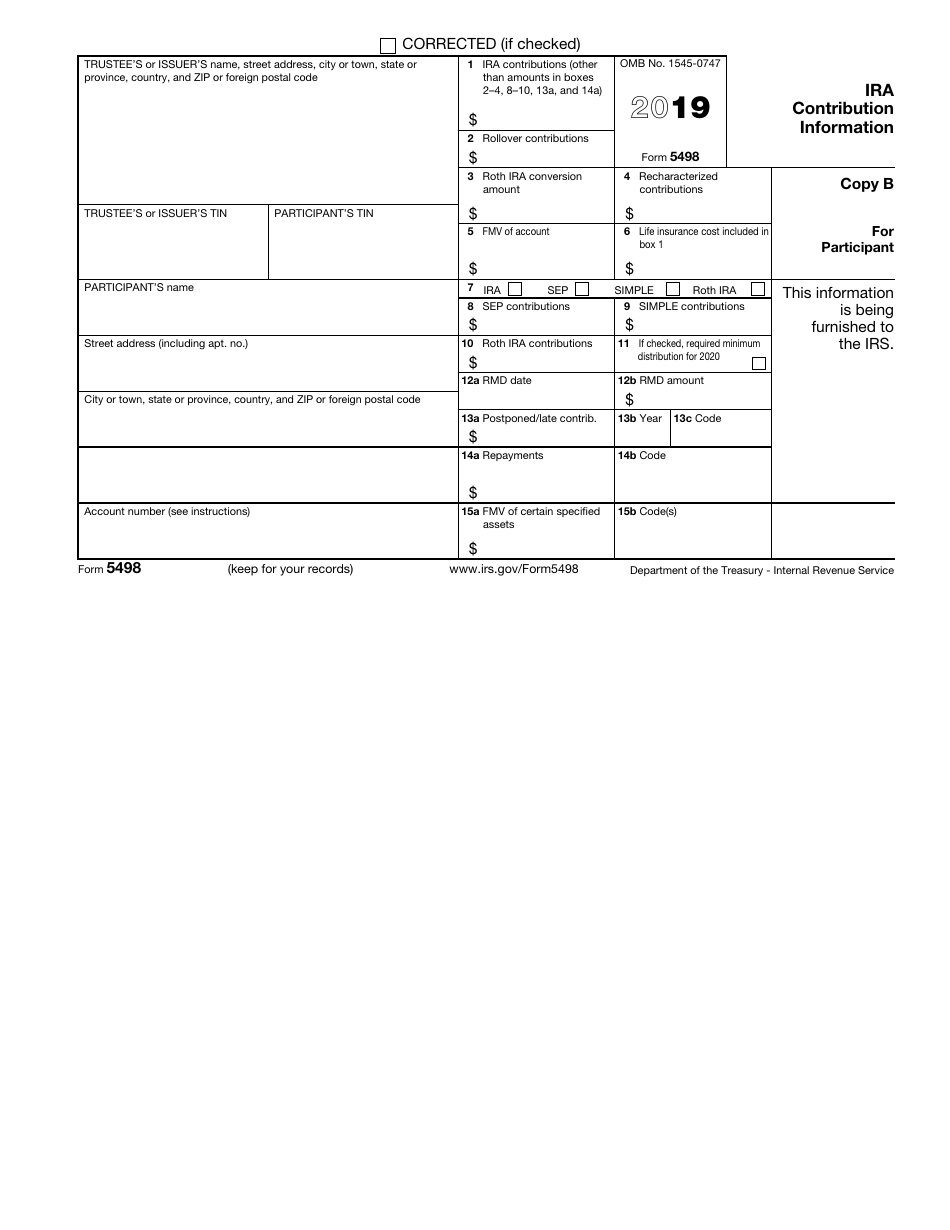

IRS Form 5498, IRA Contribution Information - also known as the IRA Contribution Information Form 5498 - is a form that financial institutions acting as trustees or issuers of individual retirement arrangements (IRAs) file with the Internal Revenue Service (IRS) for each person for whom they maintained an IRA in the calendar year. This form is issued by the IRS and revised on a yearly basis . You can find a fillable Form IRS 5498 for download below.

What Is the Purpose of Form 5498?

The purpose of the form is to report contributions to IRAs, Roth conversions, IRA recharacterizations, and the fair market value (FMV) of the account, to the IRS.

When Is IRS Form 5498 Due?

Form 5498 due date is June 1, 2020 filing for the previous year. If this date falls on a weekend day or a legal holiday, the form may be filed on the next business day. It is possible to get an automatic 30-day extension of time to file by completing Form 8809 by June 1, 2020, and this request may be filed on paper only.

The penalty for failing to timely file the form is $50 per return with no maximum, except if the failure is due to reasonable cause.

