This version of the form is not currently in use and is provided for reference only. Download this version of

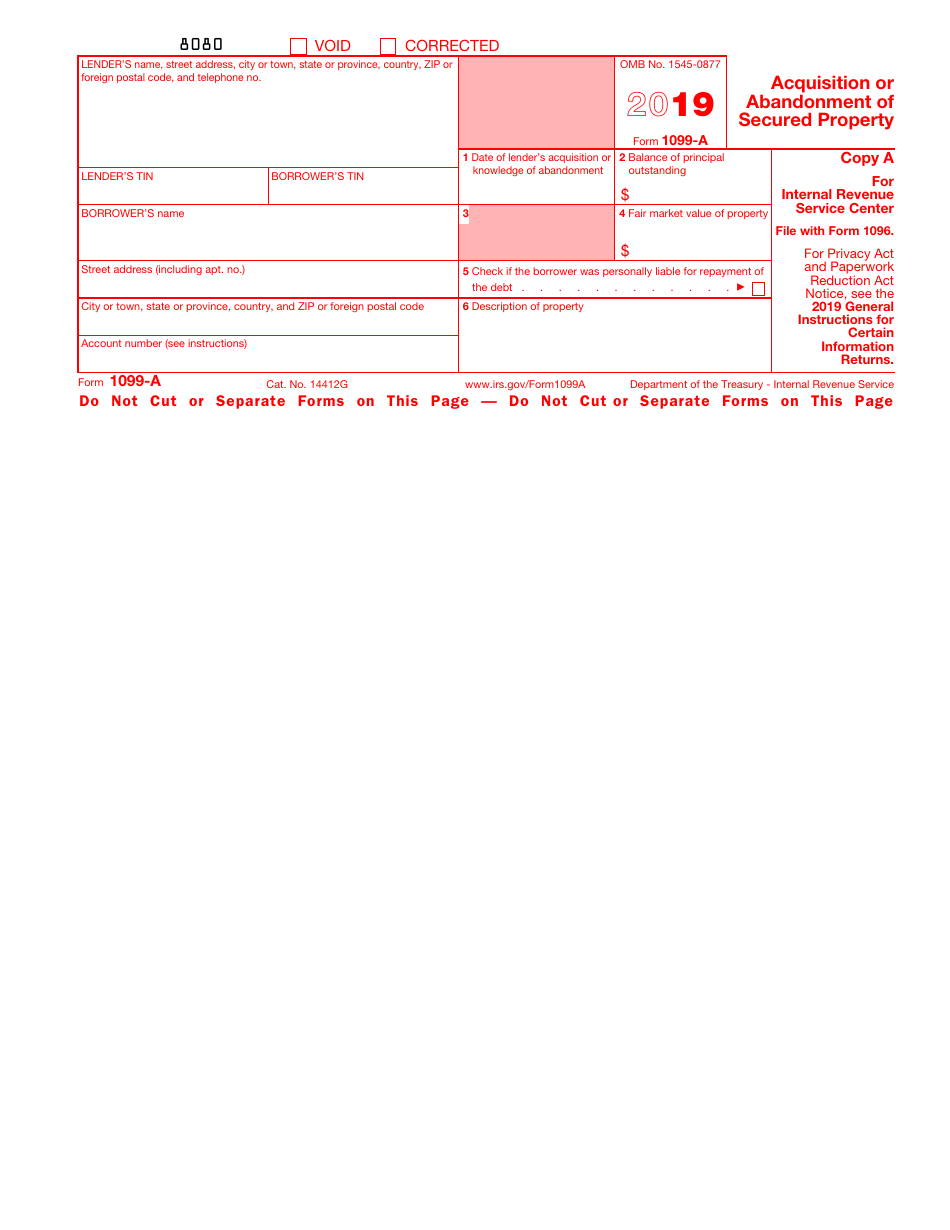

IRS Form 1099-A

for the current year.

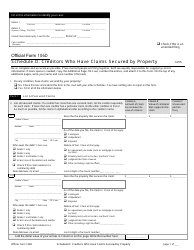

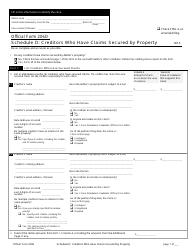

IRS Form 1099-A Acquisition or Abandonment of Secured Property

What Is IRS Form 1099-A?

