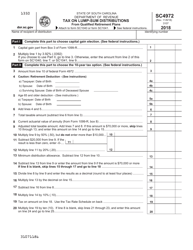

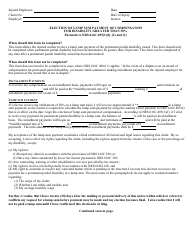

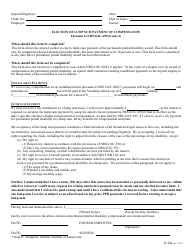

Form LS WKS Ohio Lump Sum Retirement / Distribution Credit Worksheet - Ohio

What Is Form LS WKS?

This is a legal form that was released by the Ohio Department of Taxation - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

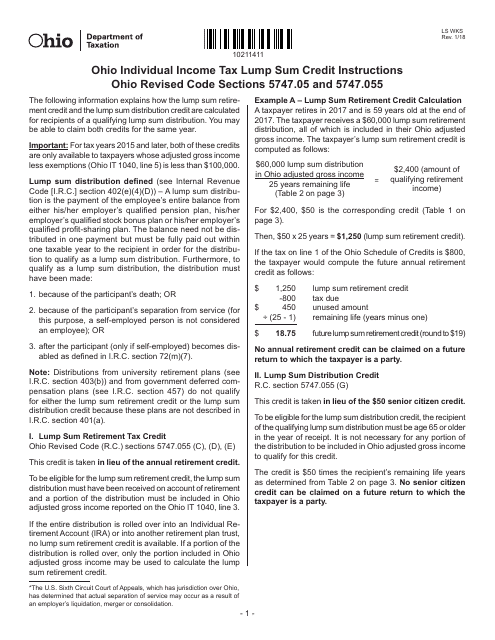

Q: What is the LS WKS Ohio Lump Sum Retirement/Distribution Credit Worksheet?

A: The LS WKS Ohio Lump Sum Retirement/Distribution Credit Worksheet is a form used in Ohio to calculate the tax credit for lump sum retirement or distribution income.

Q: What is the purpose of the LS WKS Ohio Lump Sum Retirement/Distribution Credit Worksheet?

A: The purpose of the LS WKS Ohio Lump Sum Retirement/Distribution Credit Worksheet is to determine the amount of tax credit that can be claimed on lump sum retirement or distribution income.

Q: Who needs to fill out the LS WKS Ohio Lump Sum Retirement/Distribution Credit Worksheet?

A: Ohio residents who have received a lump sum retirement or distribution income need to fill out the LS WKS Ohio Lump Sum Retirement/Distribution Credit Worksheet.

