This version of the form is not currently in use and is provided for reference only. Download this version of

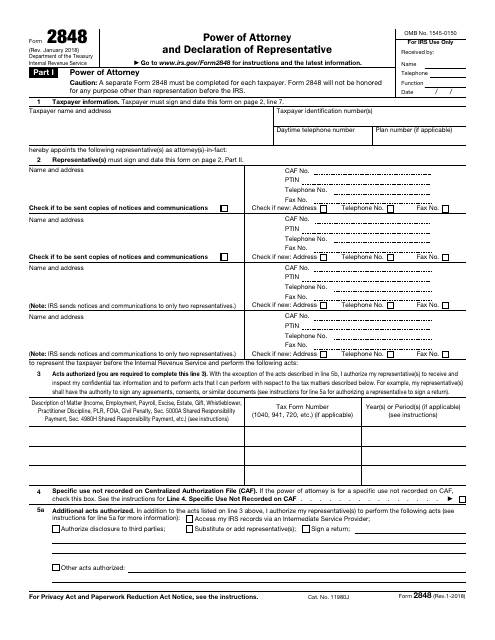

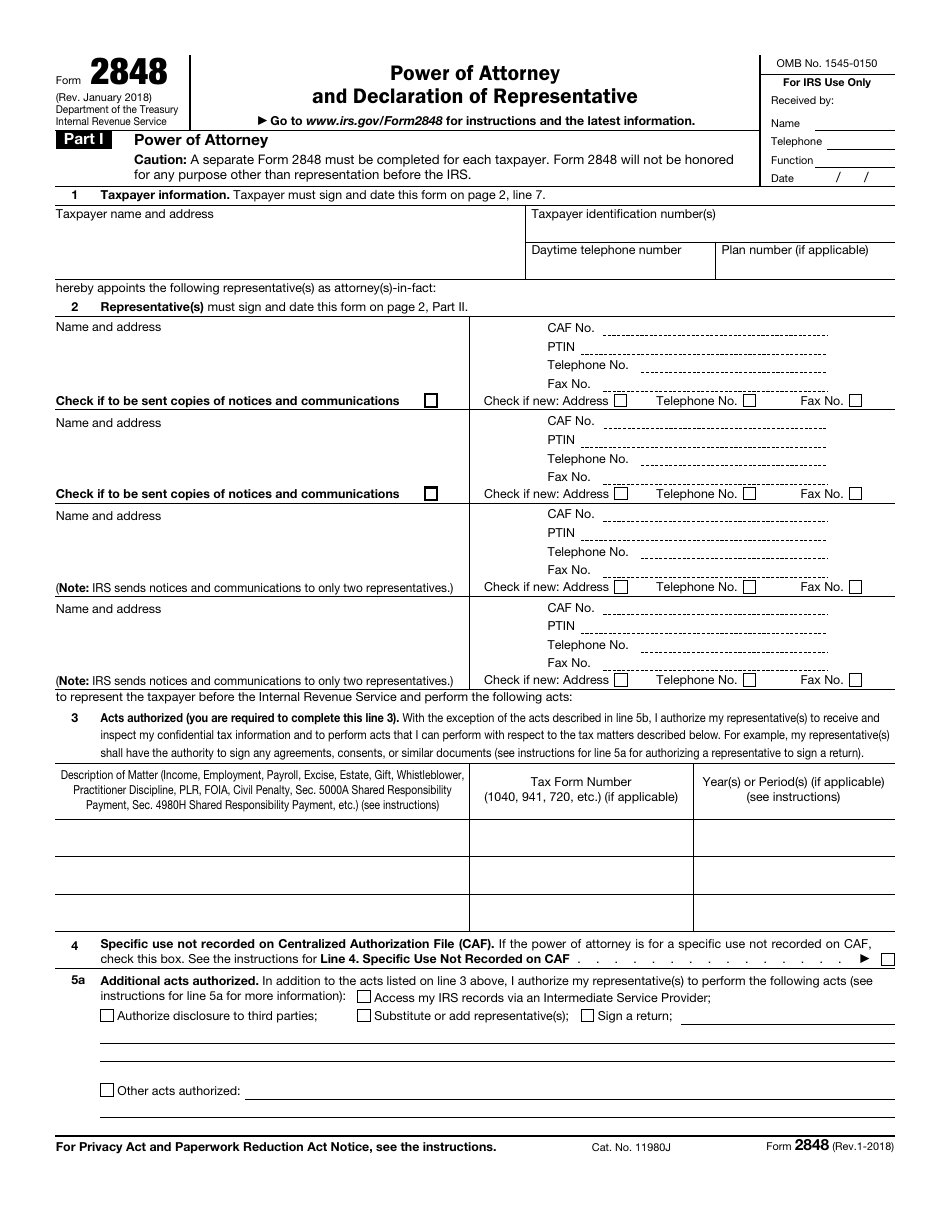

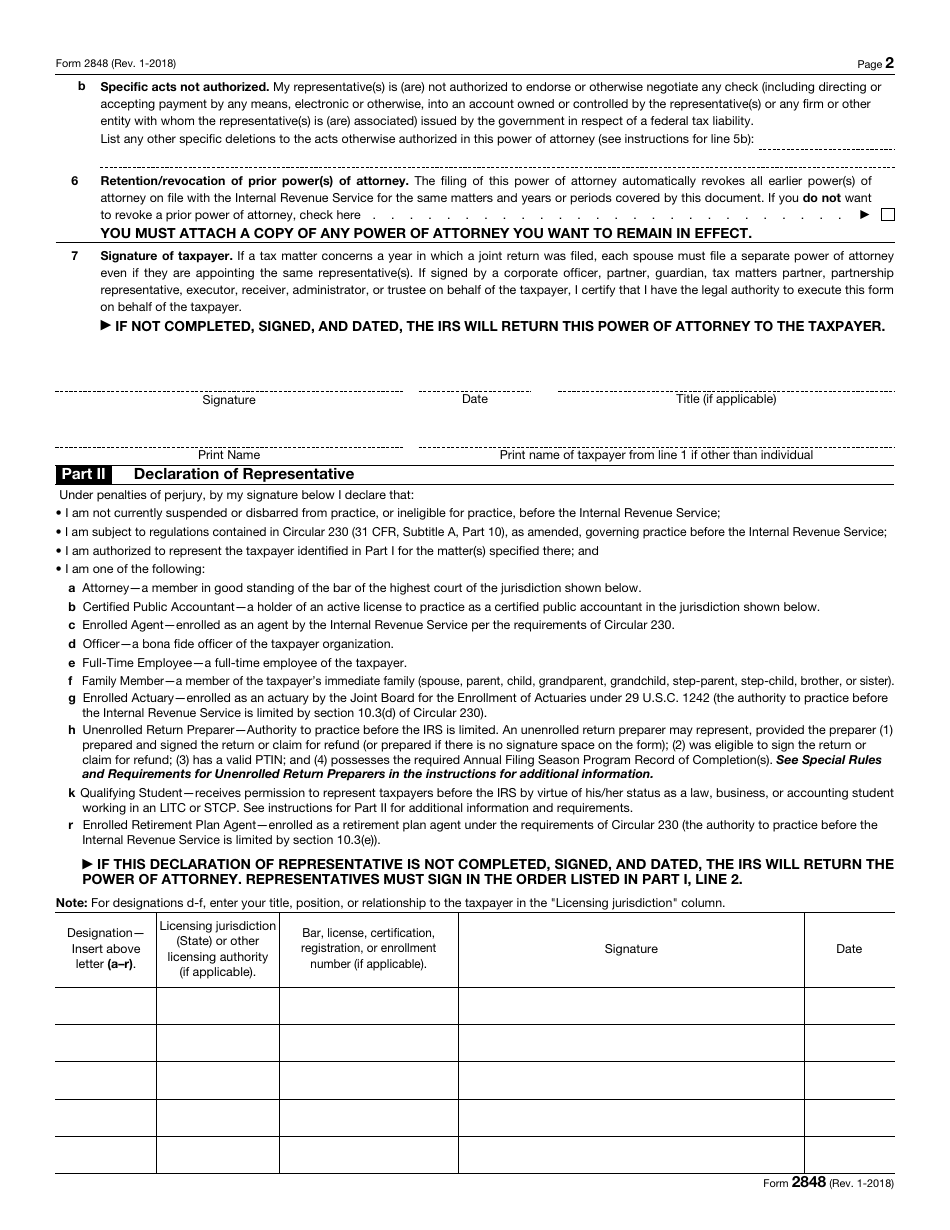

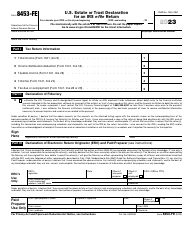

IRS Form 2848

for the current year.

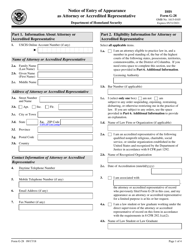

IRS Form 2848 Power of Attorney and Declaration of Representative

What Is IRS Form 2848?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on January 1, 2018. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 2848?

A: IRS Form 2848 is called Power of Attorney and Declaration of Representative.

Q: What is the purpose of IRS Form 2848?

A: The purpose of IRS Form 2848 is to authorize someone to represent you before the IRS.

Q: Who can use IRS Form 2848?

A: Any taxpayer who wants to designate a representative can use IRS Form 2848.

Q: What information is required on IRS Form 2848?

A: IRS Form 2848 requires information about the taxpayer, the representative, and the specific tax matters to be addressed.

Q: Can I use IRS Form 2848 for state taxes?

A: No, IRS Form 2848 is only for federal tax matters. Each state has its own form for designating a representative for state taxes.

Q: Do I need to submit IRS Form 2848 with my tax return?

A: Generally, you do not need to submit IRS Form 2848 with your tax return. It is used separately to authorize representation.

Q: How long is IRS Form 2848 valid?

A: IRS Form 2848 is valid until revoked or a specific expiration date is stated on the form.

Q: Can I revoke a Power of Attorney granted on IRS Form 2848?

A: Yes, you can revoke a Power of Attorney by submitting a written request to the IRS.

Q: Can I authorize more than one representative using IRS Form 2848?

A: Yes, you can authorize multiple representatives on IRS Form 2848.

Form Details:

- A 2-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 2848 through the link below or browse more documents in our library of IRS Forms.