This version of the form is not currently in use and is provided for reference only. Download this version of

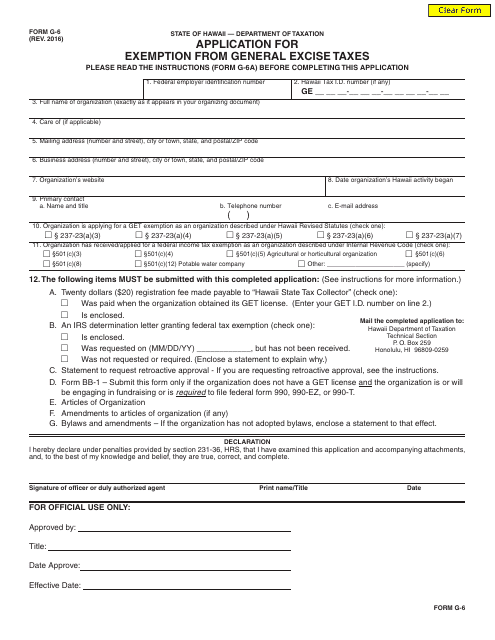

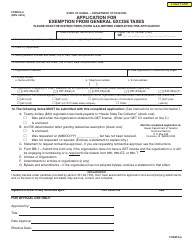

Form G-6

for the current year.

