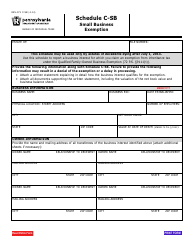

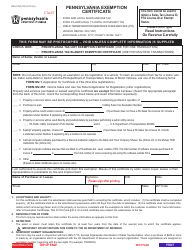

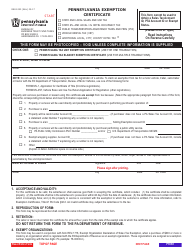

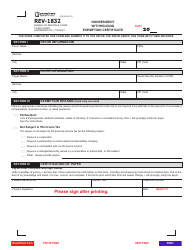

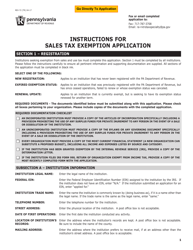

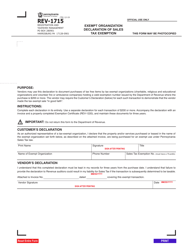

Instructions for Form REV-571 Schedule C-SB Small Business Exemption - Pennsylvania

This document contains official instructions for Form REV-571 Schedule C-SB, Small Business Exemption - a form released and collected by the Pennsylvania Department of Revenue. An up-to-date fillable Form REV-571 Schedule C-SB is available for download through this link.

FAQ

Q: What is Form REV-571?

A: Form REV-571 is a schedule that allows small businesses in Pennsylvania to claim an exemption.

Q: What is the purpose of Form REV-571?

A: The purpose of Form REV-571 is to provide small businesses in Pennsylvania with a small business exemption.

Q: Who can use Form REV-571?

A: Small businesses in Pennsylvania can use Form REV-571.

Q: What does the small business exemption entail?

A: The small business exemption allows eligible businesses to be exempt from certain taxes and fees.

Q: Are there any eligibility requirements for the small business exemption?

A: Yes, there are eligibility requirements that businesses must meet in order to qualify for the small business exemption.

Q: What should I do if I have questions about Form REV-571?

A: If you have questions about Form REV-571, you can contact the Pennsylvania Department of Revenue for assistance.

Instruction Details:

- This 1-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Pennsylvania Department of Revenue.