This version of the form is not currently in use and is provided for reference only. Download this version of

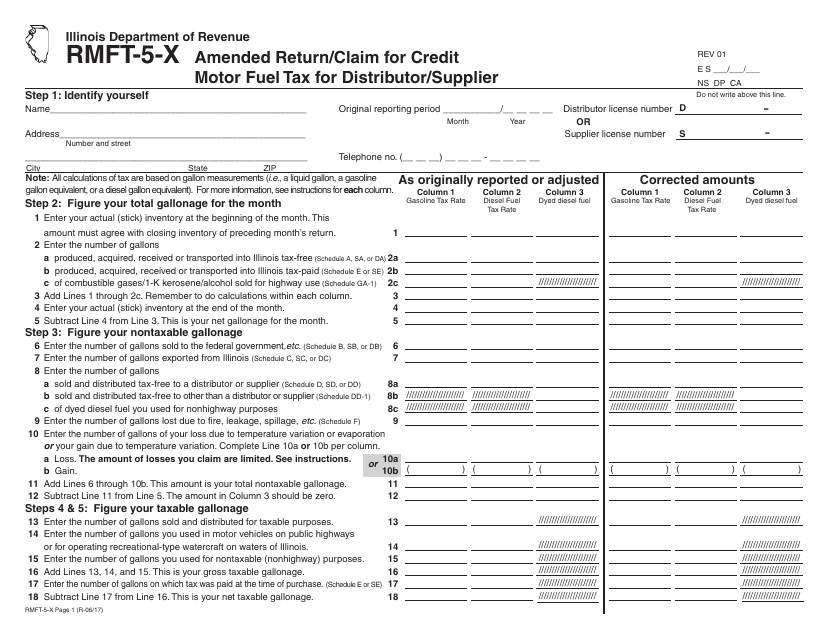

Form RMFT-5-X

for the current year.

