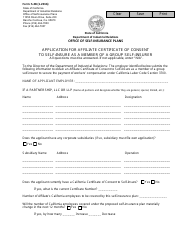

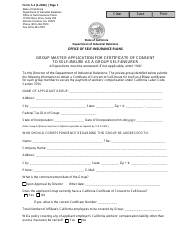

This version of the form is not currently in use and is provided for reference only. Download this version of

Form AR-1

for the current year.

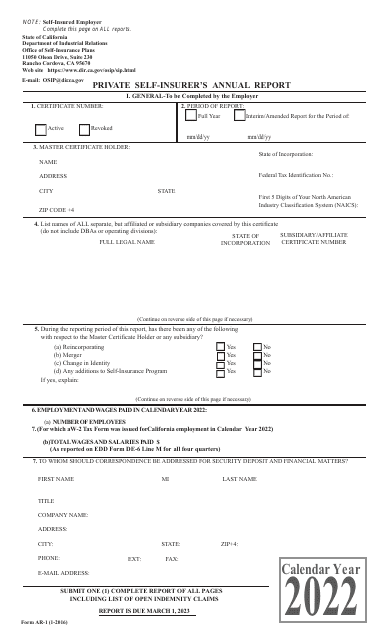

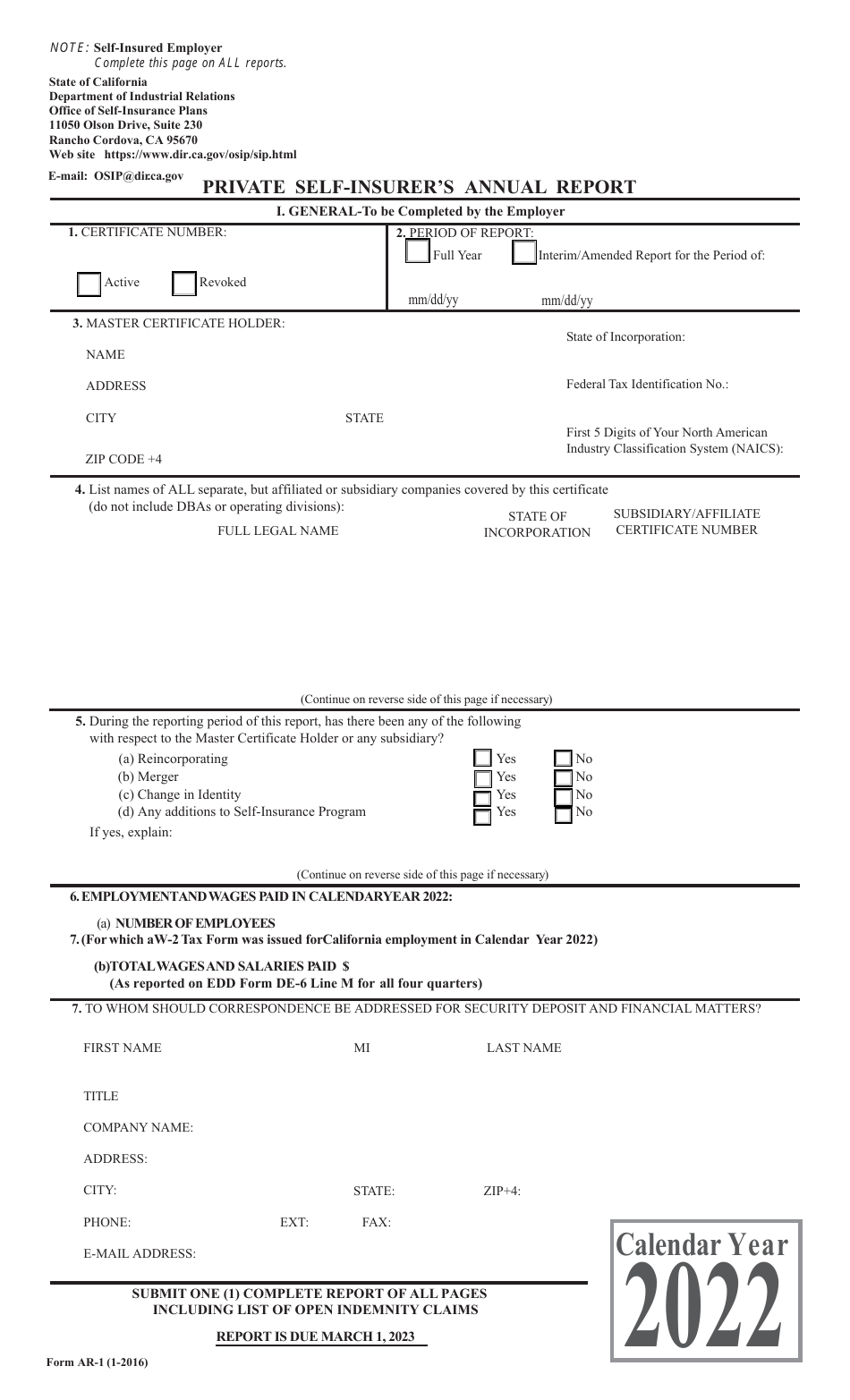

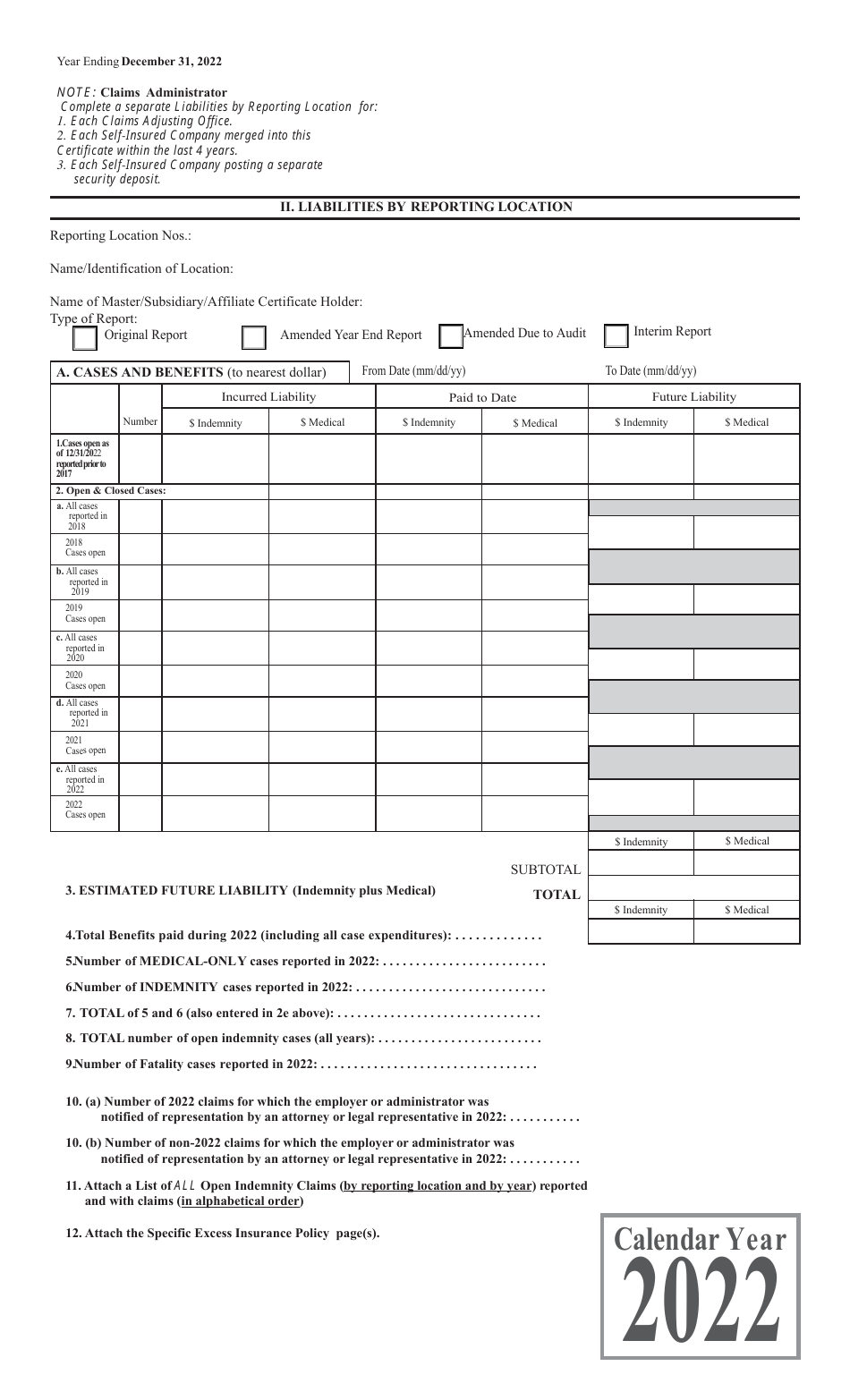

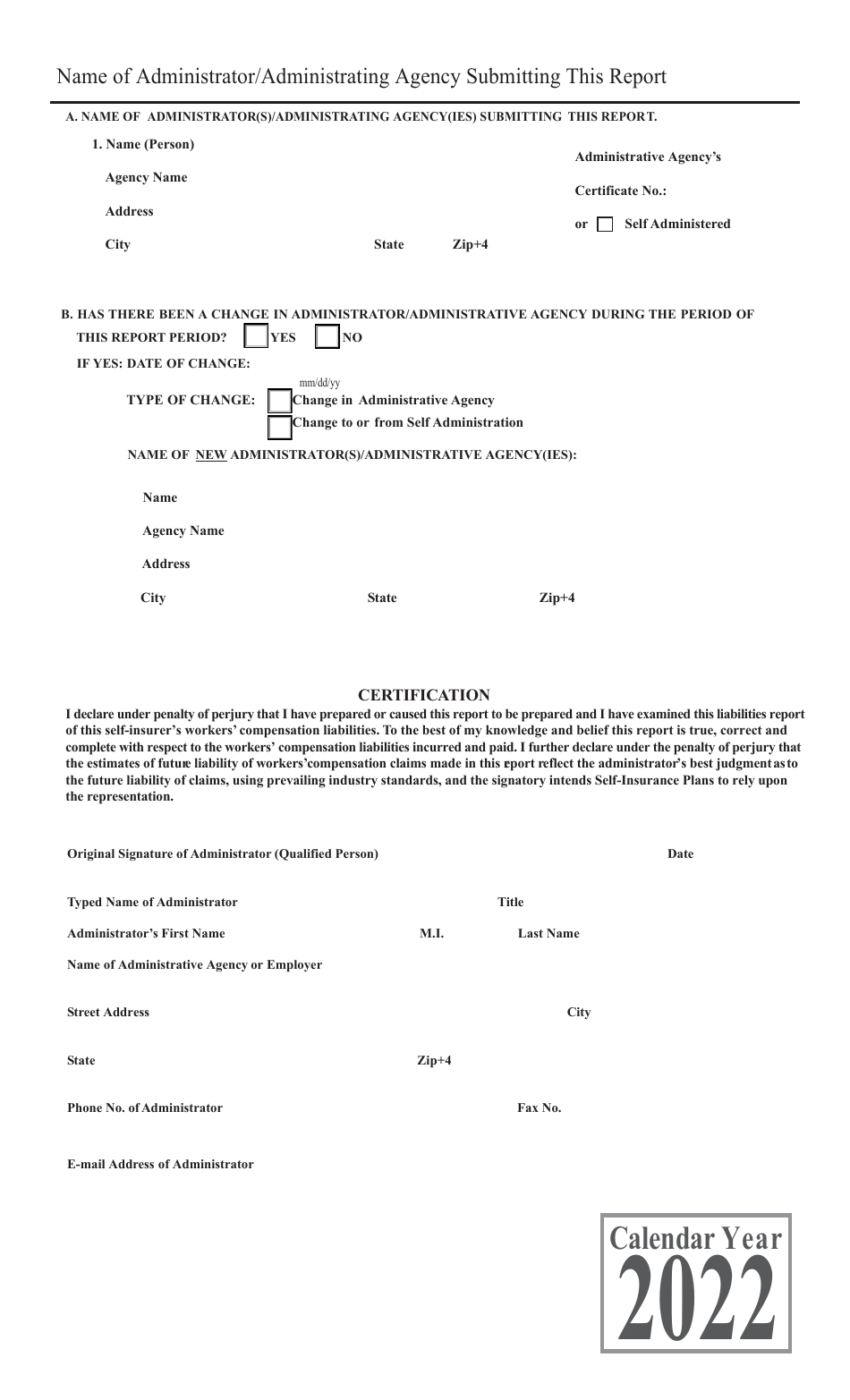

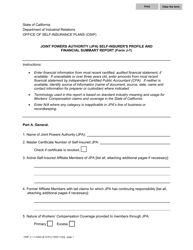

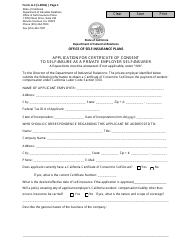

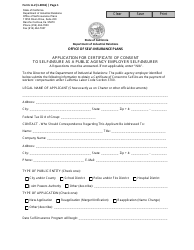

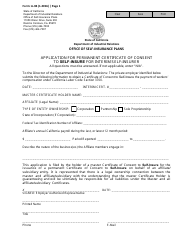

Form AR-1 Private Self-insurer's Annual Report - California

What Is Form AR-1?

This is a legal form that was released by the California Department of Industrial Relations - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form AR-1?

