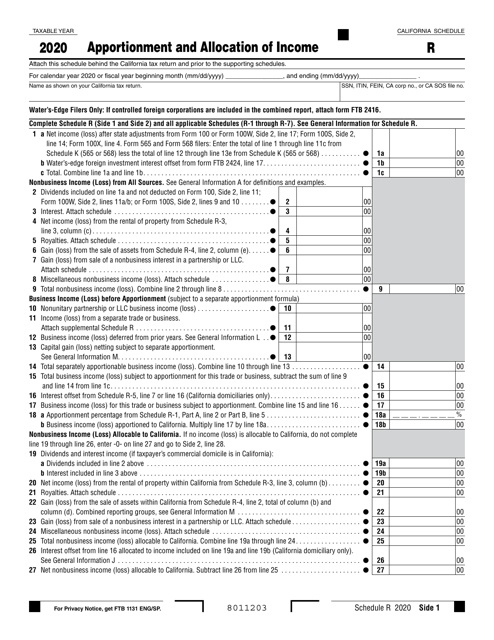

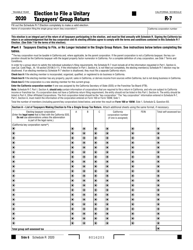

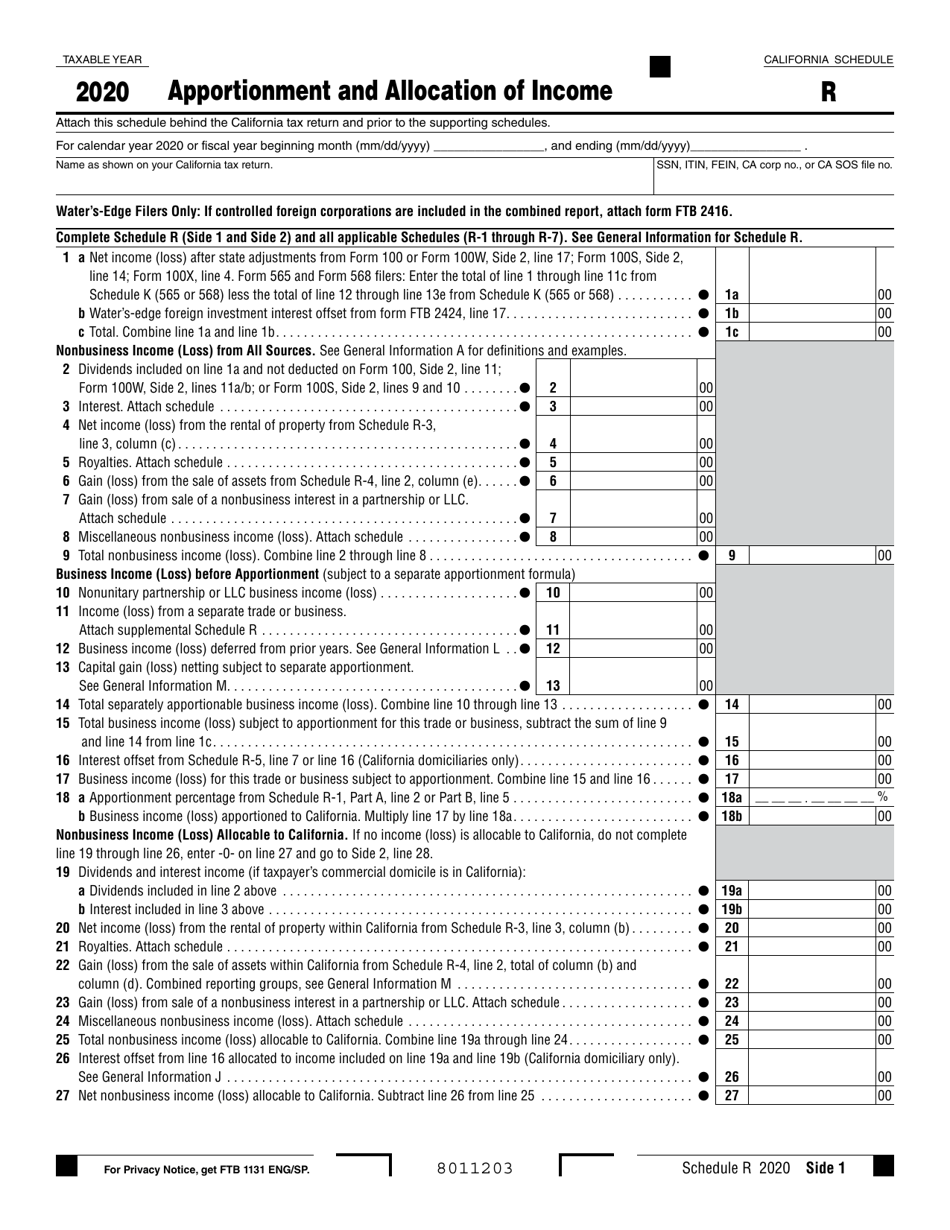