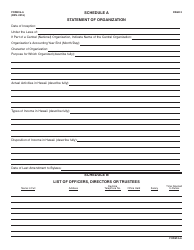

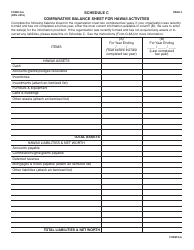

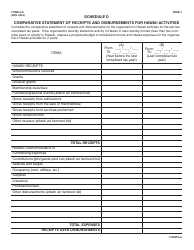

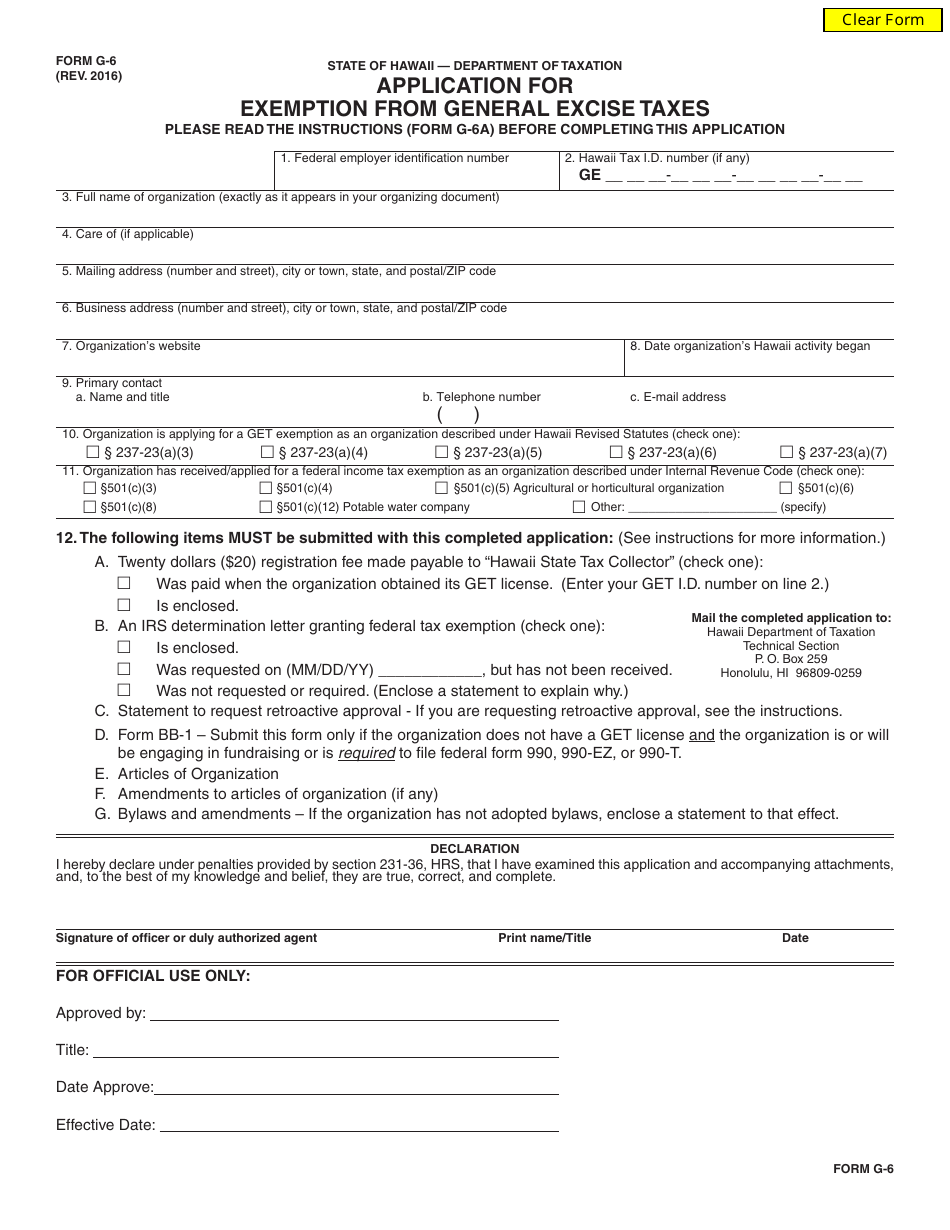

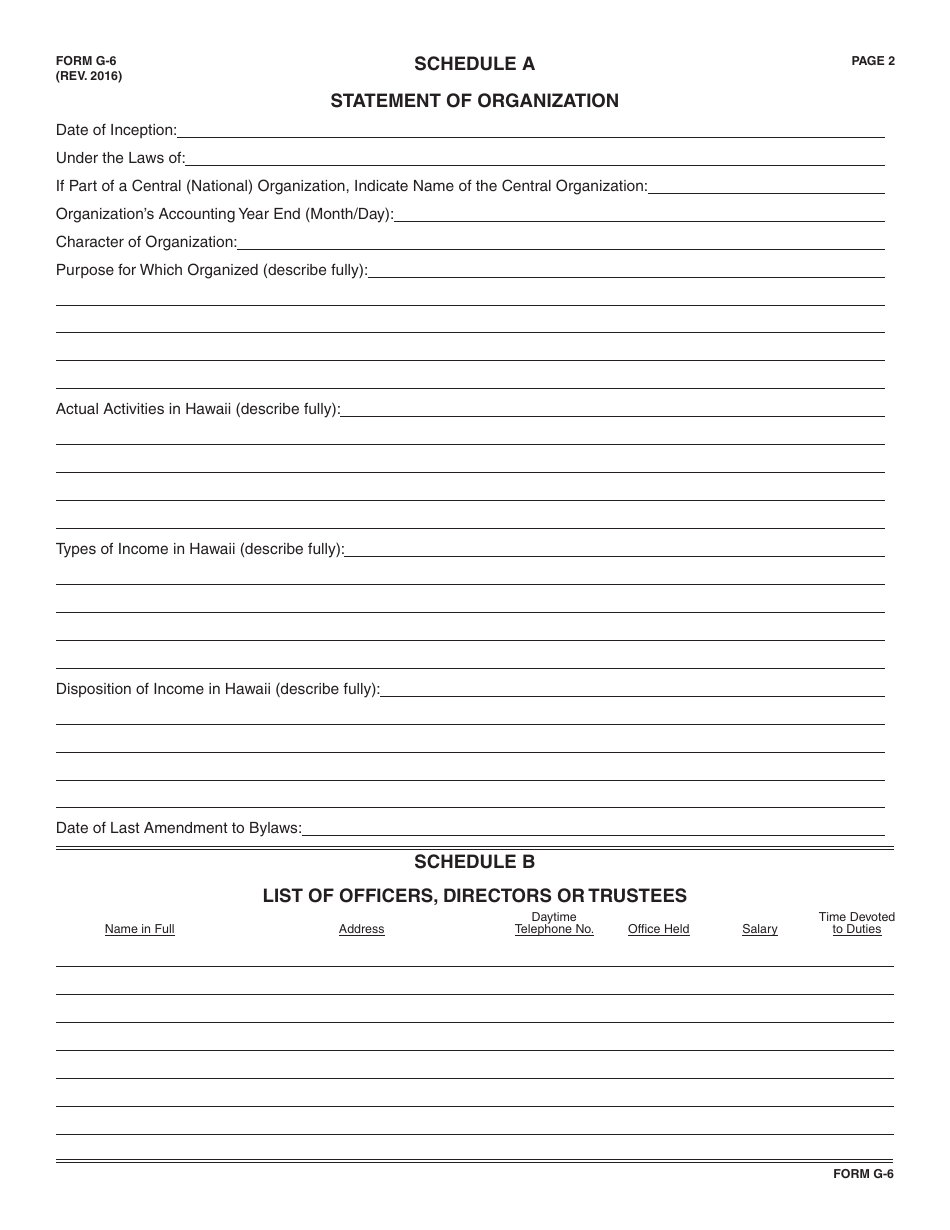

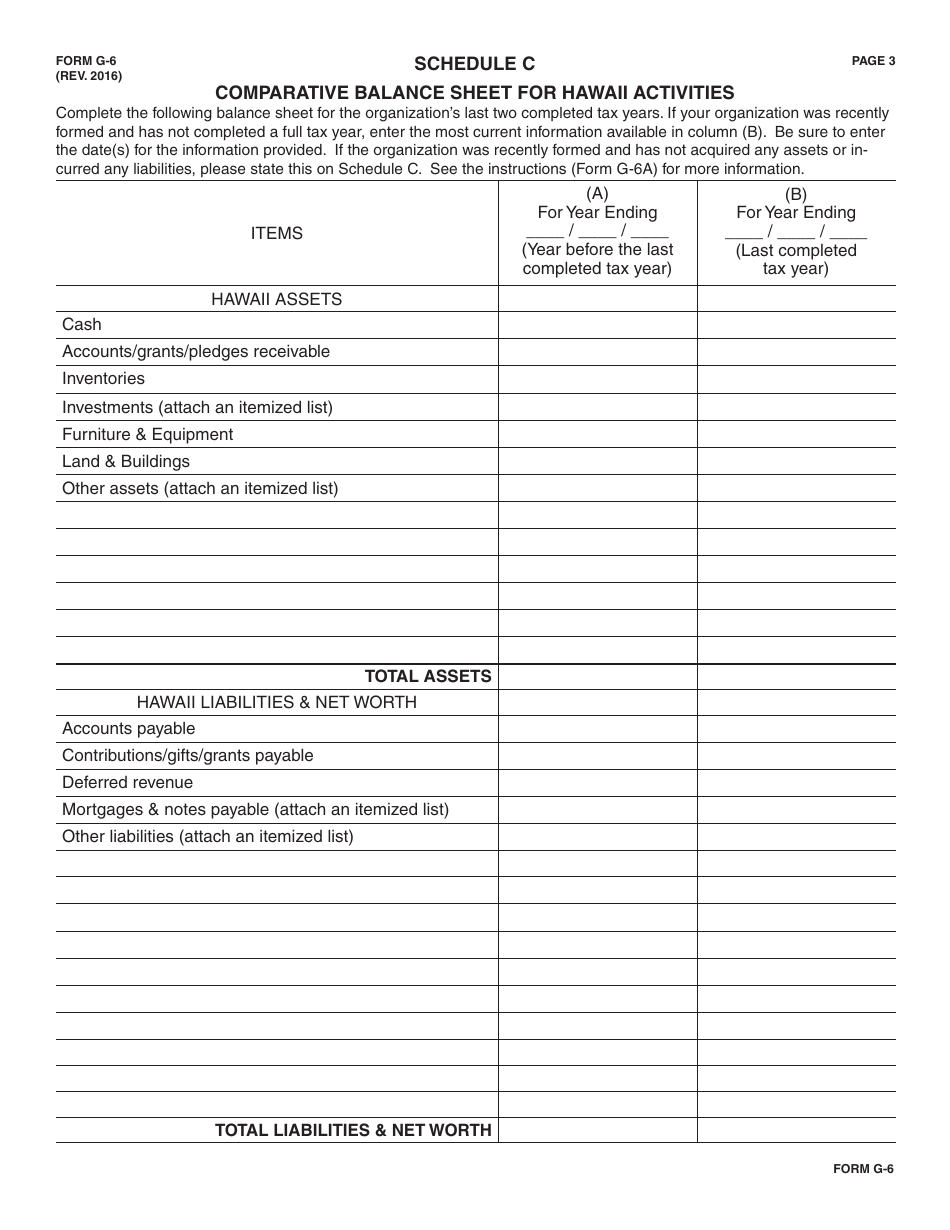

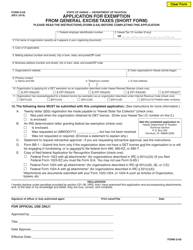

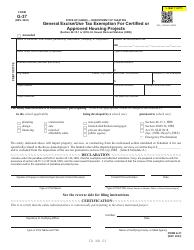

Form G-6 Application for Exemption From General Excise Taxes - Hawaii

What Is Form G-6?

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form G-6?

A: Form G-6 is an application for exemption from general excise taxes.

Q: What are general excise taxes?

A: General excise taxes are a type of tax imposed on most business activities in Hawaii.

