This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form 1094-C

for the current year.

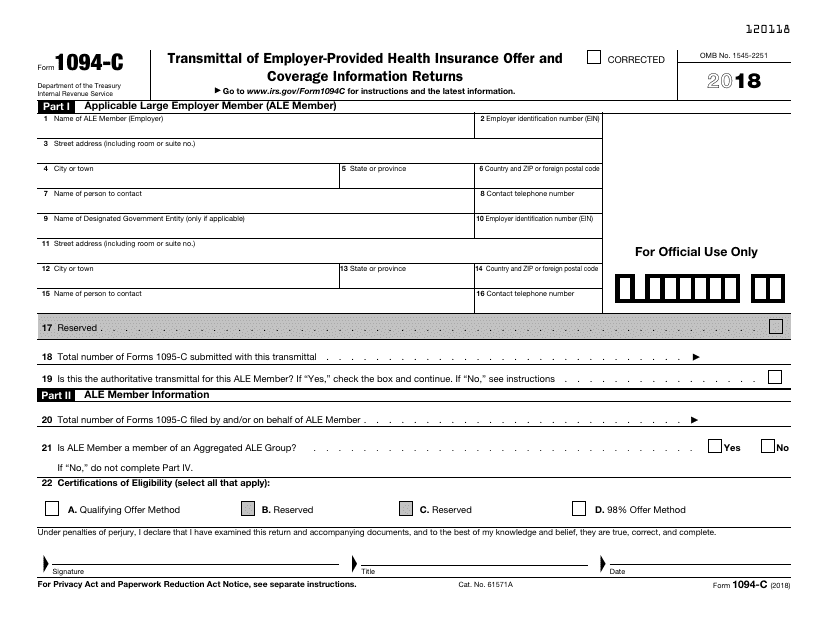

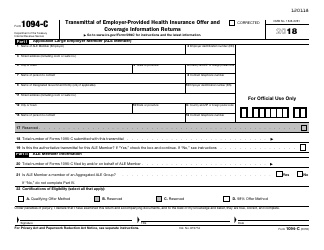

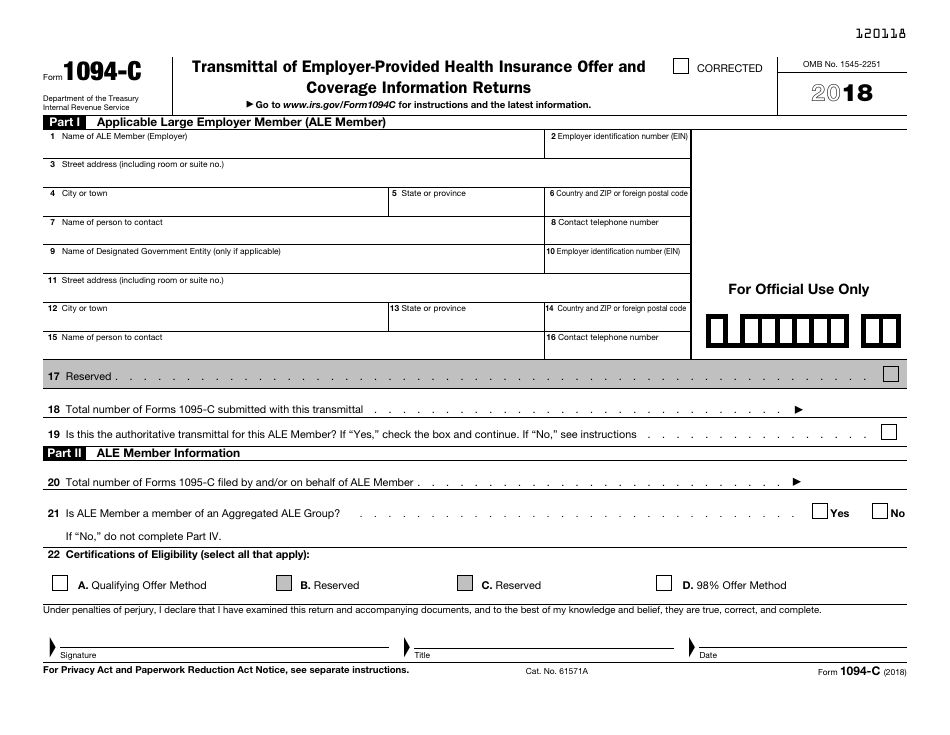

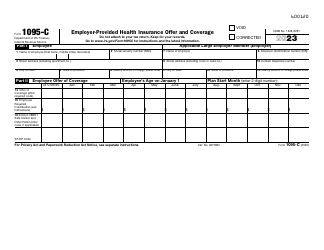

IRS Form 1094-C Transmittal of Employer-Provided Health Insurance Offer and Coverage Information Returns

What Is IRS Form 1094-C?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is Form 1094-C?

A: Form 1094-C is a transmittal form used by employers to submit information returns related to employer-provided health insurance offer and coverage to the IRS.

Q: Who needs to file Form 1094-C?

A: Applicable Large Employers (ALEs) that offer health insurance coverage to their employees are required to file Form 1094-C.

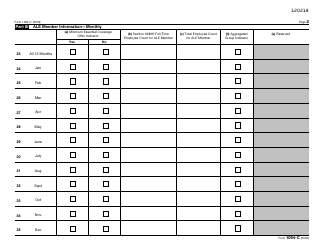

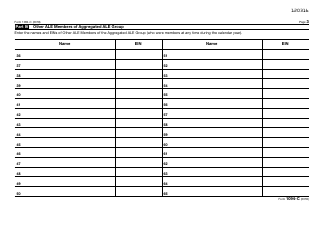

Q: What information is included in Form 1094-C?

