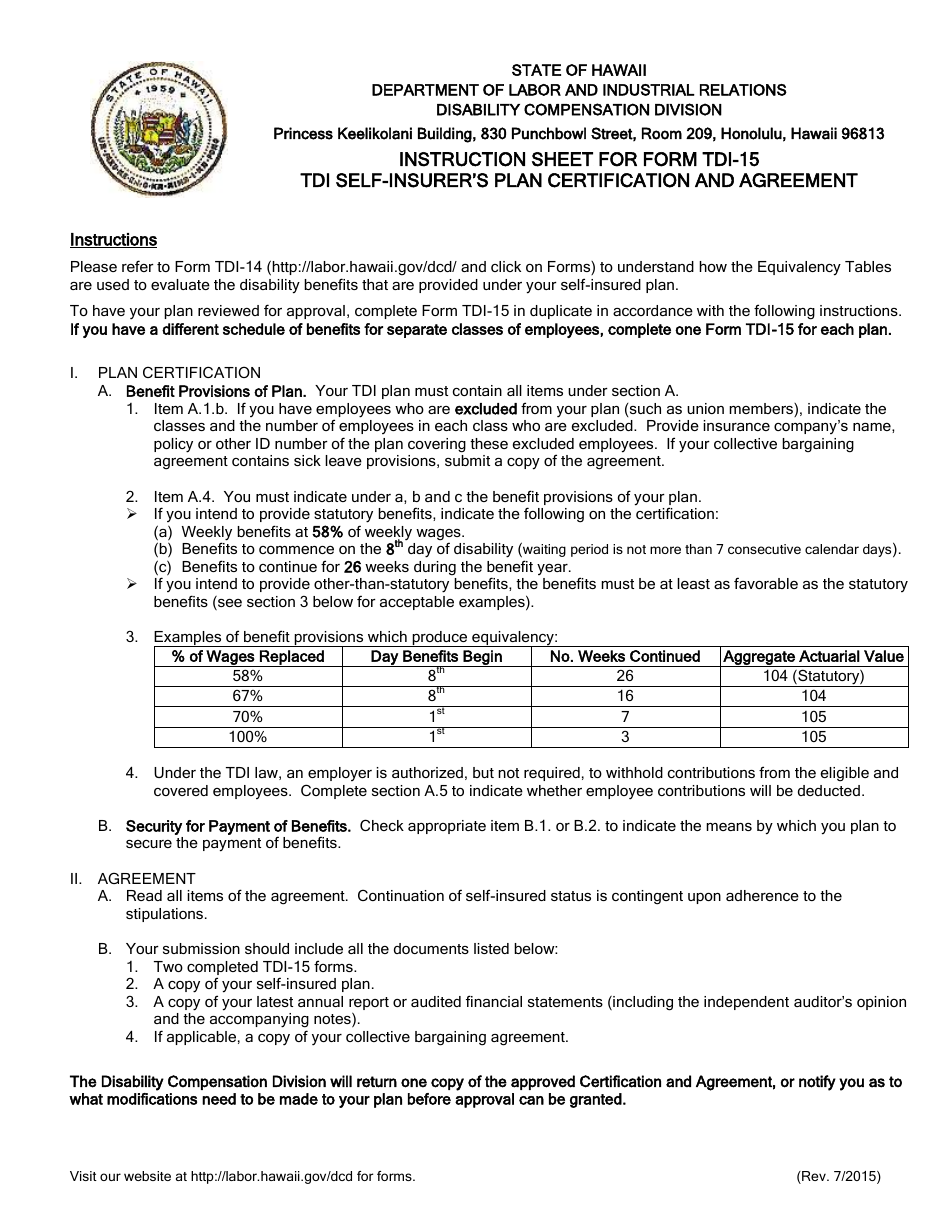

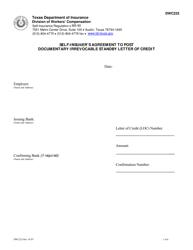

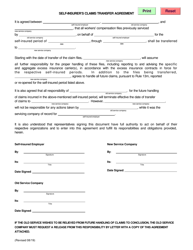

Form TDI-15 Tdi Self-insurer's Plan Certification and Agreement - Hawaii

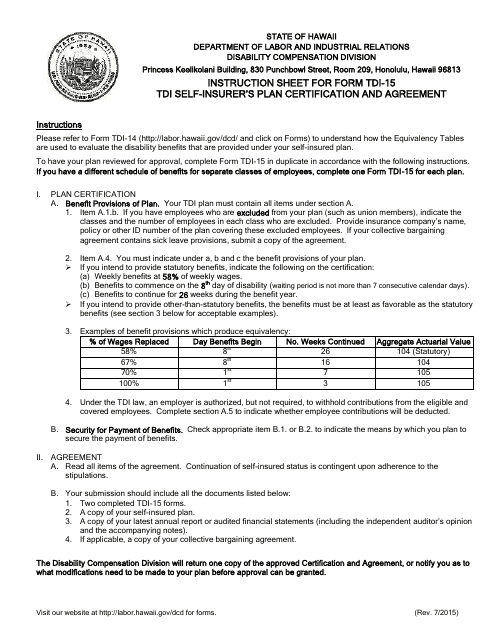

What Is Form TDI-15?

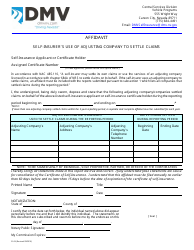

This is a legal form that was released by the Hawaii Department of Labor & Industrial Relations - a government authority operating within Hawaii. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form TDI-15?

A: Form TDI-15 is the Tdi Self-insurer's Plan Certification and Agreement.

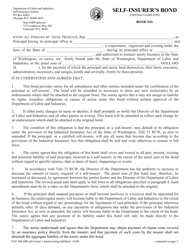

Q: What is the purpose of Form TDI-15?

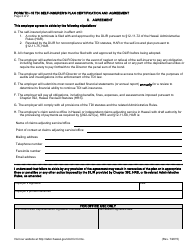

A: The purpose of Form TDI-15 is to certify and establish a self-insurer's plan for TDI benefits in Hawaii.

Q: Who needs to fill out Form TDI-15?

A: Employers who wish to self-insure for TDI benefits in Hawaii need to fill out Form TDI-15.

Q: Is Form TDI-15 specific to Hawaii?

A: Yes, Form TDI-15 is specific to Hawaii and is used to establish a self-insurer's plan for TDI benefits in the state.

Q: Is there a fee for filing Form TDI-15?

A: Yes, there is a fee for filing Form TDI-15. The fee amount is specified in the form instructions.

Q: When should Form TDI-15 be filed?

A: Form TDI-15 should be filed at least 60 days before the desired effective date of the self-insurer's plan.

