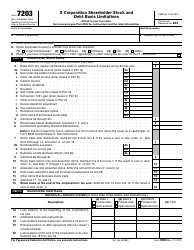

This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form 1099-C

for the current year.

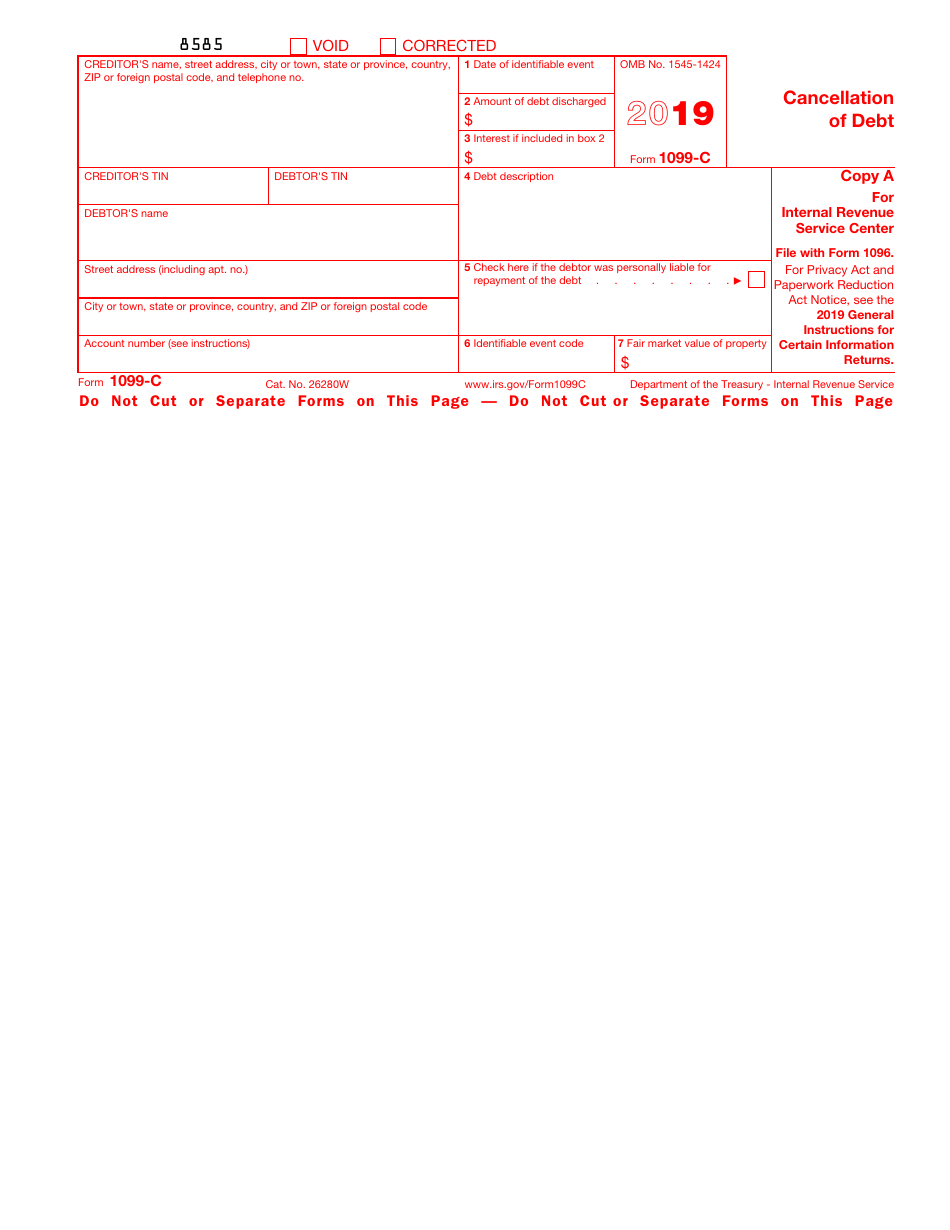

