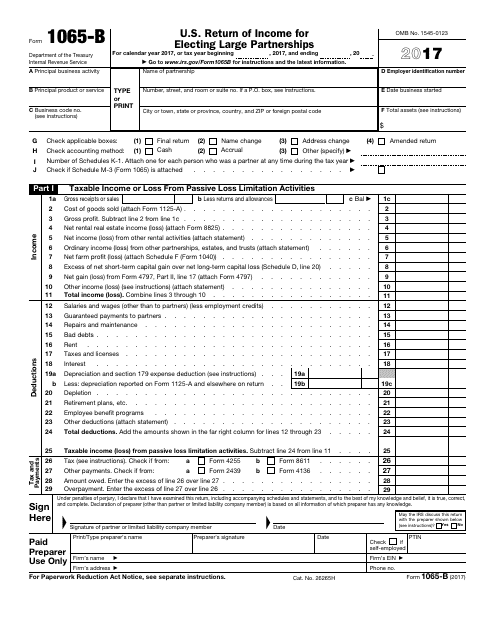

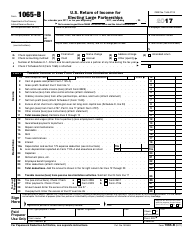

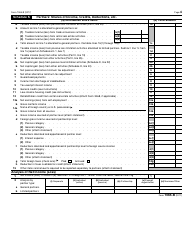

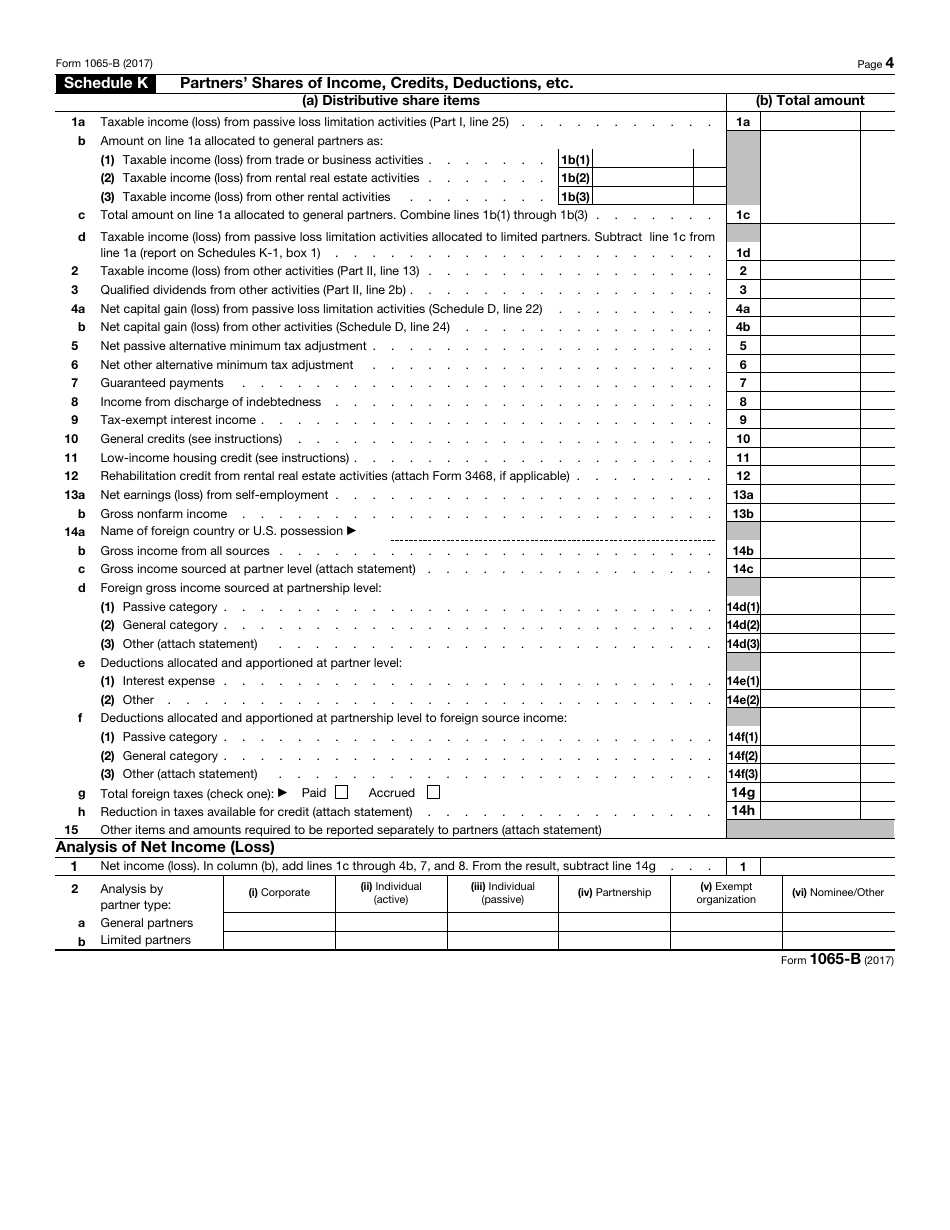