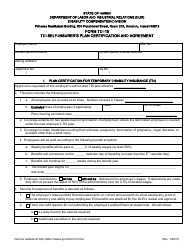

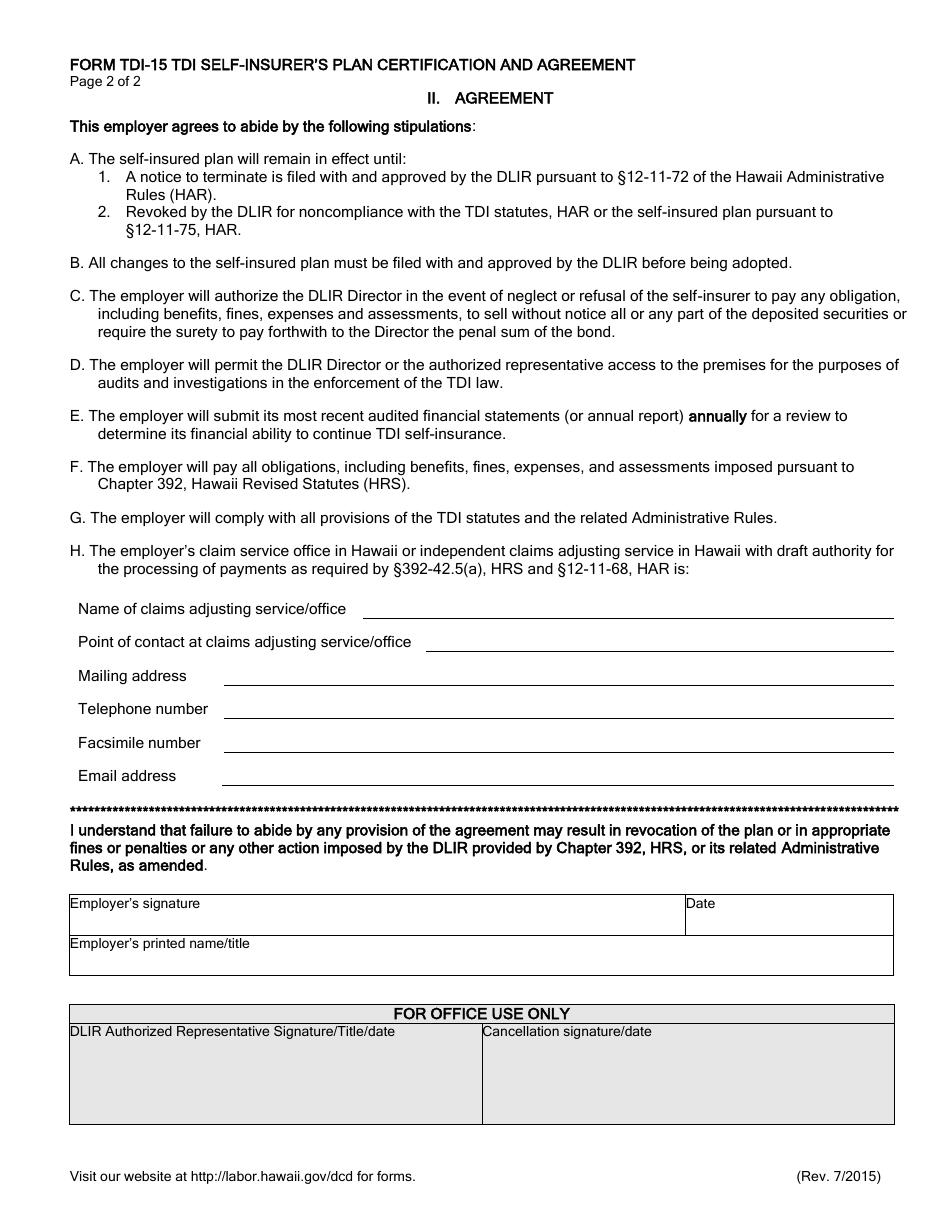

Q: What information is required in Form TDI-15?

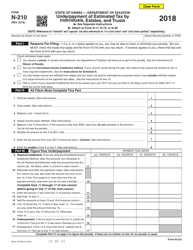

A: Form TDI-15 requires information about the employer, including contact details, financial information, and a proposed self-insurer's plan.

Q: Are there any additional documents required with Form TDI-15?

A: Yes, additional documents such as financial statements and a surety bond or deposit are required to be submitted with Form TDI-15.

Q: Is Form TDI-15 required for all employers in Hawaii?

A: No, Form TDI-15 is only required for employers who wish to self-insure for TDI benefits. Other employers may contribute to the state-managed TDI fund.

Form Details:

- Released on July 1, 2015;

- The latest edition provided by the Hawaii Department of Labor & Industrial Relations;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form TDI-15 by clicking the link below or browse more documents and templates provided by the Hawaii Department of Labor & Industrial Relations.