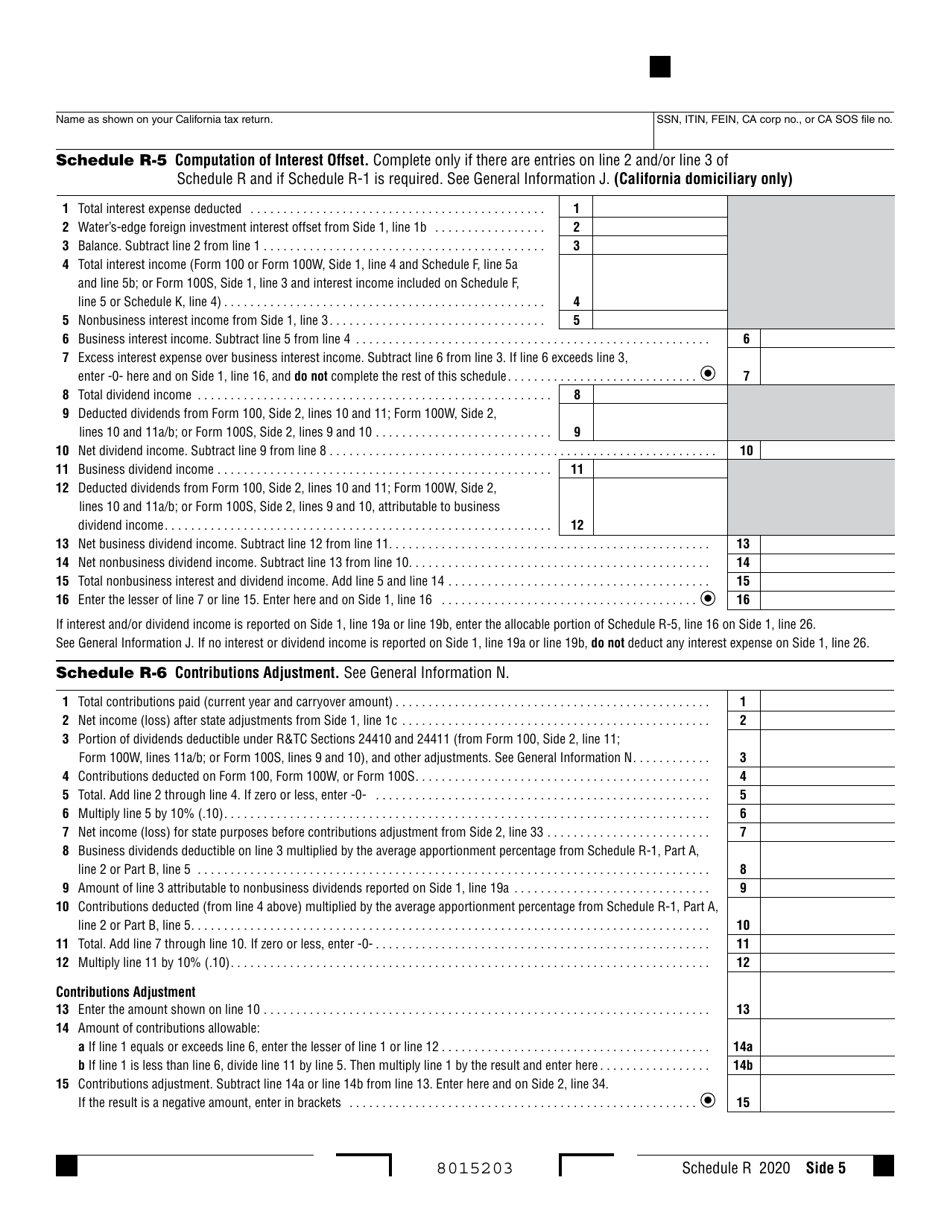

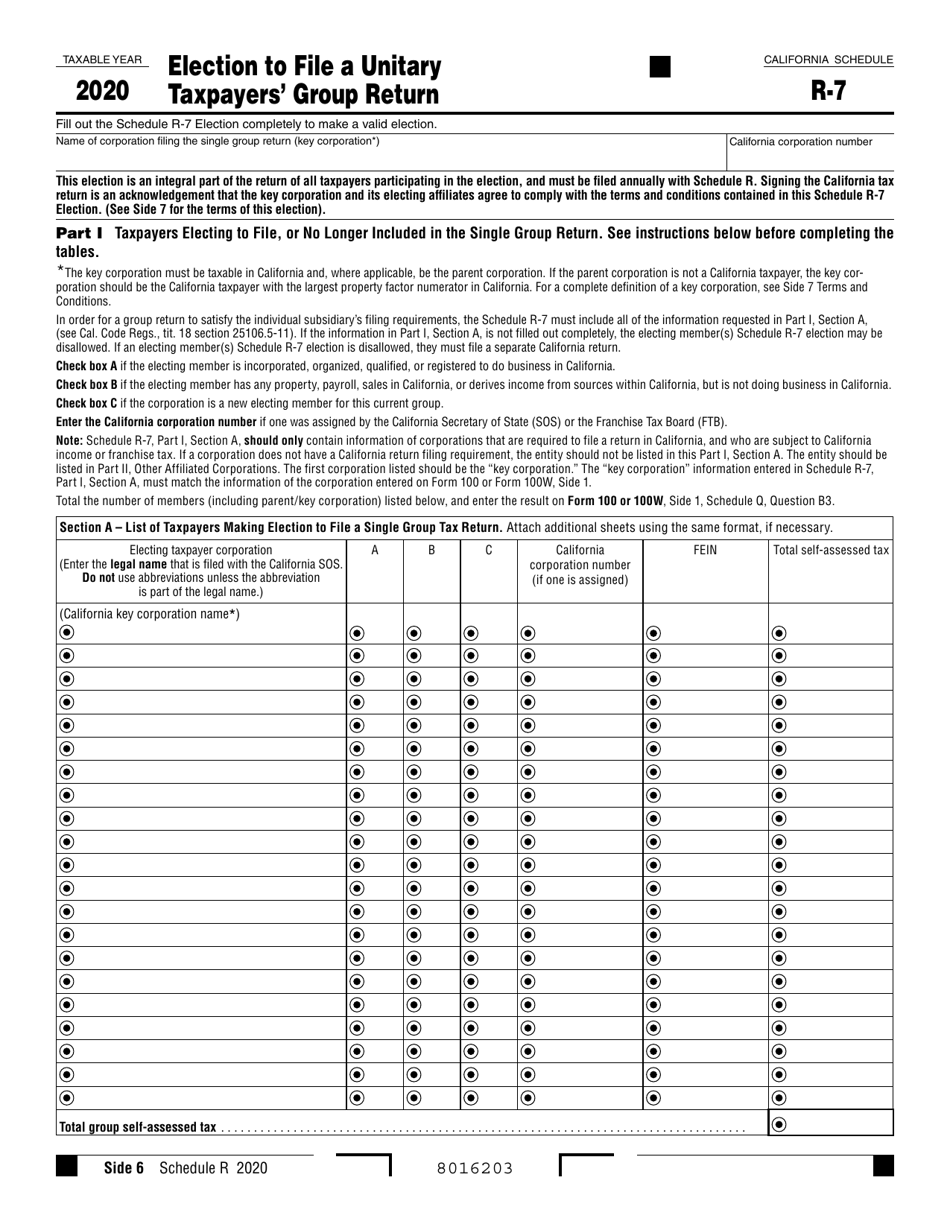

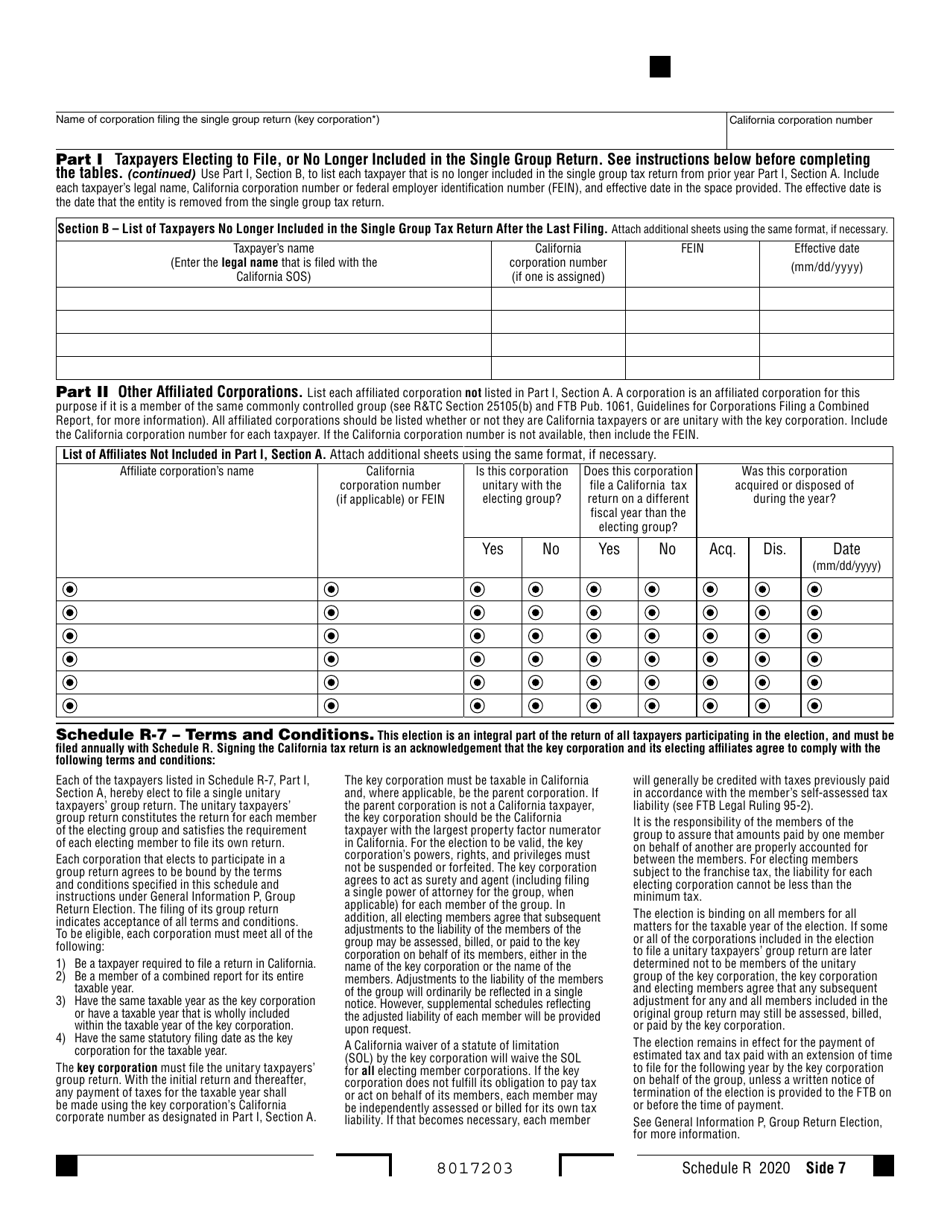

Schedule R Apportionment and Allocation of Income - California

What Is Schedule R?

This is a legal form that was released by the California Franchise Tax Board - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Schedule R?

