This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 1094-C, 1095-C

for the current year.

Instructions for IRS Form 1094-C, 1095-C

This document contains official instructions for IRS Form 1094-C , and IRS Form 1095-C . Both forms are released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 1094-C is available for download through this link. The latest available IRS Form 1095-C can be downloaded through this link.

FAQ

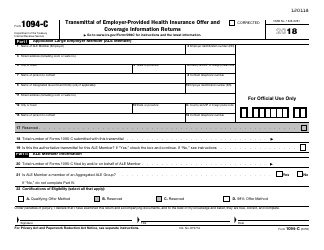

Q: What is IRS Form 1094-C?

A: IRS Form 1094-C is used by applicable large employers to report information about offers of health coverage to full-time employees.

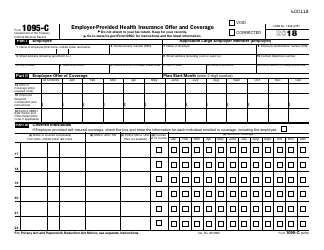

Q: What is IRS Form 1095-C?

A: IRS Form 1095-C is used to provide information to the IRS and to employees about health insurance coverage offered by an applicable large employer.

Q: Who needs to file IRS Form 1094-C?

A: Applicable large employers, which are generally defined as those with 50 or more full-time employees, including full-time equivalent employees, need to file IRS Form 1094-C.

Q: Who needs to file IRS Form 1095-C?

A: Applicable large employers that offer health insurance coverage to their full-time employees need to file IRS Form 1095-C for each employee who was offered coverage.

Q: What information is required on IRS Form 1094-C?

A: IRS Form 1094-C requires information about the employer, the type of coverage offered, and the number of full-time employees.

Q: What information is required on IRS Form 1095-C?

A: IRS Form 1095-C requires information about the employee, the employer, and the health insurance coverage offered.

Q: When is the deadline to file IRS Form 1094-C?

A: The deadline to file IRS Form 1094-C is typically February 28th, or March 31st if filing electronically, following the calendar year in which the coverage was offered.

Q: When is the deadline to file IRS Form 1095-C?

A: The deadline to provide IRS Form 1095-C to employees is typically March 2nd, following the calendar year in which the coverage was offered.

Q: What happens if I don't file IRS Form 1094-C or 1095-C?

A: Failure to file IRS Form 1094-C or 1095-C may result in penalties imposed by the IRS.

Instruction Details:

- This 17-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.