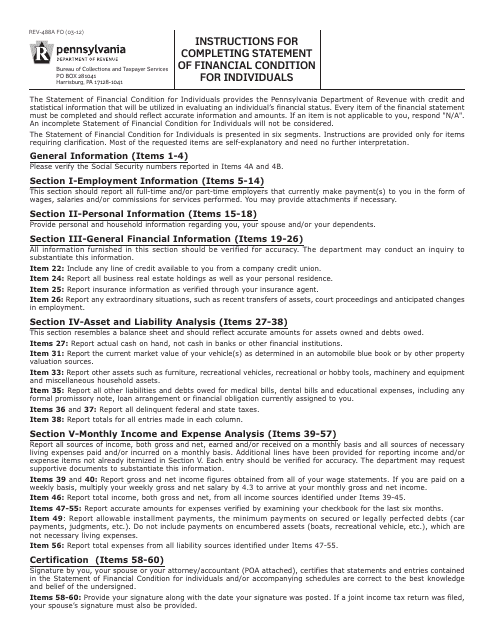

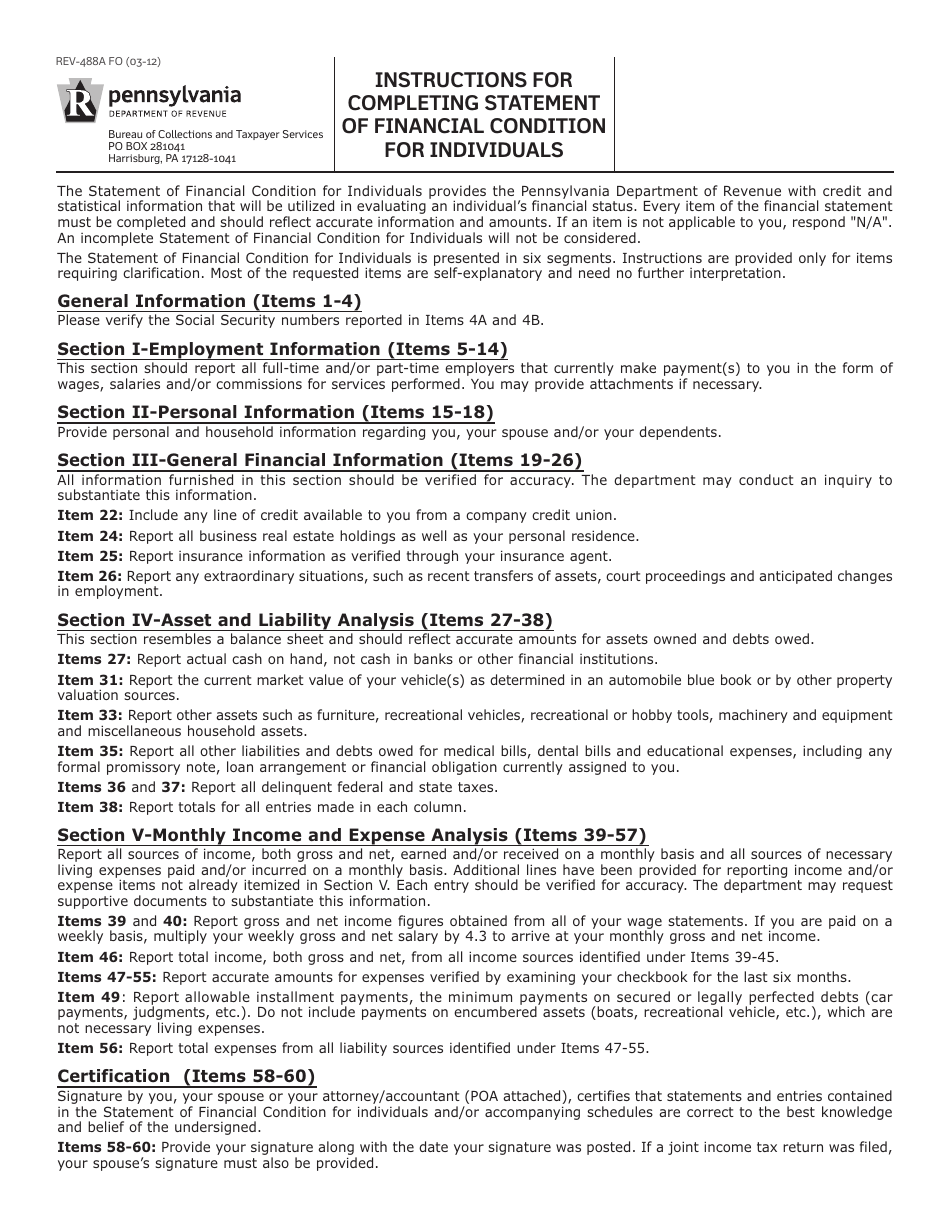

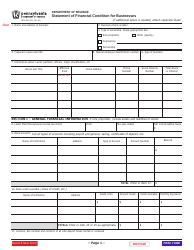

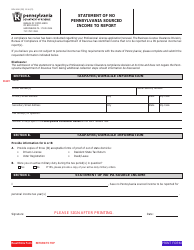

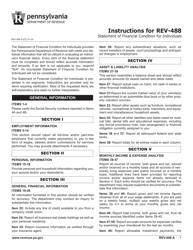

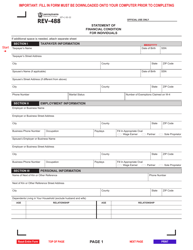

Instructions for Form REV-488A Statement of Financial Condition for Individuals - Pennsylvania

This document contains official instructions for Form REV-488A , Statement of Financial Condition for Individuals - a form released and collected by the Pennsylvania Department of Revenue.

FAQ

Q: Who needs to fill out Form REV-488A?

A: Individuals in Pennsylvania who are required to provide a statement of their financial condition.

Q: What is Form REV-488A used for?

A: Form REV-488A is used to provide a statement of financial condition for individuals in Pennsylvania.

Q: What information do I need to provide on Form REV-488A?

A: You will need to provide information about your assets, liabilities, income, expenses, and other financial details.

Q: Do I need to include supporting documentation with Form REV-488A?

A: Yes, you should include supporting documentation such as bank statements, tax returns, and financial statements.

Q: When is the deadline for filing Form REV-488A?

A: The deadline for filing Form REV-488A is usually April 15th, unless otherwise stated by the Pennsylvania Department of Revenue.

Q: Can I file Form REV-488A electronically?

A: No, Form REV-488A must be filed by mail or delivered in person to the Pennsylvania Department of Revenue.

Q: Can I request an extension to file Form REV-488A?

A: Yes, you can request an extension by contacting the Pennsylvania Department of Revenue.

Q: What are the consequences of not filing Form REV-488A?

A: Failure to file Form REV-488A or providing false or misleading information can result in penalties and legal consequences.

Instruction Details:

- This 1-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Pennsylvania Department of Revenue.