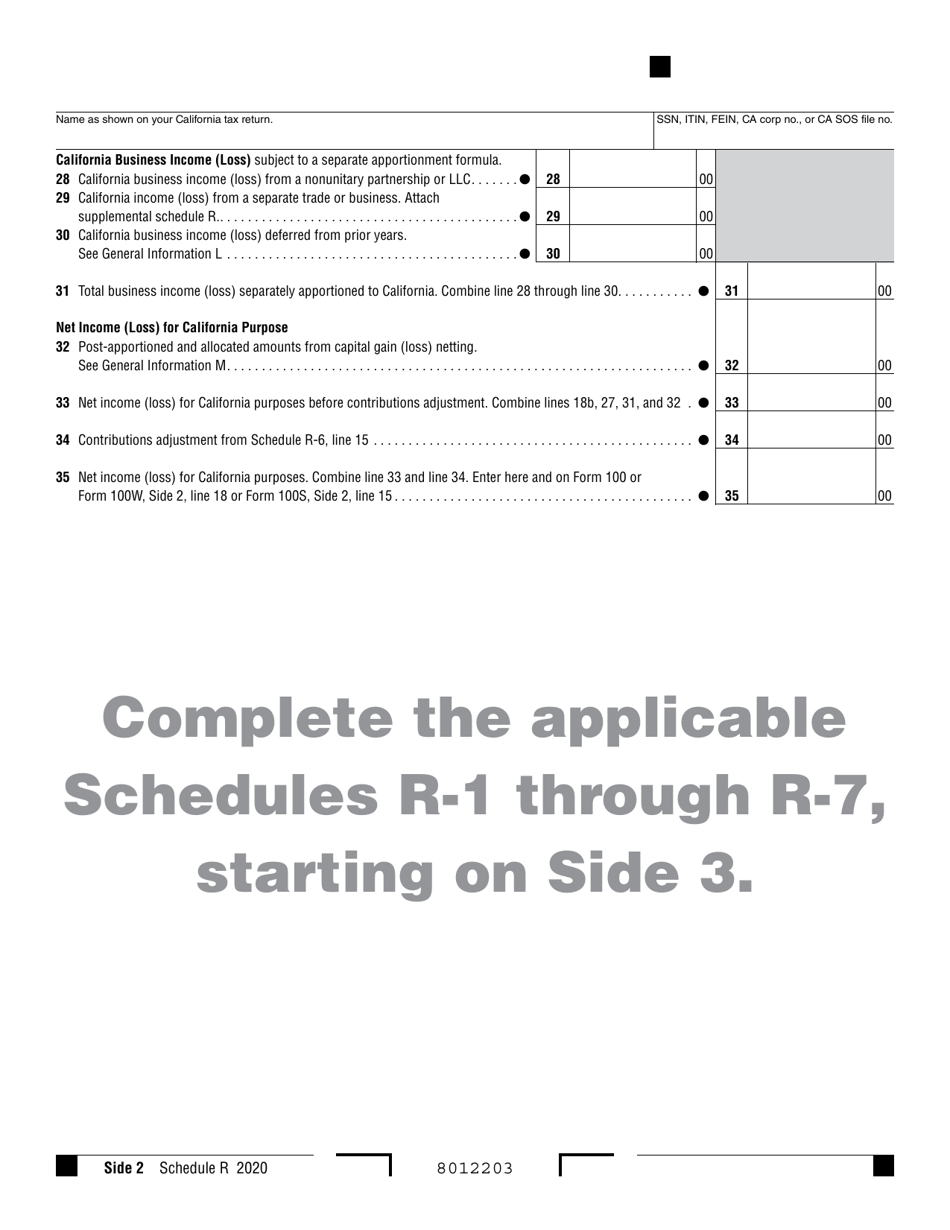

A: Schedule R is a form used for the apportionment and allocation of income in the state of California.

Q: What is the purpose of Schedule R?

A: The purpose of Schedule R is to determine how much of a taxpayer's income should be allocated and apportioned to California.

Q: Who needs to file Schedule R?

A: Taxpayers who have income from sources both inside and outside of California need to file Schedule R.

Q: What information is required for Schedule R?

