This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 1040-C

for the current year.

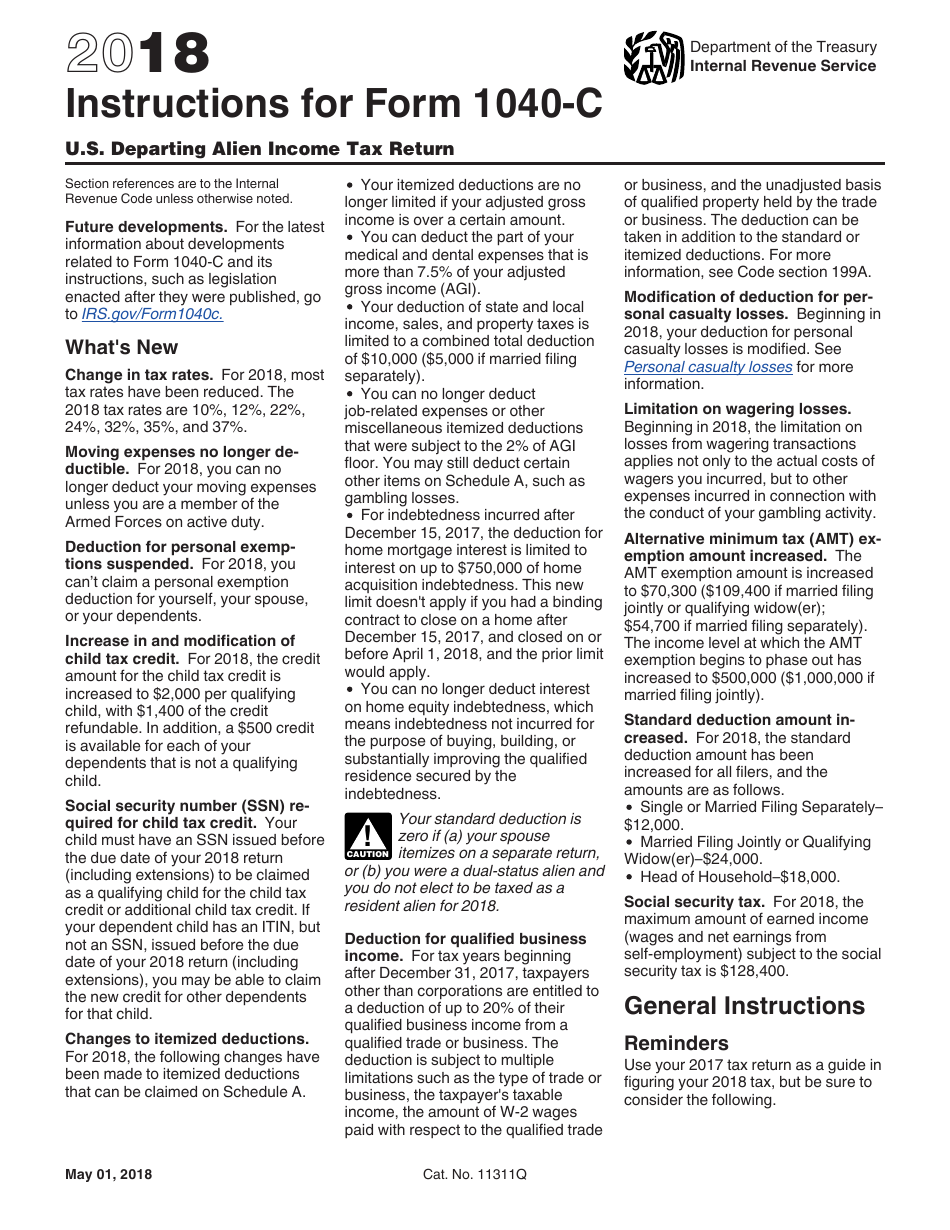

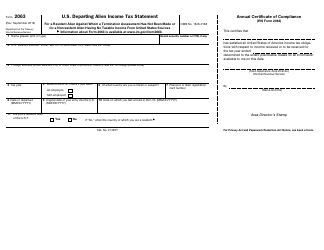

Instructions for IRS Form 1040-C U.S. Departing Alien Income Tax Return

This document contains official instructions for IRS Form 1040-C , U.S. Departing Alien Income Tax Return - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 1040-C is available for download through this link.

FAQ

Q: What is IRS Form 1040-C?

A: IRS Form 1040-C is the U.S. Departing Alien Income Tax Return.

Q: Who needs to file IRS Form 1040-C?

A: Nonresident aliens who are leaving the United States and have income from U.S. sources need to file Form 1040-C.

Q: What is the purpose of IRS Form 1040-C?

A: The purpose of Form 1040-C is to report and pay any income tax due on income earned in the United States by nonresident aliens who are leaving the country.

Q: When is IRS Form 1040-C due?

A: Form 1040-C is due on the date of departure from the United States.