Q: Who can use Form G-6?

A: Form G-6 can be used by individuals or organizations seeking exemption from general excise taxes.

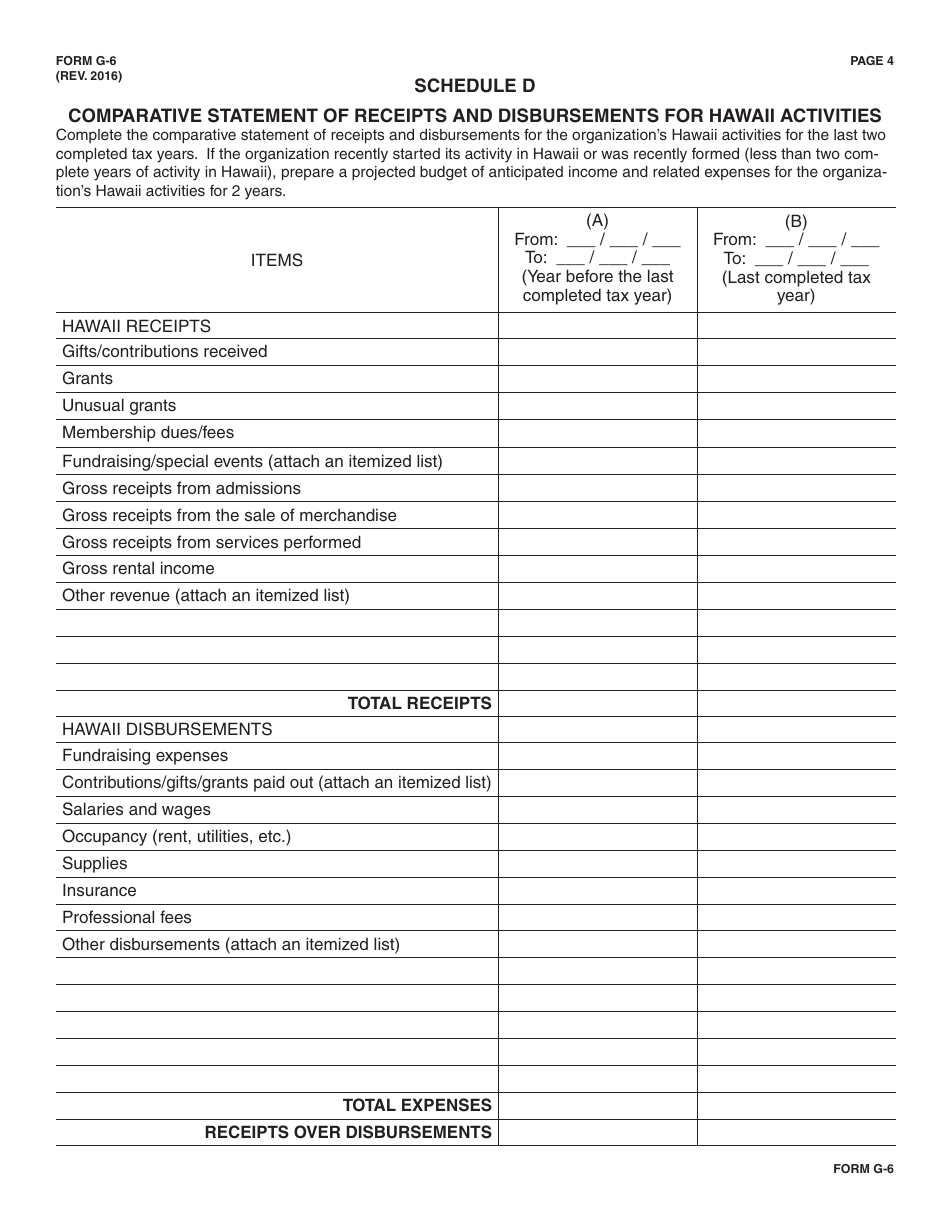

Q: What information is required on Form G-6?

A: Form G-6 requires information about the applicant's business or organization, the reason for seeking exemption, and supporting documentation.

Q: Is there a fee to submit Form G-6?

A: No, there is no fee to submit Form G-6.

Q: How long does it take to process Form G-6?

A: The processing time for Form G-6 varies, but it generally takes several weeks.

Q: Will I receive confirmation of my exemption?

A: If your application for exemption is approved, you will receive a Certificate of Exemption.

Q: Can I use my Certificate of Exemption for all transactions?

A: Yes, you can use your Certificate of Exemption for all qualifying exempt transactions in Hawaii.

Form Details:

- Released on January 1, 2016;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form G-6 by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.