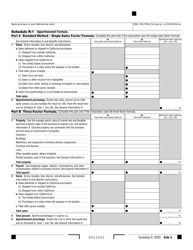

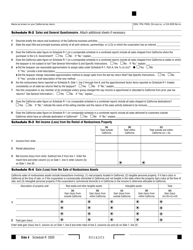

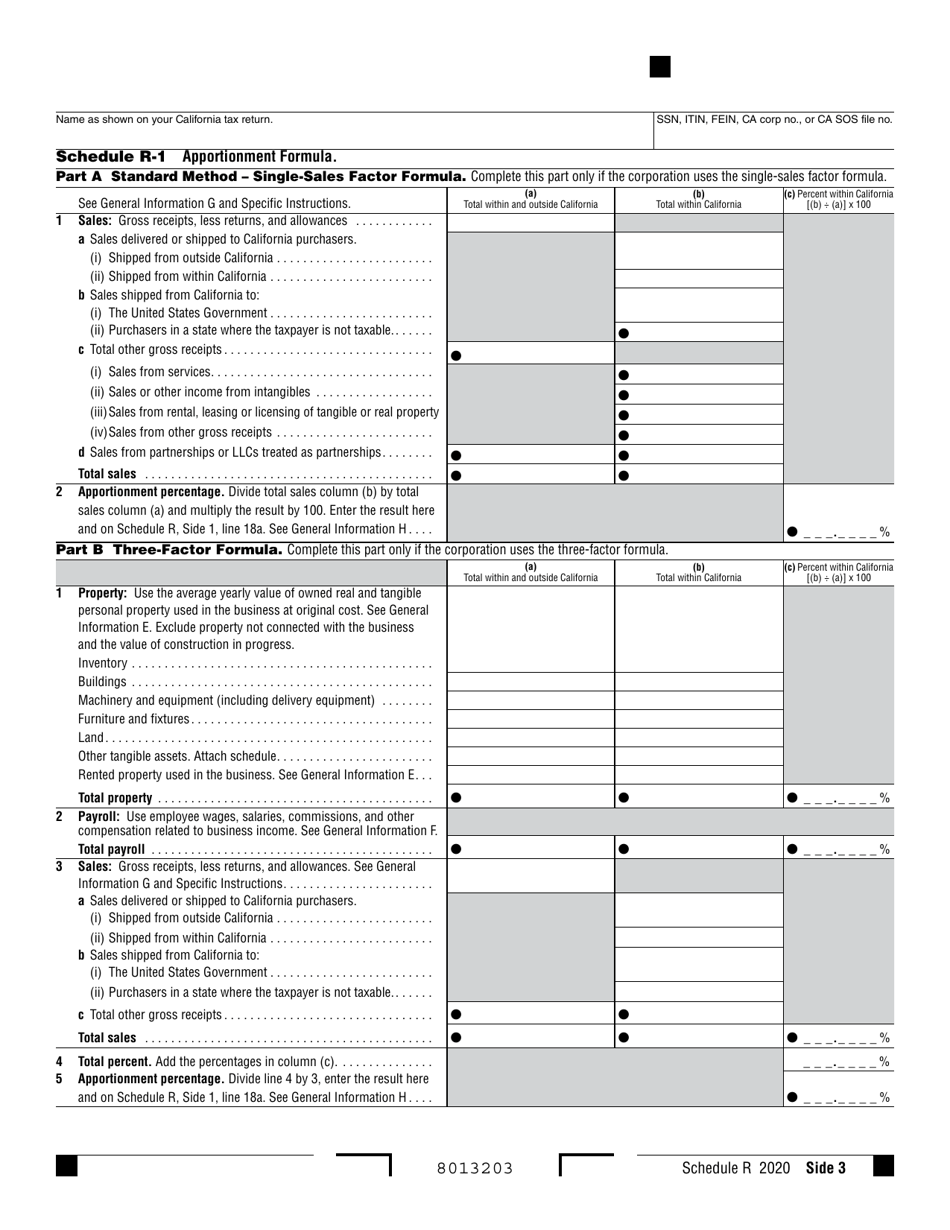

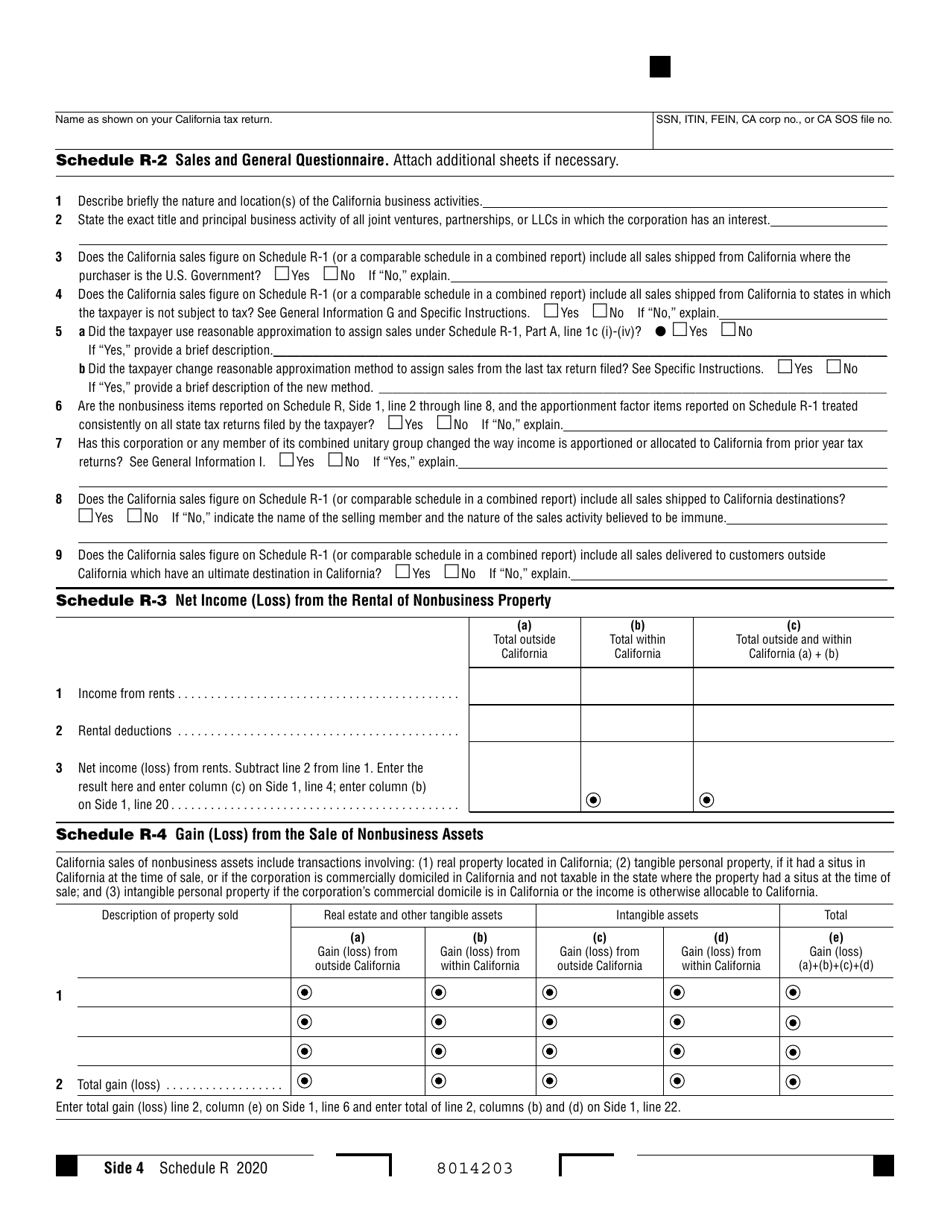

A: Schedule R requires information such as total income, sales, property, and payroll within and outside of California.

Q: How does Schedule R apportion and allocate income?

A: Schedule R uses a formula based on sales, property, and payroll factors to determine how much of a taxpayer's income should be allocated and apportioned to California.

Q: Is Schedule R only for California residents?

A: No, Schedule R is also required for non-residents who earn income from California sources.

Q: When is Schedule R due?

A: Schedule R is generally due at the same time as the taxpayer's California tax return, which is typically April 15th.

Q: Is Schedule R required for all types of businesses?

A: No, Schedule R is required for corporations and partnerships, but not for individuals.

Q: What happens if I don't file Schedule R?

A: Failure to file Schedule R when required can result in penalties and interest charges from the California Franchise Tax Board.

Form Details:

- The latest edition provided by the California Franchise Tax Board;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Schedule R by clicking the link below or browse more documents and templates provided by the California Franchise Tax Board.