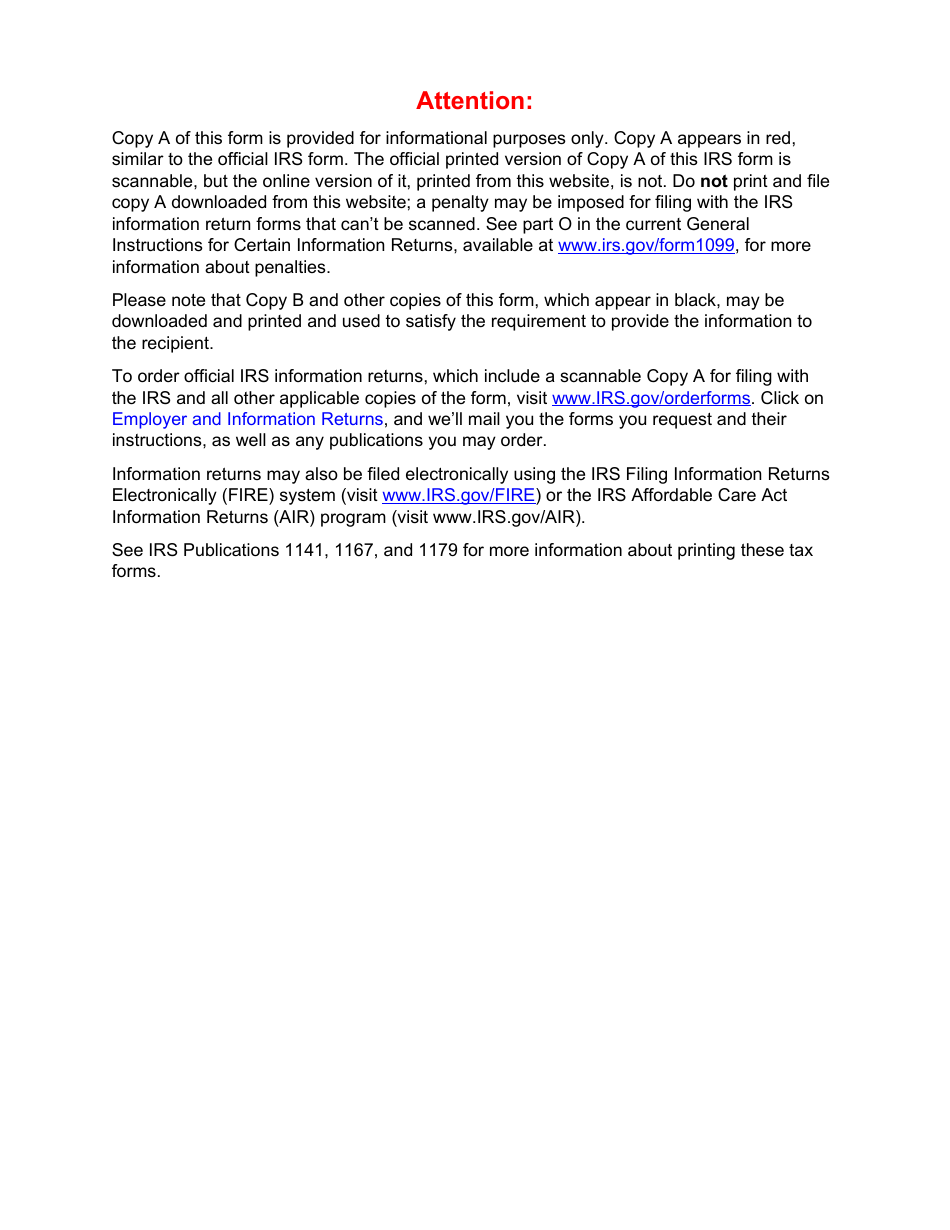

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 1099-A?

A: IRS Form 1099-A is a tax form used to report the acquisition or abandonment of secured property.

Q: Who needs to file IRS Form 1099-A?

