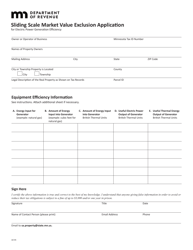

Instructions for Market Value Report Form - Minnesota

This document was released by Minnesota Department of Revenue and contains the most recent official instructions for Market Value Report Form .

FAQ

Q: What is the Market Value Report Form?

A: The Market Value Report Form is a document used in Minnesota to report the market value of real property.

Q: Who needs to fill out the Market Value Report Form?

A: Property owners or their designated representatives are responsible for filling out the Market Value Report Form.

Q: When is the Market Value Report Form due?

A: The Market Value Report Form is typically due on May 15th of each year.

Q: What information is required on the Market Value Report Form?

A: The Market Value Report Form requires information about the property, including its address, description, and market value.

Q: What happens if I don't file the Market Value Report Form?

A: Failure to file the Market Value Report Form may result in penalties or an estimated market value assigned by the county assessor.

Q: Are there any exemptions from filing the Market Value Report Form?

A: Certain types of properties may be exempt from filing the Market Value Report Form. Contact your local county assessor's office for more information.

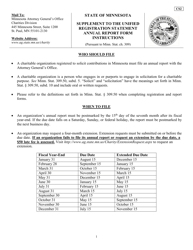

Q: What is the purpose of the Market Value Report Form?

A: The Market Value Report Form is used to determine the assessed value of the property for tax purposes.

Q: Can I appeal the market value assessment on the Market Value Report Form?

A: Yes, property owners have the right to appeal the market value assessment on the Market Value Report Form if they believe it is incorrect.

Instruction Details:

- This 3-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library legal documents released by the Minnesota Department of Revenue.