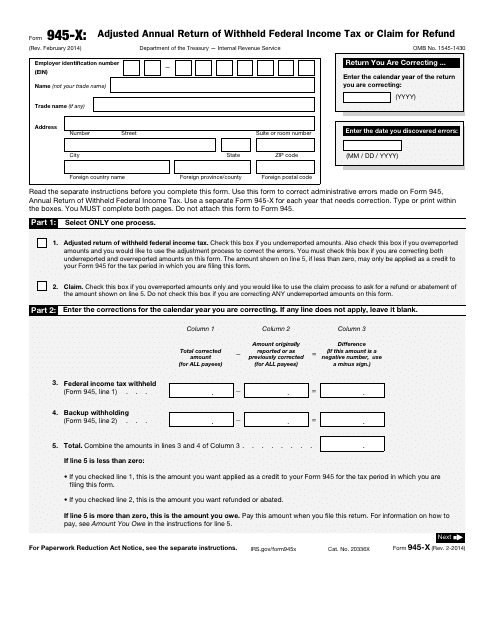

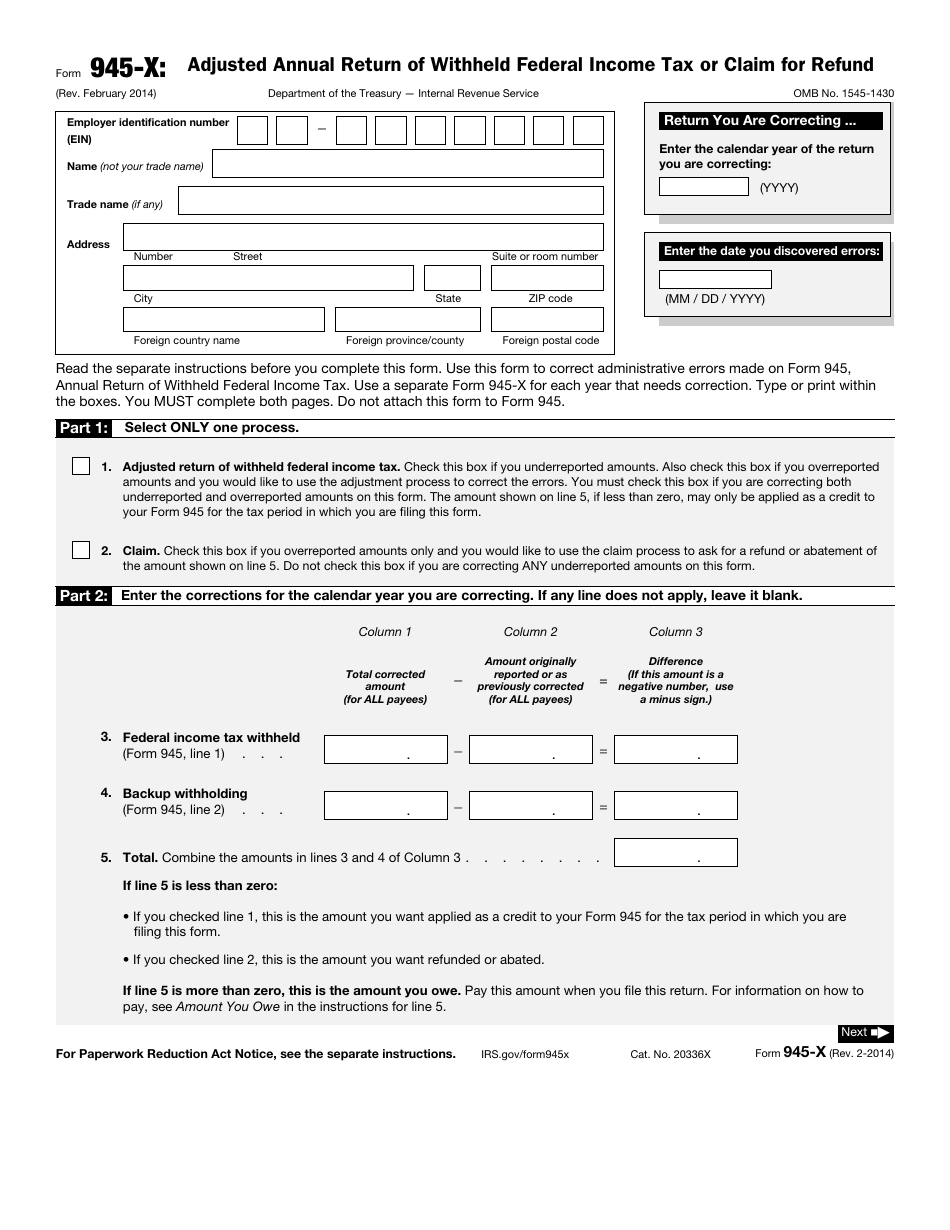

IRS Form 945-X Adjusted Annual Return of Withheld Federal Income Tax or Claim for Refund

What Is IRS Form 945-X?

