Instructions for IRS Form 8863 Education Credits (American Opportunity and Lifetime Learning Credits)

These instructions for IRS Form 8863, Education Credits (American Opportunity and Lifetime Learning Credits) , explain how to utilize this form when claiming costs for post-secondary schooling. Each form includes the space for two dependents. This document is provided by the Internal Revenue Service (IRS) , which last updated this document on November 14, 2023 . The IRS Form 8863 Instructions are available for download below.

What Is IRS Form 8863?

IRS Form 8863, Education Credits (American Opportunity and Lifetime Learning Credits), is a tax form used to claim one of the Internal Revenue Service (IRS) educational tax credits. It will provide a dollar-for-dollar reduction in the amount of tax owed at the end of the reporting year for the expenses incurred to attend educational institutions that participate in the student aid programs.

Who Can Use Form 8863?

The instructions detail the following topics to explain who qualifies to file IRS Form 8863:

- Total modified income level ceiling;

- Steps for filing with an additional form to include information on tuition and related education expenses,

- what you can do if you already filed for the year but are still waiting to receive proof you have paid tuition for the postsecondary school;

- Notice of the IRS' ability to ban a taxpayer from claiming these credits for future tax filings if the filer is found guilty of inappropriately applying for the credit when they did not meet the qualifications;

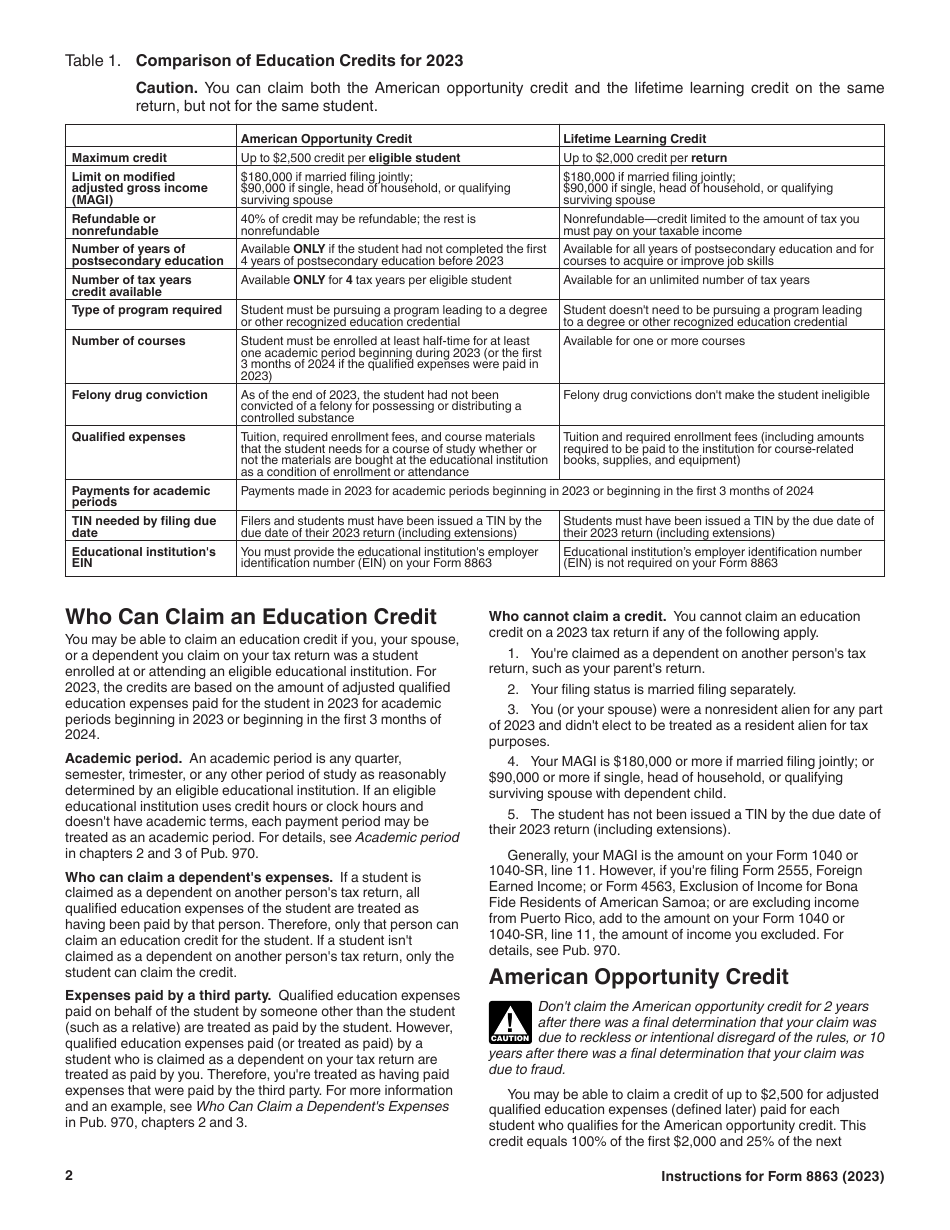

- Section comparing the two education refund tax credits available to taxpayers;