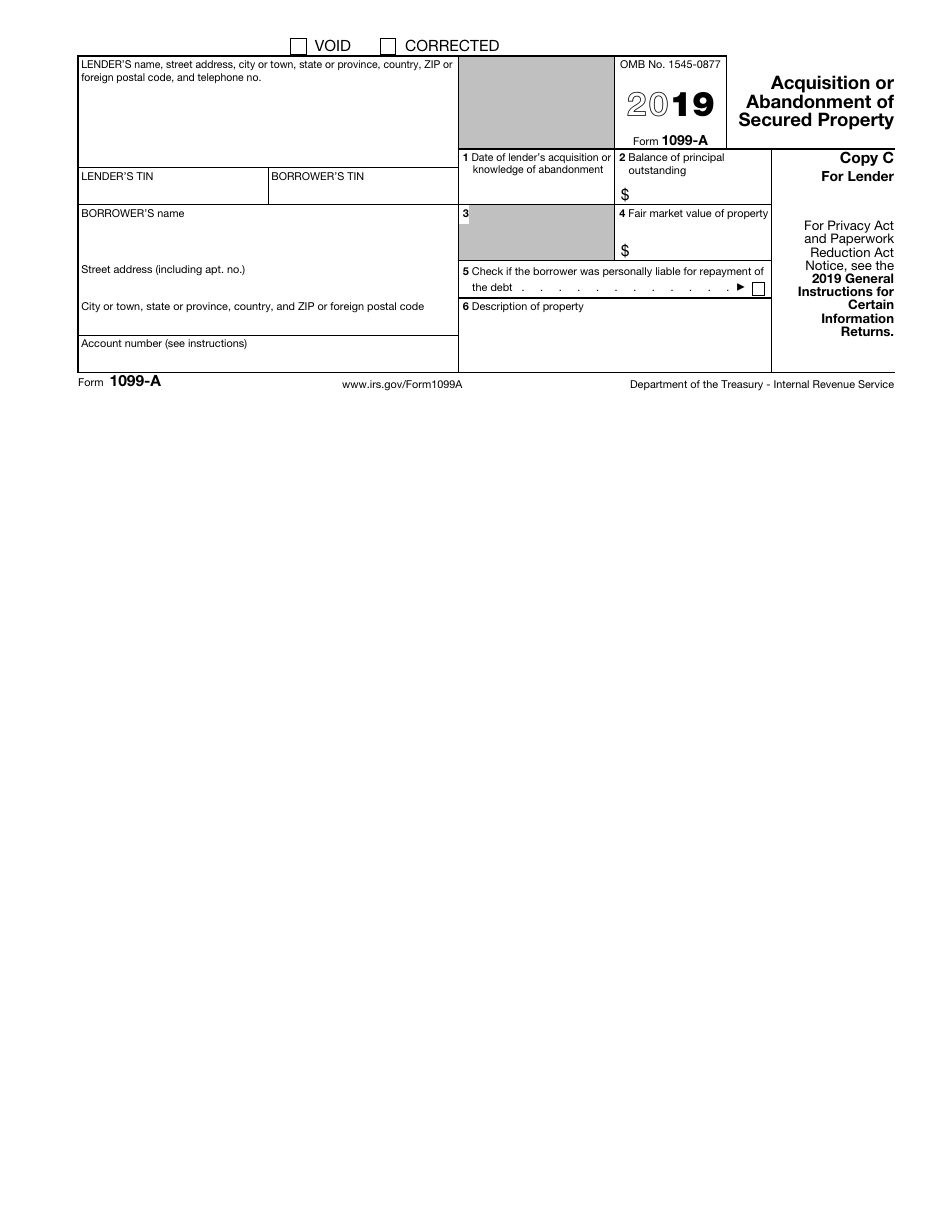

A: Lenders or creditors who have acquired or abandoned secured property need to file IRS Form 1099-A.

Q: What is the purpose of filing IRS Form 1099-A?

A: Filing IRS Form 1099-A helps the IRS track the transfer of ownership or abandonment of secured property for tax purposes.

Q: When is IRS Form 1099-A due?

A: IRS Form 1099-A is typically due to the Internal Revenue Service by January 31st of the year following the acquisition or abandonment of the property.

Q: What information is required on IRS Form 1099-A?

A: IRS Form 1099-A requires information such as the lender's or creditor's name, address, taxpayer identification number, the borrower's information, and details about the acquisition or abandonment of the secured property.

Q: What happens if I don't file IRS Form 1099-A?

A: Failure to file IRS Form 1099-A or filing it with incorrect information may result in penalties and fines from the IRS.

Q: Can I e-file IRS Form 1099-A?