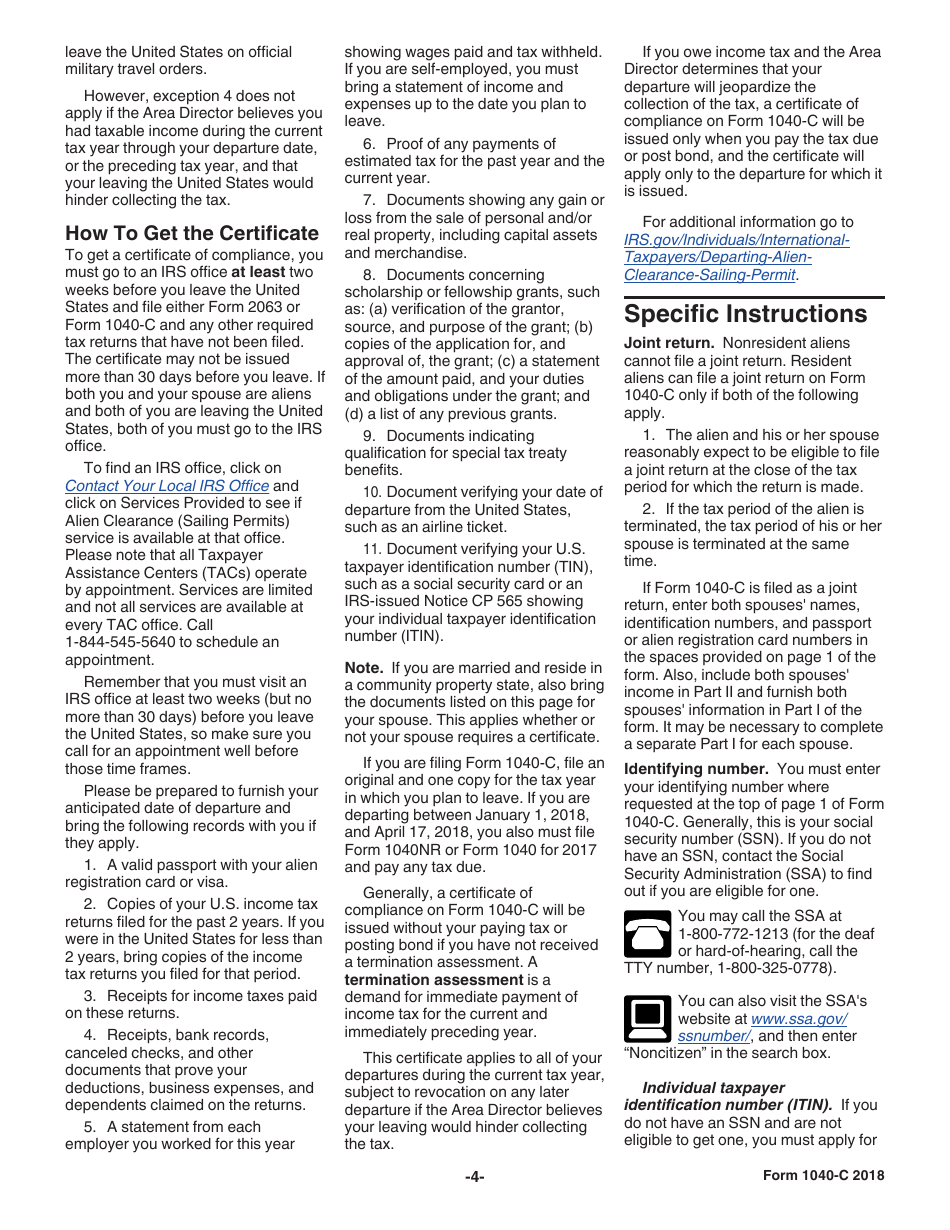

Q: How do I file IRS Form 1040-C?

A: Form 1040-C should be filed with the Internal Revenue Service (IRS) at the time of departure. Consult the instructions for details on where to file.

Q: What documentation is required for IRS Form 1040-C?

A: Nonresident aliens must attach a copy of their U.S. visa or departure permit to Form 1040-C.

Q: What happens if I don't file IRS Form 1040-C?

A: Failure to file Form 1040-C may result in penalties and interest on any unpaid tax liability.

Q: Can I e-file IRS Form 1040-C?

A: No, you cannot e-file Form 1040-C. It must be filed on paper.

Q: Is IRS Form 1040-C the same as Form 1040?

A: No, Form 1040-C is specifically for nonresident aliens who are leaving the United States. Form 1040 is the U.S. Individual Income Tax Return for resident aliens and U.S. citizens.

Q: Are there any special rules for filing IRS Form 1040-C?

A: Yes, there are special rules for deductions, exemptions, and credits for nonresident aliens. Consult the instructions for more information.

Instruction Details:

- This 10-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.