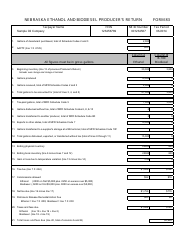

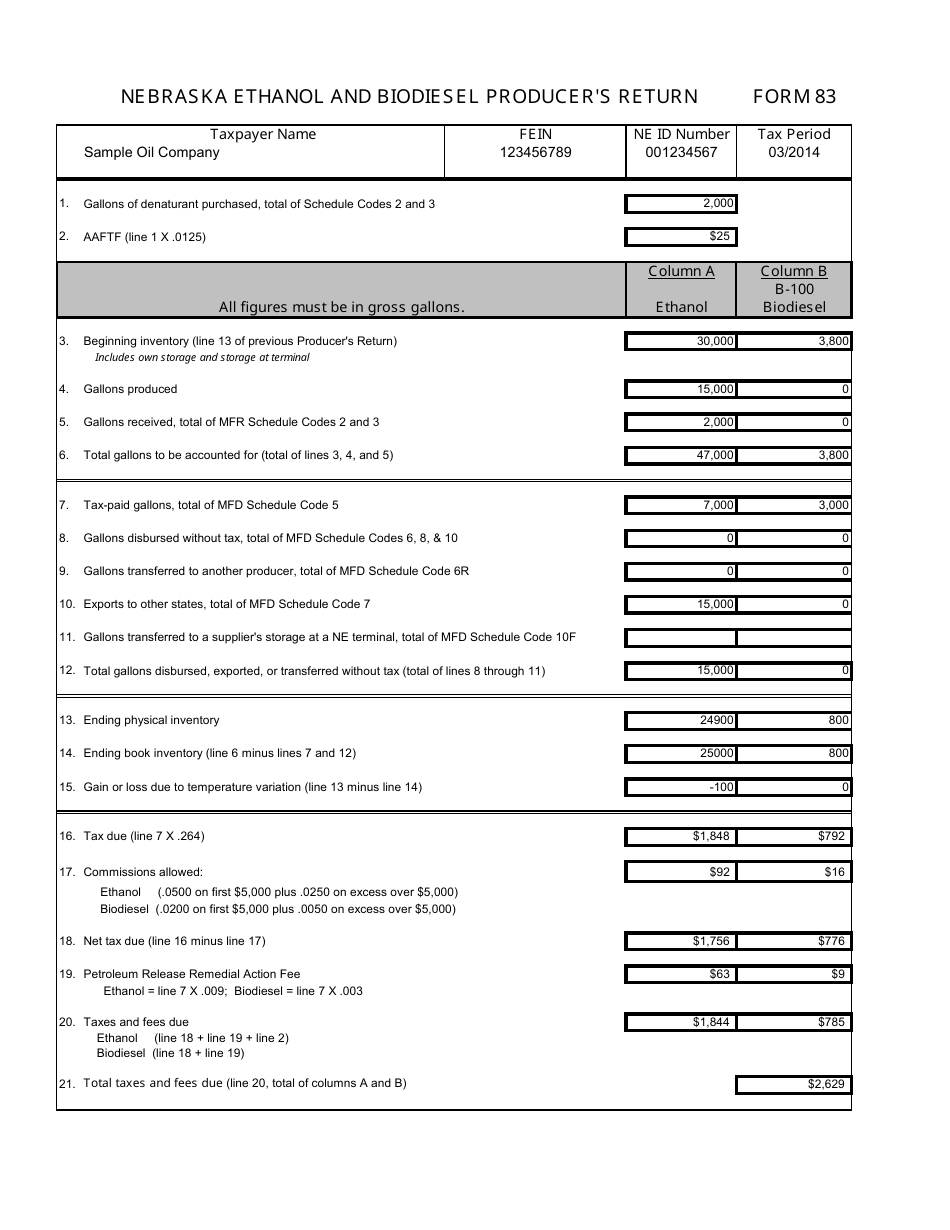

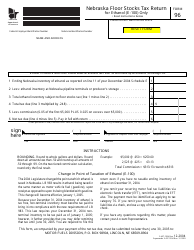

Form 83 Nebraska Ethanol and Biodiesel Producer's Return - Nebraska

What Is Form 83?

