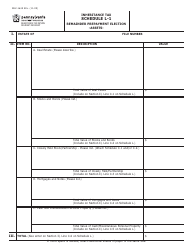

Instructions for Form REV-1649 Schedule O Deferral / Election of Spousal Trusts - Pennsylvania

This document contains official instructions for Form REV-1649 Schedule O, Deferral/Election of Spousal Trusts - a form released and collected by the Pennsylvania Department of Revenue. An up-to-date fillable Form REV-1649 Schedule O is available for download through this link.

FAQ

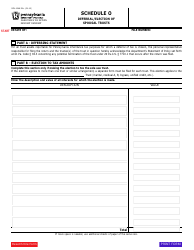

Q: What is Form REV-1649 Schedule O?

A: Form REV-1649 Schedule O is a Pennsylvania tax form used for deferral or election of spousal trusts.

Q: What is a spousal trust?

A: A spousal trust is a type of trust that is set up for the benefit of a surviving spouse.

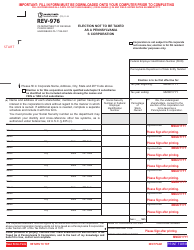

Q: What is deferral/election of spousal trusts?

A: Deferral/election of spousal trusts refers to the option of deferring or electing the taxation of income earned by the trust.

Q: When is Form REV-1649 Schedule O required?

A: Form REV-1649 Schedule O is required when there is a deferral or election of spousal trusts.

Instruction Details:

- This 1-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Pennsylvania Department of Revenue.