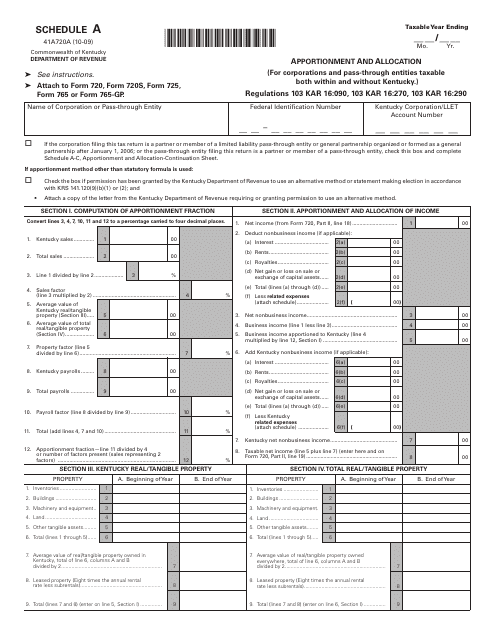

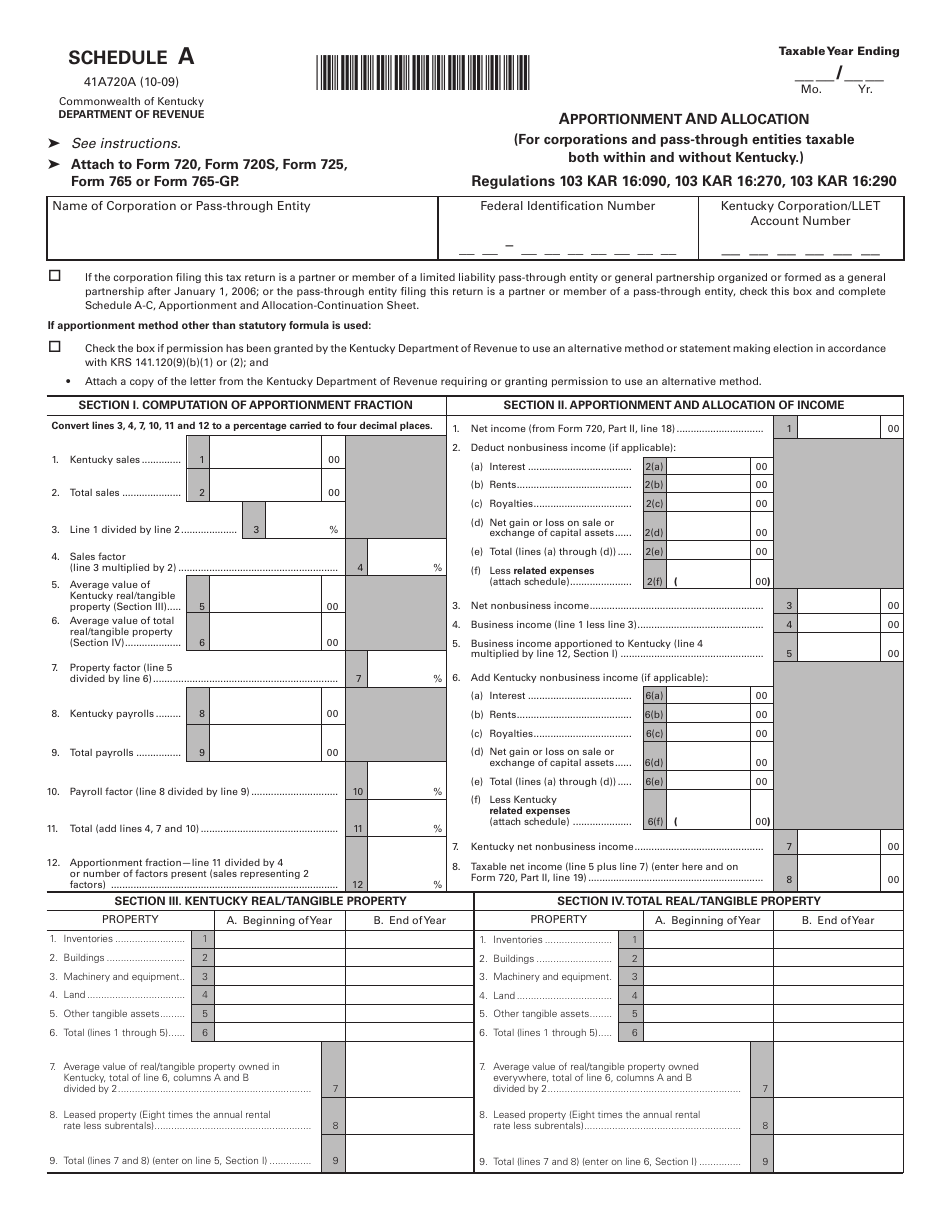

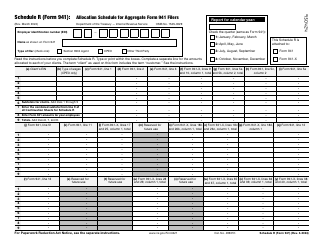

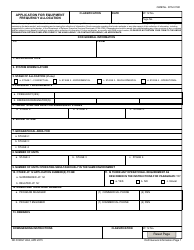

Form 41A720A Schedule A Apportionment and Allocation - Kentucky

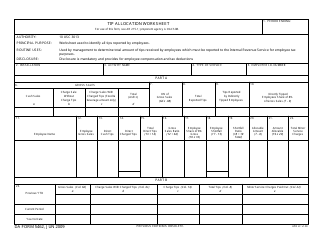

What Is Form 41A720A Schedule A?