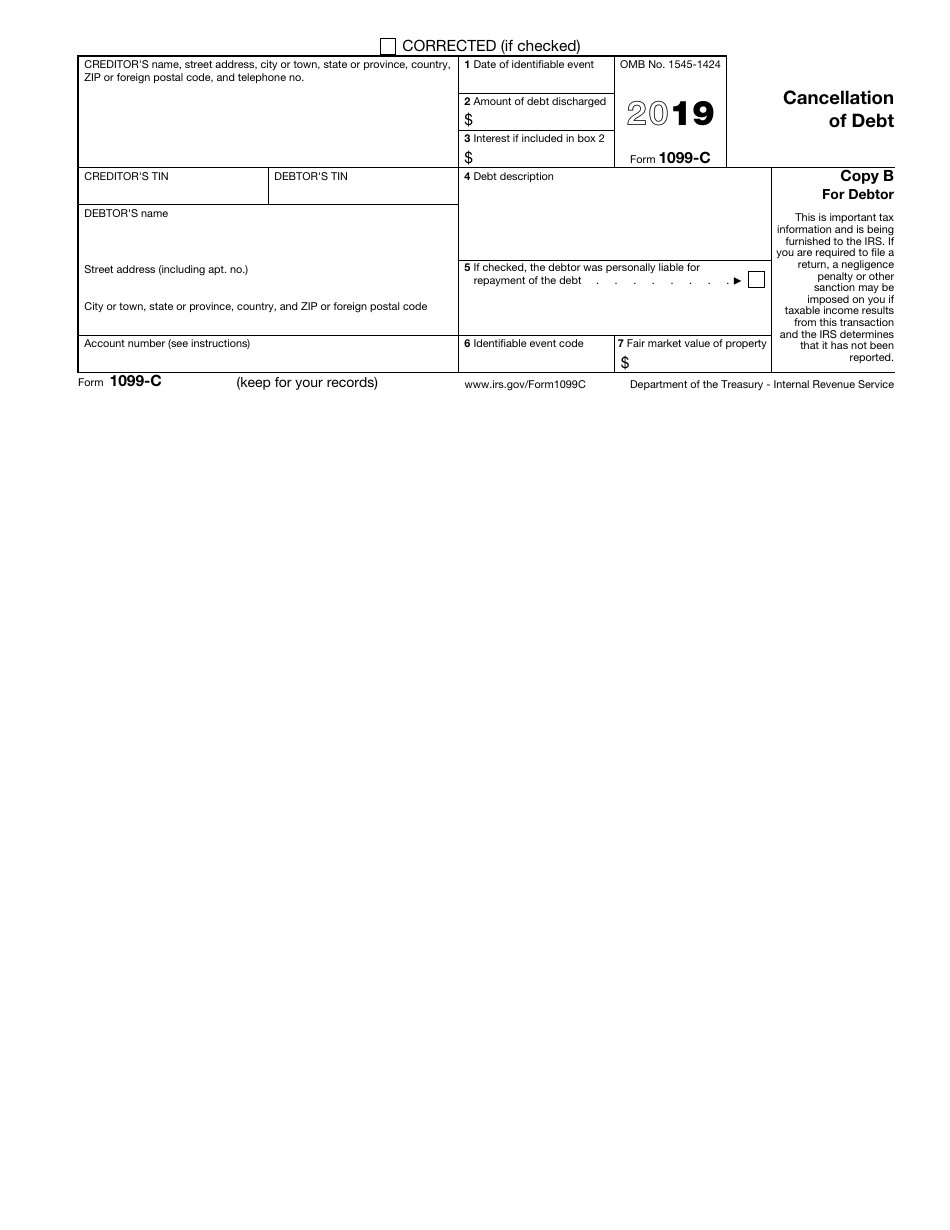

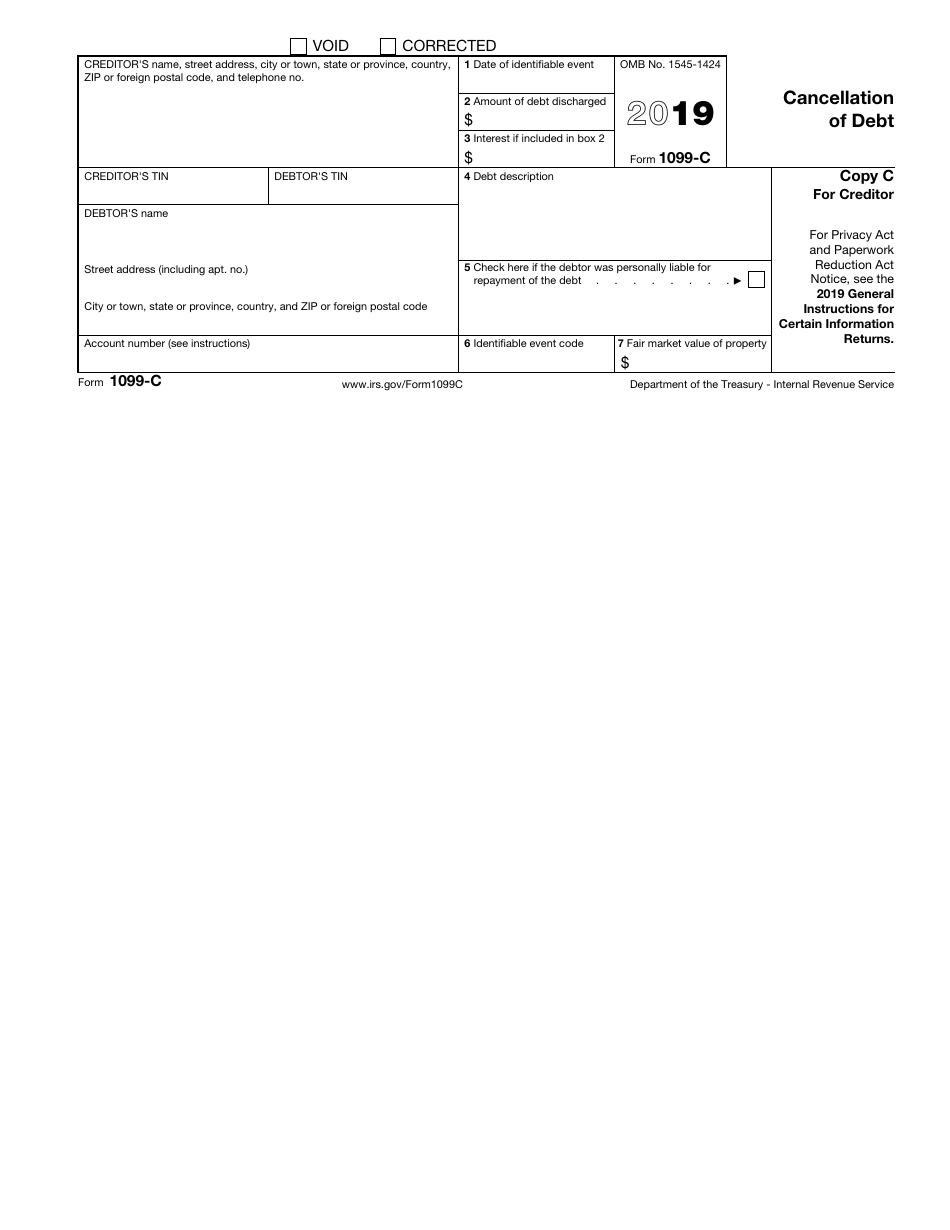

IRS Form 1099-C Cancellation of Debt

What Is IRS Form 1099-C?

IRS Form 1099-C, Cancellation of Debt , is a legal document that reports a canceled, forgiven, never paid, or wiped out debt. You need to file Form 1099-C for each debtor with whom you have negotiated a debt cancellation.