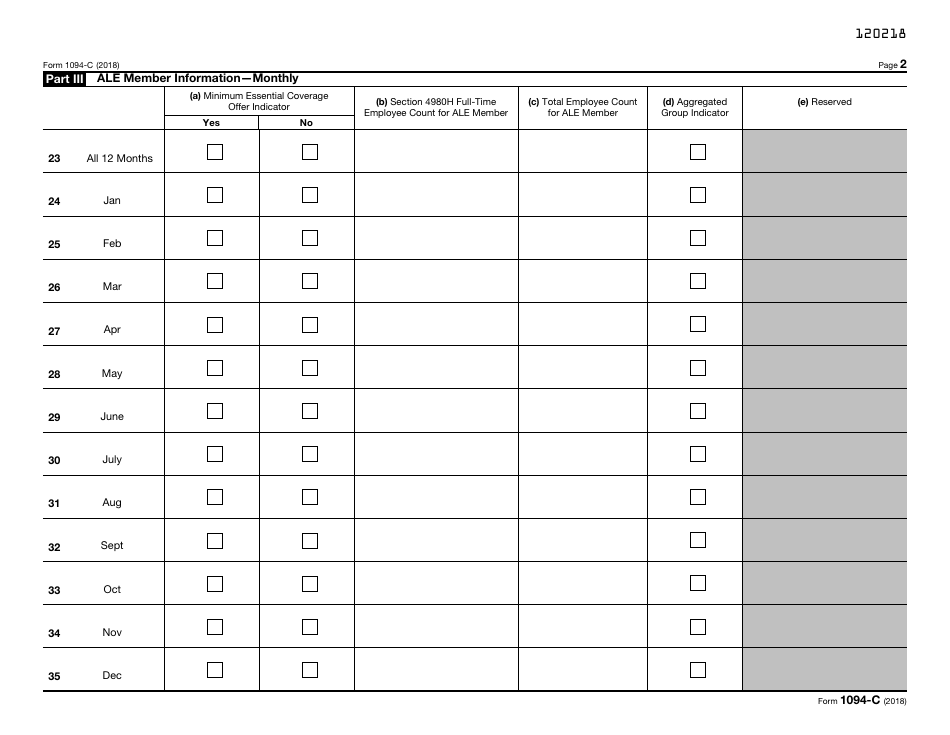

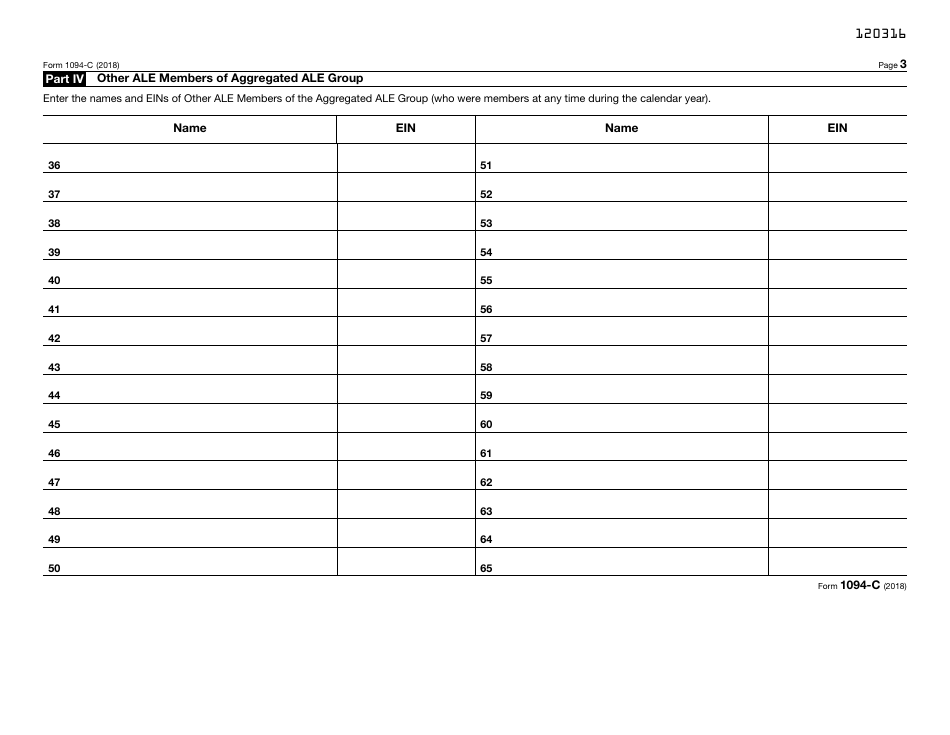

A: Form 1094-C includes information about the employer, such as name, address, and employer identification number (EIN), as well as the number of full-time employees and information about the health insurance coverage offered.

Q: When is Form 1094-C due?

A: Form 1094-C must be filed with the IRS by the end of February if filing by paper, or by the end of March if filing electronically.

Q: Are there any penalties for not filing Form 1094-C?

A: Yes, there are penalties for not filing or filing incorrect or incomplete forms. It is important to ensure the accuracy and timely filing of Form 1094-C to avoid these penalties.

Form Details:

- A 3-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 1094-C through the link below or browse more documents in our library of IRS Forms.