This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 8863

for the current year.

Instructions for IRS Form 8863 Education Credits (American Opportunity and Lifetime Learning Credits)

This document contains official instructions for IRS Form 8863 , Education Credits (American Opportunity and Lifetime Learning Credits) - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury.

FAQ

Q: What is IRS Form 8863?

A: IRS Form 8863 is a form used to claim education credits - the American Opportunity Credit or the Lifetime Learning Credit.

Q: What are education credits?

A: Education credits are tax credits that can help individuals offset the cost of higher education expenses.

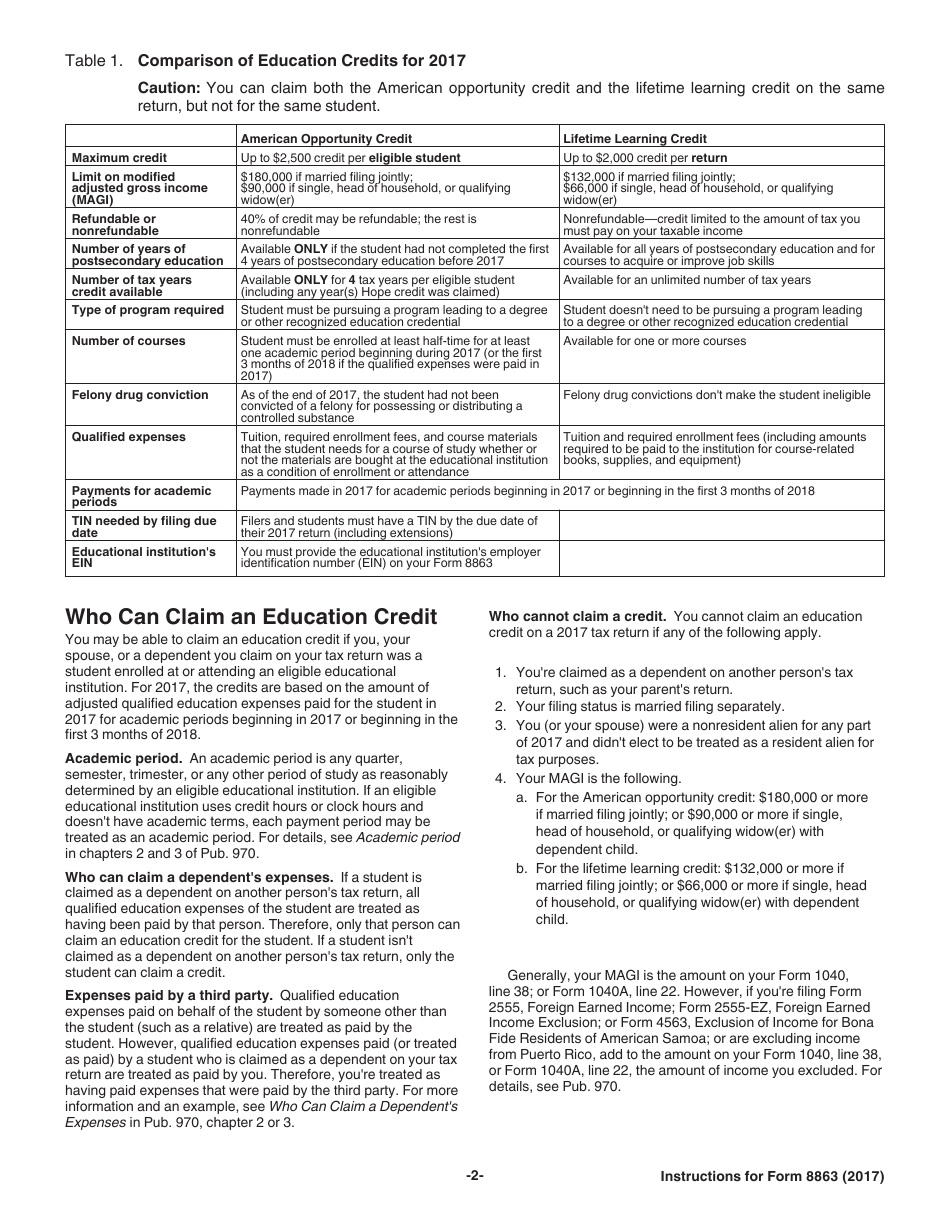

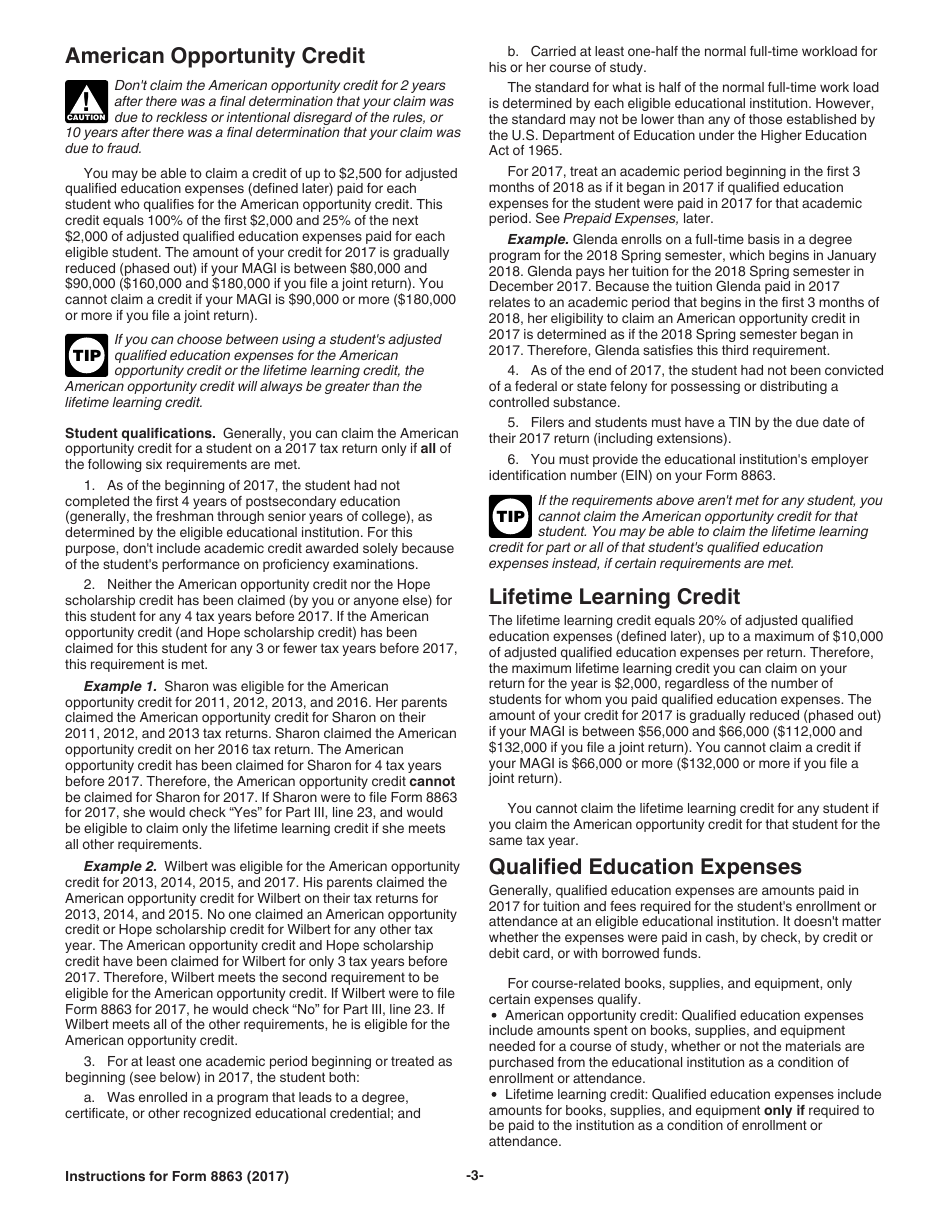

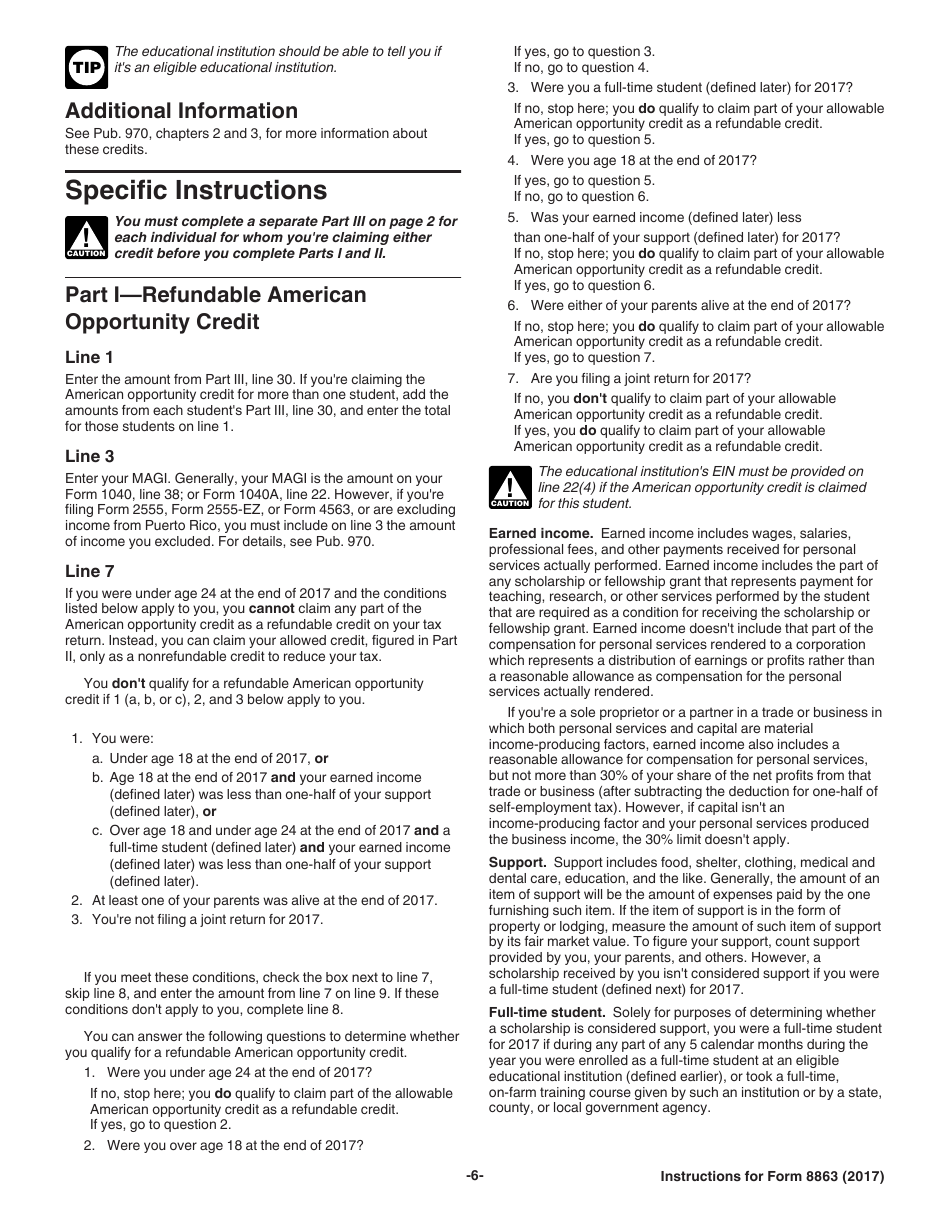

Q: What is the American Opportunity Credit?

A: The American Opportunity Credit is a tax credit that provides financial assistance for eligible education expenses during the first four years of postsecondary education.

Q: What is the Lifetime Learning Credit?

A: The Lifetime Learning Credit is a tax credit that provides financial assistance for eligible education expenses incurred by individuals who are taking courses to acquire or improve job skills.

Q: Who is eligible to claim education credits?

A: Eligibility for education credits depends on various factors, such as the student's enrollment status, the type of educational institution, and the amount of qualified expenses paid.