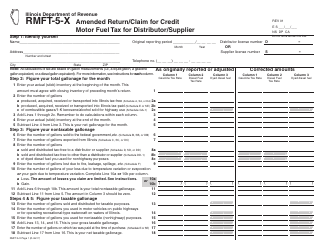

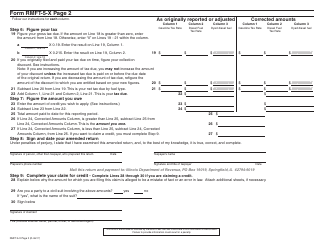

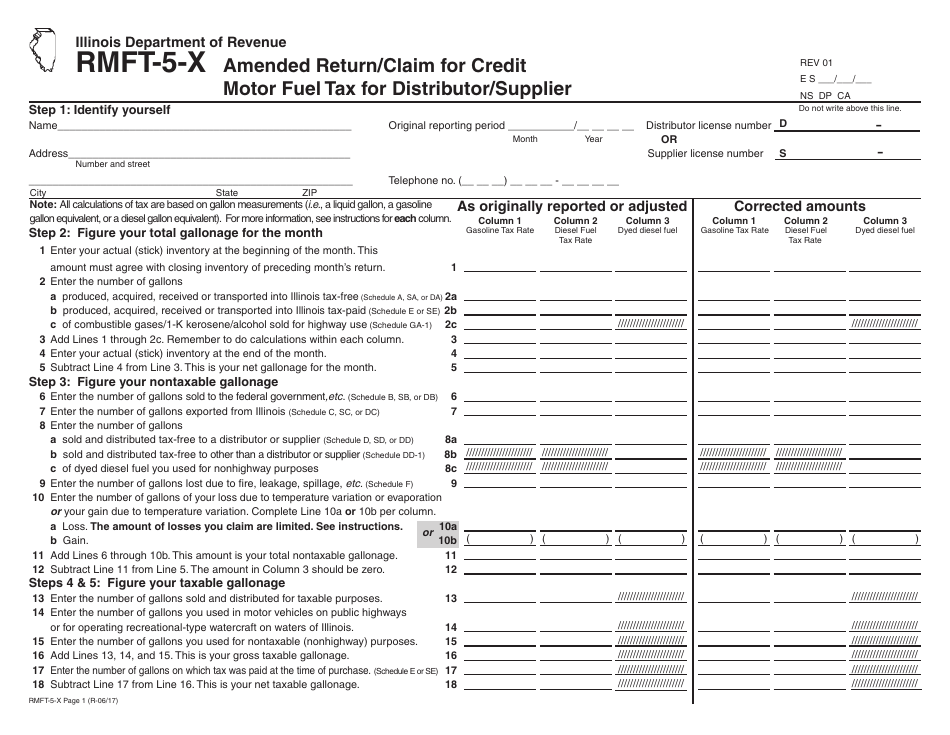

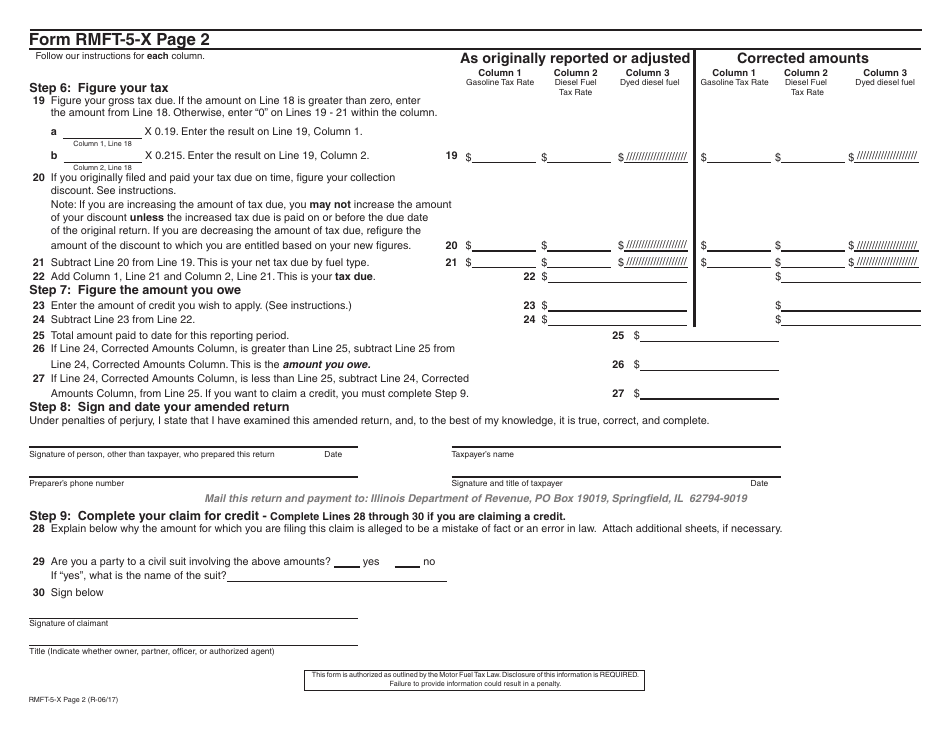

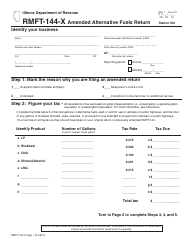

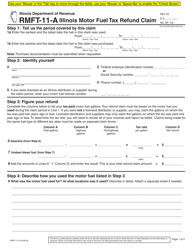

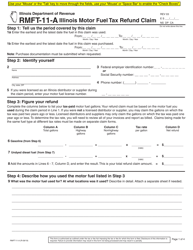

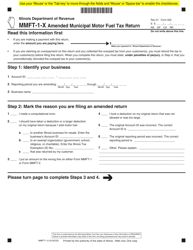

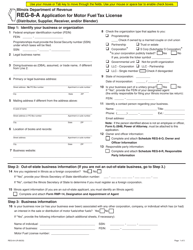

Form RMFT-5-X Amended Return / Claim for Credit Motor Fuel Tax for Distributor / Supplier - Illinois

What Is Form RMFT-5-X?

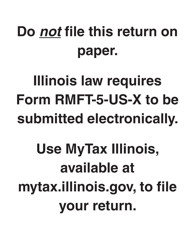

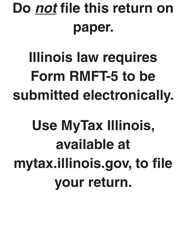

This is a legal form that was released by the Illinois Department of Revenue - a government authority operating within Illinois. Check the official instructions before completing and submitting the form.

FAQ

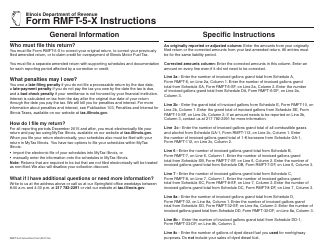

Q: What is the RMFT-5-X form?

A: The RMFT-5-X form is an Amended Return/Claim for Credit Motor Fuel Tax for Distributor/Supplier form used in Illinois.

Q: Who should use the RMFT-5-X form?

A: Distributors and suppliers of motor fuel who need to make amendments or claim credits on their motor fuel tax returns in Illinois should use this form.

Q: What is the purpose of the RMFT-5-X form?

A: The RMFT-5-X form is used to correct errors or omissions made on previously filed motor fuel tax returns or to claim credits for overpaid taxes.

Q: When should I file the RMFT-5-X form?

A: The RMFT-5-X form should be filed as soon as the need for an amendment or credit arises, but no later than the due date for the original return.

Form Details:

- Released on June 1, 2017;

- The latest edition provided by the Illinois Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form RMFT-5-X by clicking the link below or browse more documents and templates provided by the Illinois Department of Revenue.