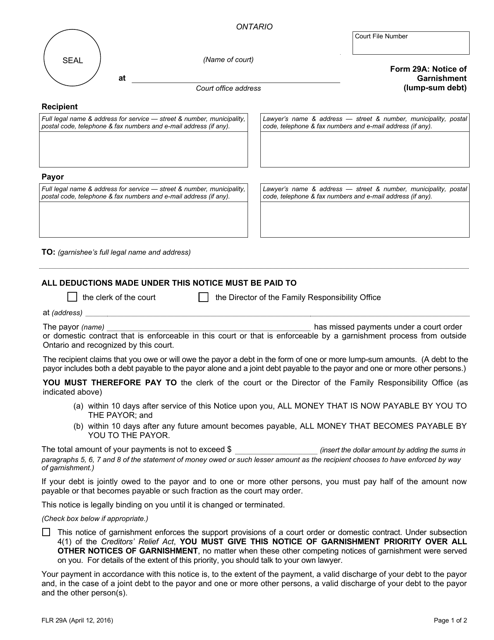

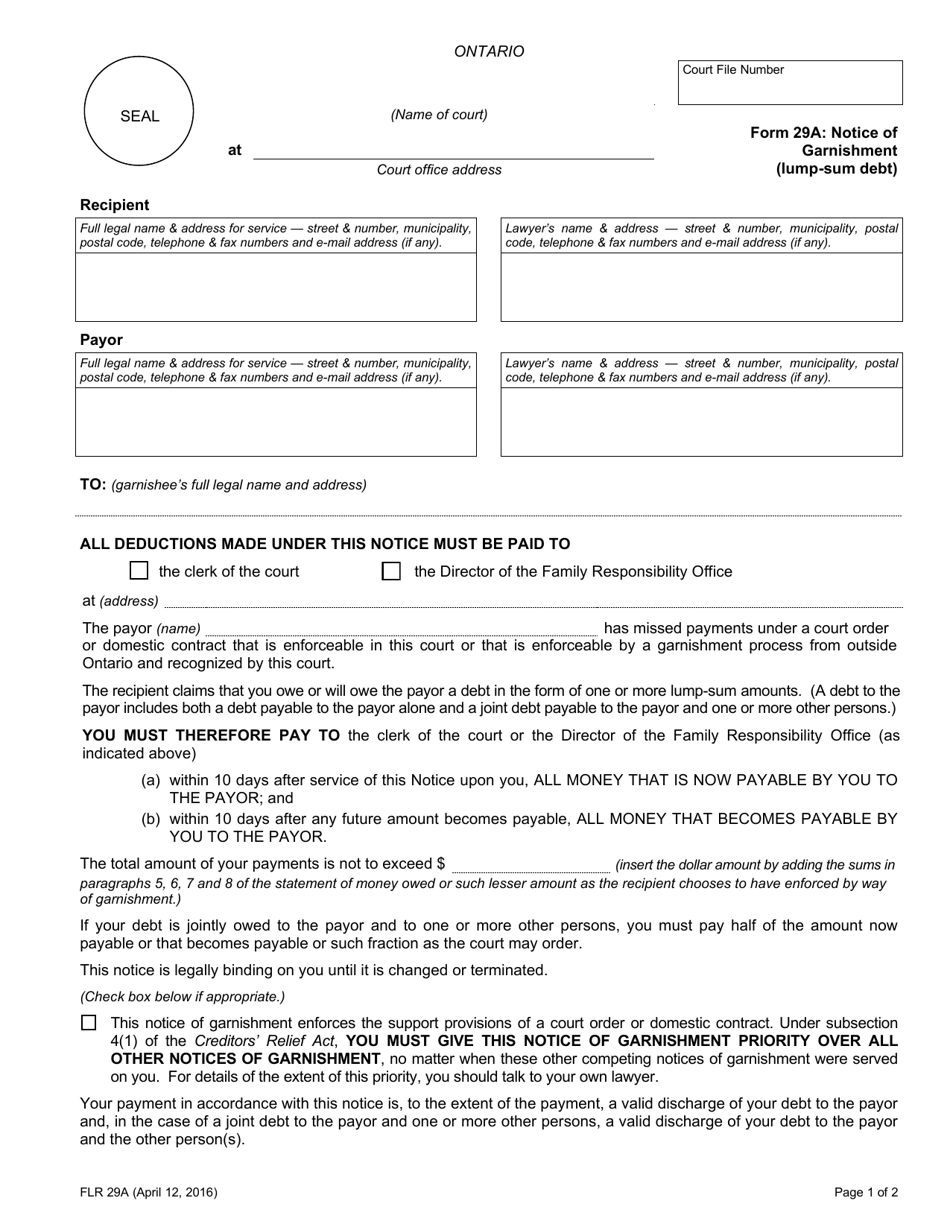

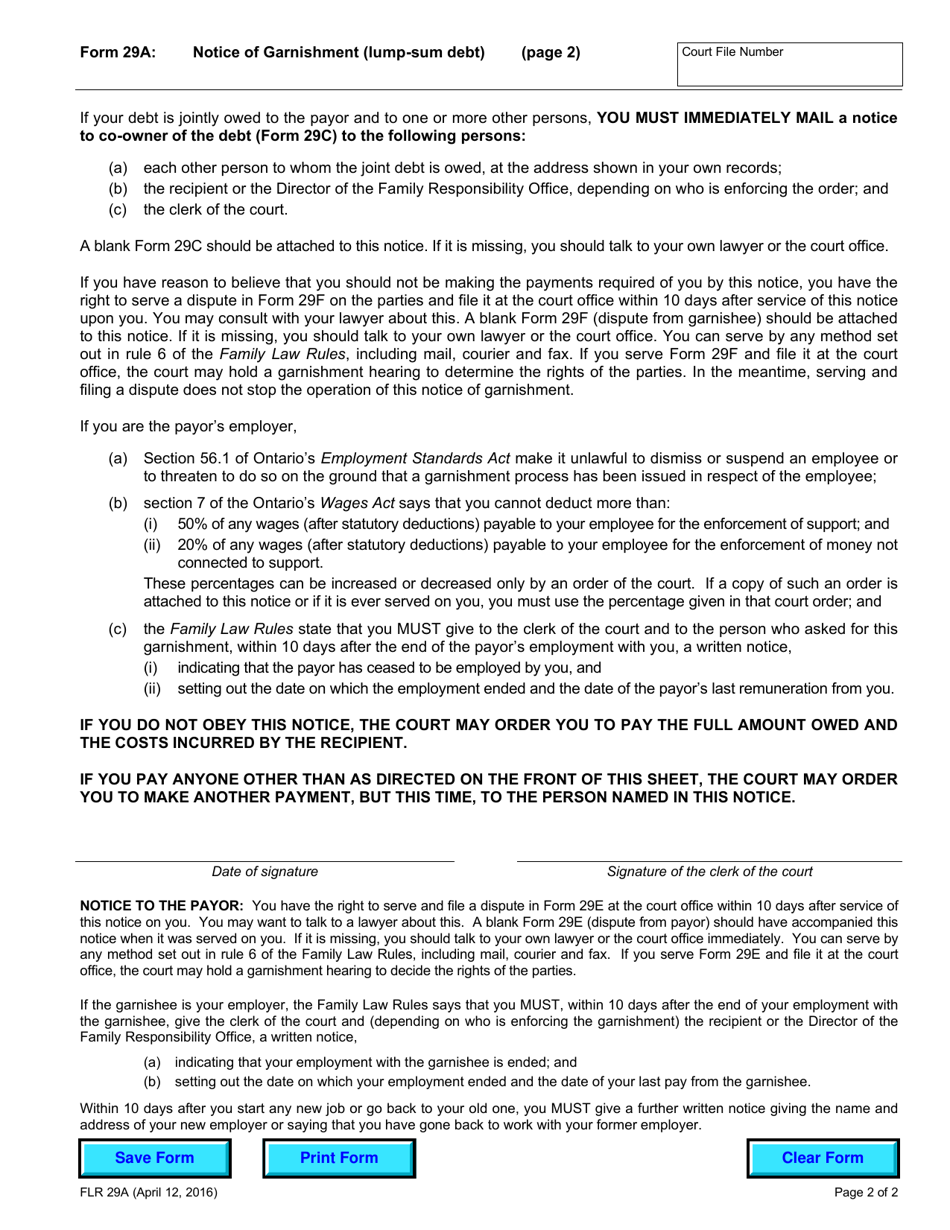

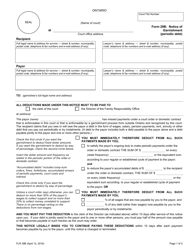

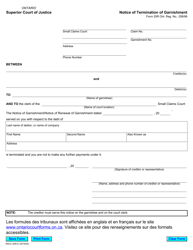

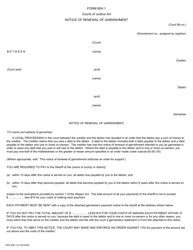

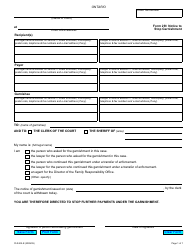

Form 29A Notice of Garnishment (Lump-Sum Debt) - Ontario, Canada

Form 29A Notice of Garnishment (Lump-Sum Debt) in Ontario, Canada is used to notify an employer or other garnishee that a lump-sum payment is owed to a debtor, and that a portion of that payment should be withheld and paid towards the debtor's outstanding debt.

The creditor files the Form 29A Notice of Garnishment (Lump-Sum Debt) in Ontario, Canada.

FAQ

Q: What is Form 29A?

A: Form 29A is a Notice of Garnishment (Lump-Sum Debt) used in Ontario, Canada.