A: Form AR-1 is the Private Self-insurer's Annual Report in California.

Q: Who needs to file Form AR-1?

A: Private self-insurers in California need to file Form AR-1.

Q: What is the purpose of Form AR-1?

A: The purpose of Form AR-1 is to report the financial and operational information of private self-insurers in California.

Q: When is Form AR-1 due?

A: Form AR-1 is due annually on April 1st.

Q: Is there a filing fee for Form AR-1?

A: Yes, there is a filing fee for Form AR-1. The fee amount varies.

Q: Are there any penalties for late filing of Form AR-1?

A: Yes, there are penalties for late filing of Form AR-1. It is important to submit the form on time.

Q: Who can assist me in filling out Form AR-1?

A: You can seek assistance from a licensed insurance professional or a certified public accountant to help you fill out Form AR-1.

Q: What information is required on Form AR-1?

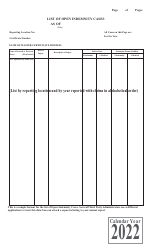

A: Form AR-1 requires information about the self-insurer's financial statements, claim information, and administrative expenses.

Q: Are there any additional requirements for self-insurers in California?

A: Yes, self-insurers in California have additional requirements such as maintaining security deposit and obtaining excess insurance coverage.

Form Details:

- Released on January 1, 2016;

- The latest edition provided by the California Department of Industrial Relations;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form AR-1 by clicking the link below or browse more documents and templates provided by the California Department of Industrial Relations.