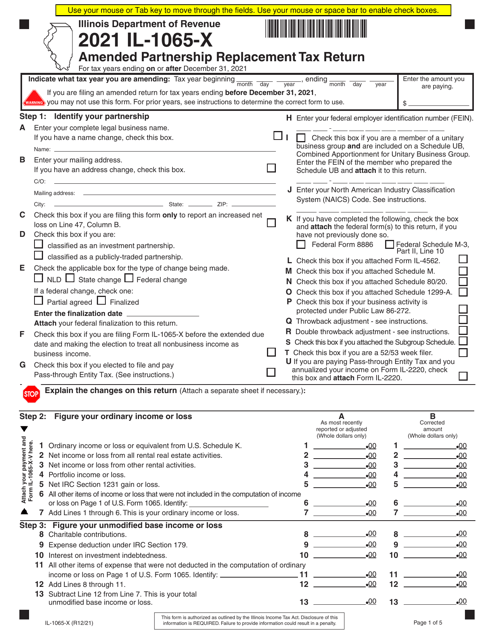

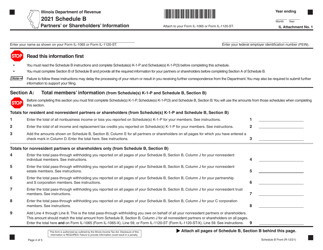

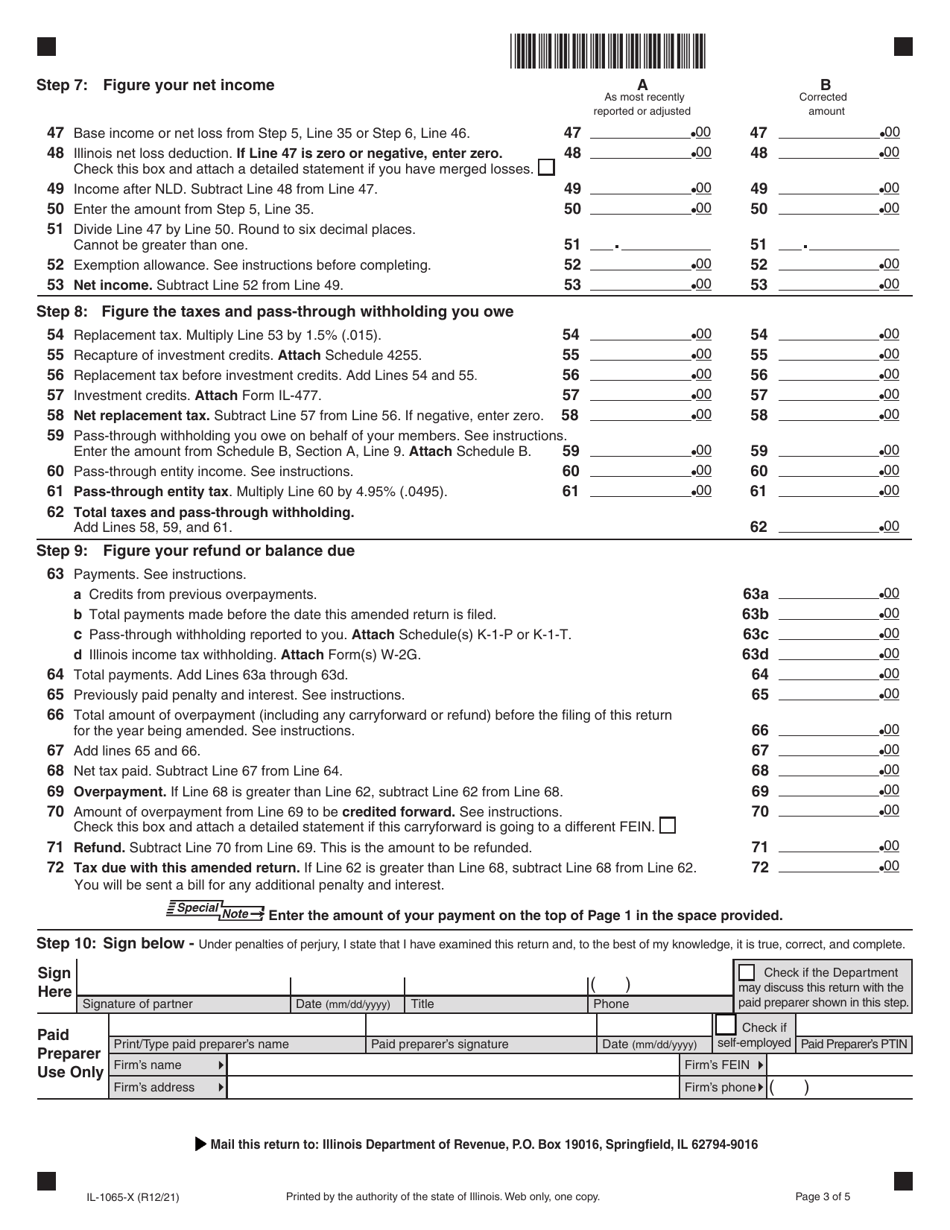

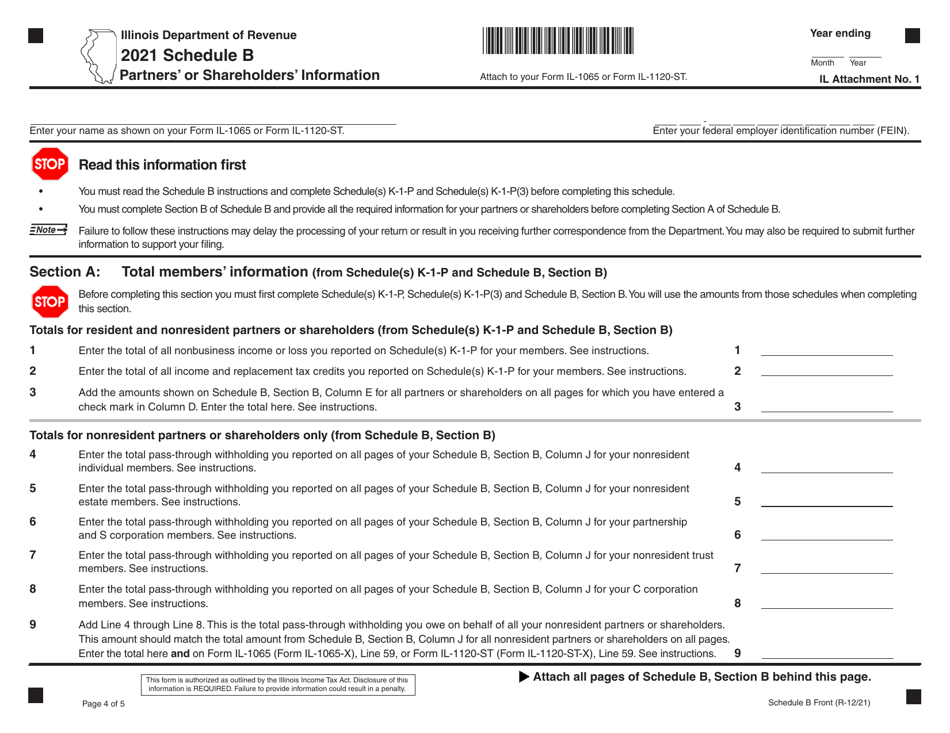

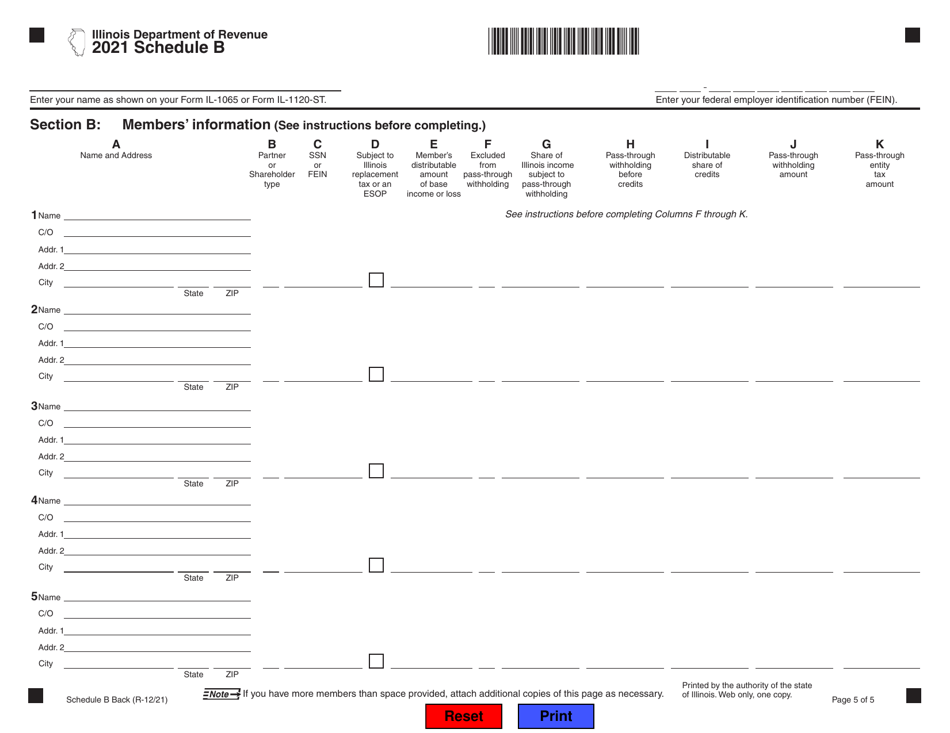

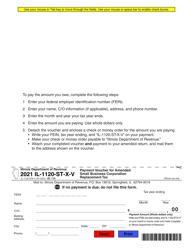

Form IL-1065-X Amended Partnership Replacement Tax Return - Illinois

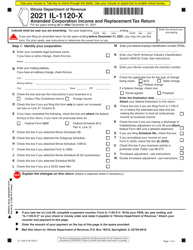

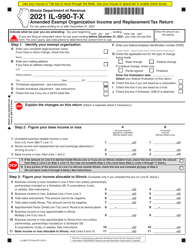

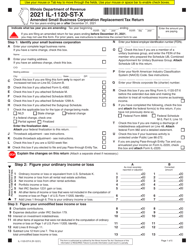

What Is Form IL-1065-X?

This is a legal form that was released by the Illinois Department of Revenue - a government authority operating within Illinois. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IL-1065-X?

A: Form IL-1065-X is an amended partnership replacement tax return for the state of Illinois.

Q: When should I use Form IL-1065-X?

A: You should use Form IL-1065-X when you need to amend a partnership tax return in Illinois.

Q: Why would I need to file Form IL-1065-X?

A: You may need to file Form IL-1065-X to correct errors or make changes to a previously filed partnership tax return in Illinois.

