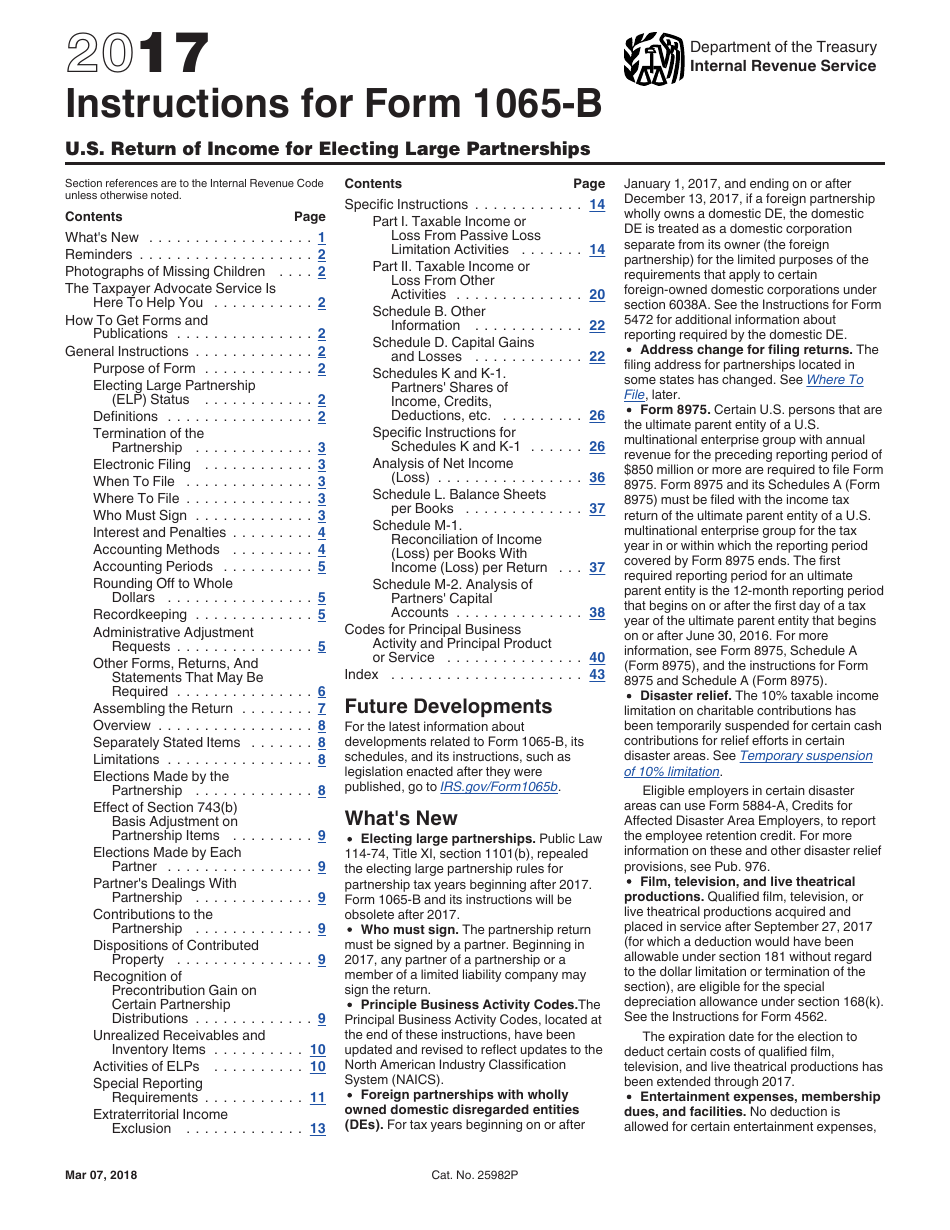

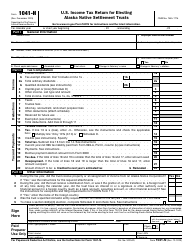

Instructions for IRS Form 1065-B U.S. Return of Income for Electing Large Partnerships

This document contains official instructions for IRS Form 1065-B , U.S. Return of Income for Electing Large Partnerships - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 1065-B is available for download through this link.