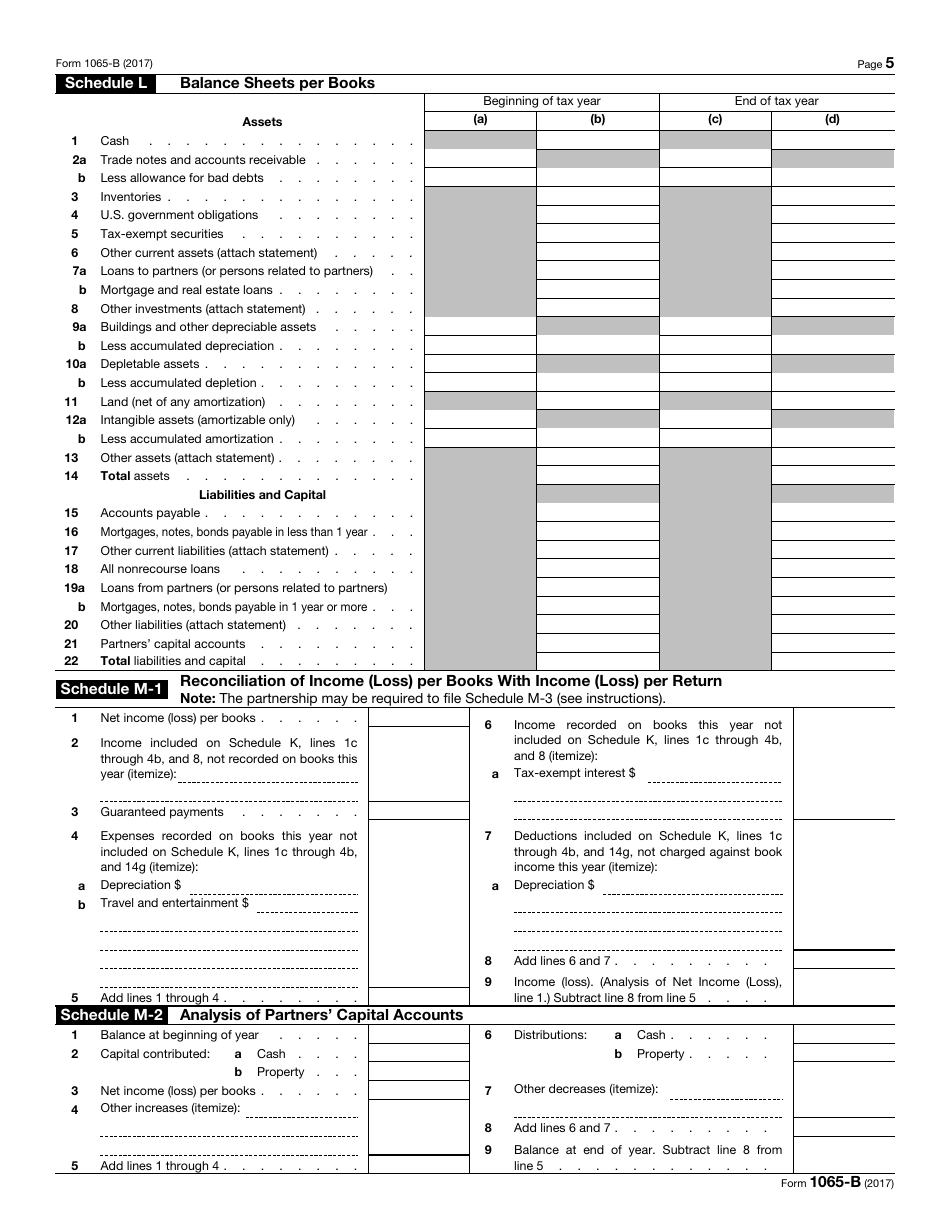

IRS Form 1065-B U.S. Return of Income for Electing Large Partnerships

What Is Form 1065-B?