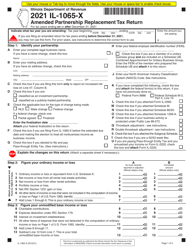

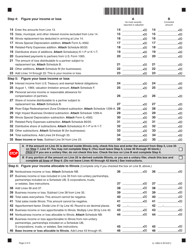

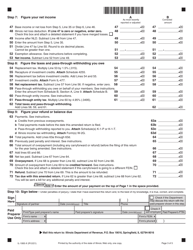

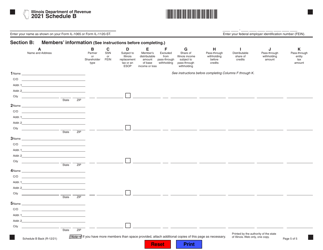

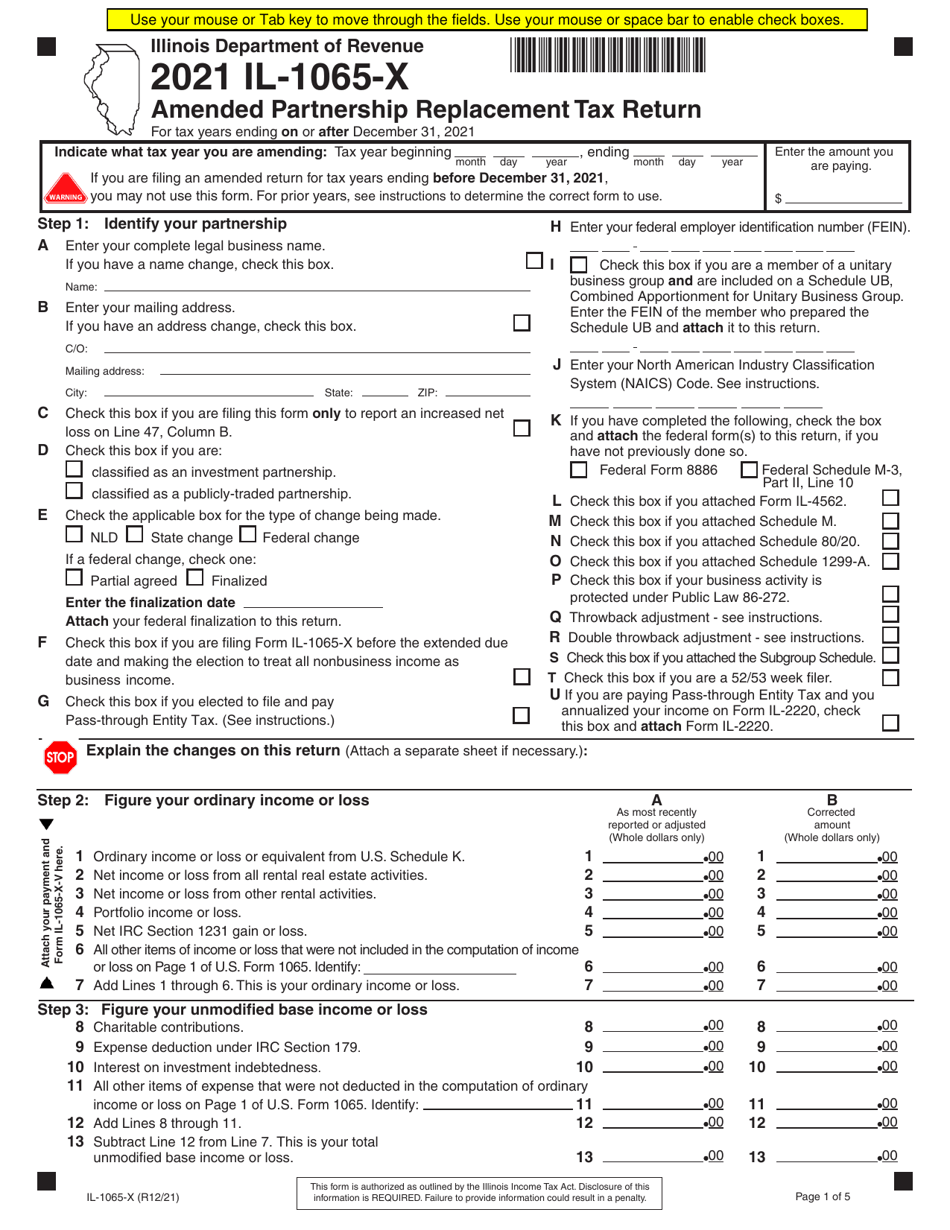

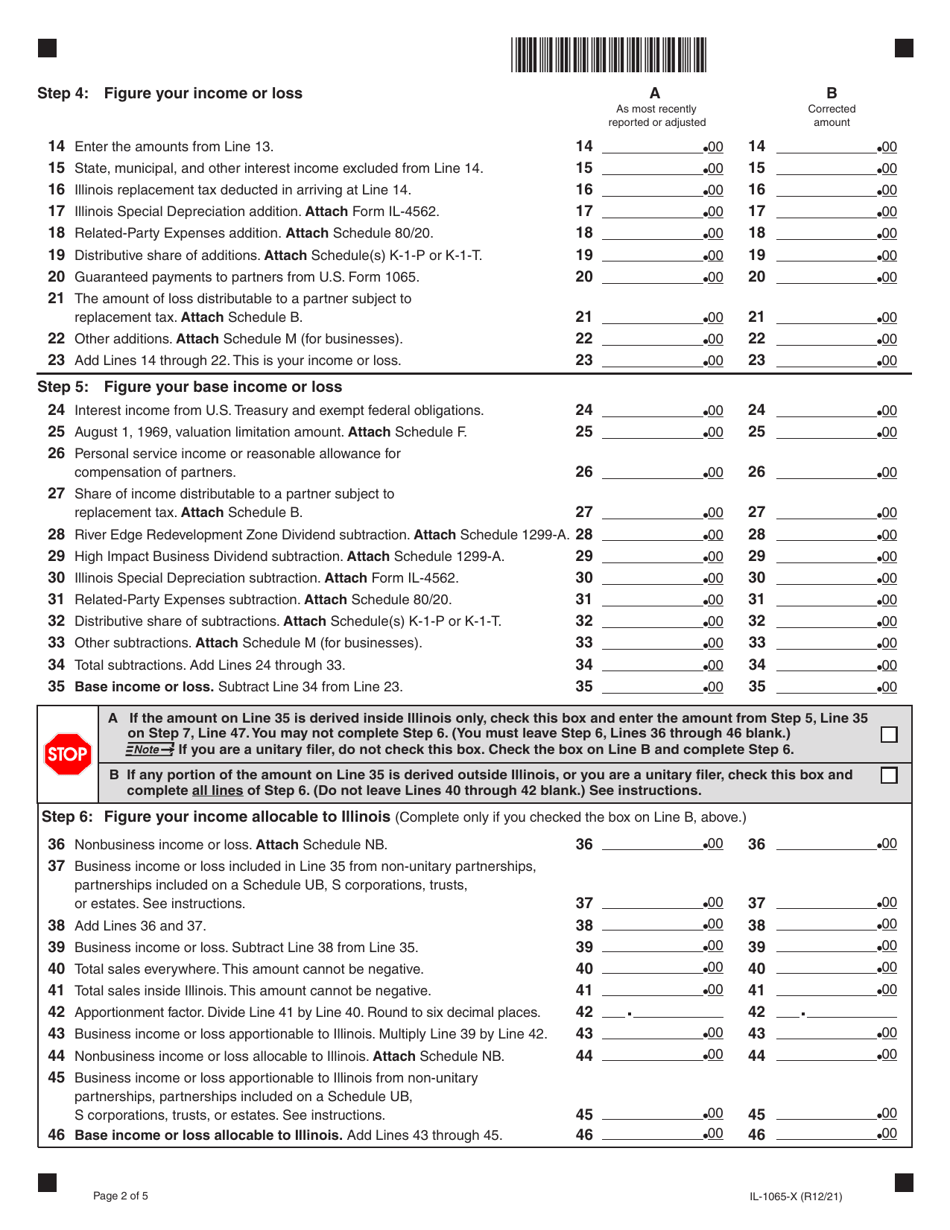

Q: How do I fill out Form IL-1065-X?

A: You will need to provide information about the original return, the changes being made, and any supporting documentation. Detailed instructions are available with the form.

Q: Is there a deadline for filing Form IL-1065-X?

A: Yes, Form IL-1065-X must be filed within 3 years from the due date of the original partnership return or within 1 year from the date of final federal determination, whichever is later.

Q: Are there any fees associated with filing Form IL-1065-X?

A: No, there are no fees required to file Form IL-1065-X.

Q: Can I e-file Form IL-1065-X?

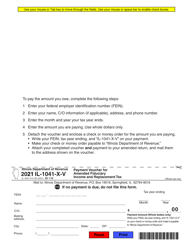

A: No, currently the Illinois Department of Revenue does not offer e-filing for Form IL-1065-X. It must be filed by mail.

Q: What should I do after filing Form IL-1065-X?

A: After filing Form IL-1065-X, you should keep a copy of the completed form and any supporting documentation for your records.

Form Details:

- Released on December 1, 2021;

- The latest edition provided by the Illinois Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IL-1065-X by clicking the link below or browse more documents and templates provided by the Illinois Department of Revenue.