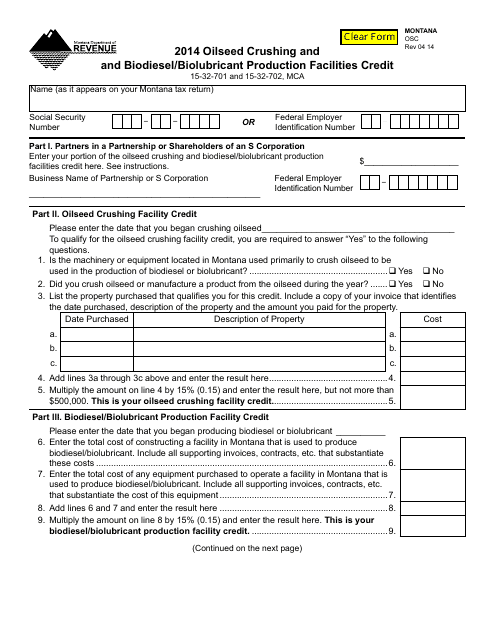

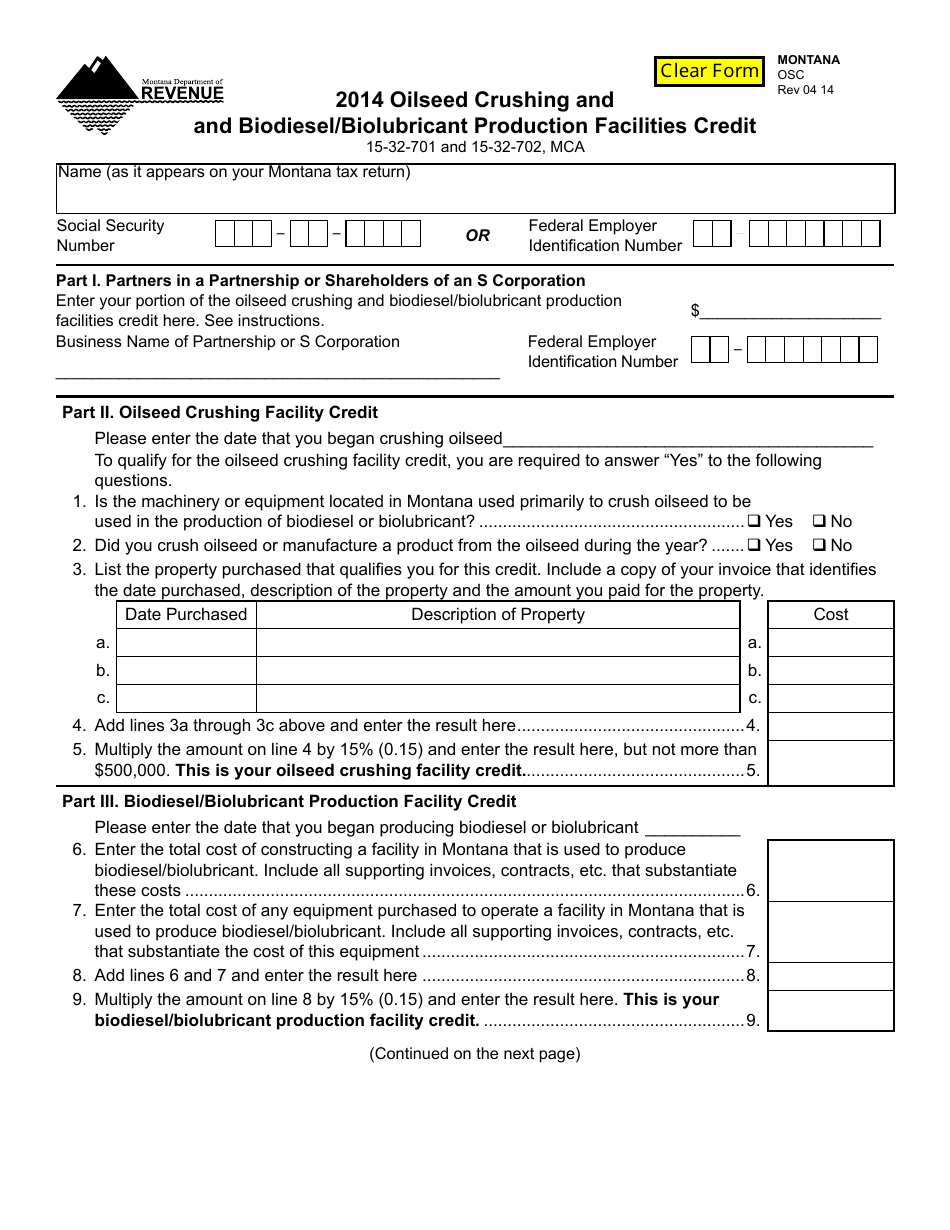

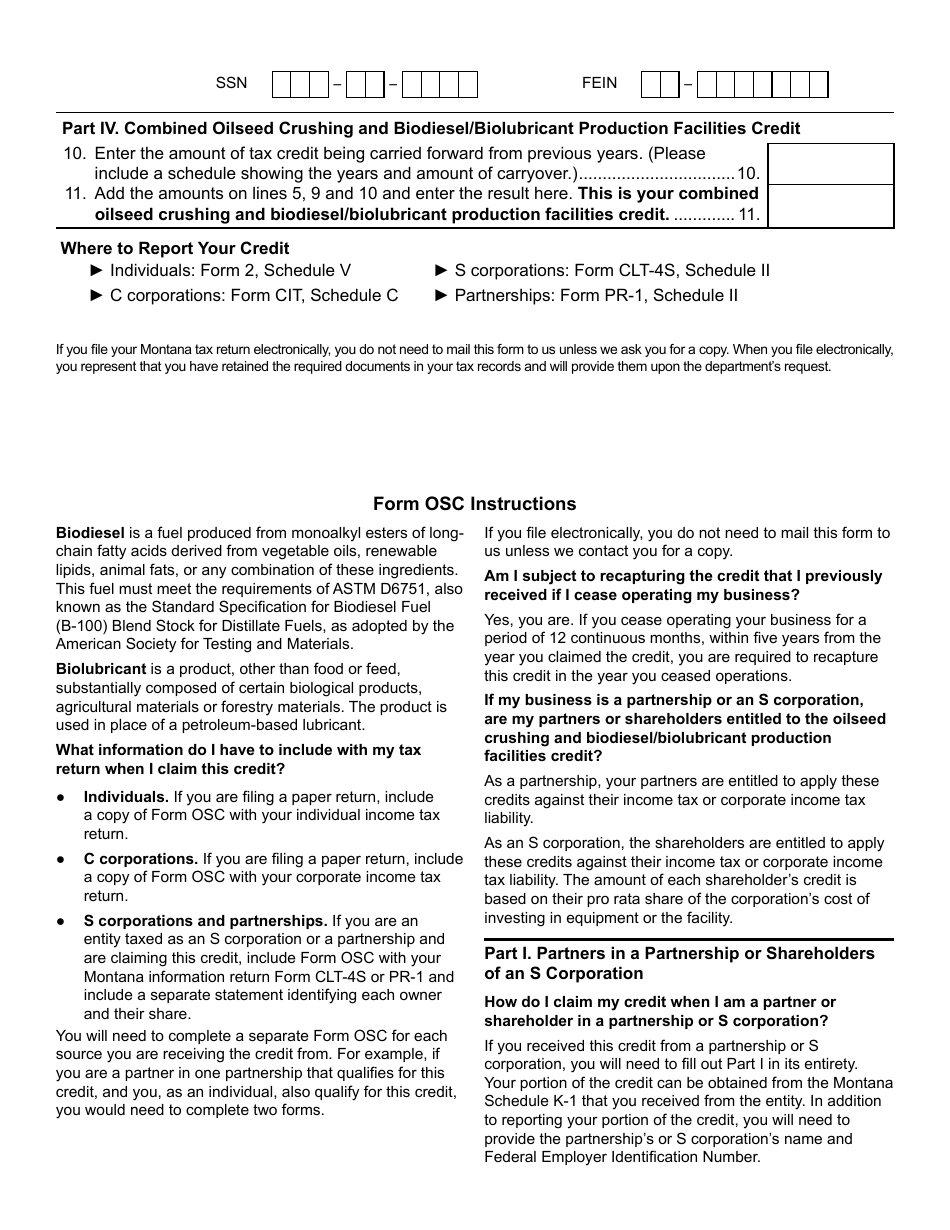

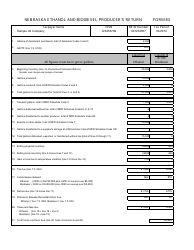

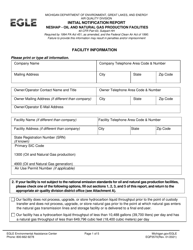

Form OSC Oilseed Crushing and Biodiesel / Biolubricant Production Facilities Credit - Montana

What Is Form OSC?

