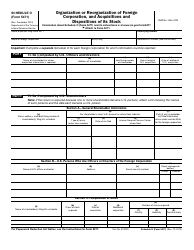

This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 1099-A, 1099-C

for the current year.

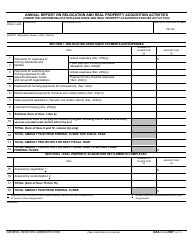

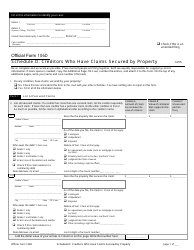

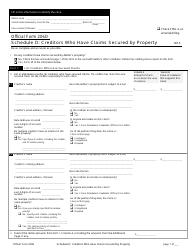

Instructions for IRS Form 1099-A, 1099-C Acquisition or Abandonment of Secured Property and Cancellation of Debt

This document contains official instructions for IRS Form 1099-A , and IRS Form 1099-C . Both forms are released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 1099-A is available for download through this link. The latest available IRS Form 1099-C can be downloaded through this link.

FAQ

Q: What is IRS Form 1099-A?

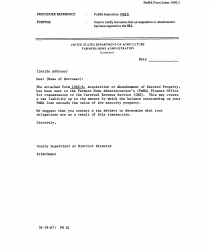

A: IRS Form 1099-A is used to report the acquisition or abandonment of secured property.

Q: What is IRS Form 1099-C?

A: IRS Form 1099-C is used to report the cancellation of debt.

Q: When is Form 1099-A used?

A: Form 1099-A is used when there has been an acquisition or abandonment of secured property, such as a foreclosure or repossession.

Q: When is Form 1099-C used?

A: Form 1099-C is used when debt has been cancelled, forgiven, or discharged.

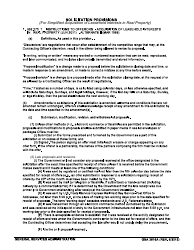

Q: Who needs to file these forms?

A: The financial institution or entity that is responsible for the acquisition, abandonment, or cancellation of debt should file these forms.

Q: What information is needed to complete these forms?

A: You will need the borrower's information, details about the property, and the amount of debt cancelled or discharged.

Q: Are these forms filed with the IRS?

A: Yes, these forms need to be filed with both the recipient and the IRS.

Q: What is the deadline for filing these forms?

A: The deadline for filing these forms with the IRS is generally January 31st of the year following the calendar year in which the acquisition, abandonment, or cancellation of debt occurred.

Q: Are there any penalties for not filing these forms?

A: Yes, there may be penalties for not filing these forms or for filing them late, so it is important to ensure timely and accurate filing.

Instruction Details:

- This 6-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.