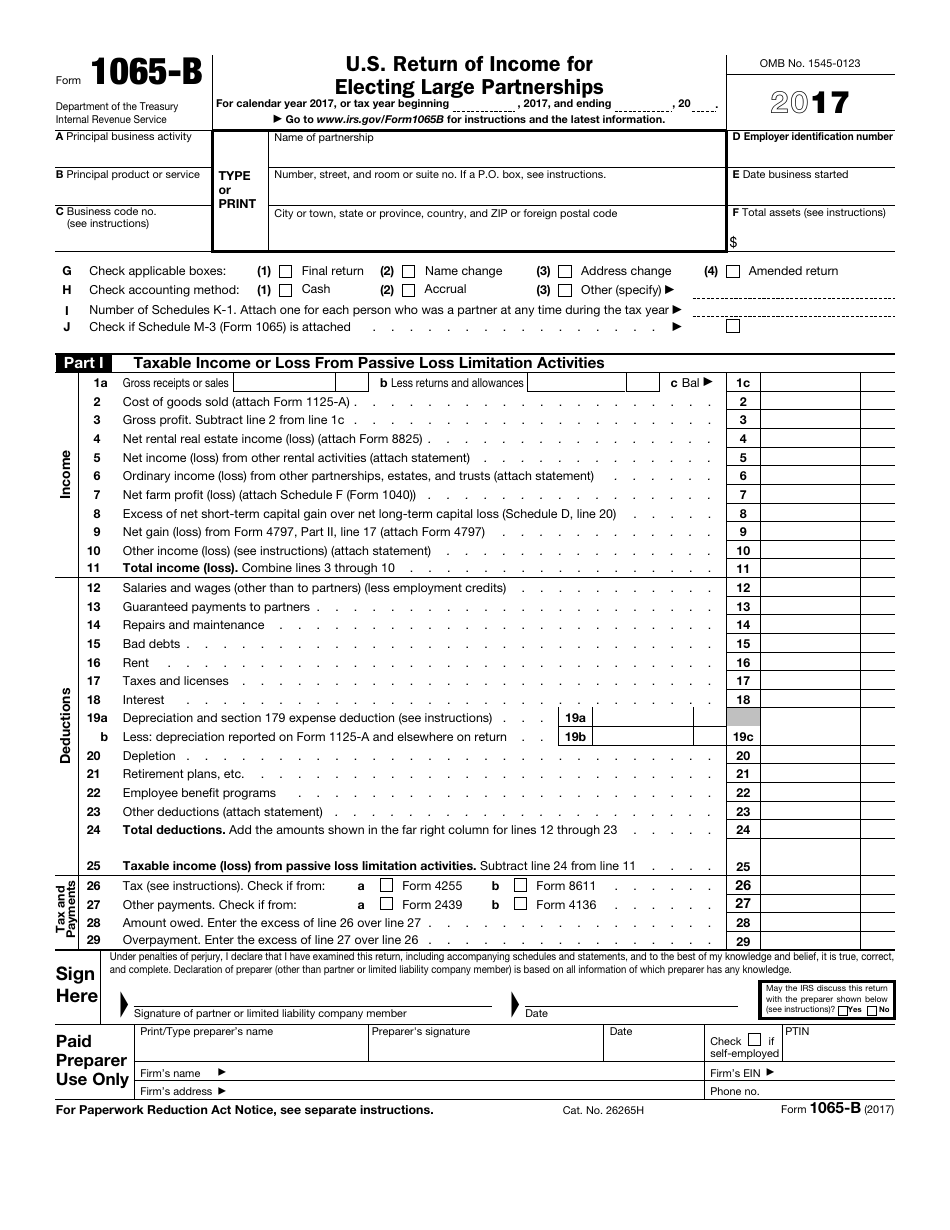

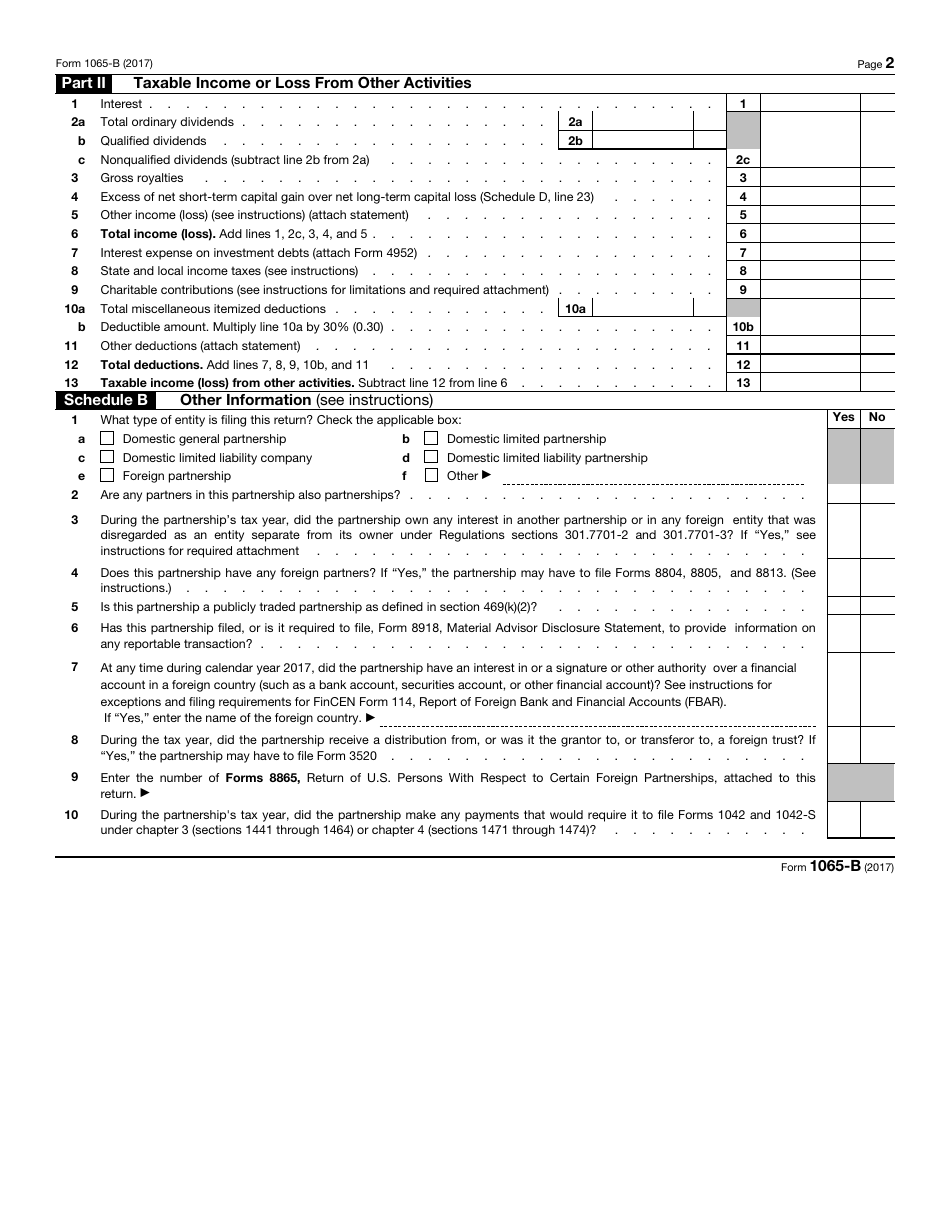

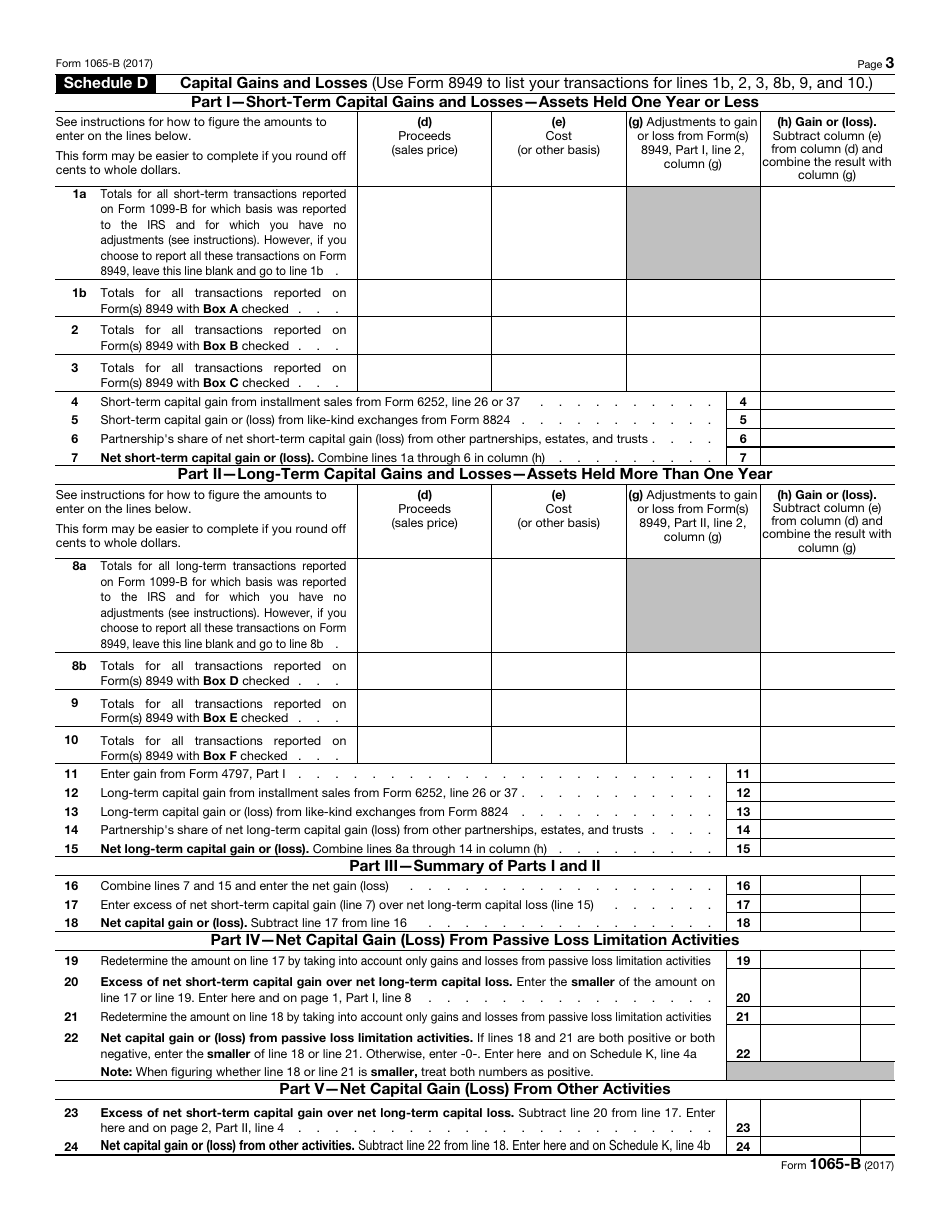

IRS Form 1065-B, U.S. Return of Income for Electing Large Partnerships, is a document used to report to the Internal Revenue Service (IRS) the gains, losses, income, deductions, and other information from the electing large partnership's operation. The latest version of the form was released 2017 with all previous editions obsolete. A fillable 1065-B Form is available for download below.

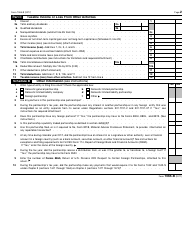

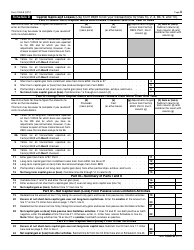

To comply with the IRS 1065-B Form filing requirements, you must file it with certain schedules. Schedule F (Profit or Loss from Farming) must be filed if the partnership is engaged in the business of farming. Schedule K-1 (Partner's Share