A: No, you cannot e-file IRS Form 1099-A. It must be filed by mail.

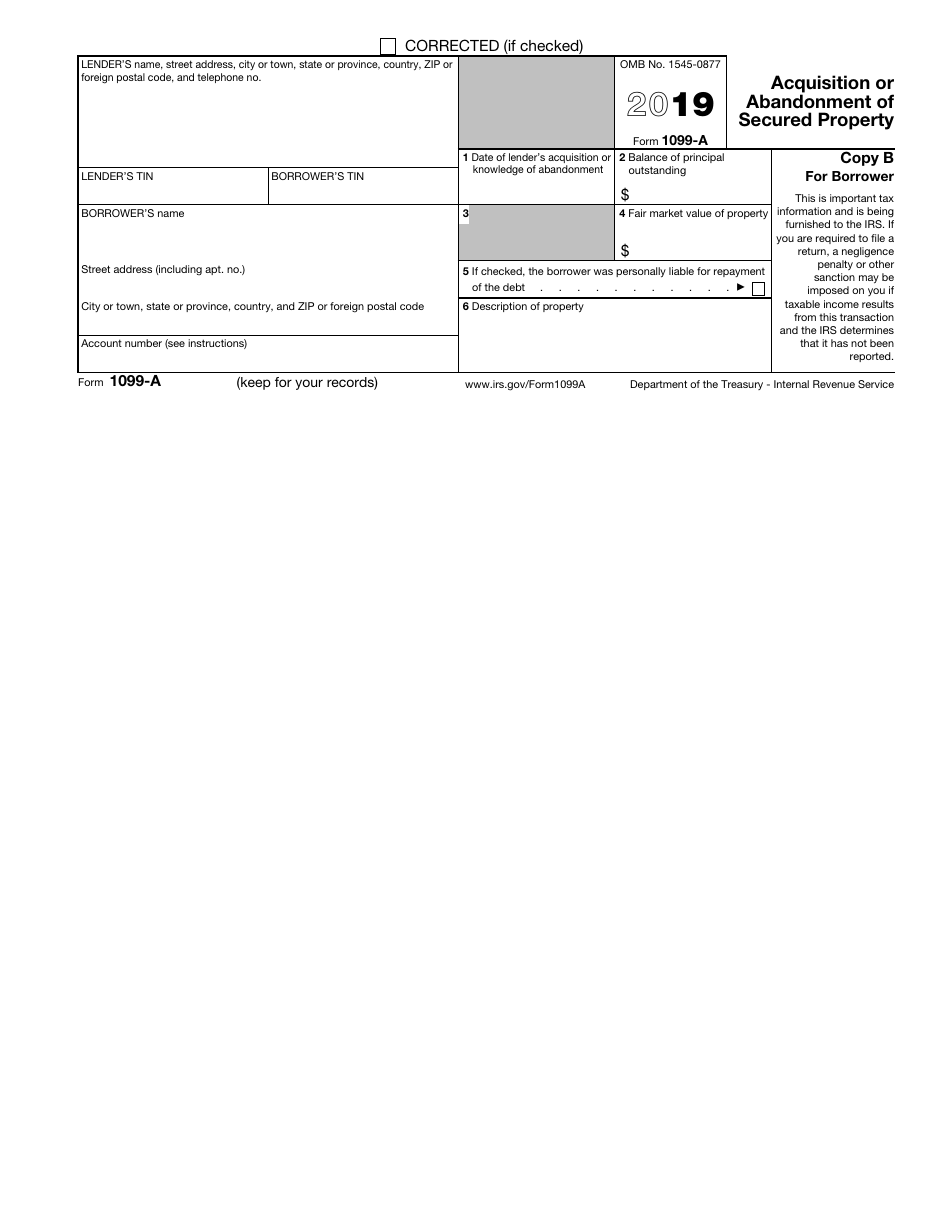

Q: Do I need to send a copy of IRS Form 1099-A to the borrower?

A: Yes, you are required to send a copy of IRS Form 1099-A to the borrower whose name is listed on the form.

Q: Can I correct errors on IRS Form 1099-A?

A: Yes, if you have made an error on a filed IRS Form 1099-A, you can correct it by filing a corrected form, known as IRS Form 1099-Ac.

Form Details:

- A 6-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 1099-A through the link below or browse more documents in our library of IRS Forms.