Alternate Name:

- Cancellation of Debt Form

Lenders and creditors send this document to the IRS and borrowers if the debt of $600 or more was forgiven or canceled. The amount of canceled debt may be the entire amount or portion of the total amount owed. These identifiable events include the following circumstances:

- Discharge in bankruptcy;

- Cancellation or extinguishment that makes the debt unenforceable in foreclosure or similar federal nonbankruptcy or state court proceeding:

- Cancellation or extinguishment when the creditor chooses foreclosure remedies that bar their right to collect the debt;

- Cancellation or extinguishment that makes the debt unenforceable under a probate;

- Cancellation or extinguishment when the 1099-C statute of limitations for collecting the debt expires;

- Discharge of indebtedness after the creditor and the debtor has entered into an agreement;

- Discharge of indebtedness after the creditor made a decision to cancel the debt.

Form 1099-C was released by the Internal Revenue Service (IRS) and the latest version of the form was issued in 2019 with all previous editions obsolete. You can download a fillable 1099-C Form through the link below.

IRS Form 1099-C Instructions

Provide the following information in the Cancellation of Debt Form:

- Write down the creditor's name, address, telephone number, and taxpayer identification number;

- State the debtor's name, address, and taxpayer identification number;

- Enter the date of the identifiable event - the day when the debt was deemed canceled;

- Record the amount of the canceled debt;

- Report interest separately;

- Describe the origin of the debt - mortgage, credit card expenditure, student loans, etc.;

- If the debtor had personal liability for repayment of the debt, check the appropriate box;

- Enter the code to reflect the nature of the identifiable event. To find the code to use, consult with the official Instructions for Forms 1099-A and 1099-C, issued by the IRS;

- If you file this form for execution, foreclosure, or similar sale, indicate the fair market value of the property.

There are several copies of the Form 1099-C - submit them to the IRS, your creditor, and keep one for your records.

Where to Report 1099-C Form?

Form 1099-C mailing address depends on your place of residence:

| Alabama, Arizona, Arkansas, Delaware, Florida, Georgia, Kentucky, Maine, Massachusetts, Mississippi, New Hampshire, New Jersey, New Mexico, New York, North Carolina, Ohio, Texas, Vermont, Virginia | Department of the Treasury, Internal Revenue Service Center, Austin, TX 73301 |

| Alaska, Colorado, Hawaii, Idaho, Illinois, Indiana, Iowa, Kansas, Michigan, Minnesota, Missouri, Montana, Nebraska, Nevada, North Dakota, Oklahoma, Oregon, South Carolina, South Dakota, Tennessee, Utah, Washington, Wisconsin, Wyoming | Department of the Treasury, Internal Revenue Service Center, P.O. Box 219256, Kansas City, MO 64121-9256 |

| California, Connecticut, District of Columbia, Louisiana, Maryland, Pennsylvania, Rhode Island, West Virginia | Department of the Treasury, Internal Revenue Service Center, Ogden, UT 84201 |

| Your place of residence or a principal place of business is outside the U.S. | Department of the Treasury, Internal Revenue Service Center, Austin, TX 73301 |

What Is a "1099-C Cancellation of Debt Notice?"

When you resolve a debt, you may receive a 1099-C notice in your mail. The IRS considers canceled or forgiven debt as income. If you receive this form from a lender, you need to report the portion of the waived debt on that document to the IRS as taxable income. Enter the canceled amount on the "Other Income" line of your Form 1040, U.S. Individual Income Tax Return. The 1099-C tax rate you pay is the same as if you received the income as salary or wages. File Form 1099-C in the year that follows the reporting year in which the identifiable event occurs.

However, there are situations when income from a canceled debt is not taxable - 1099-C exceptions include certain bankruptcies, interest, non-principal amounts (fines, fees, penalties, and administrative costs), foreign debtors, guarantors and sureties, and 1099-C insolvency cases (taxpayers owe more in debt that they have in assets).