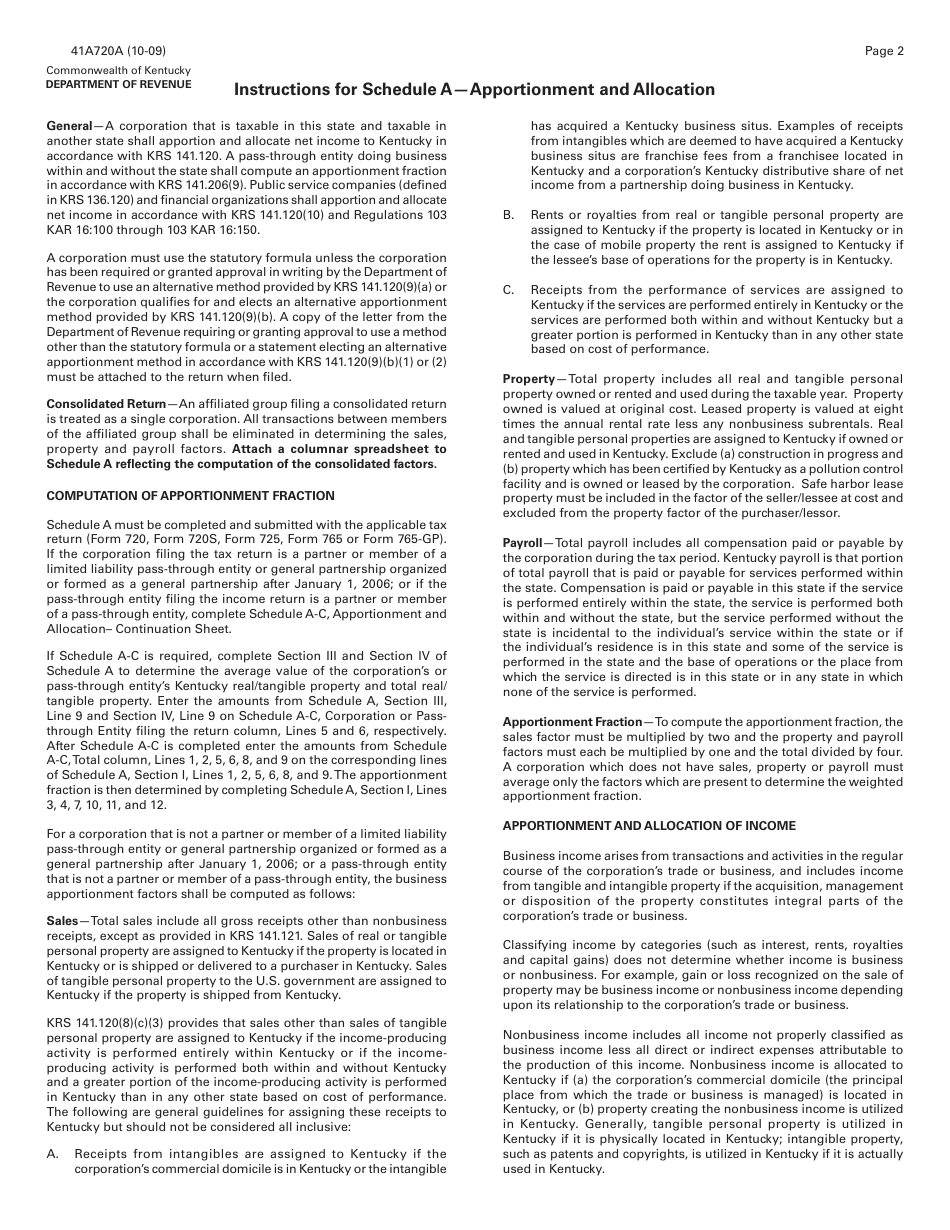

This is a legal form that was released by the Kentucky Department of Revenue - a government authority operating within Kentucky. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 41A720A?

A: Form 41A720A is a schedule used for apportionment and allocation in Kentucky.

Q: What is the purpose of Form 41A720A?

A: The purpose of Form 41A720A is to calculate and allocate income for tax purposes in Kentucky.

Q: Who needs to file Form 41A720A?

A: Anyone required to file a Kentucky tax return and has income from multiple states or jurisdictions needs to file Form 41A720A.

Q: What information is required on Form 41A720A?

A: Form 41A720A requires the taxpayer to provide details of their apportionment and allocation factors, as well as any necessary adjustments.

Q: Is Form 41A720A specific to Kentucky?

A: Yes, Form 41A720A is specific to Kentucky tax purposes and is not used for federal or other statetax filings.

Form Details:

- Released on October 1, 2009;

- The latest edition provided by the Kentucky Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 41A720A Schedule A by clicking the link below or browse more documents and templates provided by the Kentucky Department of Revenue.