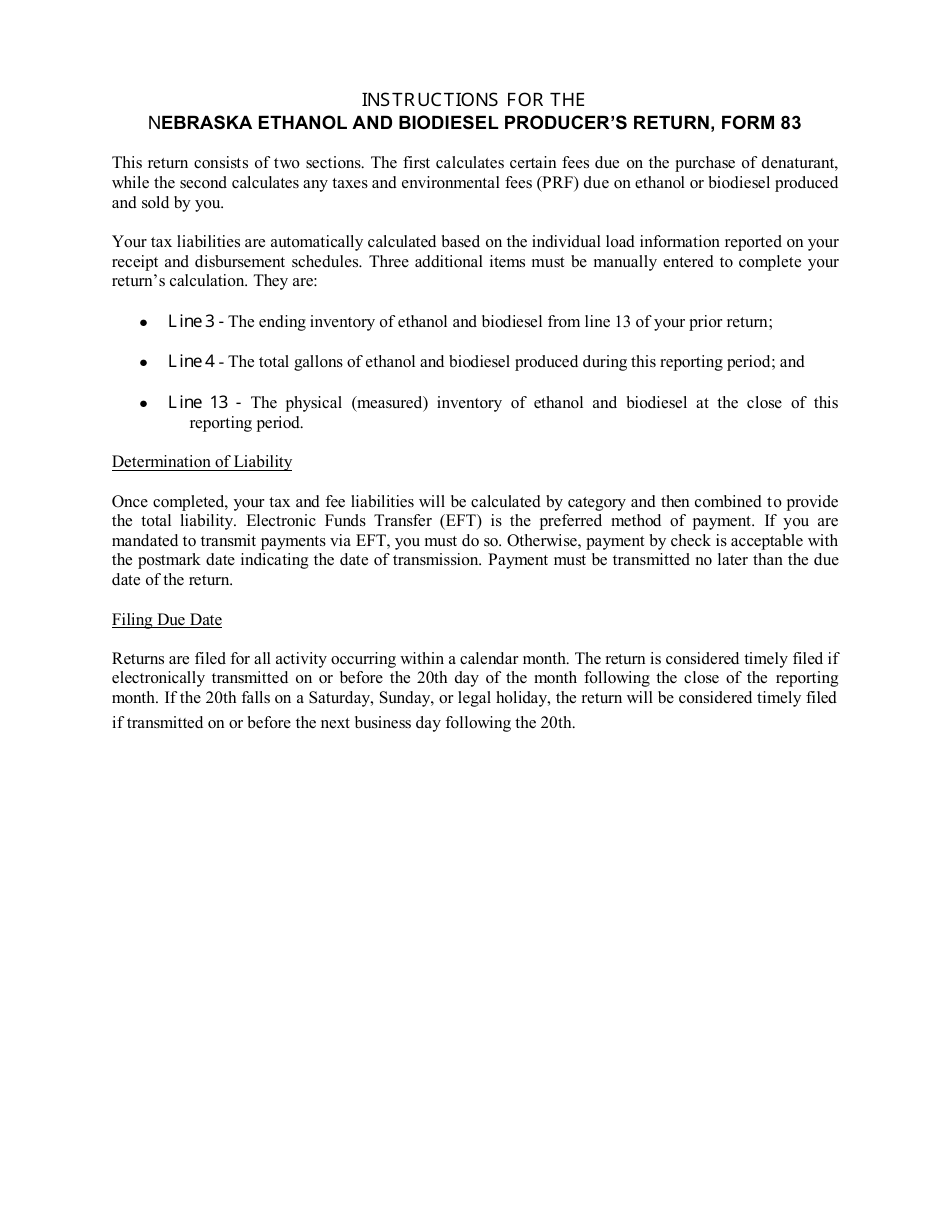

This is a legal form that was released by the Nebraska Department of Revenue - a government authority operating within Nebraska. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 83 Nebraska?

A: Form 83 Nebraska is a tax return form specifically for ethanol and biodiesel producers in Nebraska.

Q: Who needs to file Form 83 Nebraska?

A: Ethanol and biodiesel producers in Nebraska need to file Form 83.

Q: What is the purpose of Form 83 Nebraska?

A: The purpose of Form 83 Nebraska is to report and pay the tax on ethanol and biodiesel production in Nebraska.

Q: When is Form 83 Nebraska due?

A: Form 83 Nebraska is due on or before the 15th day of the fourth month following the close of the producer's fiscal year.

Q: Are there any penalties for late filing of Form 83 Nebraska?

A: Yes, there are penalties for late filing of Form 83 Nebraska, which may include interest charges and late payment penalties.

Form Details:

- The latest edition provided by the Nebraska Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 83 by clicking the link below or browse more documents and templates provided by the Nebraska Department of Revenue.