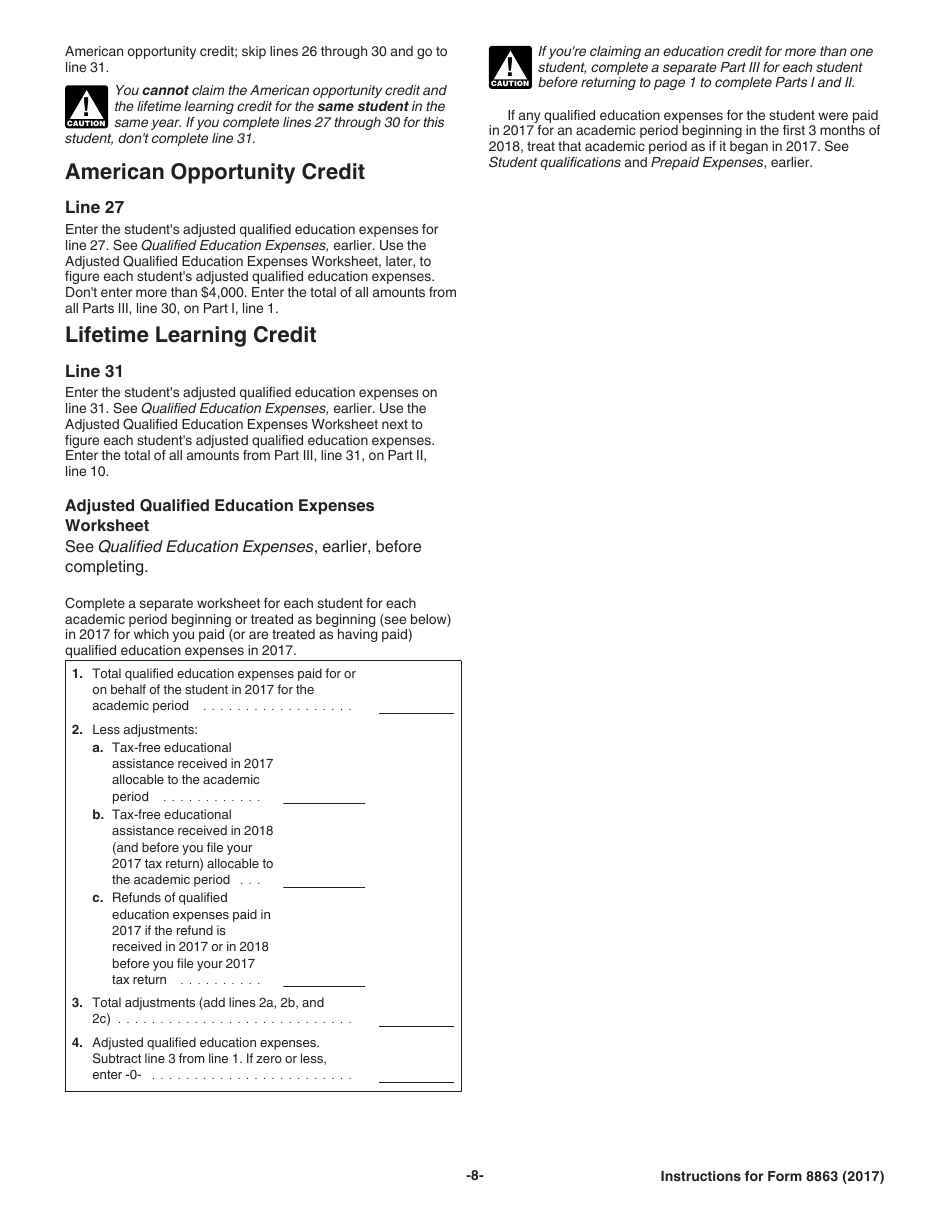

Q: What expenses qualify for education credits?

A: Qualified expenses include tuition, fees, and required course materials. Certain expenses, such as room and board or transportation costs, do not qualify.

Q: When is the deadline for filing IRS Form 8863?

A: The deadline for filing IRS Form 8863 is usually the same as the deadline for filing your federal income tax return, which is typically April 15th.

Q: Can I claim both the American Opportunity Credit and the Lifetime Learning Credit?

A: No, you cannot claim both credits for the same student in the same year. You must choose one credit based on your eligibility.

Q: Are education credits refundable?

A: The American Opportunity Credit is partially refundable, meaning you may be eligible to receive a refund even if you don't owe any taxes. The Lifetime Learning Credit is non-refundable.

Q: Is there an income limit for claiming education credits?

A: Yes, there are income limits for claiming education credits. The specific income limits depend on the tax year and filing status.

Q: What supporting documents do I need to include with Form 8863?

A: You may need to include documentation such as Form 1098-T from the educational institution, receipts for qualified expenses, and any other relevant records.

Instruction Details:

- This 8-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.