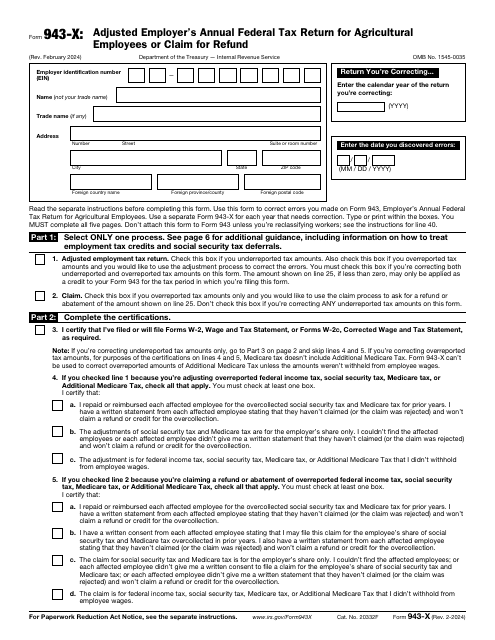

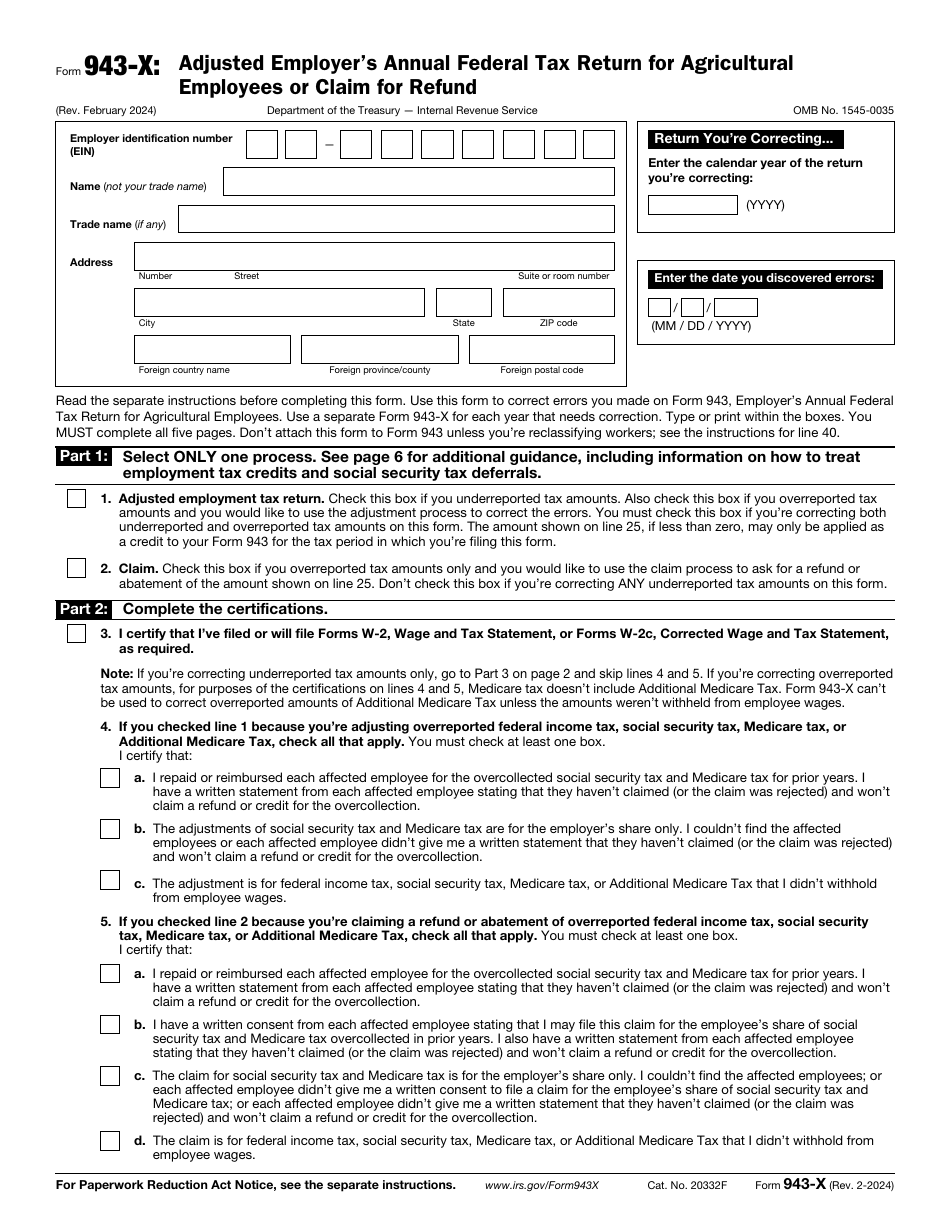

IRS Form 943-X Adjusted Employer's Annual Federal Tax Return for Agricultural Employees or Claim for Refund

What Is IRS Form 943-X?

