This version of the form is not currently in use and is provided for reference only. Download this version of

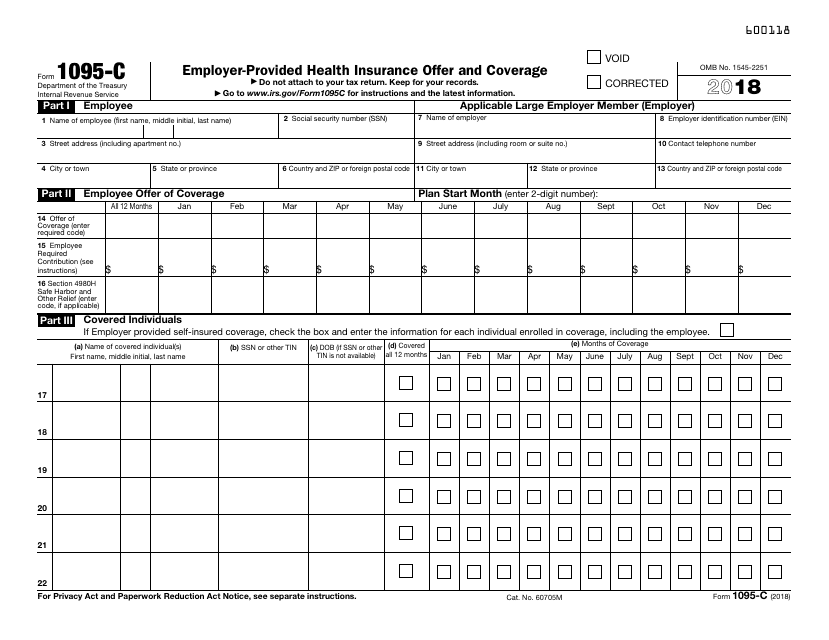

IRS Form 1095-C

for the current year.

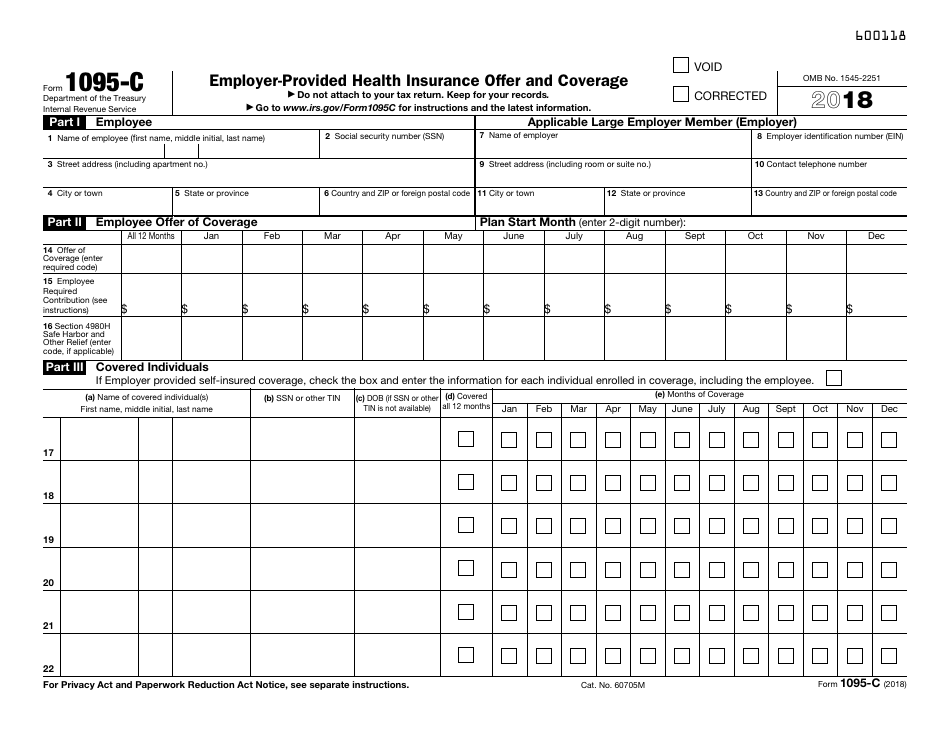

IRS Form 1095-C Employer-Provided Health Insurance Offer and Coverage

What Is IRS Form 1095-C?

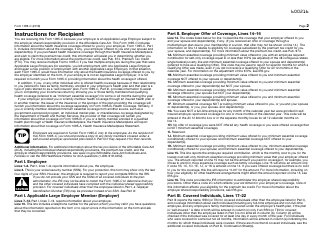

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 1095-C?