IRS Form 5498 Instructions

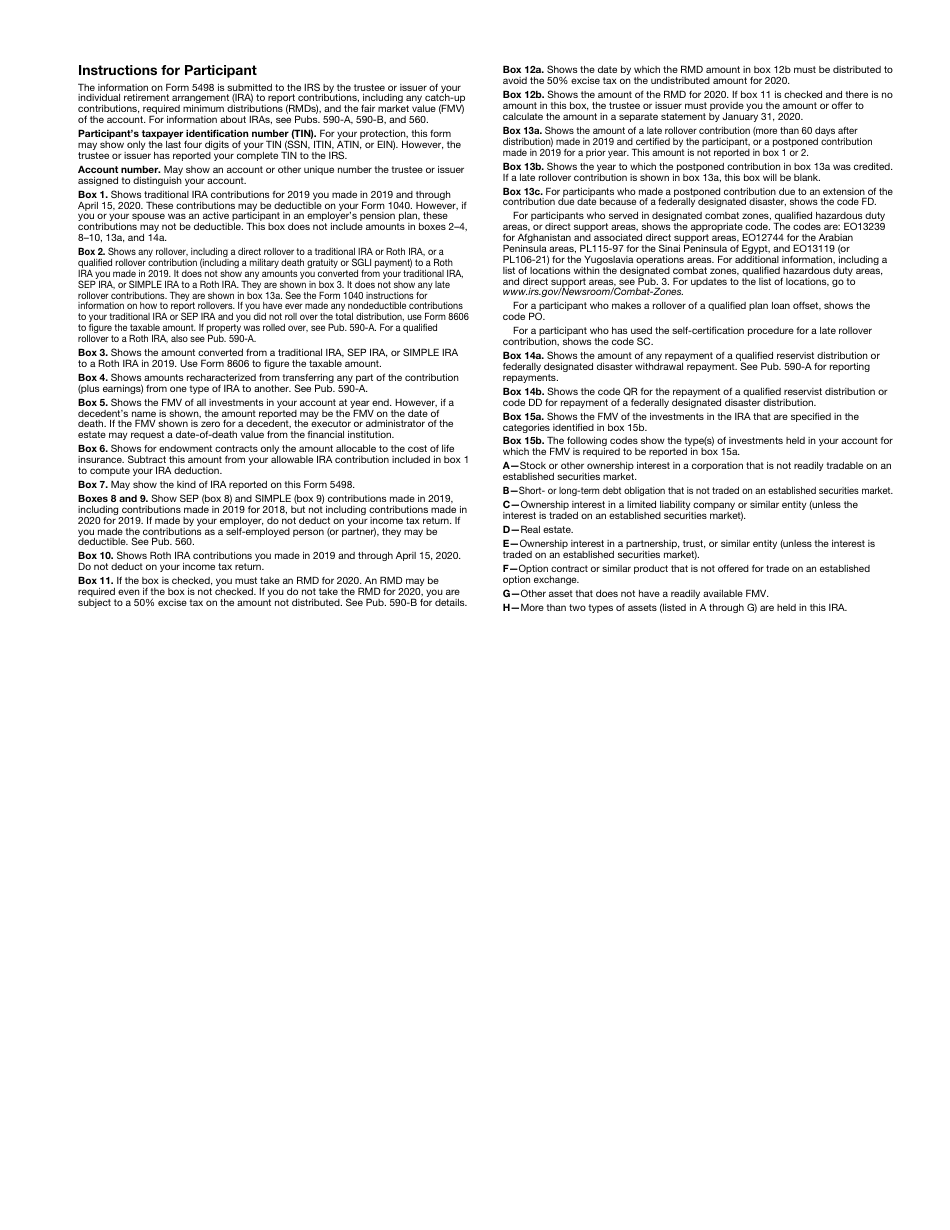

You can find detailed Instruction for this form on the IRS site or through this link. If you are filing the 5498 tax statement on paper, you are required to send it along with a Form 1096, Annual Summary and Transmittal of U.S. Information Returns, as the transmittal document. Please be aware that you cannot file a black-and-white photocopy of Form 1096 or Copy A of Form 5498 that you print because they are scanned during processing. If you must file 250 or more 5498 Forms, you are required to file them electronically. For this purpose, you can use the Filing Information Returns Electronically System (FIRE System).

You must file this form for each person for whom in 2019 you maintained any IRA, but it is not necessary to file a Form 5498 for each investment under one IRA plan. However, if a participant has established two or more IRA plans with you, you must file a separate form for each plan.