This is a legal form that was released by the Montana Department of Revenue - a government authority operating within Montana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

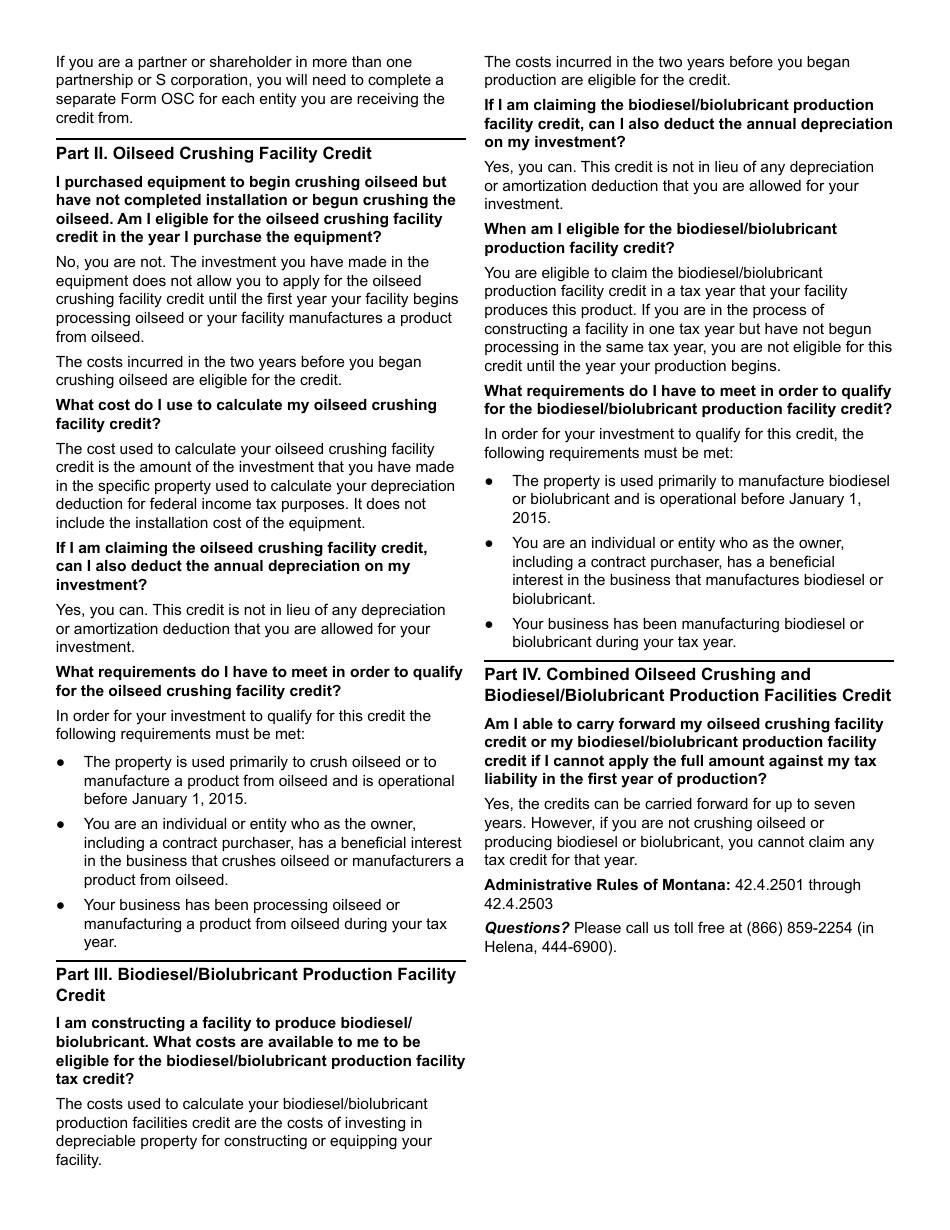

Q: What is the Form OSC Oilseed Crushing and Biodiesel/Biolubricant Production Facilities Credit?

A: Form OSC is a tax credit offered in Montana for oilseed crushing and biodiesel/biolubricant production facilities.

Q: Who is eligible for the Form OSC credit?

A: Oilseed crushing and biodiesel/biolubricant production facilities in Montana are eligible for this credit.

Q: What is the purpose of the Form OSC credit?

A: The purpose of this credit is to encourage the development and expansion of oilseed crushing and biodiesel/biolubricant production facilities in Montana.

Q: What are the benefits of the Form OSC credit?

A: The credit allows eligible facilities to claim a credit against their corporate or individual incometax liability.

Q: How can I apply for the Form OSC credit?

A: To apply for the credit, you need to fill out Form OSC and submit it to the Montana Department of Revenue.

Form Details:

- Released on April 1, 2014;

- The latest edition provided by the Montana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form OSC by clicking the link below or browse more documents and templates provided by the Montana Department of Revenue.