This version of the form is not currently in use and is provided for reference only. Download this version of

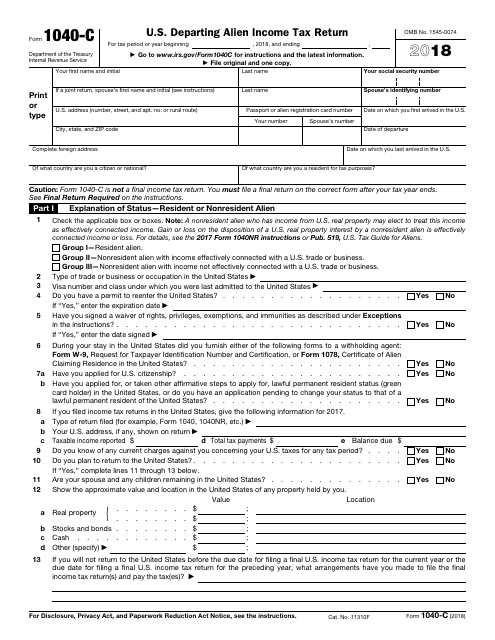

IRS Form 1040-C

for the current year.

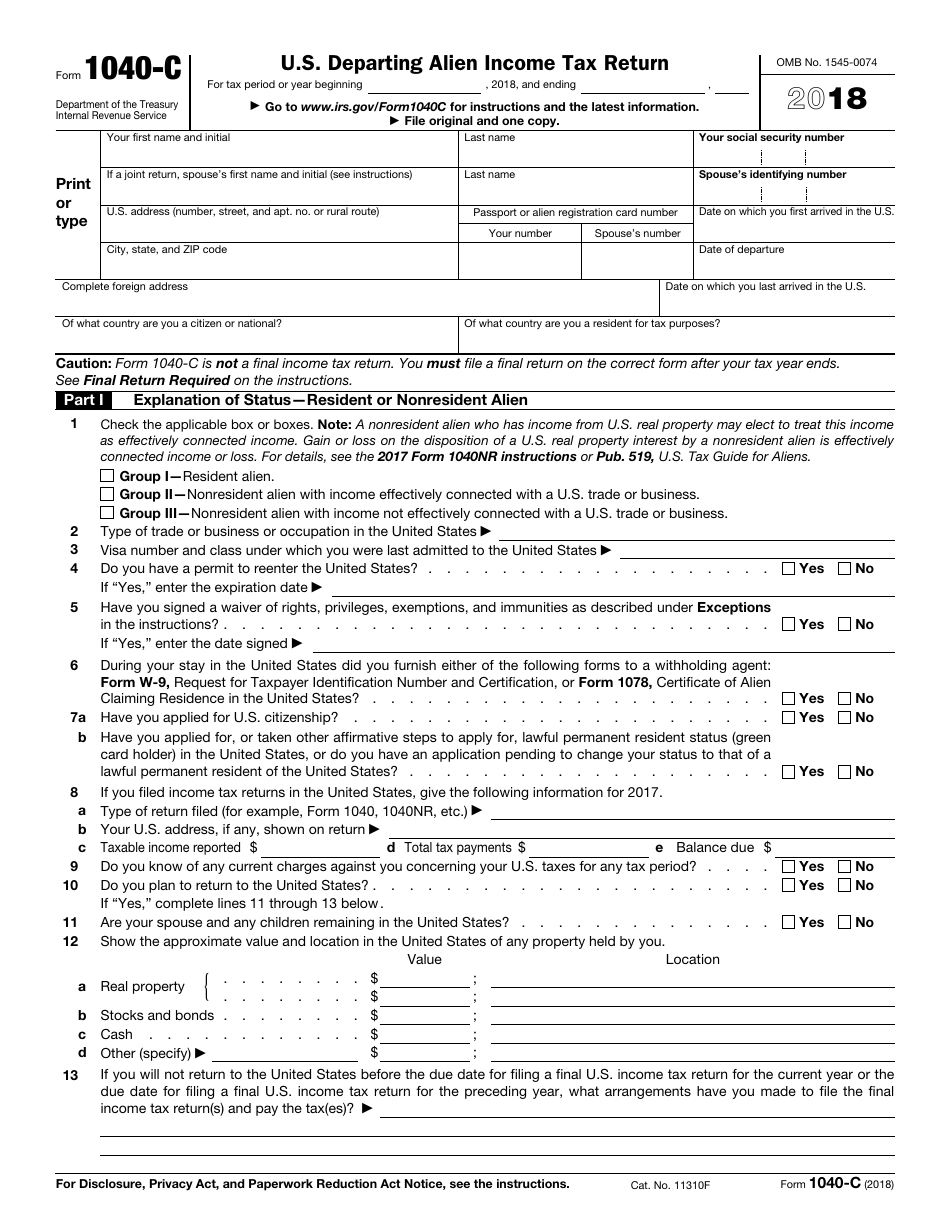

IRS Form 1040-C U.S. Departing Alien Income Tax Return

What Is IRS Form 1040-C?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on January 1, 2018. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 1040-C?