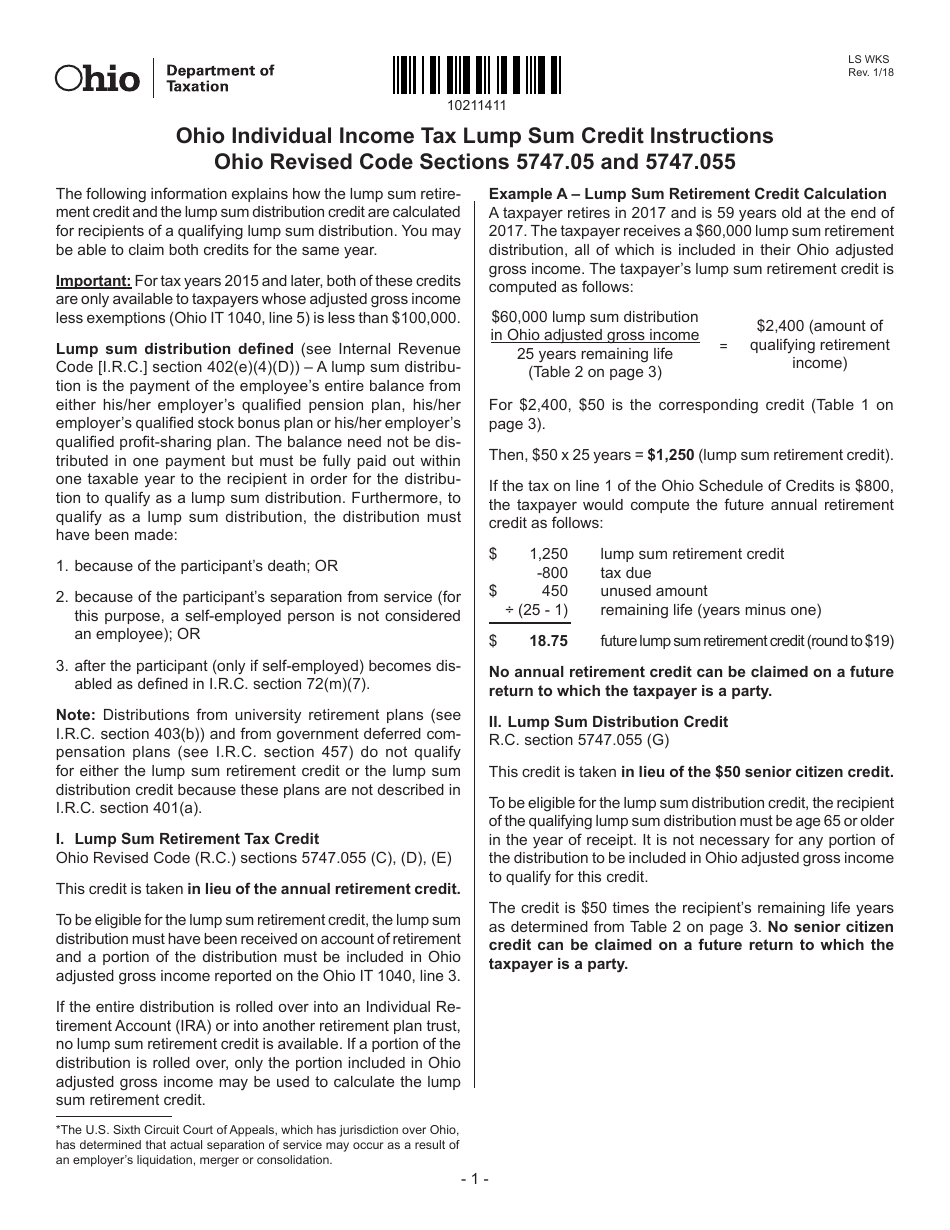

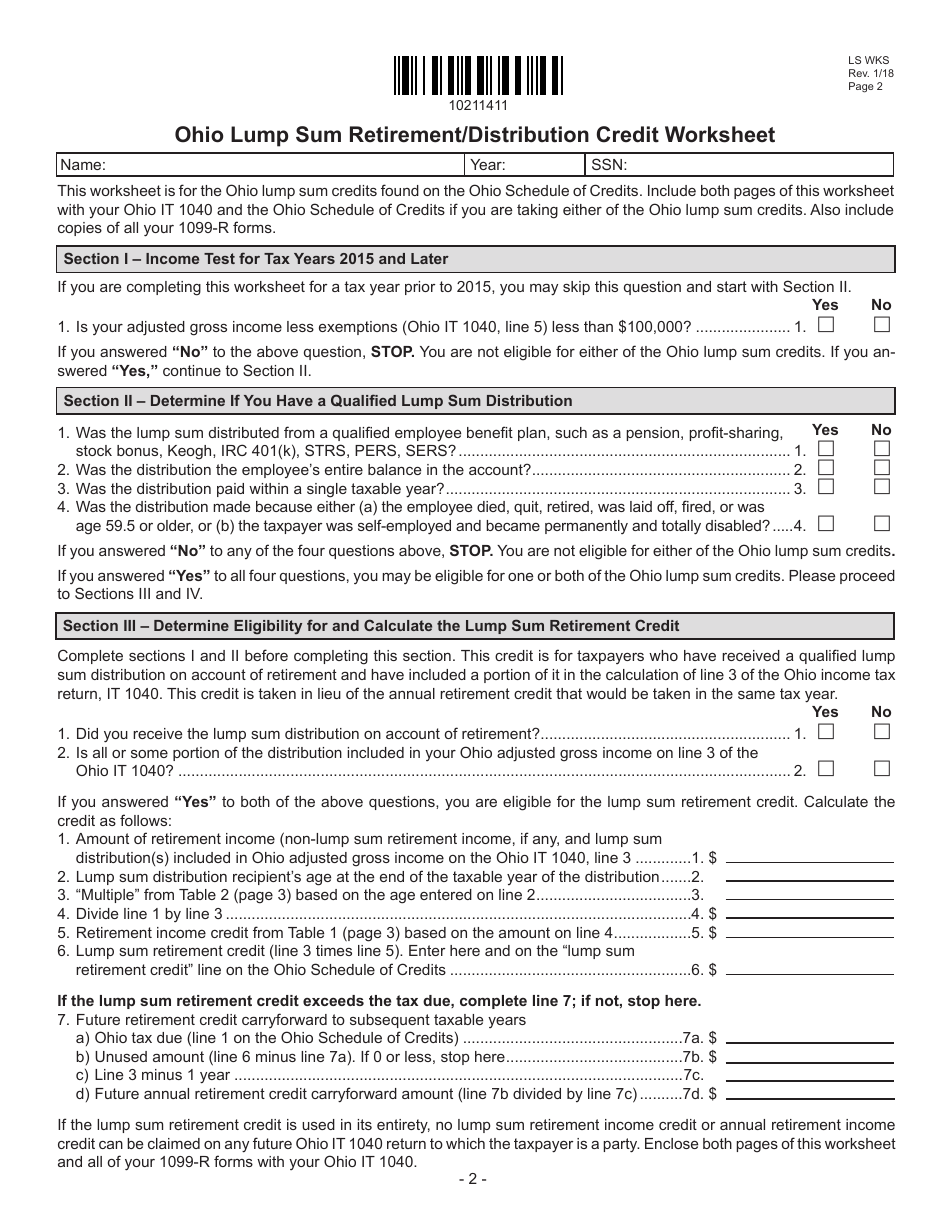

Q: How do I fill out the LS WKS Ohio Lump Sum Retirement/Distribution Credit Worksheet?

A: Follow the instructions on the worksheet to fill out the necessary information, including the amount of the lump sum retirement or distribution income and any other relevant details.

Q: What happens after I fill out the LS WKS Ohio Lump Sum Retirement/Distribution Credit Worksheet?

A: After filling out the LS WKS Ohio Lump Sum Retirement/Distribution Credit Worksheet, you will have calculated the tax credit amount that you can claim on your Ohio state tax return.

Q: Is the LS WKS Ohio Lump Sum Retirement/Distribution Credit Worksheet specific to Ohio?

A: Yes, the LS WKS Ohio Lump Sum Retirement/Distribution Credit Worksheet is specific to Ohio and is used to calculate the tax credit for lump sum retirement or distribution income in Ohio.

Q: Are there any eligibility requirements to claim the tax credit using the LS WKS Ohio Lump Sum Retirement/Distribution Credit Worksheet?

A: Yes, there may be eligibility requirements to claim the tax credit using the LS WKS Ohio Lump Sum Retirement/Distribution Credit Worksheet. It is recommended to review the instructions and guidelines provided with the worksheet to determine if you qualify.

Q: Can I claim the tax credit for lump sum retirement or distribution income in Ohio without using the LS WKS Ohio Lump Sum Retirement/Distribution Credit Worksheet?

A: No, the LS WKS Ohio Lump Sum Retirement/Distribution Credit Worksheet is required to calculate and claim the tax credit for lump sum retirement or distribution income in Ohio.

Form Details:

- Released on January 1, 2018;

- The latest edition provided by the Ohio Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form LS WKS by clicking the link below or browse more documents and templates provided by the Ohio Department of Taxation.