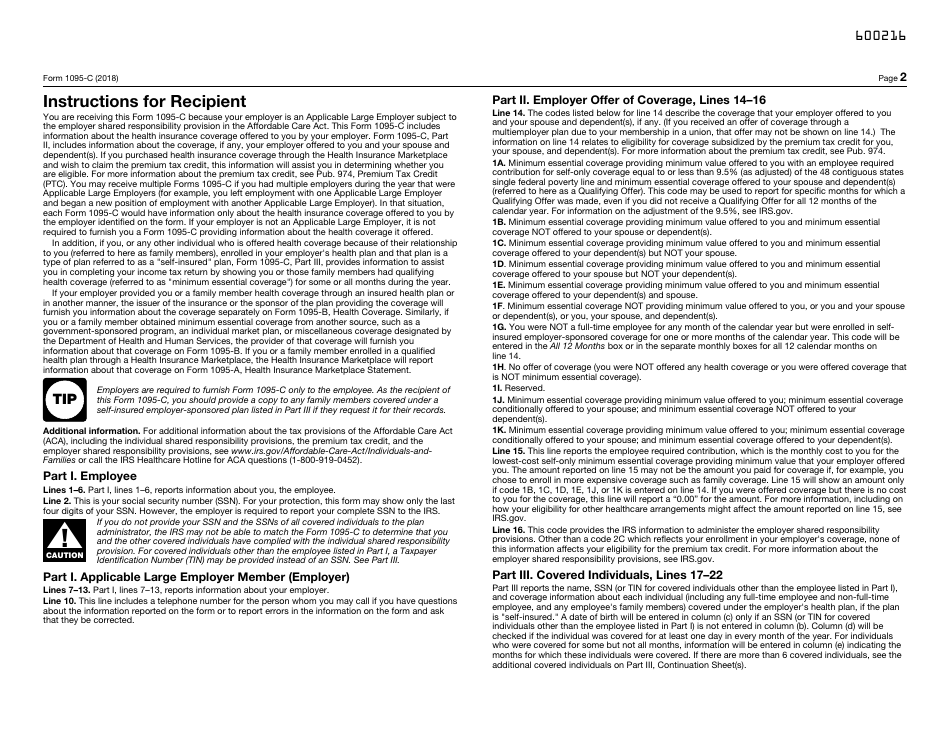

A: IRS Form 1095-C is a tax form that provides information about the health insurance coverage offered by an employer.

Q: Who receives IRS Form 1095-C?

A: Employees who were eligible for employer-provided health insurance coverage during the tax year receive IRS Form 1095-C.

Q: What information does IRS Form 1095-C contain?

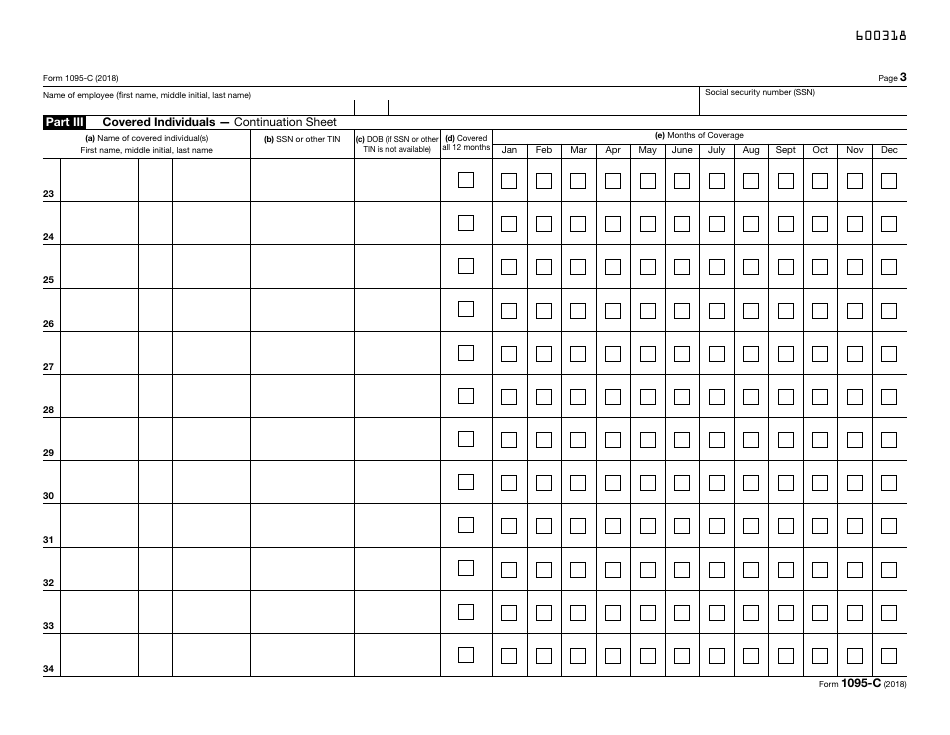

A: IRS Form 1095-C contains information about the health insurance coverage offered by an employer, including the months in which coverage was available and the employee's share of the monthly premium.

Q: Why do I need IRS Form 1095-C?

A: You may need IRS Form 1095-C to complete your federal income tax return, as it provides information about your health insurance coverage.

Q: How do I get IRS Form 1095-C?

A: Your employer is responsible for providing you with IRS Form 1095-C. They should either mail it to you or make it available to you electronically.

Q: What do I do with IRS Form 1095-C?

A: Keep IRS Form 1095-C with your tax records. You do not need to submit it with your tax return, but you may need the information it contains to complete your return correctly.

Form Details:

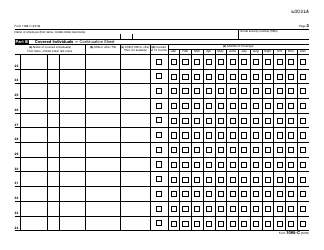

- A 3-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 1095-C through the link below or browse more documents in our library of IRS Forms.