IRS Form 943-X, Adjusted Employer's Annual Federal Tax Return for Agricultural Employees or Claim for Refund , is a fiscal document designed to allow taxpayers to amend the information they previously filed reporting tax deducted from an employee's wages. Additionally, it lets the employer submit a claim for a refund. If you noticed you made a mistake when completing IRS Form 943, Employer's Annual Federal Tax Return for Agricultural Employees, yet the documentation has already been filed with the tax organs, you have a chance to fix the error with the help of Form 943-X whether you miscalculated the wages that have to be taxed or your share of social security tax.

This instrument was issued by the Internal Revenue Service (IRS) on February 1, 2024 - older editions of the form are now outdated. An IRS Form 943-X fillable version is available for download below.

Form 943-X Instructions

The IRS Form 943-X Instructions are as follows:

-

Provide information about your entity - list the legal name and the trade name separately, indicate your address, and state your employer identification number . It is crucial to add the year of the tax return you wish to amend and inform the authorities about the day when the errors were discovered.

-

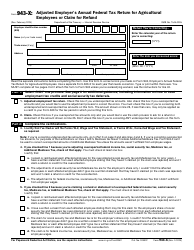

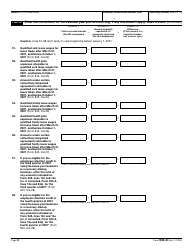

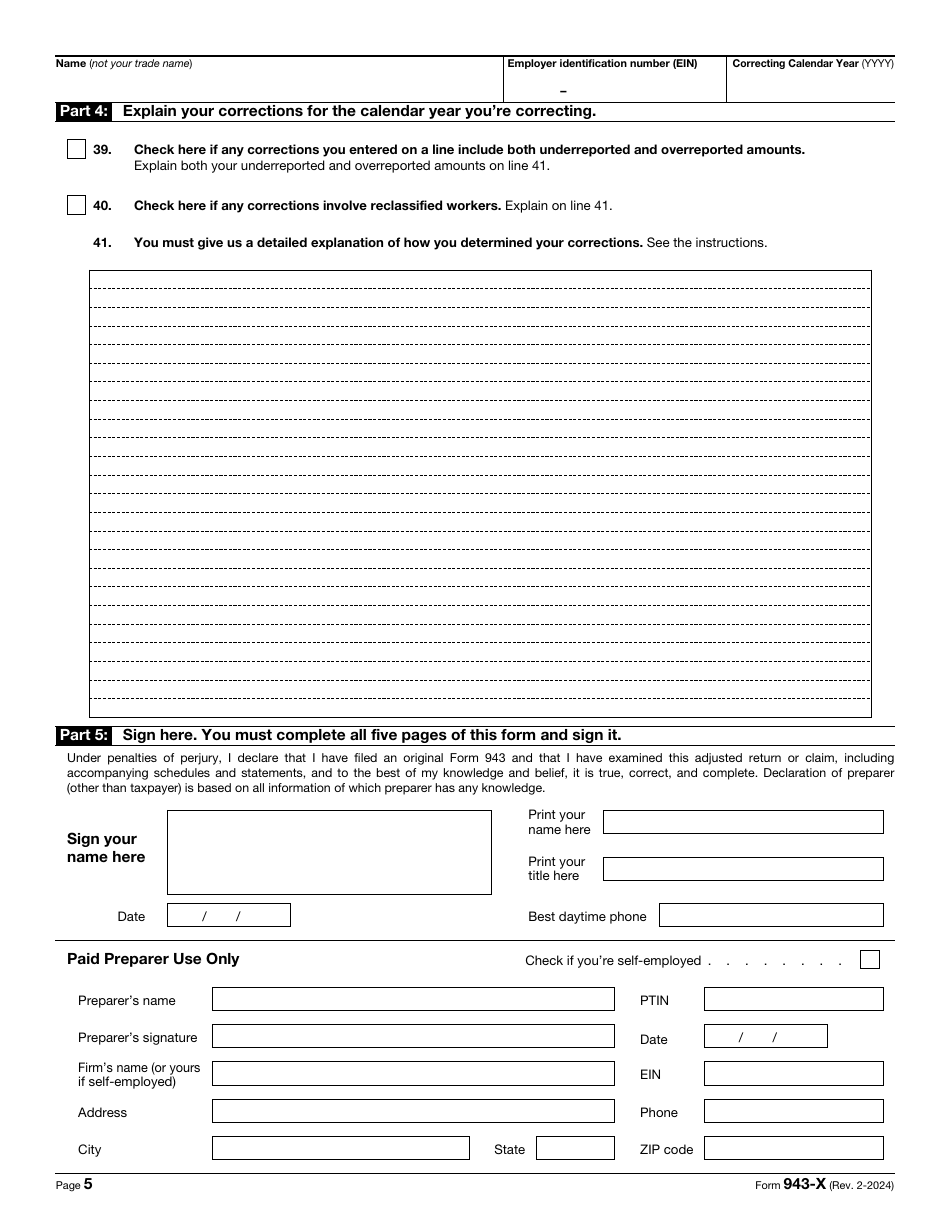

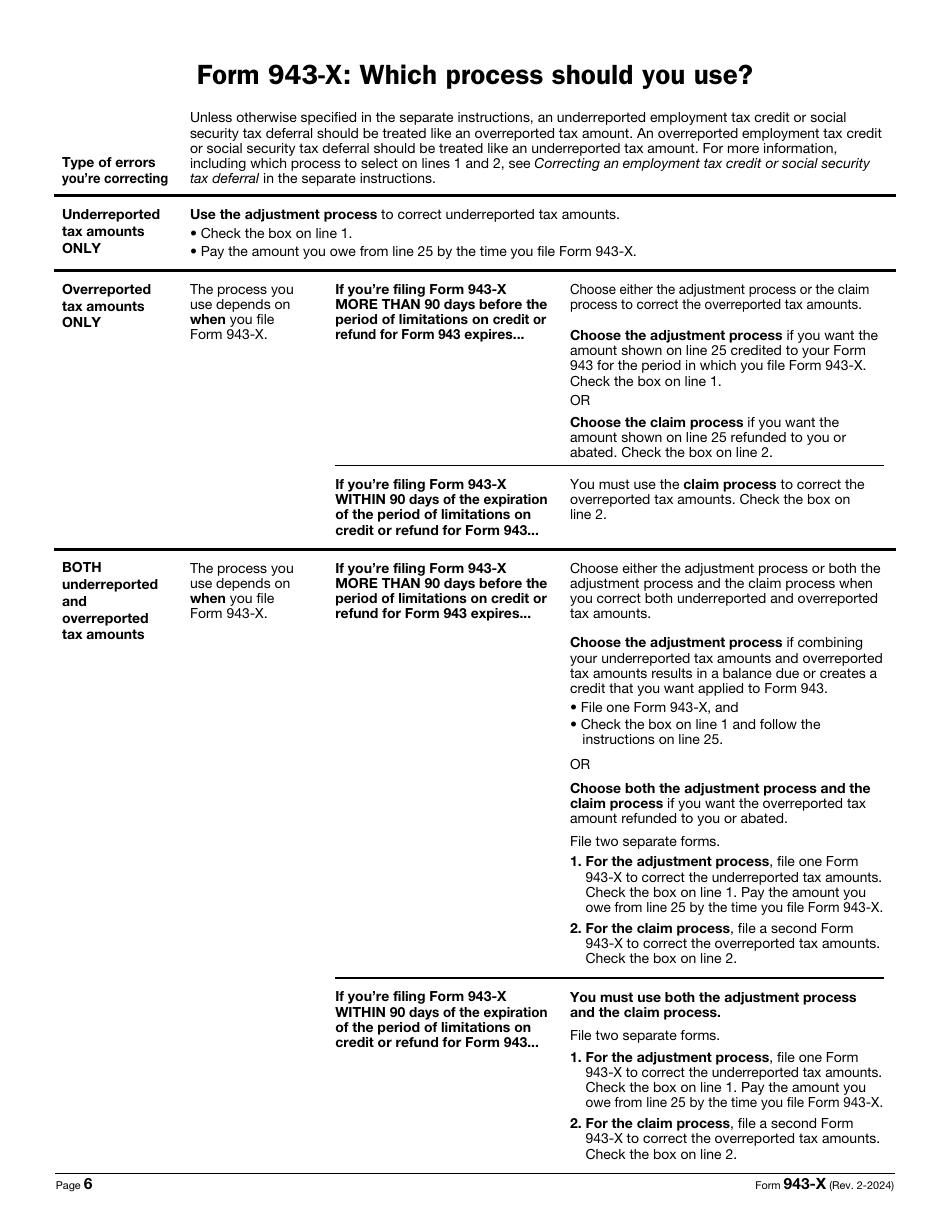

Check the box to clarify whether you are making adjustments to the previously filed document or you are requesting a tax refund . Read the certifications listed in the form and answer the questions to elaborate on the circumstances of filing.