A: IRS Form 1040-C is the U.S. Departing Alien Income Tax Return.

Q: Who needs to file Form 1040-C?

A: Nonresident aliens who are leaving the United States and had income from U.S. sources need to file Form 1040-C.

Q: What is the purpose of Form 1040-C?

A: The purpose of Form 1040-C is to report and pay any remaining U.S. income tax liability before a nonresident alien departs from the United States.

Q: When should Form 1040-C be filed?

A: Form 1040-C should be filed before a nonresident alien leaves the United States.

Q: What information is required on Form 1040-C?

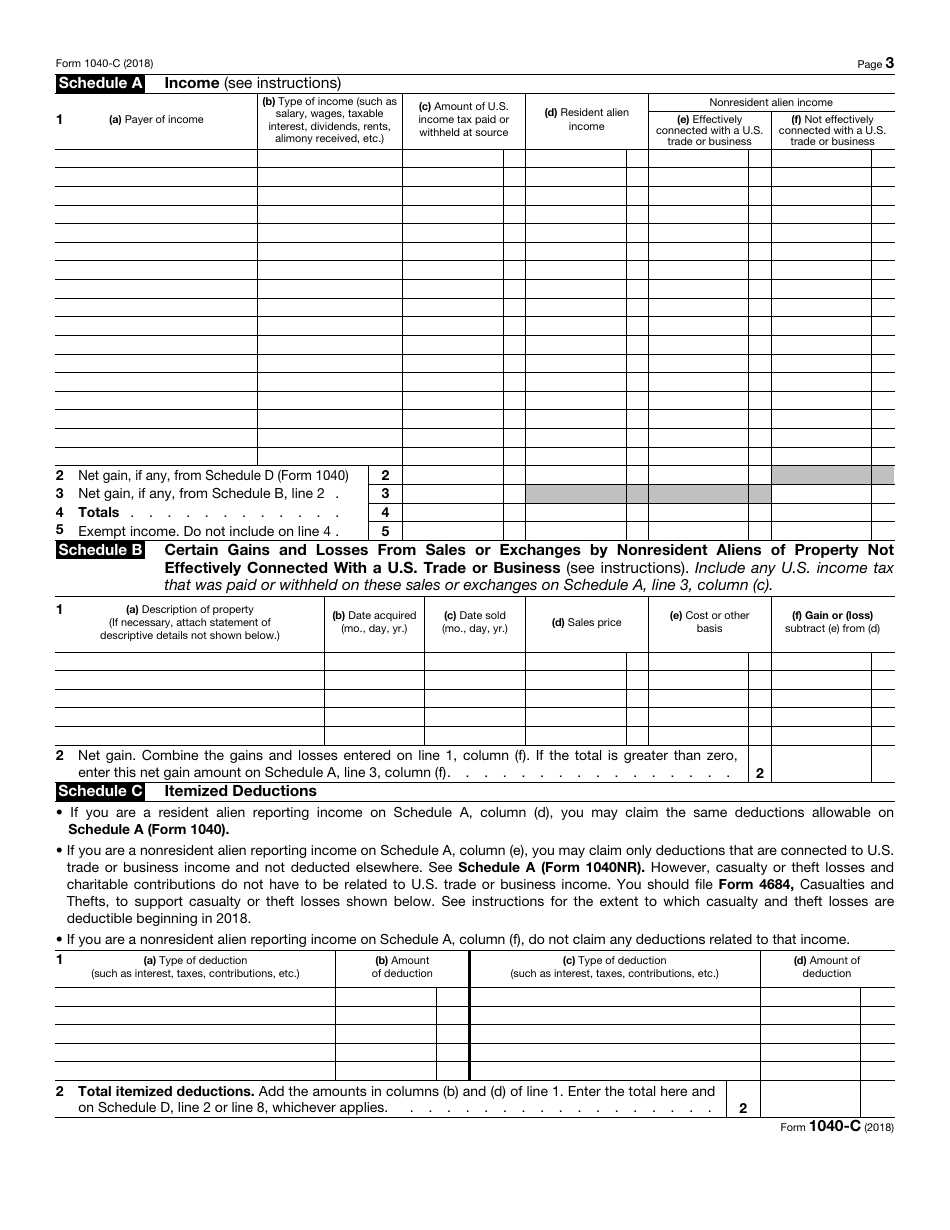

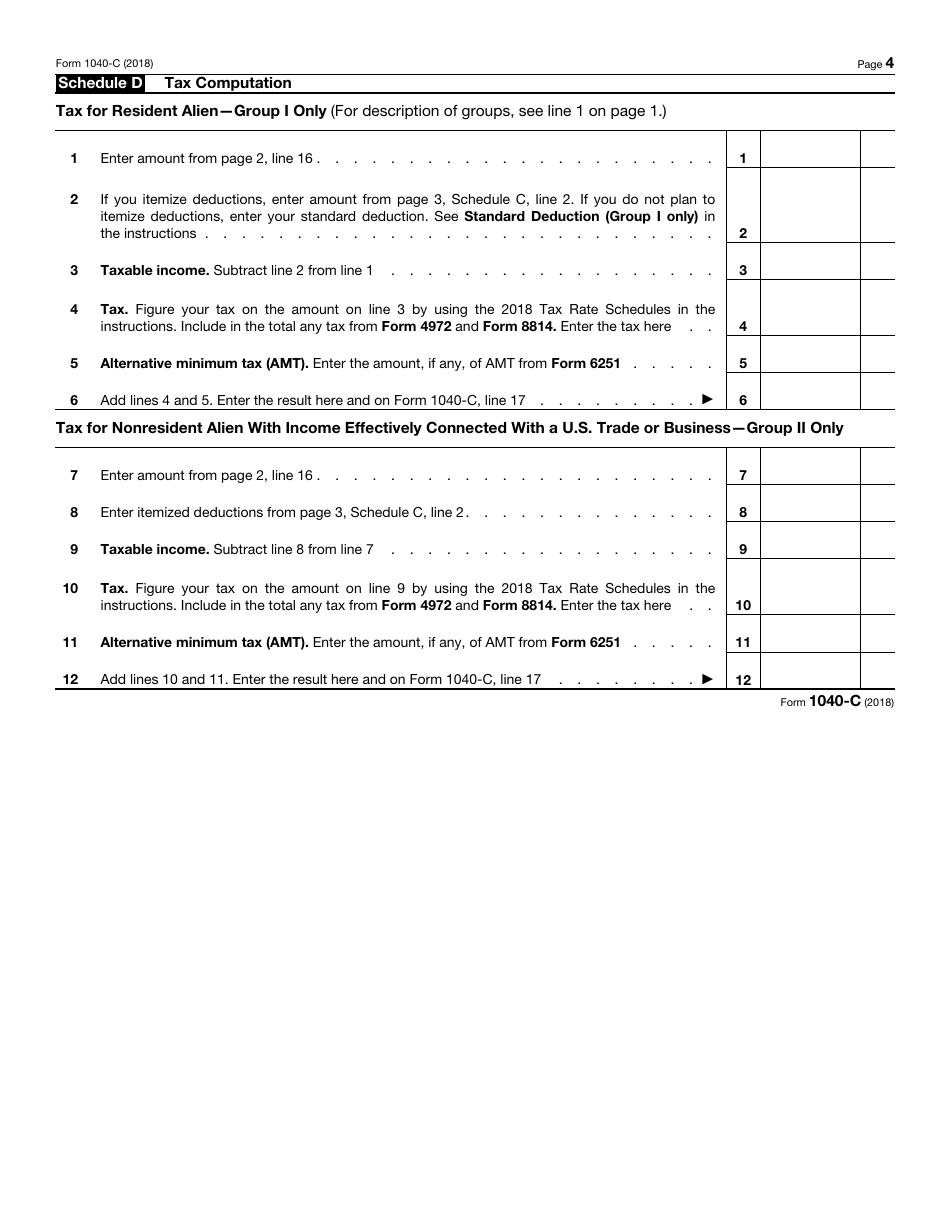

A: Form 1040-C requires information about the nonresident alien's income, deductions, and tax liability.

Q: Are there any penalties for not filing Form 1040-C?

A: Yes, there can be penalties for not filing Form 1040-C or for underpaying the tax liability.

Q: Can I e-file Form 1040-C?

A: No, you cannot e-file Form 1040-C. It must be filed by mail.

Q: Is Form 1040-C only for U.S. citizens?

A: No, Form 1040-C is specifically for nonresident aliens.

Q: What happens if I don't have any U.S. source income?

A: If you don't have any U.S. source income, you usually do not need to file Form 1040-C.

Form Details:

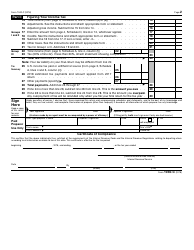

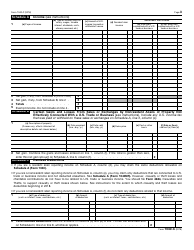

- A 4-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 1040-C through the link below or browse more documents in our library of IRS Forms.