IRS Form 945-X, Adjusted Annual Return of Withheld Federal Income Tax or Claim for Refund , is a fiscal instrument used by taxpayers to modify the information they submitted via IRS Form 945, Annual Return of Withheld Federal Income Tax.

Alternate Names:

- Tax Form 945-X;

- Form 945X.

As soon as you discover you reported the wrong amount of federal income tax, you are required to reach out to tax organs and correct your mistakes following the established procedure so that you avoid paying interest and penalties. It is necessary to file a separate Form 945-X for every Form 945 that contains inaccurate details.

This statement was released by the Internal Revenue Service (IRS) on February 1, 2014 , rendering older editions of the form outdated. You may find an IRS Form 945-X fillable version through the link below.

Check out the 945 Series of forms to see more IRS documents in this series.

Form 945-X Instructions

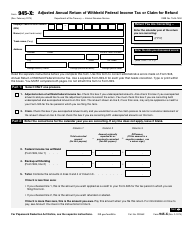

Follow these IRS Form 945-X Instructions to make changes to a previously filed Form 945:

-

Identify the company by its employer identification number, the name of the business, and the mailing address . Specify the year when Form 945 was filed and indicate the date when you learned about the errors.

-

Check the appropriate box to confirm you overreported or underreported amounts - in the former instance, you will be entitled to request abatement or refund . Correct the amounts that were wrong in the previous document and enter the difference.

