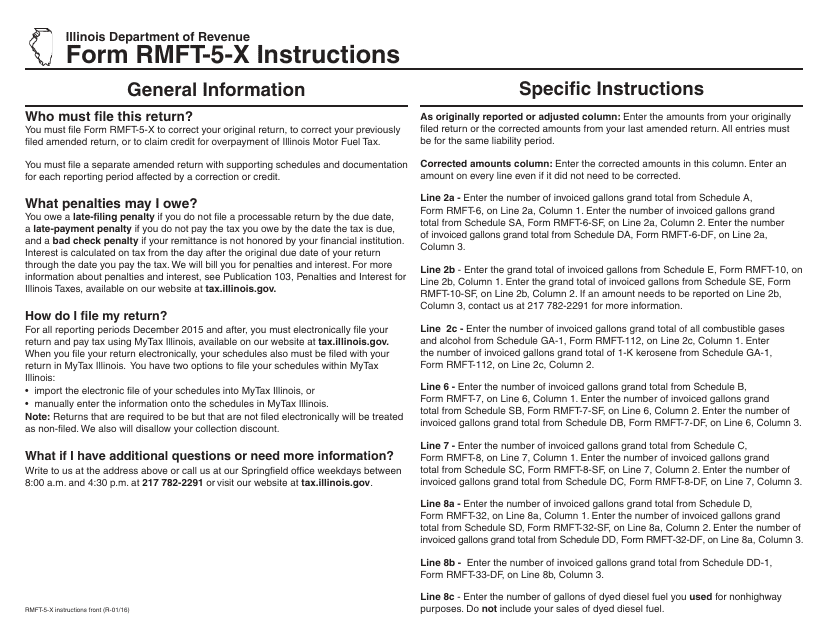

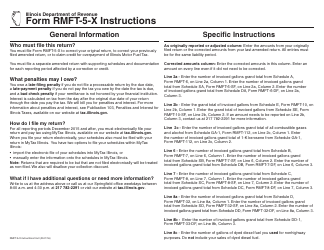

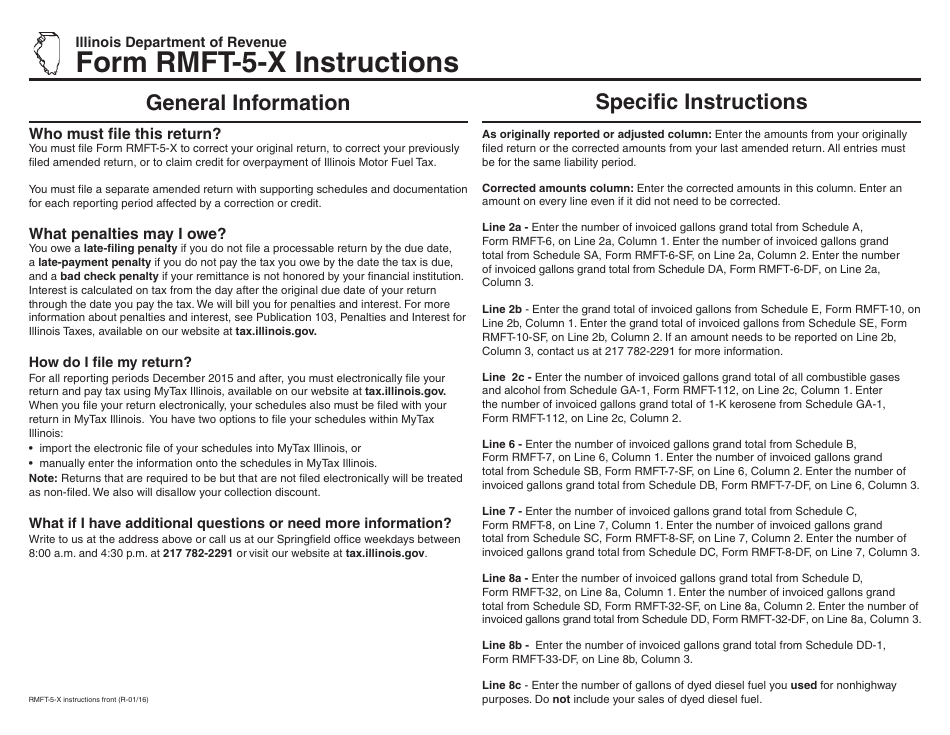

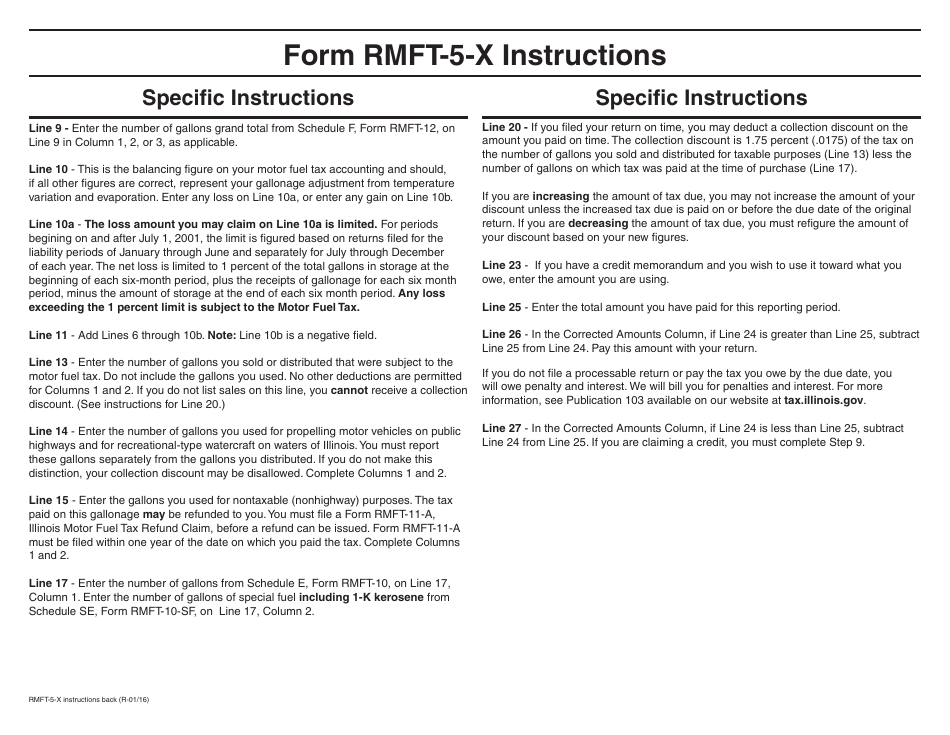

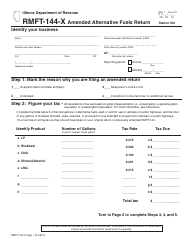

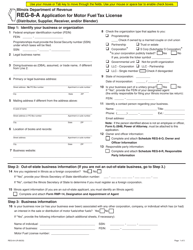

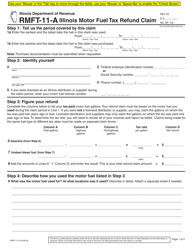

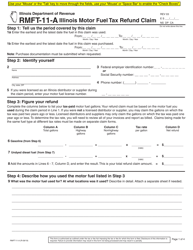

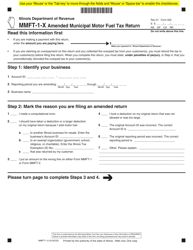

Instructions for Form RMFT-5-X Amended Return / Claim for Credit - Motor Fuel Tax for Distributors / Suppliers - Illinois

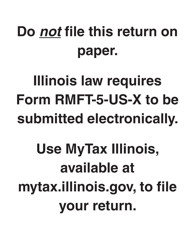

This document contains official instructions for Form RMFT-5-X , Amended Return/Claim for Credit - Motor Fuel Tax for Distributors/Suppliers - a form released and collected by the Illinois Department of Revenue. An up-to-date fillable Form RMFT-5-X is available for download through this link.

FAQ

Q: What is Form RMFT-5-X?

A: Form RMFT-5-X is an Amended Return/Claim for Credit form for Motor Fuel Tax for Distributors/Suppliers in Illinois.

Q: Who should use Form RMFT-5-X?

A: This form should be used by distributors and suppliers of motor fuel in Illinois who need to amend their previously filed tax return or claim a credit.

Q: What is the purpose of Form RMFT-5-X?

