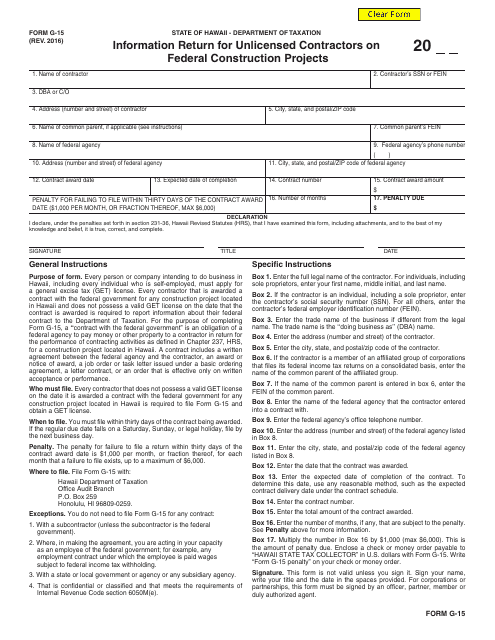

Form G-15 Information Return for Unlicensed Contractors on Federal Construction Projects - Hawaii

What Is Form G-15?

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form G-15?

A: Form G-15 is an information return for unlicensed contractors on federal construction projects in Hawaii.

Q: Who needs to file Form G-15?

A: Unlicensed contractors working on federal construction projects in Hawaii need to file Form G-15.

Q: What information is required on Form G-15?

A: Form G-15 requires information about the contractor, the federal construction project, and the contractor's qualifications.

Q: When is Form G-15 due?

A: Form G-15 is due within 30 days of commencing work on a federal construction project.

Q: What happens if I don't file Form G-15?

A: Failure to file Form G-15 may result in penalties or other legal consequences.

Q: Are there any exemptions from filing Form G-15?

A: There are exemptions for certain types of federal construction projects and contractors. It is recommended to consult the official instructions or a legal professional for specific guidance.

Form Details:

- Released on January 1, 2016;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form G-15 by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.