-

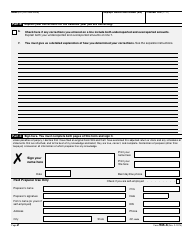

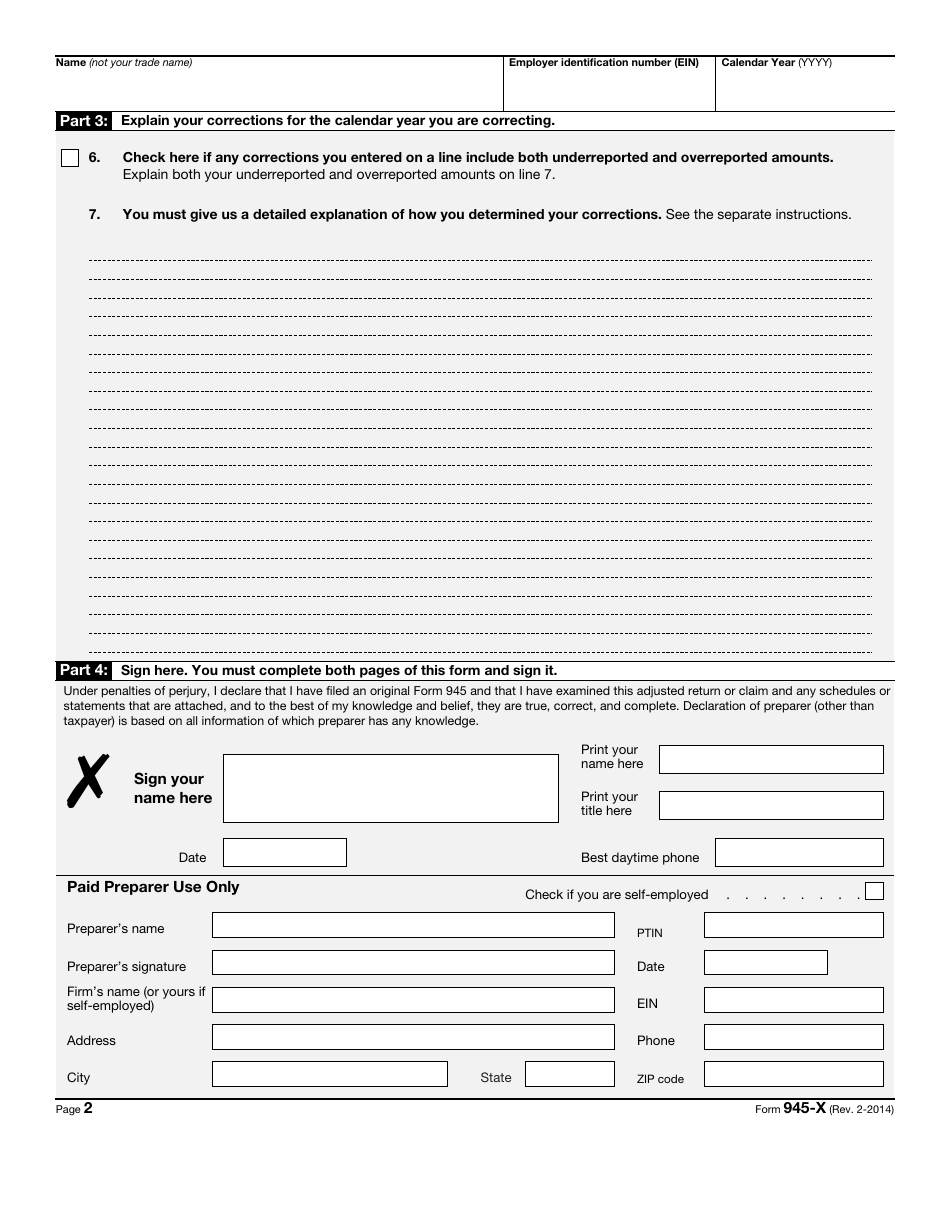

Put a tick in the box if any errors you corrected are connected to overreported and underreported amounts . Use the comments section to elaborate on the modifications you have made - you are obliged to clarify how you discovered the mistakes and what allowed you to deal with them. It is likely the space in the form will not be enough for you to list all the points - attach extra sheets of paper marked with your name, employer identification number, year, and the number of the form on top of every one of them.

-

Make sure you record your name, employer identification number, and year on top of the second page of the form . Certify the documentation - you need to add your name, title, date, and telephone number as well as sign the form. Note that if the paperwork is filled out by a tax professional you hired, they must identify themselves as well indicating their personal and contact details.

Where to Mail Form 945-X?

The Form 945-X mailing address depends on the status of your organization and its location:

-

Mail the paperwork to the Department of the Treasury, Internal Revenue Service, Ogden, UT 84201-0042 if you file the form on behalf of an exempt organization or governmental entity.

-

In case you do not have permanent residence or a main place of business in any state, submit the papers to the Internal Revenue Service, P.O. Box 409101, Ogden, UT 84409 .

-

Companies from Alabama, Alaska, Arizona, Arkansas, California, Colorado, Hawaii, Idaho, Iowa, Kansas, Louisiana, Minnesota, Mississippi, Missouri, Montana, Nebraska, Nevada, New Mexico, North Dakota, Oklahoma, Oregon, South Dakota, Texas, Utah, Washington, and Wyoming are supposed to send the documentation to the Department of the Treasury, Internal Revenue Service, Ogden, UT 84201-0042 .

-

File the form with the Department of the Treasury, Internal Revenue Service, Cincinnati, OH 45999-0042 if you are located in Connecticut, Delaware, District of Columbia, Florida, Georgia, Illinois, Indiana, Kentucky, Maine, Maryland, Massachusetts, Michigan, New Hampshire, New Jersey, New York, North Carolina, Ohio, Pennsylvania, Rhode Island, South Carolina, Tennessee, Vermont, Virginia, West Virginia, or Wisconsin.

IRS Form 945-X Related Forms:

-

IRS Form 945, Annual Return of Withheld Federal Income Tax is filed for reporting taxes withheld from payroll payments. Such payments include pensions, gambling winnings, Indian gaming profits, backup withholding, military retirement and voluntary withholding on some government payments.

-

IRS Form 945-A, Annual Record of Federal Tax Liability is filed for informing the IRS of the employer's tax liability for a calendar year for IRS Forms 945 and 945-X, IRS Forms 944 and 944-X or IRS Forms CT-1 and CT-1 X. This form is never filed alone, but only with one of the listed forms. This form is filed only by monthly depositors, which accumulated tax liability for over $100,000 and are all semi-weekly depositors.