A: The purpose of this form is to report any changes or corrections to a previously filed tax return or to claim a credit for overpaid motor fuel tax.

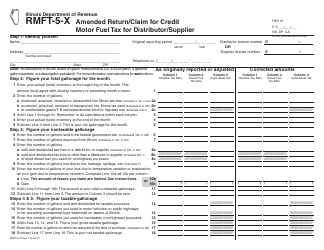

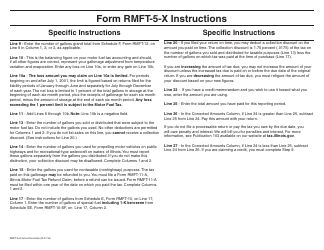

Q: How do I fill out Form RMFT-5-X?

A: You will need to provide your distributor or supplier information, details of the original return being amended, and the changes or corrections you are making.

Q: Are there any deadlines for filing Form RMFT-5-X?

A: Yes, Form RMFT-5-X should be filed within 3 years from the date the original return was due or within 1 year from the date of overpayment, whichever is later.

Q: Is there a fee for filing Form RMFT-5-X?

A: No, there is no fee for filing this form.

Q: What supporting documents do I need to include with Form RMFT-5-X?

A: You may need to include copies of invoices, contracts, or other documentation to support the changes or corrections being made.

Q: How long does it take for the Illinois Department of Revenue to process Form RMFT-5-X?

A: Processing times vary, but it generally takes several weeks for the department to review and process the form.

Instruction Details:

- This 2-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Illinois Department of Revenue.