FAQ

Q: What is IRS Form 1065-B?

A: IRS Form 1065-B is the U.S. Return of Income for Electing Large Partnerships.

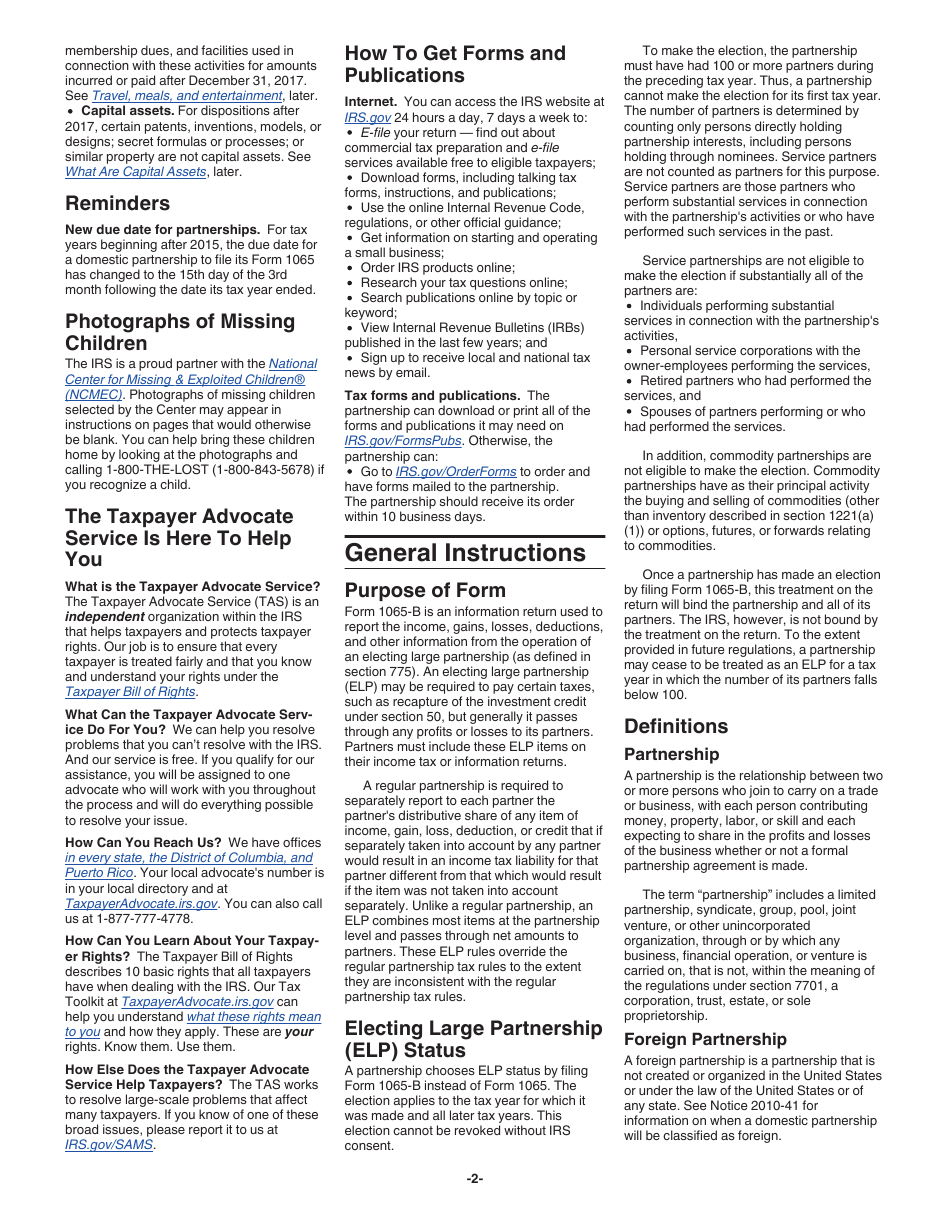

Q: Who needs to file IRS Form 1065-B?

A: Electing large partnerships need to file IRS Form 1065-B.

Q: What is an electing large partnership?