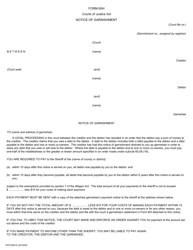

Q: When is Form 29A used?

A: Form 29A is used when a lump-sum debt is owed and a creditor wants to garnish the debtor's wages.

Q: What is a Notice of Garnishment?

A: A Notice of Garnishment is a legal document that allows a creditor to collect money from a debtor's wages to satisfy a debt.

Q: Who can use Form 29A?

A: Form 29A can be used by creditors who have obtained a judgment or order for payment of a debt.

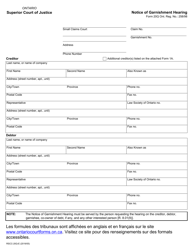

Q: What information is required on Form 29A?

A: Form 29A requires the creditor to provide information about the debtor, the employer, and the amount of the debt.

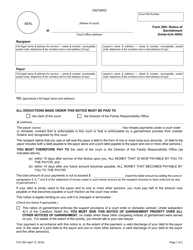

Q: How is Form 29A served?

A: Form 29A must be served on the debtor's employer in order to initiate the garnishment process.

Q: What happens after Form 29A is served?

A: Once Form 29A is served, the employer is required to deduct a portion of the debtor's wages and send it to the creditor until the debt is paid off.

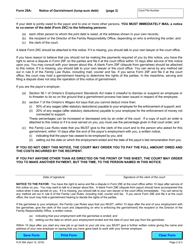

Q: Can the debtor dispute a Notice of Garnishment?

A: Yes, the debtor has the right to dispute a Notice of Garnishment by filing a Motion to Set Aside the garnishment order.

Q: What are the consequences of ignoring a Notice of Garnishment?

A: Ignoring a Notice of Garnishment can lead to further legal action and enforcement measures, such as seizing assets or freezing bank accounts.

Q: Is Form 29A specific to Ontario, Canada?

A: Yes, Form 29A is specific to Ontario, Canada and may have different variations in other provinces.