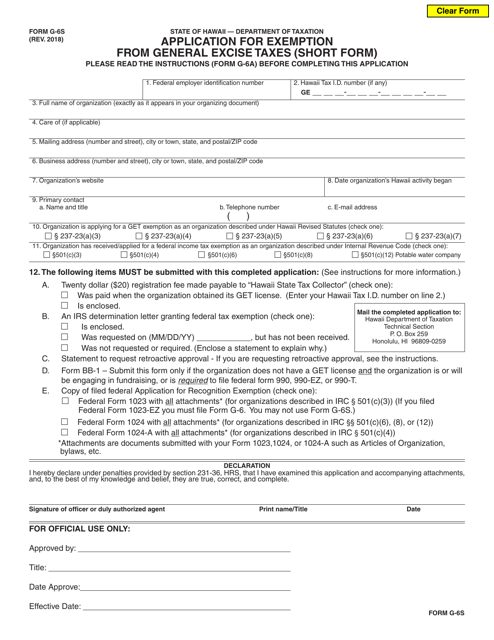

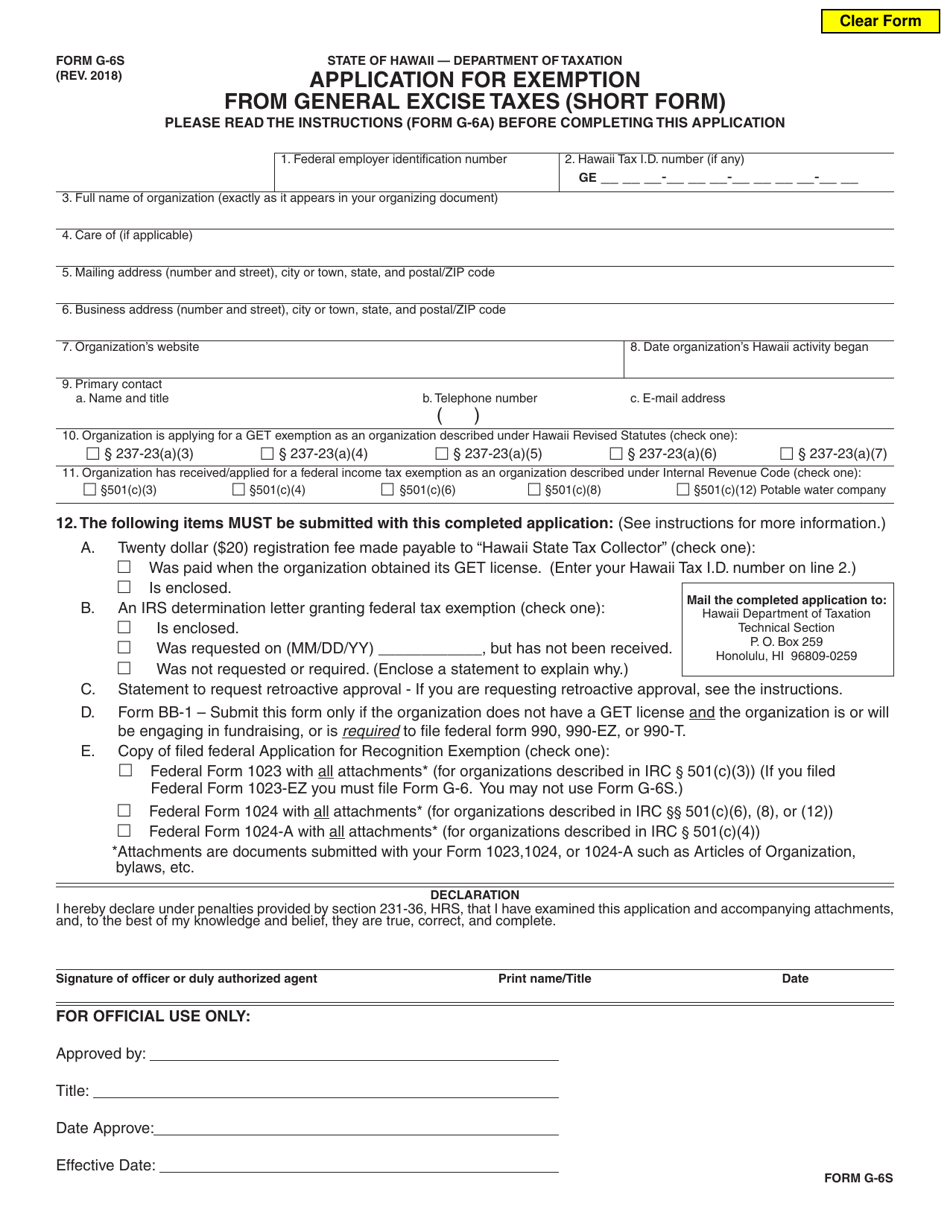

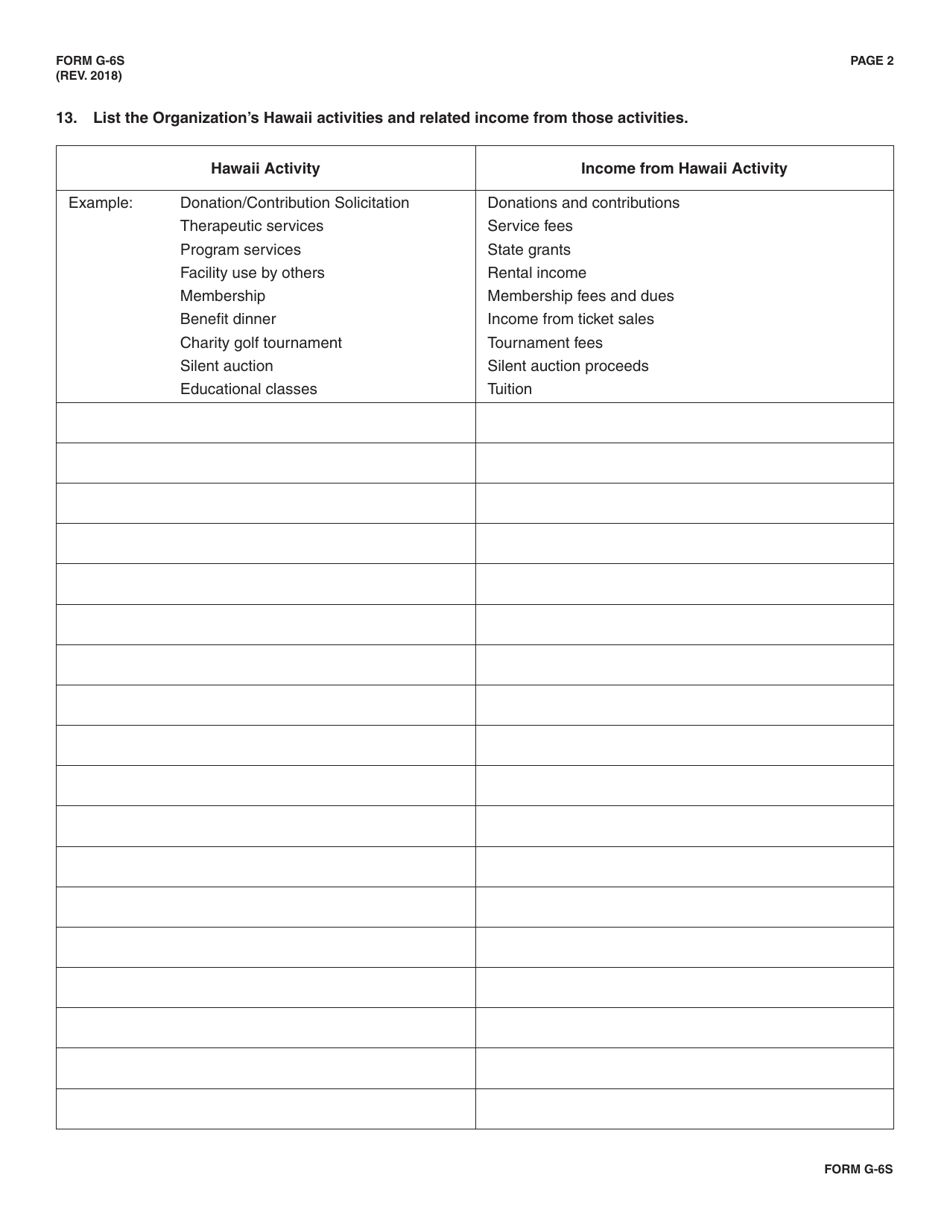

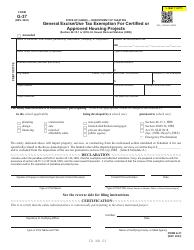

Form G-6S Application for Exemption From General Excise Taxes (Short Form) - Hawaii

What Is Form G-6S?

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form G-6S?

A: Form G-6S is the Application for Exemption From General Excise Taxes (Short Form) in Hawaii.

Q: Who needs to file Form G-6S?

A: Individuals and businesses in Hawaii who are seeking exemption from general excise taxes can file Form G-6S.

Q: What is the purpose of Form G-6S?

A: The purpose of Form G-6S is to apply for an exemption from general excise taxes in Hawaii.

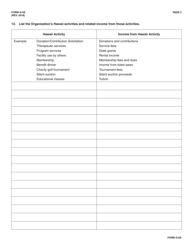

Q: What information do I need to provide on Form G-6S?

A: You will need to provide your personal or business information, details about your exemption eligibility, and any supporting documentation.

Q: Is there a fee to file Form G-6S?

A: No, there is no fee to file Form G-6S.

Q: When should I file Form G-6S?

A: You should file Form G-6S at least 30 days before the start of the exemption period you are applying for.

Q: What happens after I file Form G-6S?

A: After you file Form G-6S, the Hawaii Department of Taxation will review your application and notify you of their decision.

Q: How long does it take to process Form G-6S?

A: The processing time for Form G-6S can vary, but it typically takes several weeks to be reviewed and processed.

Form Details:

- Released on January 1, 2018;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form G-6S by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.