A: An electing large partnership is a partnership with 100 or more partners, where each partner is an eligible partner.

Q: What is an eligible partner?

A: An eligible partner is an individual, a C corporation, an S corporation, or an estate of a deceased partner.

Q: How do I file IRS Form 1065-B?

A: You can file IRS Form 1065-B by mail or electronically.

Q: When is the deadline to file IRS Form 1065-B?

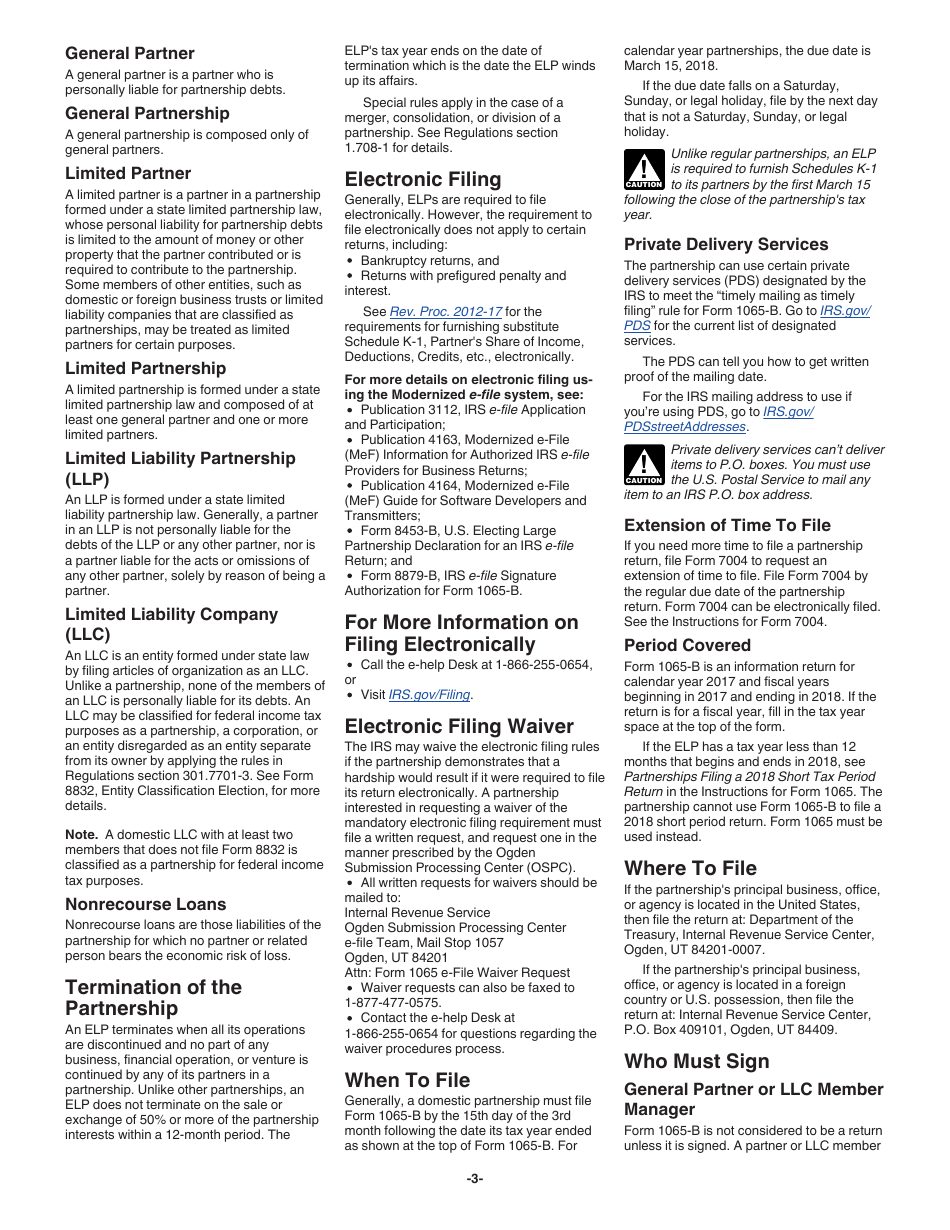

A: The deadline to file IRS Form 1065-B is usually March 15th, or the 15th day of the third month following the close of the partnership's tax year.