-

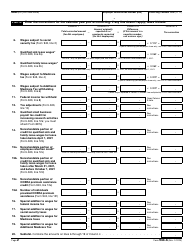

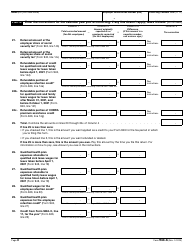

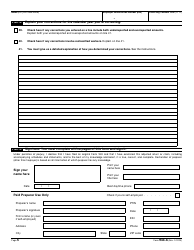

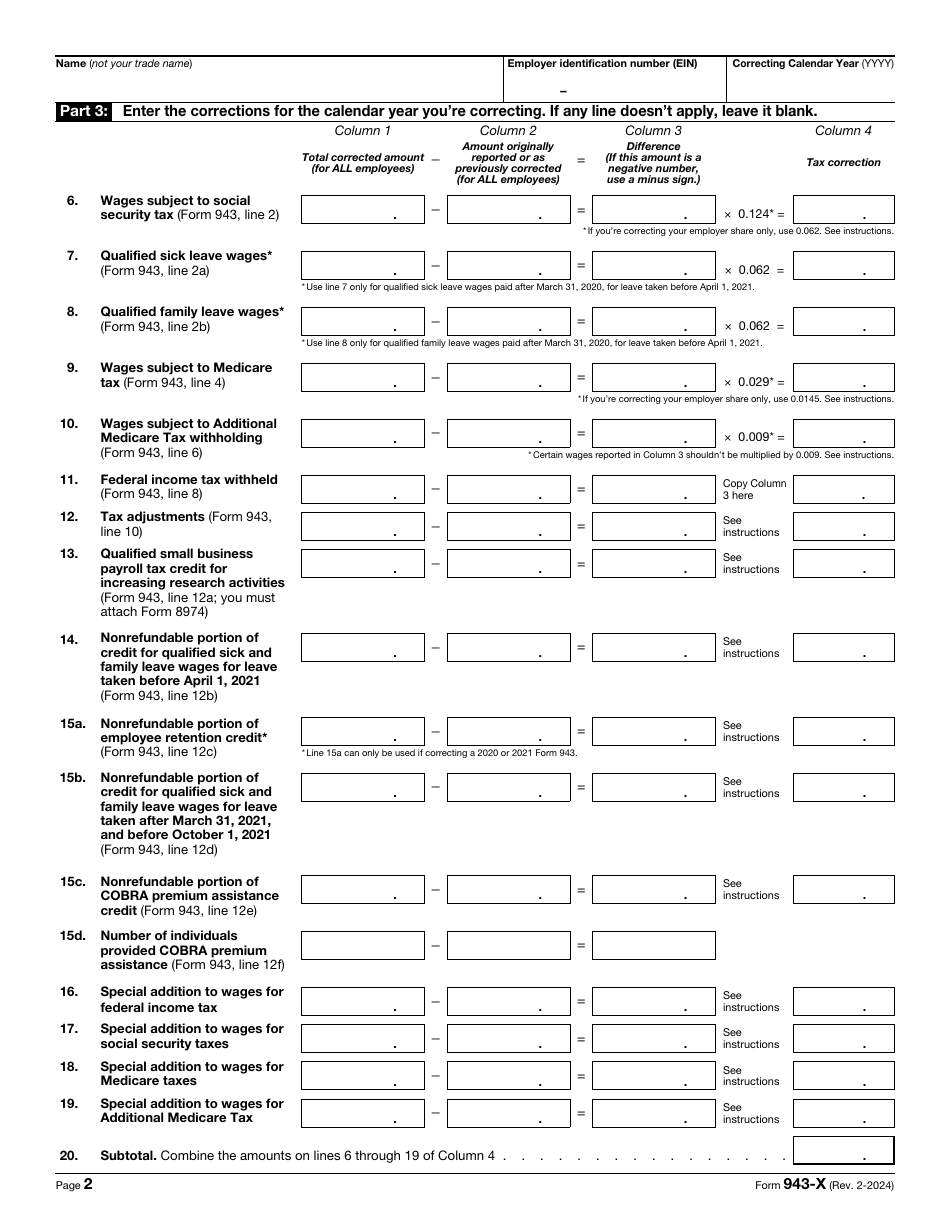

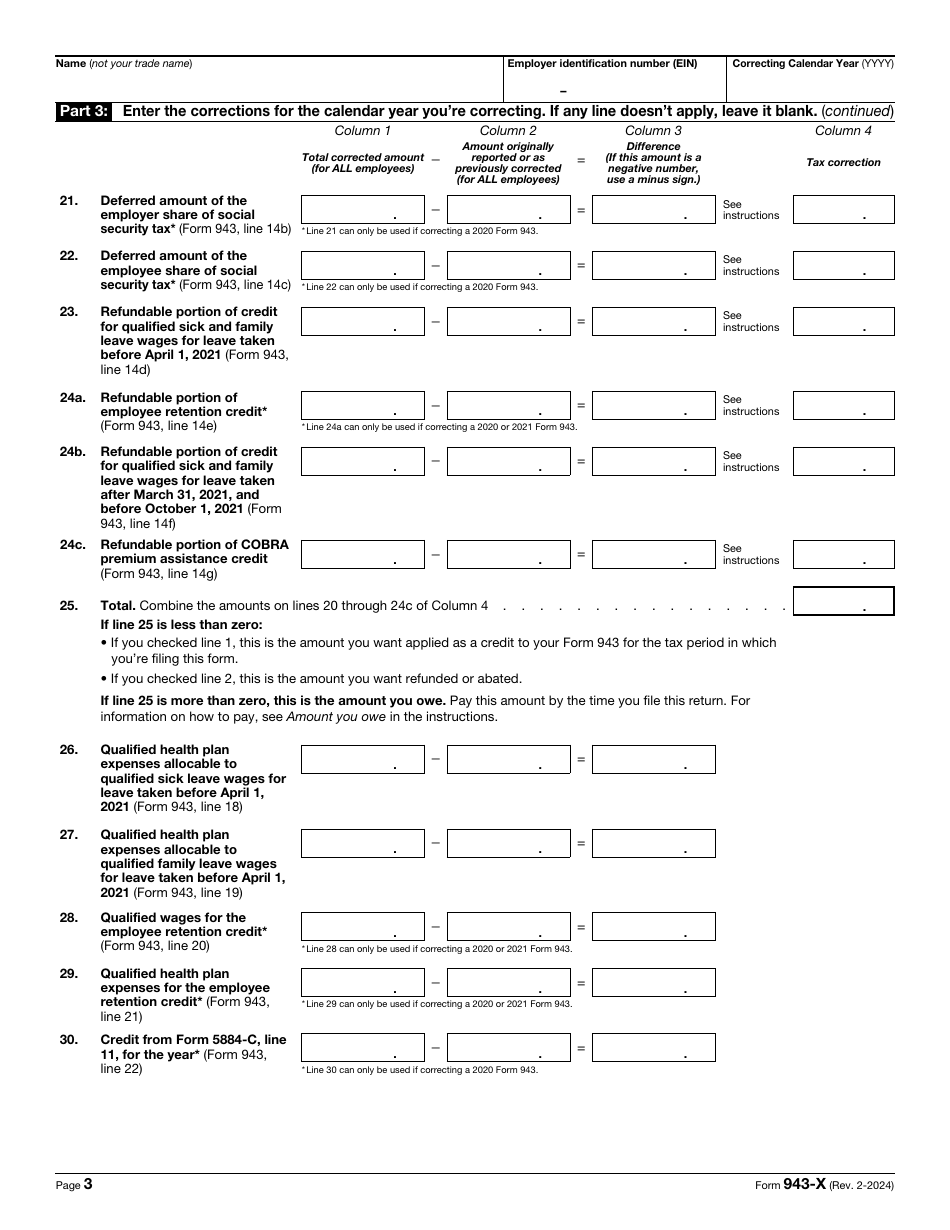

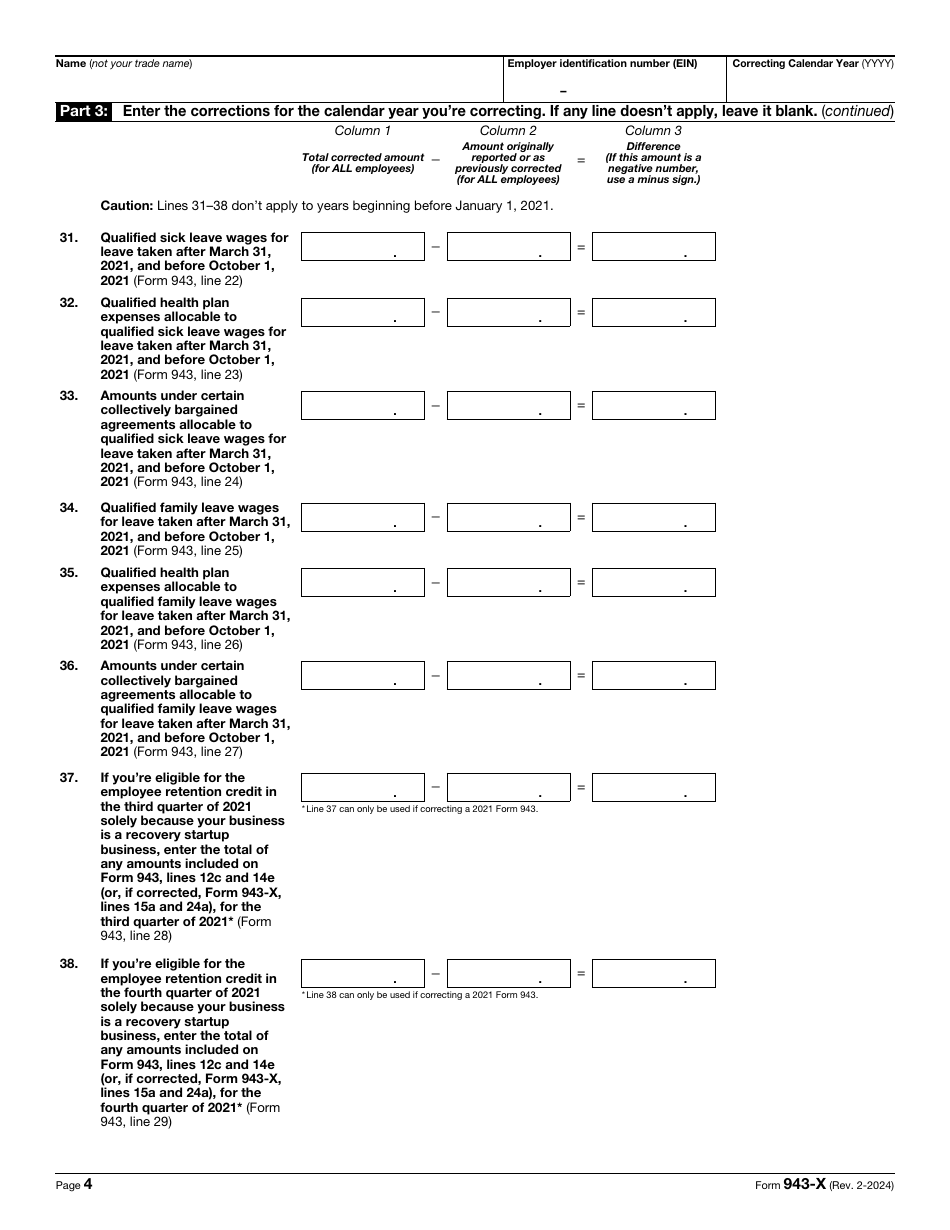

Use the second, third, and fourth pages of the form to record all the corrections separately . You will have to enter the amounts you reported before as well as the right numbers you computed afterward. It is necessary to explain your thought process in the remarks section - let the authorities know how you determined the correction was required. If the space in the form is not enough, attach extra sheets to the document.

-

Certify Form 943-X and ensure it contains your telephone number so that the IRS can reach out to you without delay . Note that it is permitted to authorize another individual or firm to complete the document on your behalf - in this case, they are also supposed to identify themselves and sign the instrument.