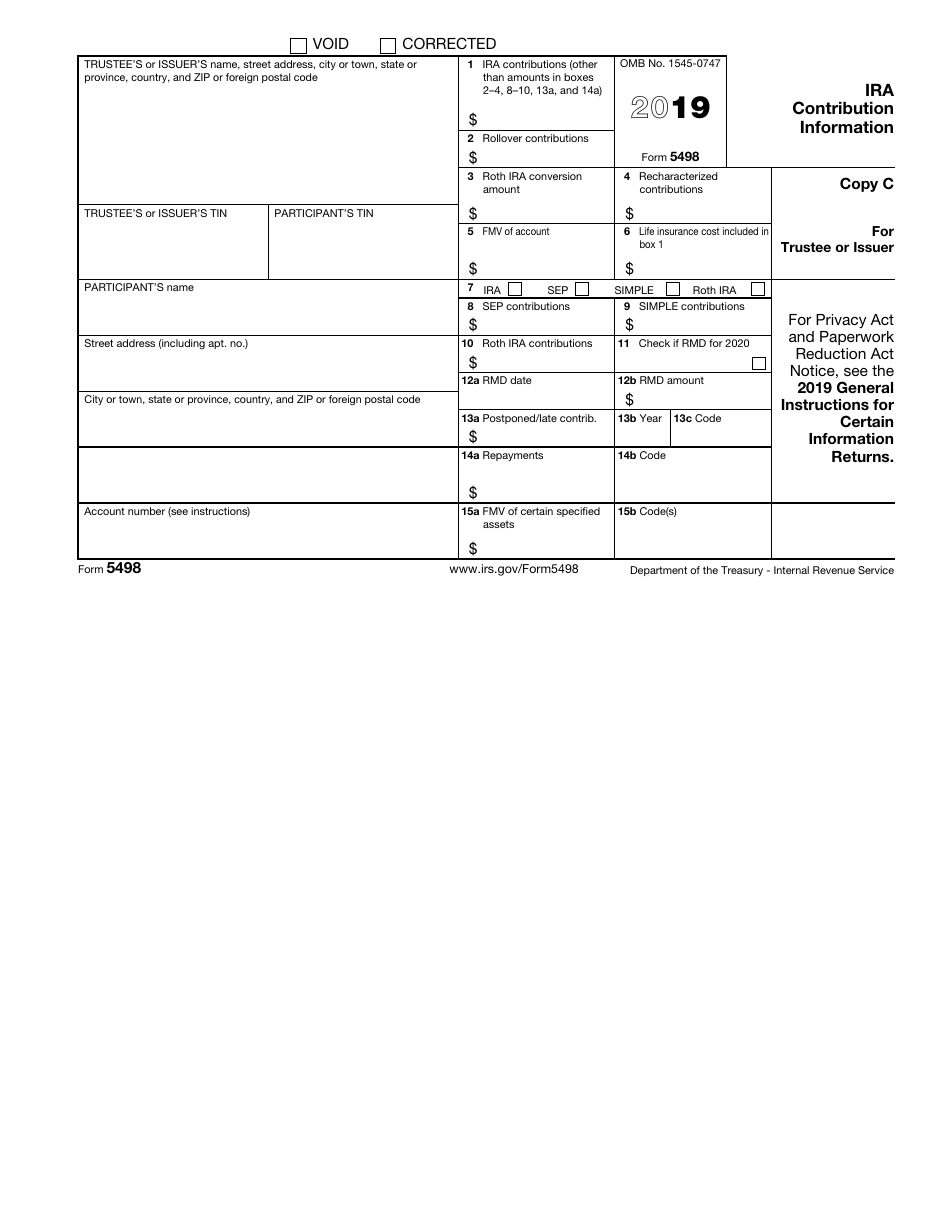

You also must furnish clear and legible statements to recipients containing the information furnished to the IRS, as well as additional information, if applicable. Copy B of this form must be furnished to the participant by June 1, 2020. However, information on FMV and required minimum distributions (RMD) must be furnished, if applicable, by January 31, 2020. The requirement to take RMD applies to those aged 70.5 and older, as well as to persons who inherited IRAs, and you must inform this by checking Box 11. Copy C of the form is to be kept in the trustee or issuer's records.

Where to Send IRS Form 5498?

If you file Copy A of the form on paper, you are required to file it with the Department of the Treasury Internal Revenue Service Center. Depending on your principal place of business, the address will be any of the following three: Austin, TX 73301; Ogden, UT 84201; or P.O. Box 219256 Kansas City, MO 64121-9256. Alternatively, you may file electronically.

IRS 5498 Related Forms

There are three other forms that belong to the same series:

- IRS Form 5498-QA, ABLE Account Contribution Information. This form is filed with the IRS by any State or its agency or instrumentality for reporting the contributions made to an ABLE account for each qualified ABLE account they established and maintained.

- IRS Form 5498-SA, HSA, Archer MSA, or Medicare Advantage MSA Information. This is a form filed with the IRS by trustees or custodians of a Health Savings Account (HSA), Medicare Advantage MSA (MA MSA), or Archer Medical Savings Account (Archer MSA) for reporting amounts contributed to these savings accounts and their FMV.

- IRS Form 5498-ESA, Coverdell ESA Contribution Information. This is a form filed with the IRS by trustees or issuers of a Coverdell education savings account (ESA) for each person for whom they maintained any ESA, for reporting amounts of contributions (including rollovers) to a Coverdell ESA.