of Income, Deductions, Credits, Etc.) is used to report each partner's separate share of the partnership's income, deductions, and credits.

IRS Form 1065, U.S. Return of Partnership Income, is the main form in the IRS 1065 Form series used by the IRS to receive information on income, credits, deductions, gains, losses, and other data connected to the operation of the partnership.

IRS Form 1065X, Amended Return or Administrative Adjustment Request (AAR), is a form used to correct information on Form 1065, Form 1065-B, or Form 1066, U.S. Real Estate Mortgage Investment Conduit (REMIC) Income Tax Return, that were already filed. If you wish, you can make an AAR to change the disclosure of the items regarding the partnership.

What Is an Electing Large Partnership?

An electing large partnership (ELP) is any partnership that has 100 or more partners in the preceding taxable year and elected the application of this status, and as a result, an ELP chooses to file this form instead of IRS Form 1065. Only individuals that directly hold partnership interests, including persons that hold through nominees, can be counted as partners. Service partners (partners performing substantial services connected with the partnership's operation) are not eligible to be partners. Commodity partnerships (partnerships that have as their principal activity the buying and selling of commodities) are also not eligible to make the election. The election is applied to the tax year for which it is made and it cannot be revoked without IRS consent.

Form 1065-B Instructions

Official Step-by-step Form 1065-B instructions can be downloaded by clicking this link. Basic Form 1065-B instructions are as follows:

- You must file the form by the 15th day of the 3rd month after the date the tax year has ended;

- The late filing penalty is $200 for each month or part of the month the failure continues, multiplied by the number of partners;

- ELPs must file the form electronically unless they submit bankruptcy returns or returns with prefigured interest and penalty. Visit the IRS official website to find more information on electronic filing;

- If the partnership is located in the U.S., send the form to the Department of the Treasury, Internal Revenue Service Center, Ogden, UT 84201-0007. If it is located in a foreign country or in U.S. possession, send it to the Internal Revenue Service Center, PO Box 409101, Ogden, UT 84409;

- The form must be signed by the partner or the limited liability company member.