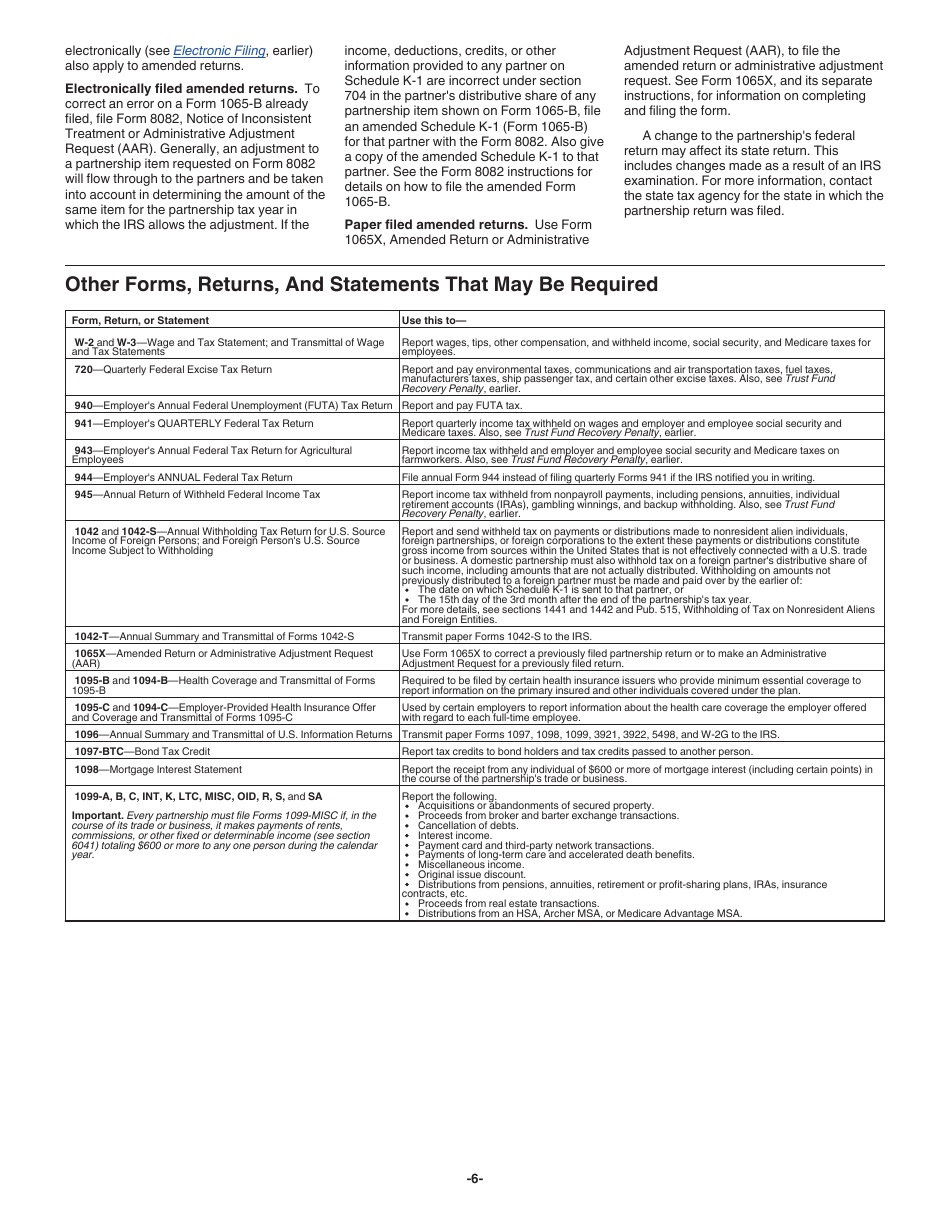

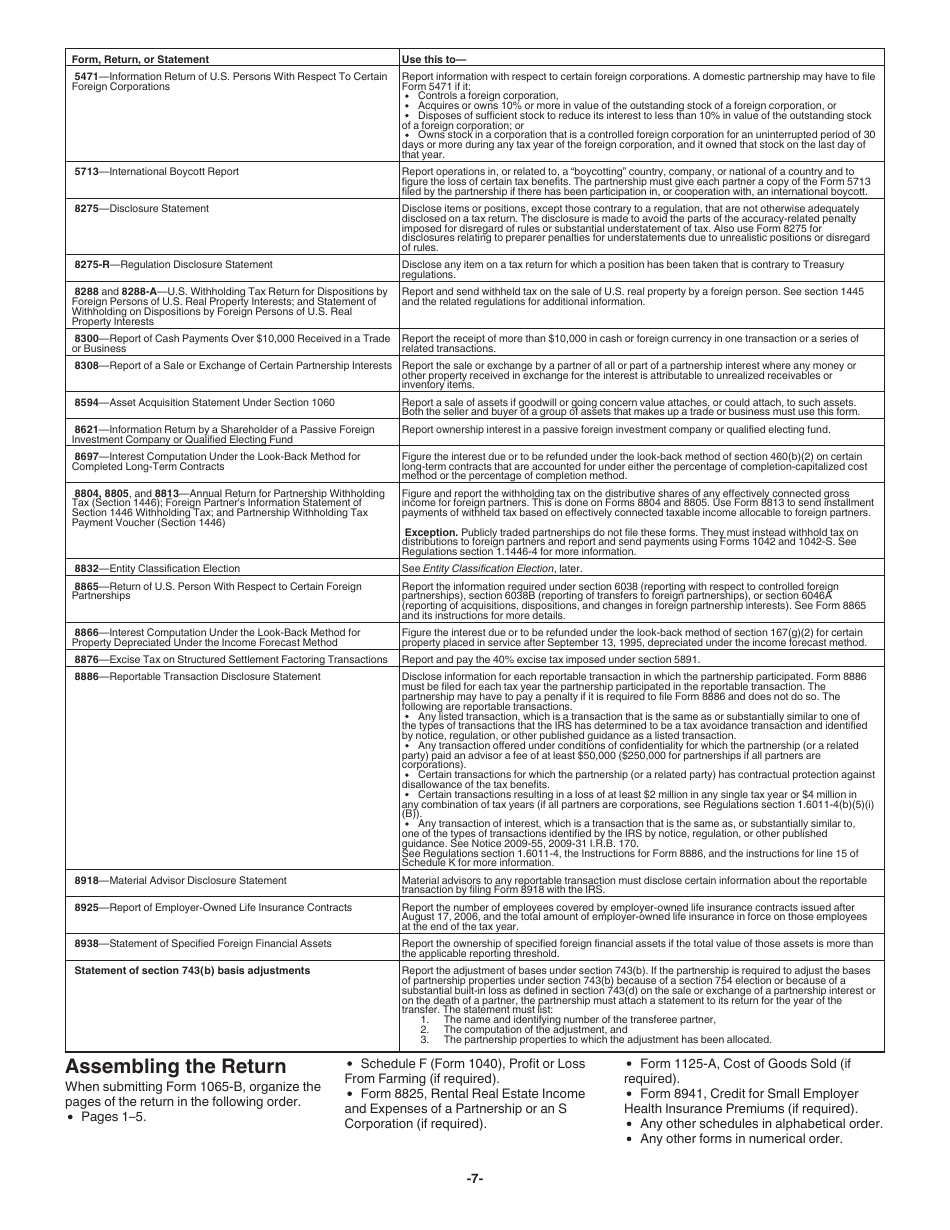

Q: What information needs to be reported on IRS Form 1065-B?

A: IRS Form 1065-B requires reporting of the partnership's income, deductions, credits, and other information.

Q: Are there any penalties for not filing IRS Form 1065-B?

A: Yes, there are penalties for not filing IRS Form 1065-B, including late filing penalties and accuracy-related penalties.

Q: Can I request an extension to file IRS Form 1065-B?

A: Yes, you can request an extension to file IRS Form 1065-B using Form 7004.

Instruction Details:

- This 43-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.