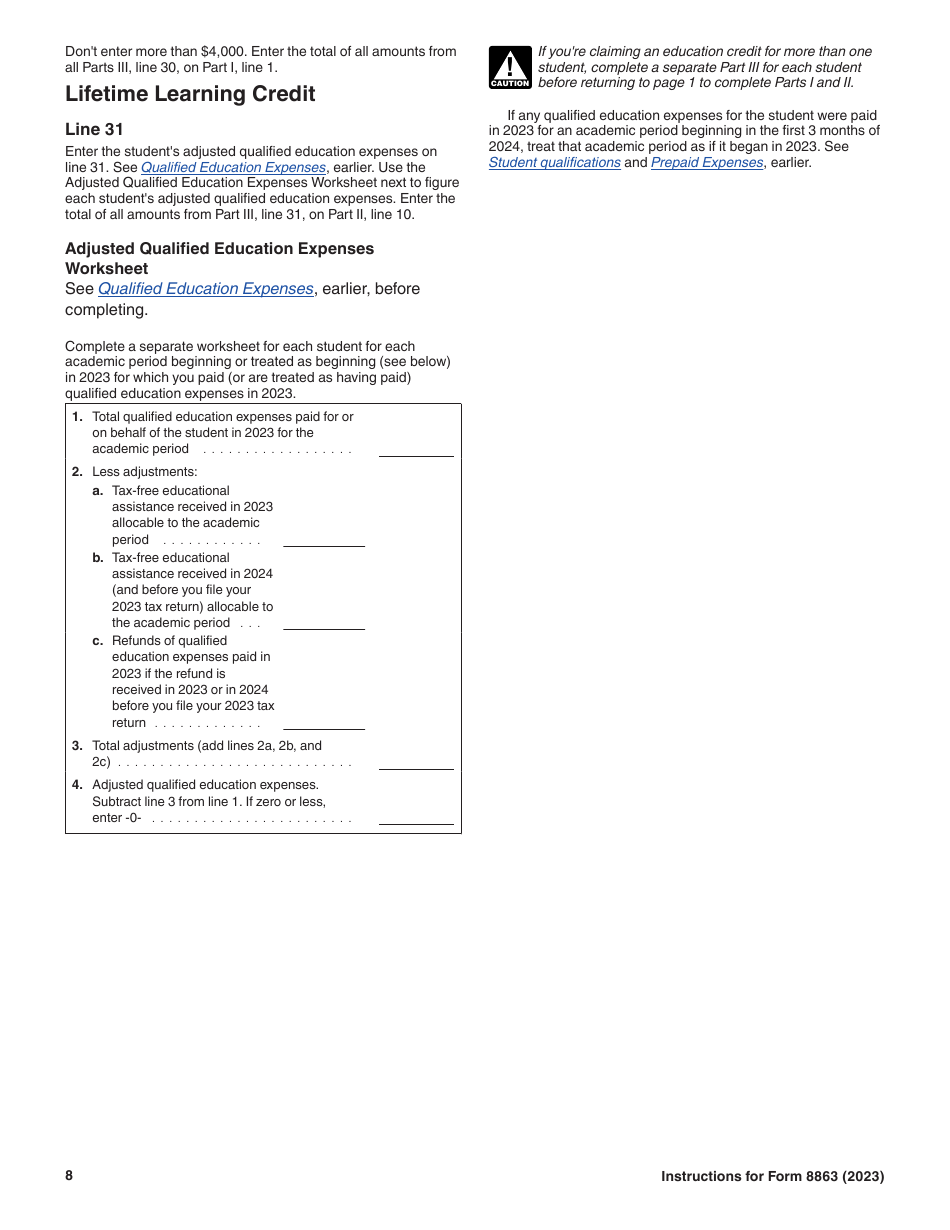

- This section documents in detail how often this claim can be used, maximum credits that can be collected, if the credit is refundable or not, what type of educational program and number of courses a student needs to be enrolled in to qualify, and additional identification numbers needed to file;

- Detailed guidelines on who can claim an Education Credit versus who cannot. The guidelines also explain how to claim expenses incurred by your dependent if a separate person also tries to claim the same individual in the same tax year as their dependent;

- Explanations for what costs will not qualify as part of the refund with the Education Credit;

- One additional worksheet for calculating any additional education-related costs per student.